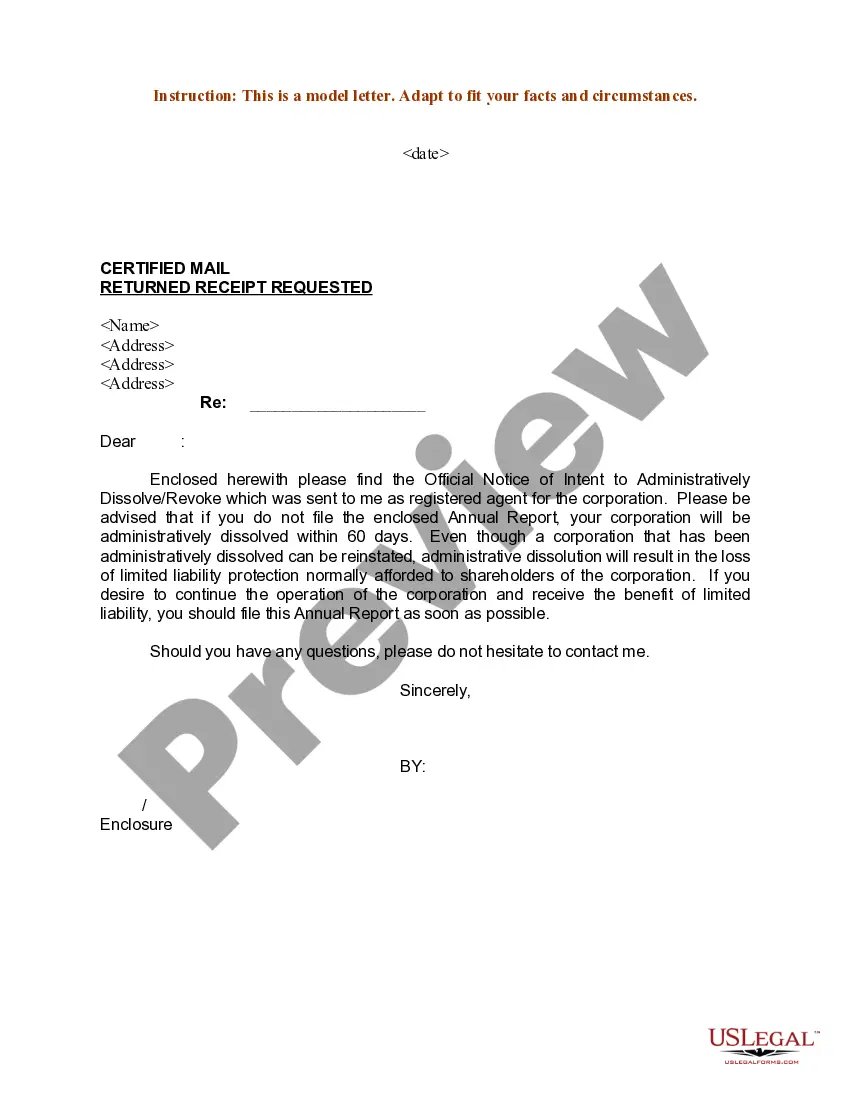

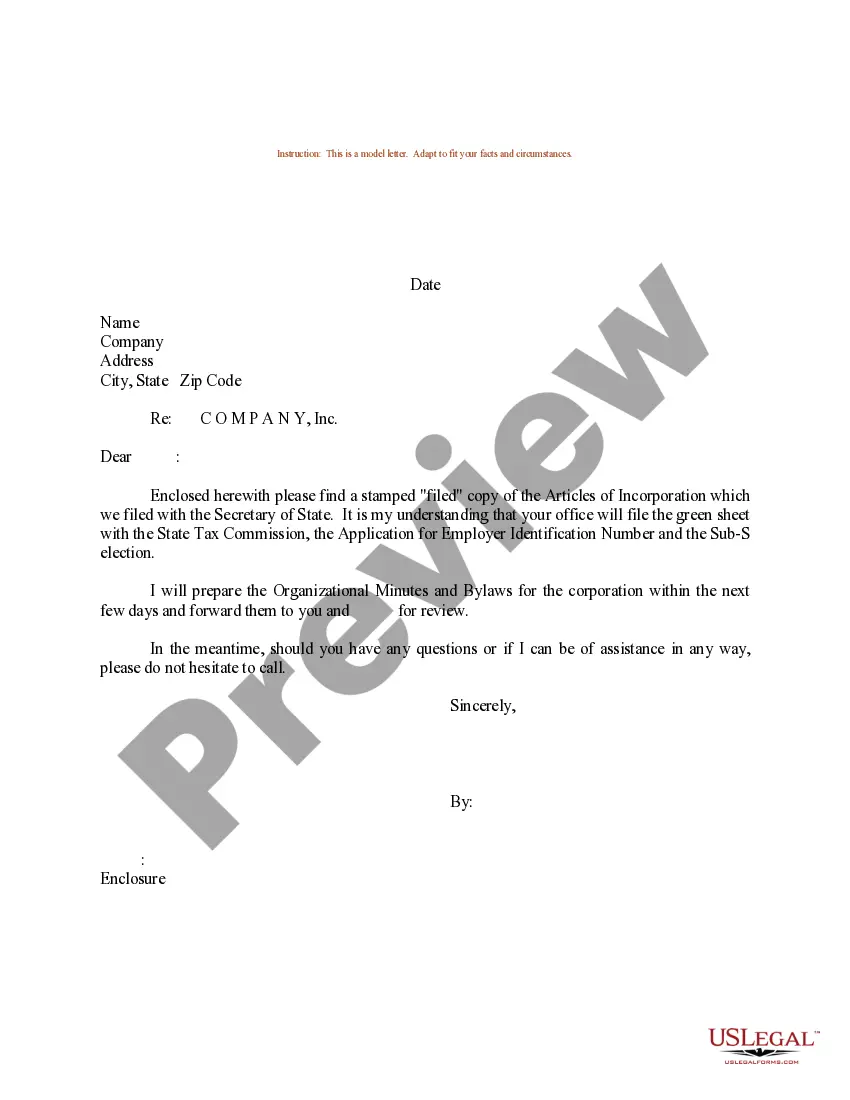

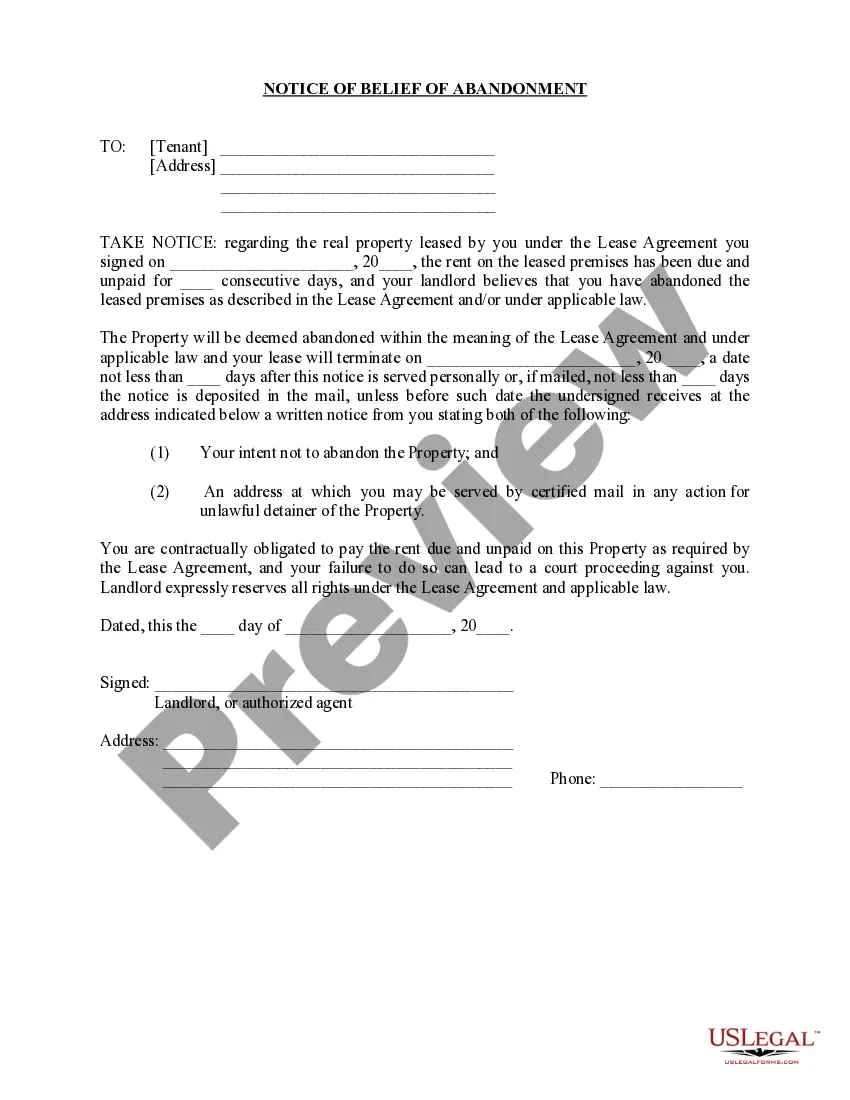

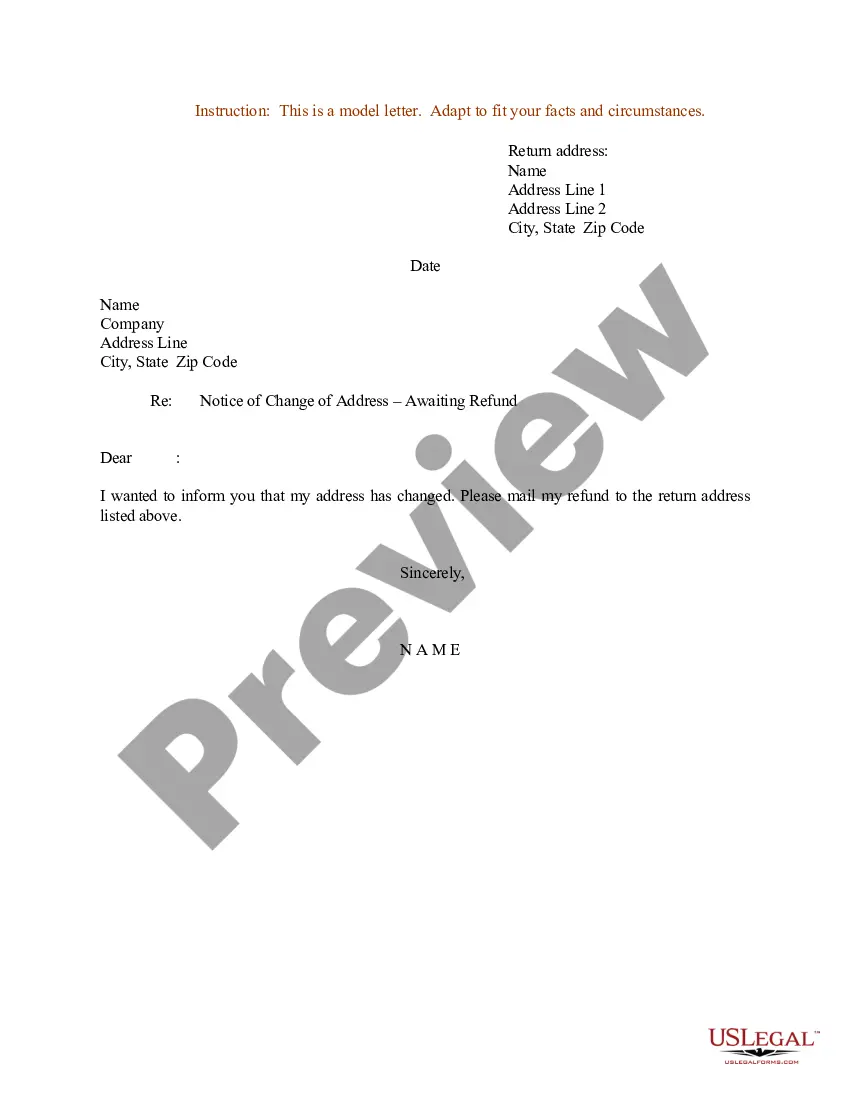

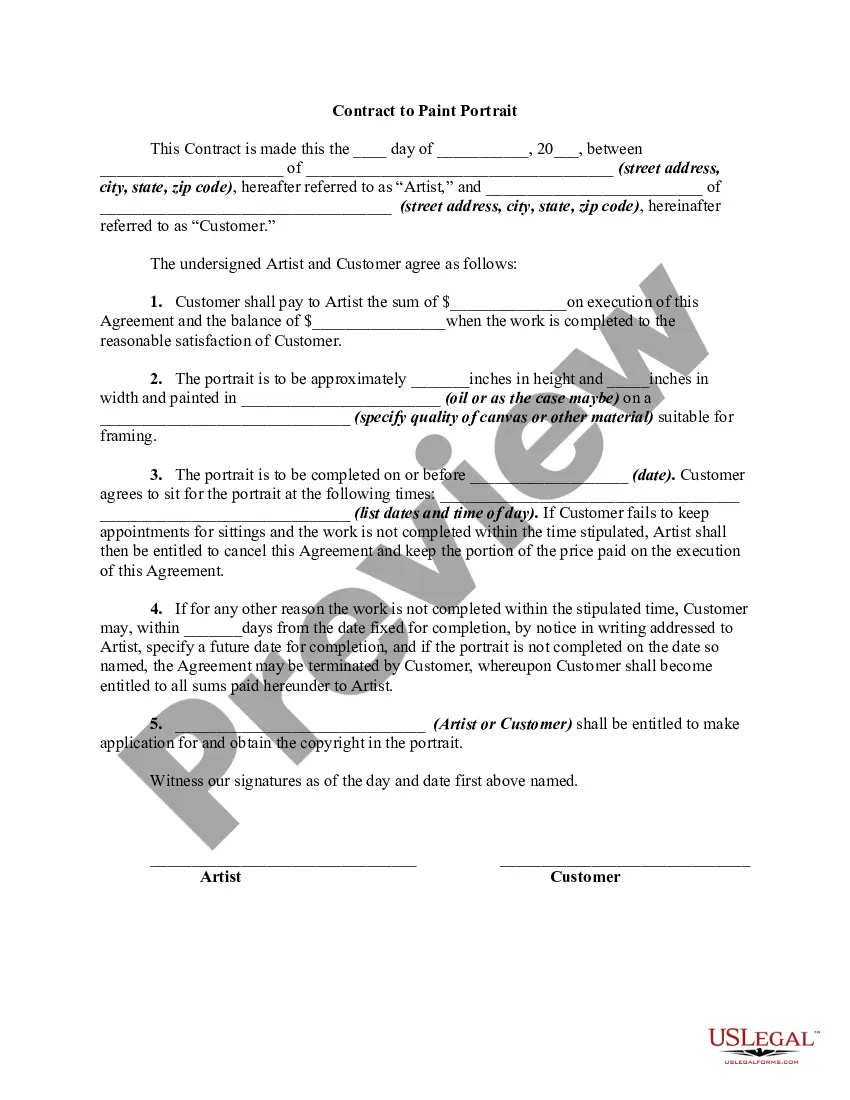

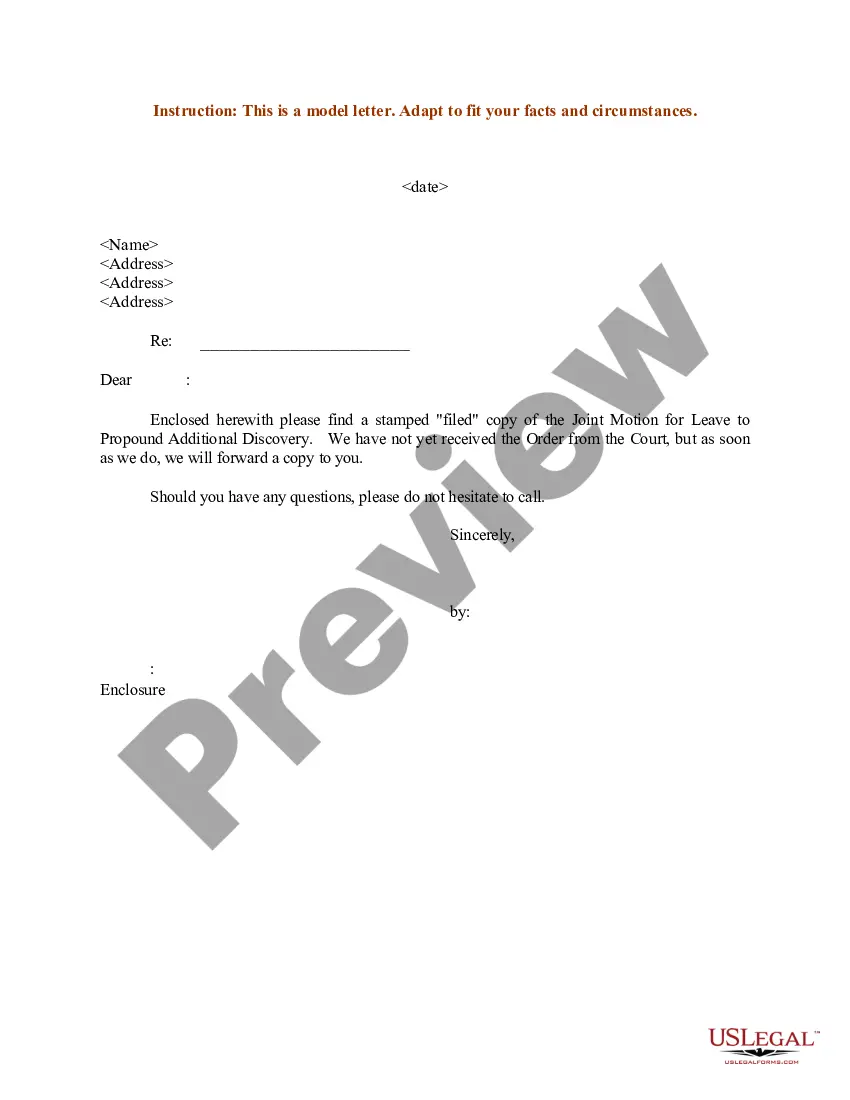

Oregon Sample Letter Notifying Client of Incorporation Status

Description

How to fill out Sample Letter Notifying Client Of Incorporation Status?

If you want to comprehensive, obtain, or print out authorized papers templates, use US Legal Forms, the largest selection of authorized forms, that can be found online. Utilize the site`s simple and easy handy search to get the papers you need. Different templates for company and person purposes are categorized by categories and claims, or keywords and phrases. Use US Legal Forms to get the Oregon Sample Letter Notifying Client of Incorporation Status within a few clicks.

In case you are currently a US Legal Forms customer, log in to your accounts and click the Acquire switch to obtain the Oregon Sample Letter Notifying Client of Incorporation Status. You can even accessibility forms you formerly delivered electronically inside the My Forms tab of the accounts.

Should you use US Legal Forms initially, follow the instructions below:

- Step 1. Ensure you have chosen the form for that right town/country.

- Step 2. Take advantage of the Preview method to look over the form`s articles. Do not overlook to learn the outline.

- Step 3. In case you are unhappy together with the type, use the Search discipline on top of the screen to locate other models from the authorized type design.

- Step 4. Once you have located the form you need, select the Buy now switch. Pick the prices prepare you prefer and put your credentials to register for an accounts.

- Step 5. Procedure the deal. You may use your bank card or PayPal accounts to complete the deal.

- Step 6. Find the formatting from the authorized type and obtain it on your product.

- Step 7. Total, revise and print out or indicator the Oregon Sample Letter Notifying Client of Incorporation Status.

Each authorized papers design you buy is yours permanently. You possess acces to each and every type you delivered electronically in your acccount. Select the My Forms portion and choose a type to print out or obtain once more.

Remain competitive and obtain, and print out the Oregon Sample Letter Notifying Client of Incorporation Status with US Legal Forms. There are millions of expert and status-certain forms you can use for your personal company or person needs.