Title: Understanding Oregon Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause Introduction: Oregon Contract with Consultant as Self-Employed Independent Contractor is an agreement that establishes the terms and conditions for engaging a consultant as an independent contractor. This type of contract typically includes a Limitation of Liability Clause which outlines the maximum financial responsibility or damages that can be imposed on the consultant. In Oregon, there are various types of contracts that fall under this category: 1. General Oregon Contract with Consultant as Self-Employed Independent Contractor: This type of contract is used when hiring a consultant to provide specialized services. It outlines the obligations and responsibilities of both parties, including project scope, deliverables, payment terms, and non-disclosure agreements. The Limitation of Liability Clause protects the consultant from excessive financial liability. 2. Oregon Contract with IT Consultant as Self-Employed Independent Contractor: Specific to information technology (IT) consultants, this contract type encompasses services such as software development, system integration, network management, and technical support. The Limitation of Liability Clause helps the IT consultant mitigate potential risks associated with system failures, data breaches, or other unforeseen issues. 3. Oregon Contract with Marketing Consultant as Self-Employed Independent Contractor: This contract type is used when engaging a marketing consultant to develop and execute marketing strategies, branding, digital campaigns, or market research. The Limitation of Liability Clause protects the consultant in case of campaign failures, reputation damage, or legal issues arising from the marketing activities. 4. Oregon Contract with Legal Consultant as Self-Employed Independent Contractor: When seeking specialized legal advice or services, this contract type outlines the consultant's obligations to provide legal expertise, such as contract drafting, compliance assistance, intellectual property matters, or dispute resolution. The Limitation of Liability Clause helps limit the consultant's liability in case of errors or omissions that may occur during legal proceedings. 5. Oregon Contract with Financial Consultant as Self-Employed Independent Contractor: This contract type engages a financial consultant to provide services such as tax planning, investment advice, financial analysis, or risk management. The Limitation of Liability Clause protects the consultant from potential financial losses incurred by the client due to investment decisions or market fluctuations beyond their control. Key Elements of an Oregon Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause: 1. Parties: Identifies the legal names and contact information of both parties involved in the agreement. 2. Scope of Work: Clearly defines the services the consultant will provide and the expected deliverables. 3. Payment Terms: Outlines the agreed-upon compensation, invoicing frequency, payment methods, and any additional expenses. 4. Term and Termination: Establishes the duration of the contract and the circumstances under which either party can terminate the agreement. 5. Intellectual Property: Determines ownership of any intellectual property created during the contractual period. 6. Confidentiality: Includes provisions ensuring the confidentiality and non-disclosure of sensitive information shared between the parties. 7. Limitation of Liability Clause: Specifies the maximum financial liability of the consultant in the event of errors, omissions, or breaches of the contract. 8. Governing Law and Jurisdiction: Identifies the applicable laws and jurisdiction that will govern the contract and any potential disputes. In conclusion, an Oregon Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause is a crucial legal agreement that safeguards the rights and responsibilities of both parties involved. It varies depending on the consultant's area of expertise, such as IT, marketing, legal, or financial. Understanding the key elements and specific terminology within these contracts is essential to protect the interests of all parties involved.

Oregon Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause

Description

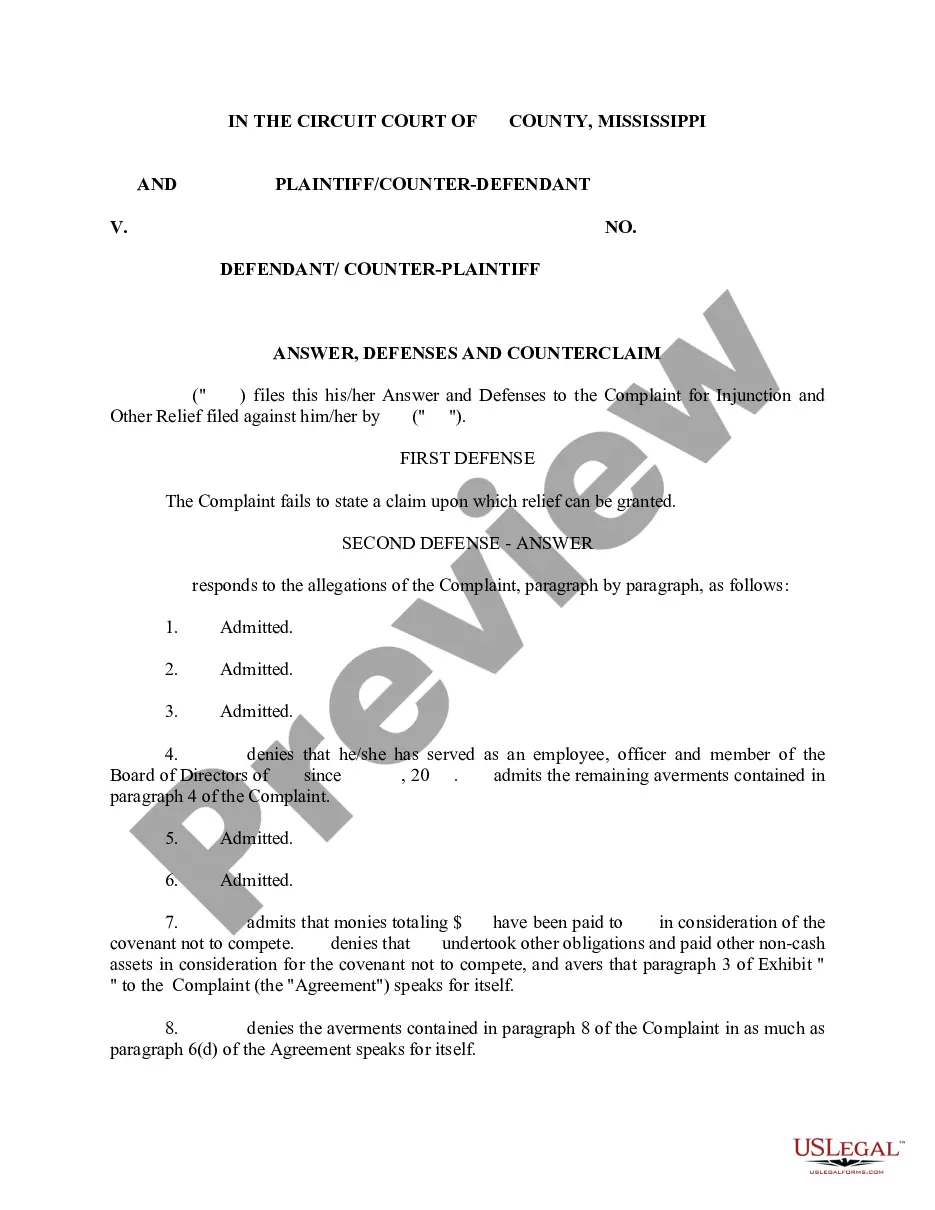

How to fill out Oregon Contract With Consultant As Self-Employed Independent Contractor With Limitation Of Liability Clause?

If you wish to obtain, download, or print sanctioned document samples, utilize US Legal Forms, the premier selection of legal forms, accessible online.

Utilize the site’s straightforward search feature to find the paperwork you require.

Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you acquire is yours forever.

You will have access to each form you obtained within your account. Click on the My documents section and select a form to print or download again.

- Use US Legal Forms to acquire the Oregon Agreement with Consultant as Self-Employed Independent Contractor including Limitation of Liability Clause in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to locate the Oregon Agreement with Consultant as Self-Employed Independent Contractor including Limitation of Liability Clause.

- You can also access forms you previously obtained from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Preview option to review the form’s content. Remember to read the details.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. After you have located the form you need, select the Buy now button. Choose the payment plan you prefer and input your details to create an account.

- Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the payment.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify and print or sign the Oregon Agreement with Consultant as Self-Employed Independent Contractor including Limitation of Liability Clause.

Form popularity

FAQ

The primary difference between an independent contractor and an employee in Oregon lies in the level of control and independence over work performed. Independent contractors operate their own businesses, set their schedules, and manage their tasks. In contrast, employees work under the direction and control of their employers. Knowing these distinctions is crucial when drafting an Oregon Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause to ensure compliance with labor laws.

Yes, in most cases, you will need a business license to operate as an independent contractor in Oregon. This requirement helps ensure compliance with local laws and regulations. Additionally, having a well-structured Oregon Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause can provide clarity and legitimacy to your services. Check with your local government for specifics on licensing requirements.

To become an independent contractor in Oregon, you need to follow a few straightforward steps. First, ensure that you meet the necessary state regulations and industry requirements. Next, consider drafting an Oregon Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause to formalize your business relationships. Finally, register your business and obtain any required licenses to operate successfully.

The independent contractor agreement in Oregon is a formal contract that establishes the relationship between a consultant and a client. This agreement outlines the terms, responsibilities, and compensation for services provided. It often includes a limitation of liability clause, helping to protect both parties in case of unforeseen issues. Understanding this agreement is vital for anyone considering an Oregon Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause.

In Oregon, the liability period for contractors varies depending on the type of work performed and any specific agreements made. Generally, a contractor may be liable for up to six years for breaches of contract and related issues under Oregon law. It is crucial to include specific terms regarding liability in your Oregon Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause to clarify expectations and responsibilities. Consulting a legal expert can help ensure your contract addresses these vital points effectively.

A limitation of liability clause in an Oregon Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause defines the extent to which a consultant can be held responsible for various issues that may arise during their work. This clause typically aims to minimize financial losses that could occur from potential lawsuits or claims against the consultant. By including this clause, both the consultant and the client can understand their legal boundaries and protect their interests. It's an essential part of a well-drafted contract.

In Oregon, the amount of work you can do without a contractor license is limited primarily to small projects. Typically, if your work is valued below a certain threshold, you might not need a license. However, this can lead to risks, especially concerning contracts like the Oregon Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause. For larger projects, securing the necessary licenses is crucial to ensure compliance and protection in your business endeavors.

Yes, contractors typically need to be licensed in Oregon to legally provide their services. This licensing includes meeting specific criteria and obtaining permits relevant to your field of work. If you are working under an Oregon Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, ensuring you are properly licensed can protect your rights and limit potential liabilities.

In Oregon, any individual or entity that engages in business activities must possess a valid business license. This includes self-employed independent contractors who operate under an Oregon Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause. Even if you provide services from home, obtaining a license helps ensure compliance with local regulations and provides legitimacy to your business.

In general, 1099 employees, or independent contractors, do not qualify for unemployment benefits in Oregon because they are not considered employees. However, there are exceptions, particularly during certain economic crises, where specific programs may provide assistance. Reviewing your Oregon Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause can help you understand your status and potential benefits.

More info

For an agreement between a company and an individual employee, there may be additional restrictions and/or liabilities as set forth in the applicable limitations and exclusions clause. This table shows the maximum level of compensation that an employee may receive upon termination, discharge, resignation, termination from employment with the company, and the potential damages (such as monetary damages) that may be awarded. An employee may receive more than the amount in the table depending on the terms and conditions of the employment and the applicable restrictions or exclusions clauses. Brief Introduction This is a brief introduction to the Limitation of Liability, or Limitation of Liability Restrictive Covenant for Collective Bargaining Disputes.