Oregon Lease to Own for Commercial Property

Description

How to fill out Lease To Own For Commercial Property?

Are you currently in a circumstance where you require documents for both business and personal reasons almost every day? There are numerous legal document templates available online, but finding reliable versions isn't straightforward.

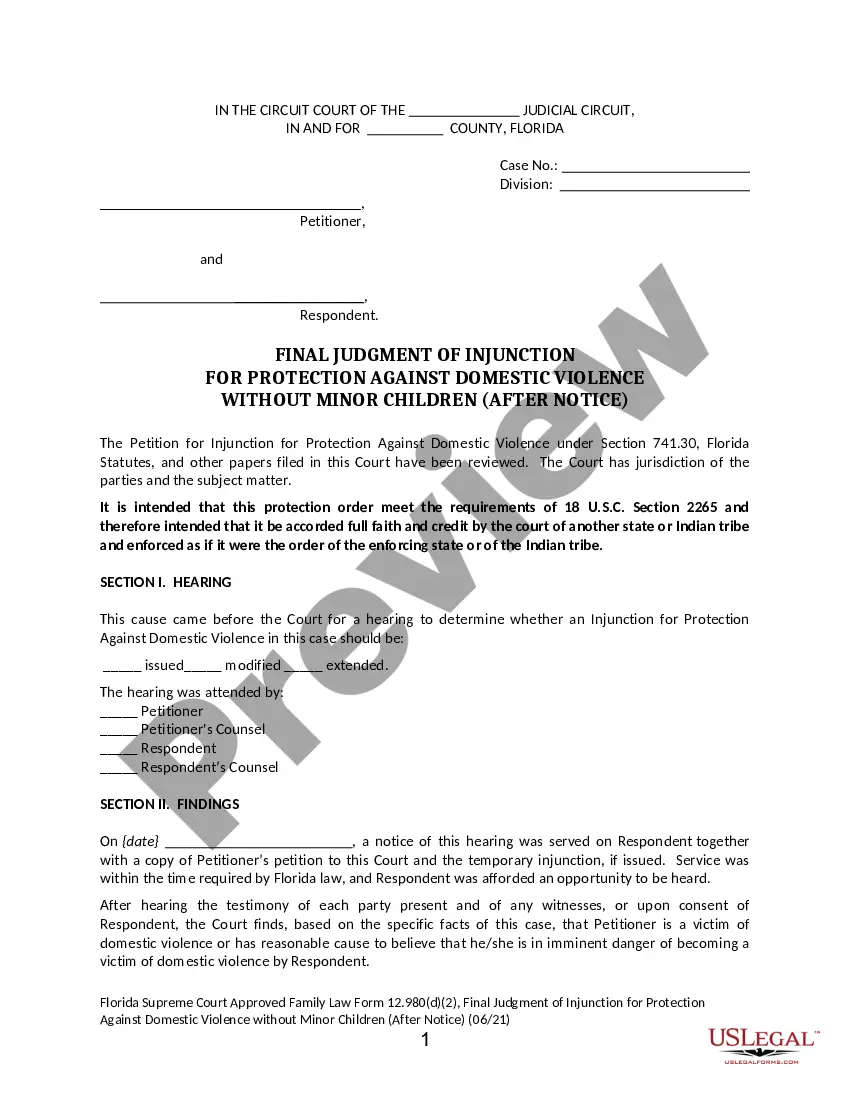

US Legal Forms provides thousands of form templates, including the Oregon Lease to Own for Commercial Property, which can be downloaded to meet state and federal requirements.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. Afterwards, you can download the Oregon Lease to Own for Commercial Property template.

- Identify the form you need and ensure it’s for the correct city/state.

- Use the Preview button to review the document.

- Check the details to confirm you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the template that suits your needs and requirements.

- Once you find the correct form, click Purchase now.

- Choose the pricing plan you prefer, complete the required information to set up your account, and process the payment using your PayPal or credit card.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

How long is a typical commercial lease? Commercial leases are typically three to five years. That guarantees enough rental income for the landlords to recoup their investment.

Except as otherwise provided by statute or agreement, such tenancy may only be terminated by either the landlord or tenant giving the other, at any time during the tenancy, not less than 30 days' notice in writing prior to the date designated in the notice for the termination of the tenancy.

An Oregon rent-to-own agreement is a form that authorizes a tenant to rent real estate for a fixed term with the option of buying the rented space when the term expires. In addition to the monthly rent, the tenant may be required to pay an upfront, non-refundable fee.

This lease structure makes the tenant responsible for the majority of costs. Specifically, the tenant pays the base rent, property but also taxes, insurance, utilities, and maintenance. This even includes standard property repairs associated with the commercial space being occupied.

Commercial property can be converted into a residential property if zoning and housing laws allow. Local governments have regulations dictating property distinctions and, in most cases, will distinguish specific areas for residential versus commercial land use.

Most commercial leases forbid subletting. There is a good reason for that. As soon as more than two parties are involved, agreement becomes more difficult and conflict more likely. Furthermore, the head landlord, who of course owns the property, is less able to enforce his rights.

It is not generally advisable to lease a commercial property without a written agreement. Issues typically arise when the landlord is looking to sell or take possession of the property and evict the tenant.

It's legal and common for commercial properties in Portland. They require your tenants to pay a monthly rent and also to contribute or completely pay for the expenses associated with operating the building and the communal spaces. This might include taxes and utilities as well as maintenance.

A Triple Net Lease (NNN Lease) is the most common type of lease in commercial buildings. In a NNN lease, the rent does not include operating expenses. Operating expenses include utilities, maintenance, property taxes, insurance and property management.

If you purchase a building that is registered as commercial property, then you may need to obtain planning permission before you go ahead and convert it to residential accommodation.