The Oregon Sale and Leaseback Agreement for Commercial Building is a contractual arrangement allowing a property owner in Oregon to sell their commercial building while simultaneously leasing it back from the buyer. This agreement offers an effective way for businesses to access capital tied up in their property without needing to relocate or disrupt their operations. In an Oregon Sale and Leaseback Agreement for Commercial Building, the property owner becomes the lessee, entering into a lease with the new owner (the buyer/investor), who becomes the lessor. This lease typically spans a long-term period, ensuring stability for the lessee and providing an attractive investment opportunity for the lessor. This unique arrangement allows businesses in Oregon to retain occupancy and utilization rights for their commercial properties while freeing up capital for various purposes, such as expansion, debt reduction, and business operations. The lease terms, rental payments, and other relevant conditions are clearly stated and agreed upon in the Sale and Leaseback Agreement. There are various types of Oregon Sale and Leaseback Agreements for Commercial Buildings, primarily categorized based on the lease structure and terms: 1. Full Payout Leaseback: In this type, the sale proceeds cover the full value of the property, and the leaseback is established for a pre-determined period. Upon completion of the lease term, the lessee typically has the option to repurchase the property or negotiate a new lease. 2. Partial Payout Leaseback: In this scenario, only a portion of the commercial property's value is paid to the seller as a lump sum, while the remaining value is paid out to the seller over the lease term. This type offers greater liquidity to the seller, as they continue to receive periodic payments. 3. Net Leaseback: A net leaseback agreement involves the lessee (previous owner) being responsible for not only the base rent but also property taxes, insurance, maintenance, and other operating expenses associated with the property. The lessor (buyer/investor) receives a more predictable, net rental income. 4. Triple Net Leaseback: This type is similar to a net leaseback; however, the lessee is also responsible for property management, repair costs, and other variable expenses explicitly listed in the agreement. The lessor enjoys minimal management obligations and a more passive, predictable income stream. The flexibility and advantages offered by the Oregon Sale and Leaseback Agreement for Commercial Building make it an appealing option for both businesses seeking capital infusion and investors looking for stable, long-term returns. It is crucial for all parties involved to thoroughly review and negotiate the terms and conditions of the agreement to ensure mutual satisfaction and a successful commercial property transaction.

Oregon Sale and Leaseback Agreement for Commercial Building

Description

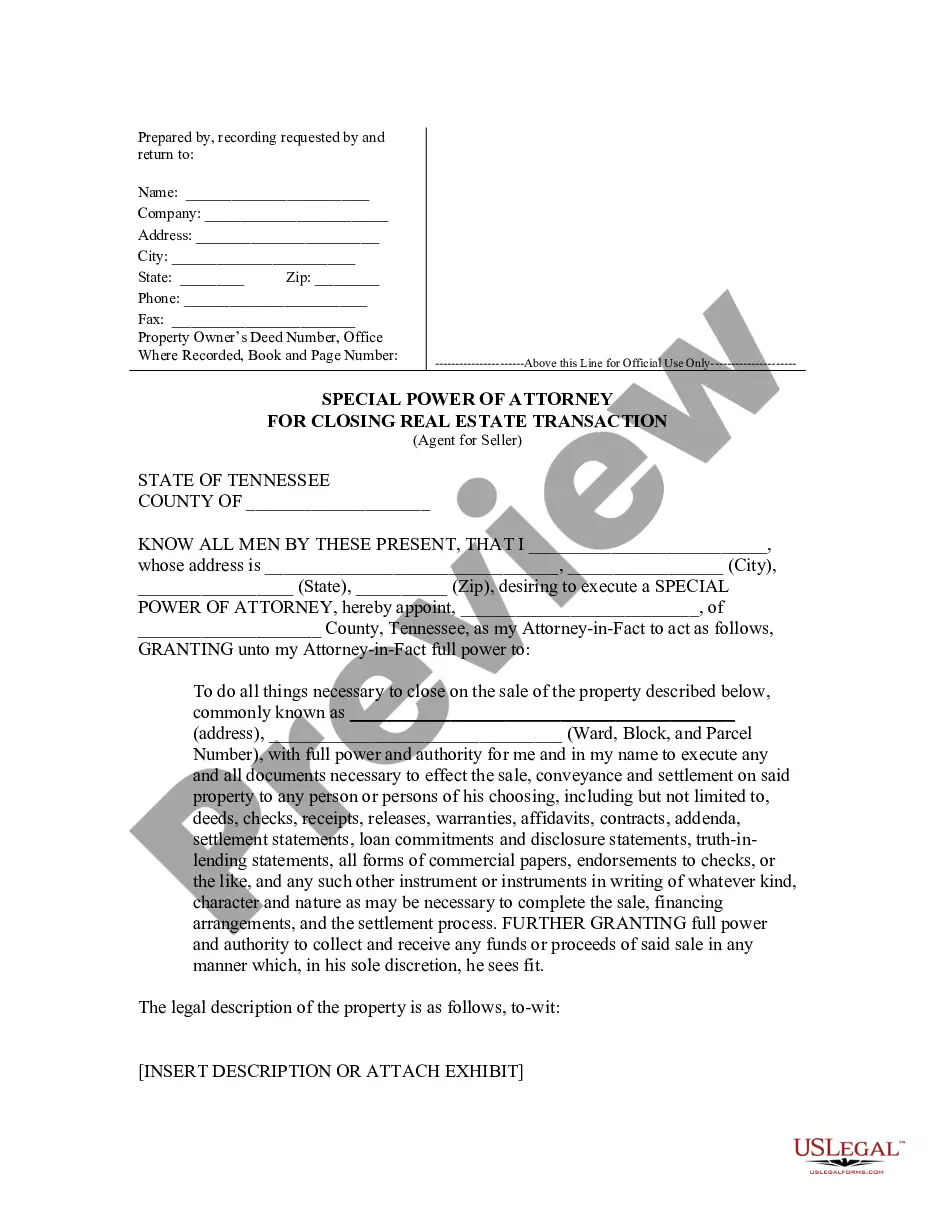

How to fill out Oregon Sale And Leaseback Agreement For Commercial Building?

Finding the right lawful record format could be a battle. Obviously, there are a lot of web templates available on the Internet, but how do you find the lawful kind you require? Make use of the US Legal Forms web site. The assistance gives a large number of web templates, such as the Oregon Sale and Leaseback Agreement for Commercial Building, which can be used for company and personal demands. All of the forms are checked out by professionals and fulfill federal and state specifications.

When you are currently signed up, log in in your bank account and then click the Acquire key to get the Oregon Sale and Leaseback Agreement for Commercial Building. Use your bank account to appear through the lawful forms you might have bought formerly. Visit the My Forms tab of your respective bank account and get yet another duplicate from the record you require.

When you are a whole new customer of US Legal Forms, allow me to share basic recommendations that you can stick to:

- First, ensure you have chosen the right kind to your city/state. It is possible to look through the shape making use of the Preview key and read the shape explanation to make sure this is basically the best for you.

- In case the kind is not going to fulfill your expectations, use the Seach area to discover the proper kind.

- When you are sure that the shape is proper, select the Purchase now key to get the kind.

- Opt for the pricing prepare you would like and type in the required details. Make your bank account and pay for the transaction with your PayPal bank account or Visa or Mastercard.

- Choose the document file format and obtain the lawful record format in your device.

- Complete, edit and print out and sign the acquired Oregon Sale and Leaseback Agreement for Commercial Building.

US Legal Forms is the most significant collection of lawful forms where you can discover a variety of record web templates. Make use of the company to obtain expertly-created documents that stick to express specifications.