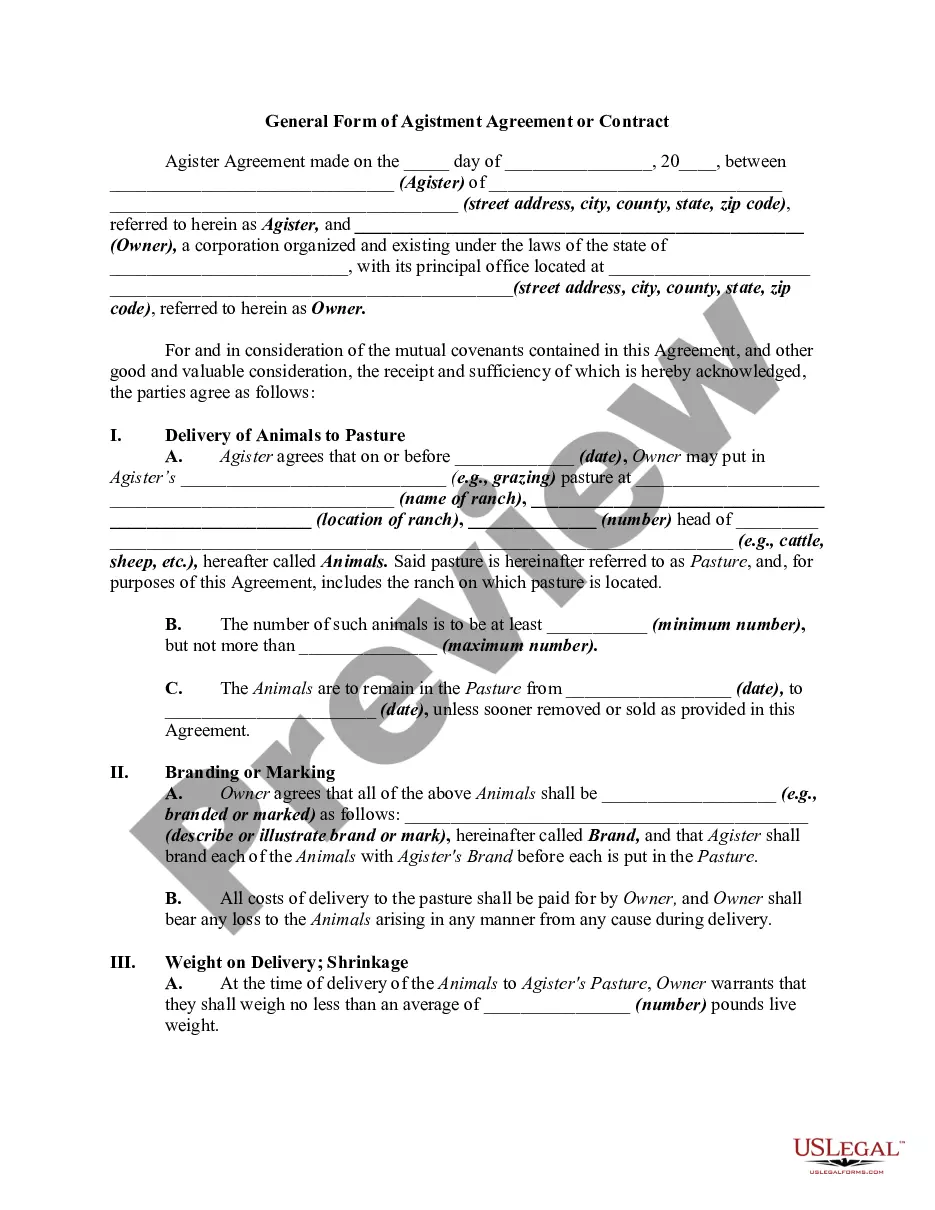

An agister is a person who feeds or pastures livestock for a fee. The duty of an agister to keep fences in good repair need not be made an express condition of the agreement, since this duty is implied. Agistment contracts are generally subject to the law of bailments.In this form, the agister is contracting out its responsibilities to a third party.

Oregon Agistment Agreement or Contract Between Agister and Self-Employed Independent Contractor

Description

How to fill out Agistment Agreement Or Contract Between Agister And Self-Employed Independent Contractor?

Are you presently in a circumstance where you need documents for both organization or particular purposes almost every day.

There are numerous legal document templates available online, but locating versions you can rely on is challenging.

US Legal Forms offers thousands of document templates, such as the Oregon Agistment Agreement or Contract Between Agister and Self-Employed Independent Contractor, which are crafted to comply with state and federal regulations.

Select a suitable file format and download your copy.

Access all of the document templates you have purchased in the My documents section. You can obtain an additional copy of the Oregon Agistment Agreement or Contract Between Agister and Self-Employed Independent Contractor whenever needed. Just click on the required form to download or print the document template.

Utilize US Legal Forms, the most extensive collection of legal documents, to save time and avoid mistakes. The service provides professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Oregon Agistment Agreement or Contract Between Agister and Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, take these steps.

- Find the form you need and ensure it is for your correct state/region.

- Use the Preview option to view the form.

- Check the details to ensure you have selected the right document.

- If the form isn’t what you are looking for, utilize the Search feature to find the document that meets your needs and requirements.

- Once you have found the correct form, click on Get now.

- Choose the pricing plan you desire, enter the required information to create your account, and process your order using PayPal or a credit card.

Form popularity

FAQ

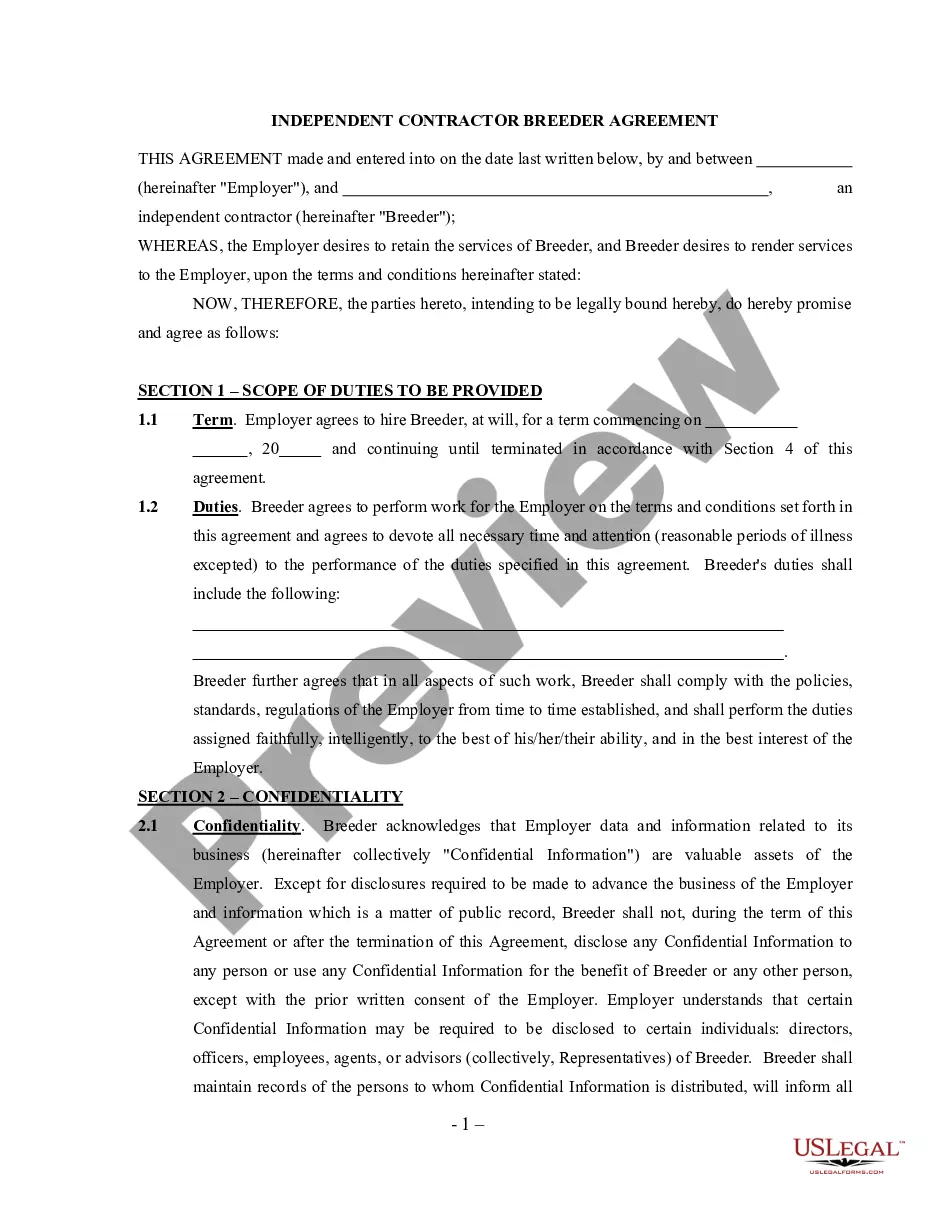

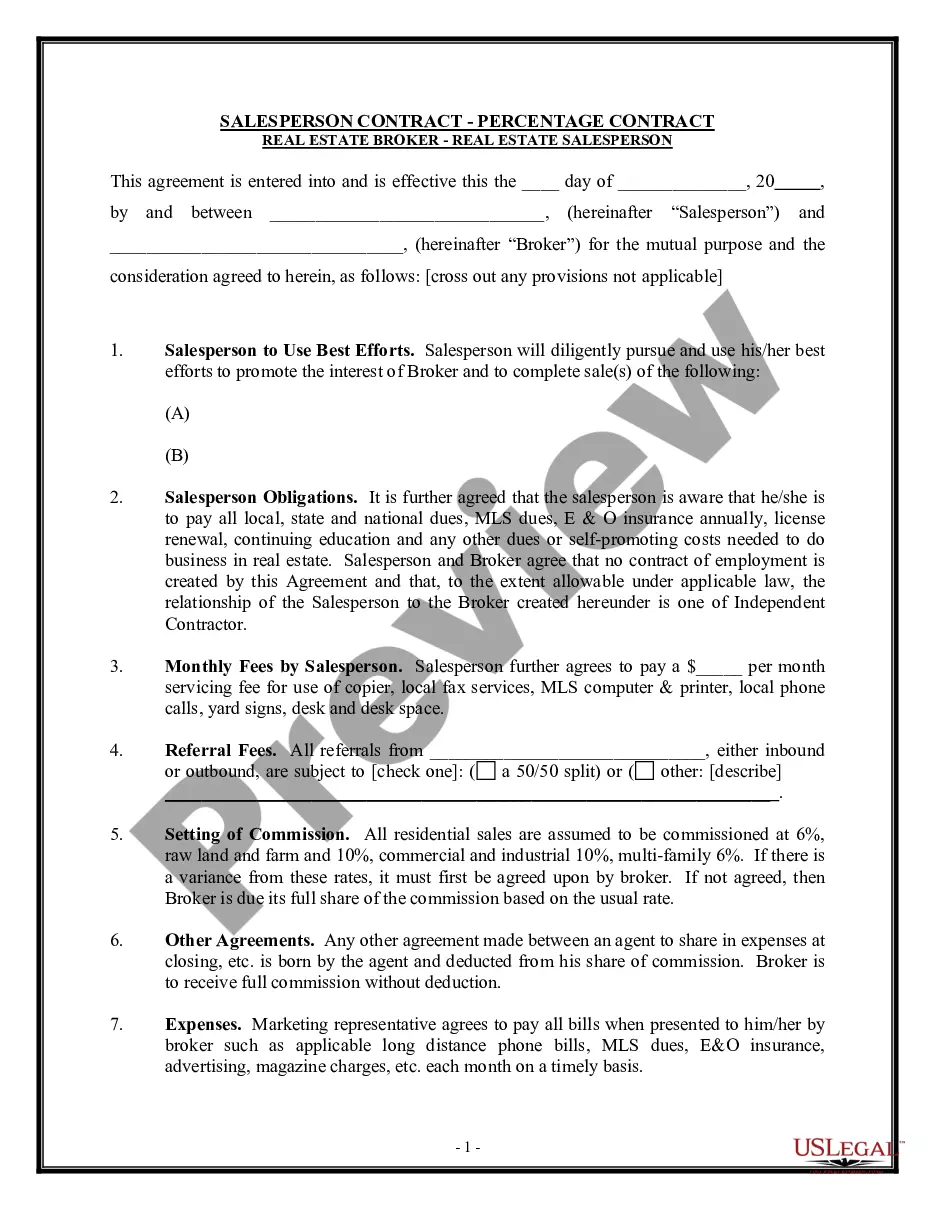

In Oregon, an independent contractor is someone who offers services independently, without substantial control from an employer. They usually operate under a business entity, negotiate their contracts, and decide their work methods. Documenting this relationship through an Oregon Agistment Agreement or Contract Between Agister and Self-Employed Independent Contractor can provide clarity and legal protection for both parties involved.

In Oregon, an employee is defined as an individual who works under the control of an employer. This includes receiving instructions on how to perform tasks, a set work schedule, and tools provided by the employer. Additionally, employees typically receive a consistent paycheck with taxes withheld. This classification affects rights and benefits under various laws, making it essential to clearly outline roles in any agreements.

A 1099 form is issued to independent contractors, while a W2 form is used for employees. The key difference lies in tax treatment; employers do not withhold taxes from a 1099 worker's compensation. As a result, independent contractors must manage tax payments to avoid penalties. Understanding this distinction is vital, especially when drafting an Oregon Agistment Agreement or Contract Between Agister and Self-Employed Independent Contractor.

The most significant factor is the level of control exerted by the employer over the worker’s activities. If the employer dictates when, where, and how work is completed, the individual is likely an employee. Conversely, if the worker has the freedom to decide on their schedules and methods, they may be classified as an independent contractor. This distinction is crucial in establishing a clear Oregon Agistment Agreement or Contract Between Agister and Self-Employed Independent Contractor.

In Oregon, 1099 employees, or independent contractors, typically do not qualify for unemployment benefits. This situation stems from the nature of their work and their relationship with employers. Since they operate as self-employed individuals, they must rely on their own savings or revenue. However, during exceptional circumstances, such as national emergencies, there may be temporary benefits available.

Yes, independent contractors in Oregon typically need a business license, depending on the nature of their work. If you’re involved in agreements like the Oregon Agistment Agreement or Contract Between Agister and Self-Employed Independent Contractor, a business license is crucial for operating legally. It helps establish credibility and can open doors to additional opportunities. You can use platforms like US Legal Forms to guide you through the licensing process and ensure you meet all requirements.

In Oregon, several types of businesses must obtain a business license. Generally, anyone who operates a business that requires permits, such as contractors or service providers, should secure a license. This includes those involved in an Oregon Agistment Agreement or Contract Between Agister and Self-Employed Independent Contractor. By having a business license, you can ensure compliance with state regulations, which is essential for legal and financial protection.

Self-employed individuals may face challenges when it comes to maternity leave. Generally, there is no guaranteed leave for self-employed people unless they have specific arrangements in place, like an Oregon Agistment Agreement or Contract Between Agister and Self-Employed Independent Contractor that addresses leave provisions. It is vital for self-employed workers to consider their options for income protection and plan ahead. For those needing support, the USLegalForms platform offers valuable resources to help you navigate these agreements effectively.

Yes, Oregon requires contractors to have a valid license for most types of contracting work. This regulation aims to uphold standards and ensure quality in the industry. If you're involved in projects that align with the Oregon Agistment Agreement or Contract Between Agister and Self-Employed Independent Contractor, verifying your licensing status is crucial.

Yes, you generally need a business license to legally work as an independent contractor in Oregon. This requirement applies to various fields and helps ensure compliance with state and local laws. If you're entering into an agreement such as the Oregon Agistment Agreement or Contract Between Agister and Self-Employed Independent Contractor, having your business license is essential.