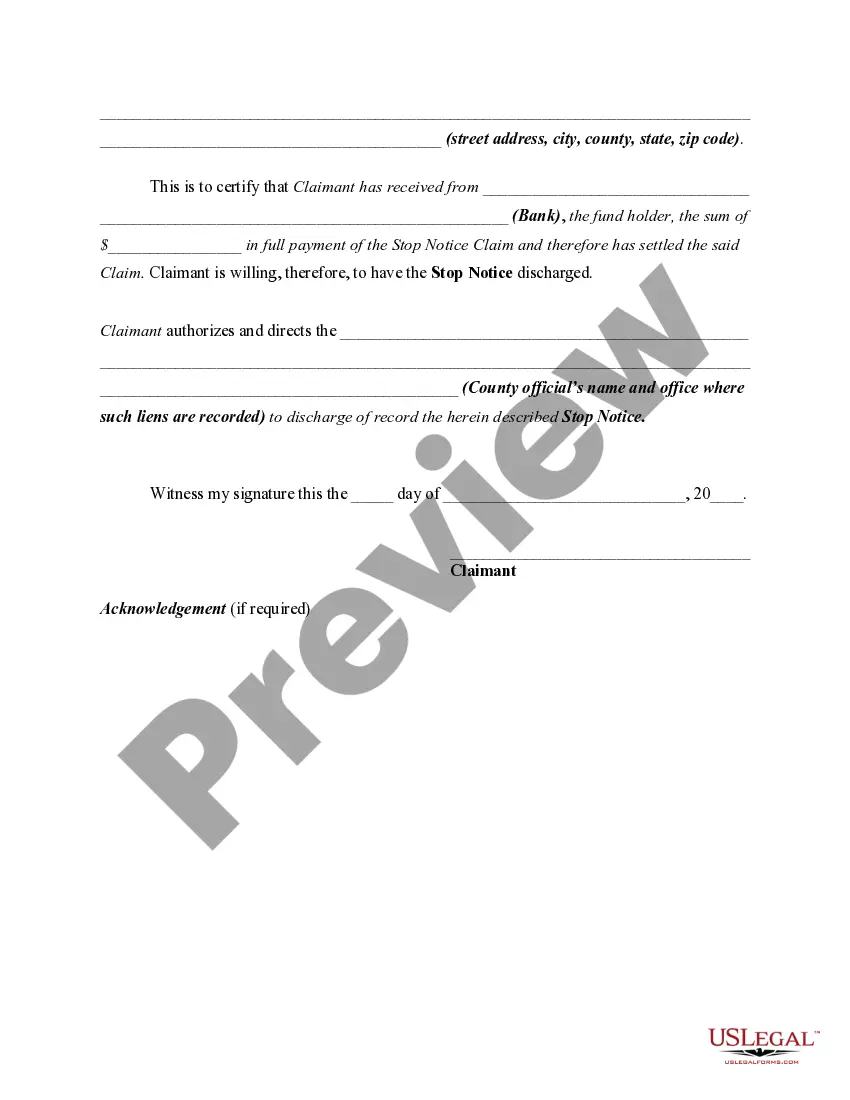

The right to execute and deliver a stop notice or a notice to withhold funds is a remedy closely related to a mechanic's lien. When a stop notice or a notice to withhold funds is received by an individual or a firm holding the construction funds for a project, the individual or firm must withhold from its disbursements sufficient money to satisfy the stop notice claim. In this form, the claimant is informing the appropriate court clerk that he has settled the claim and is authorizing the court clerk to discharge of record the Stop Notice.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.