Oregon Partial Assignment of Life Insurance Policy as Collateral

Description

How to fill out Partial Assignment Of Life Insurance Policy As Collateral?

You may spend time online looking for the approved document format that meets the federal and state requirements you will need.

US Legal Forms provides a vast array of legal templates that are reviewed by experts.

You can easily download or print the Oregon Partial Assignment of Life Insurance Policy as Collateral from my service.

If available, use the Review button to examine the document format as well. If you want to find another version of the form, use the Search field to locate the format that meets your requirements and needs.

- If you already possess a US Legal Forms account, you may sign in and click on the Acquire button.

- Then, you may fill out, edit, print, or sign the Oregon Partial Assignment of Life Insurance Policy as Collateral.

- Every legal document template you obtain is yours forever.

- To get another copy of any acquired form, visit the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document format for the area/city of your choice.

- Review the form description to ensure you have chosen the correct template.

Form popularity

FAQ

A collateral assignment is typically used when an insurance policy is used as collateral for a loan. This is a temporary assignment until the debt is paid in full.

A collateral assignment primarily serves to protect the repayment interest of the lender. An assignment of all rights in a policy is considered an absolute assignment; this would essentially constitute a change of policy ownership.

Which of these actions is taken when a policyowner uses a Life Insurance policy as collateral for a bank loan? Collateral assignment" A policyowner using the Life Insurance policy as collateral for a bank loan normally would make a collateral assignment.

The reinstatement provision allows an insured to continue coverage under a previously lapsed policy. What are collateral assignments normally associated with? Collateral loans are normally associated with bank loans.

Collateral assignment of life insurance is a method of providing a lender with collateral when you apply for a loan. In this case, the collateral is your life insurance policy's face value, which could be used to pay back the amount you owe in case you die while in debt.

?Collateral assignment of life insurance is typically associated with business loans and mortgages,? says Martinez. If you're launching a small business and applying for a loan to help you get started, the bank might request that you include your life insurance policy as collateral.

A collateral assignment supersedes your beneficiaries' rights to the death benefit. If you die, the life insurance company pays the lender, or assignee, the loan balance. As noted earlier, any remaining benefit goes to your beneficiaries.

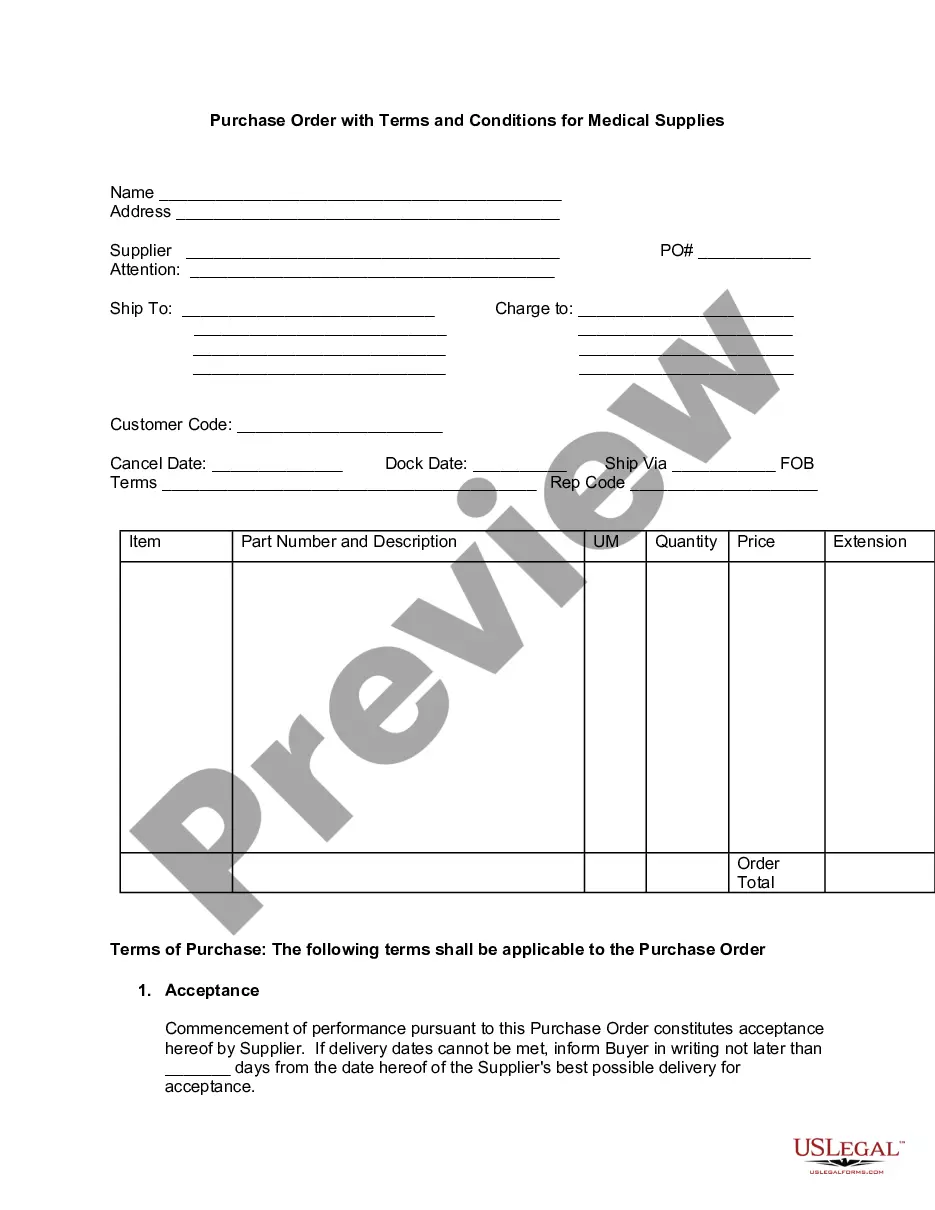

Under partial assignment, only the designated amount is paid to the assignee. Rest of the proceeds are paid to the nominee. If your expected insurance proceeds are more than the loan amount, you should opt for partial assignment.

Under partial assignment, only the designated amount is paid to the assignee. Rest of the proceeds are paid to the nominee. If your expected insurance proceeds are more than the loan amount, you should opt for partial assignment.

A collateral assignment of life insurance is a conditional assignment appointing a lender as an assignee of a policy. Essentially, the lender has a claim to some or all of the death benefit until the loan is repaid. The death benefit is used as collateral for a loan.