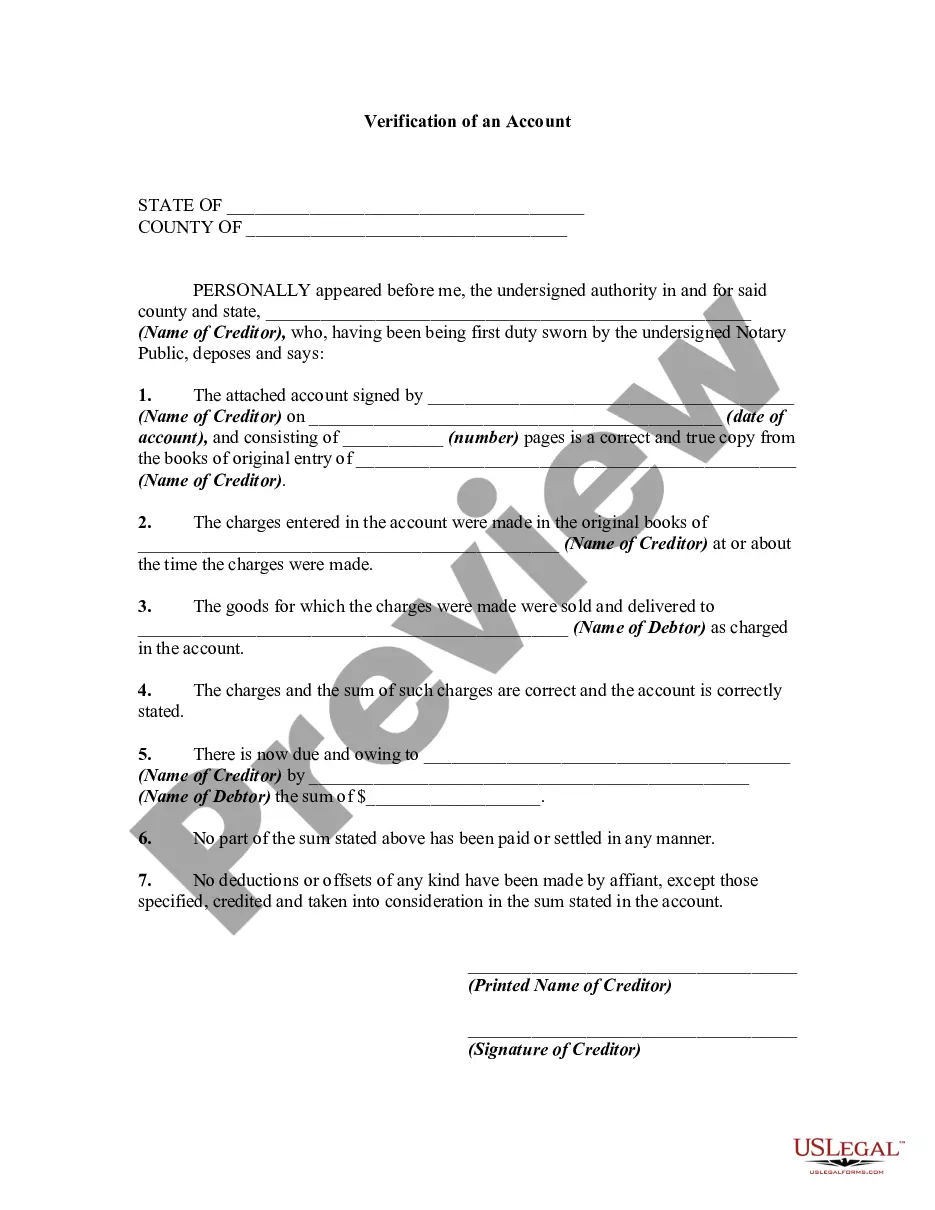

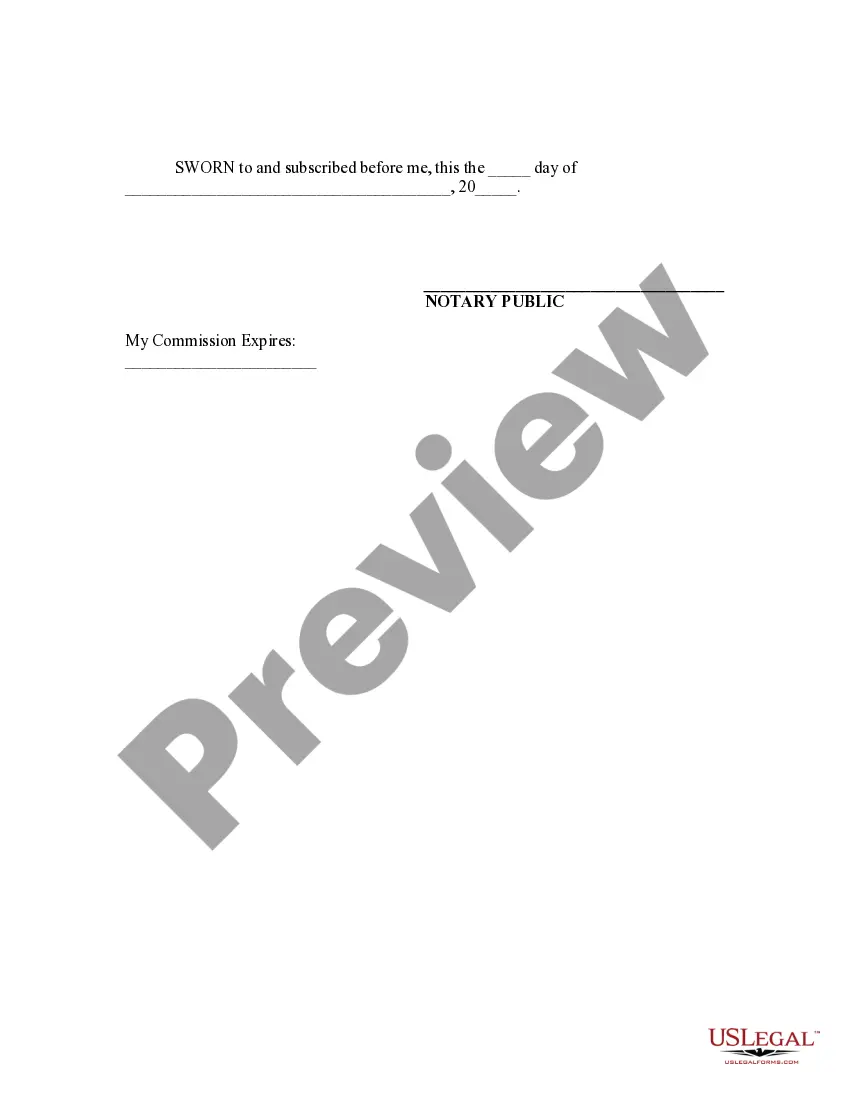

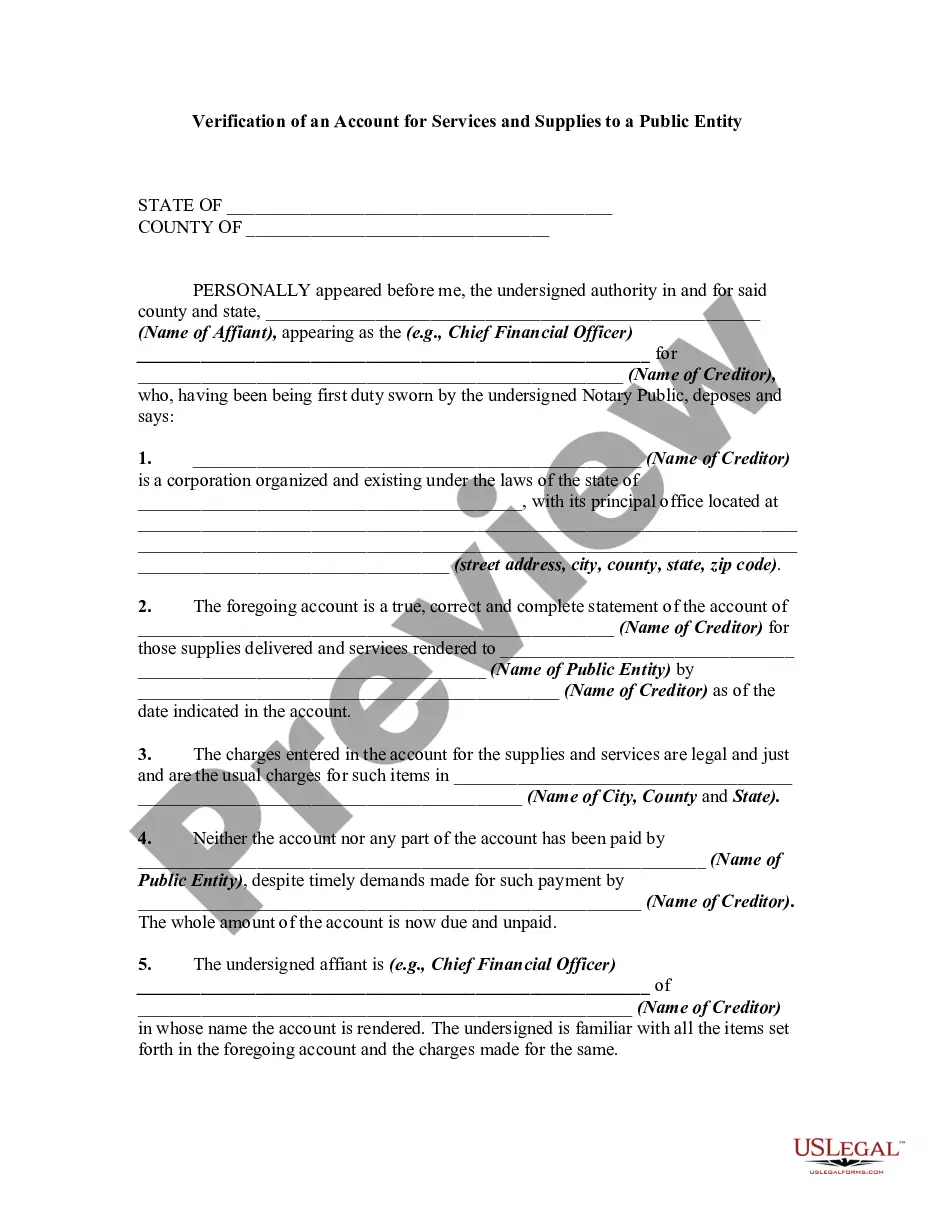

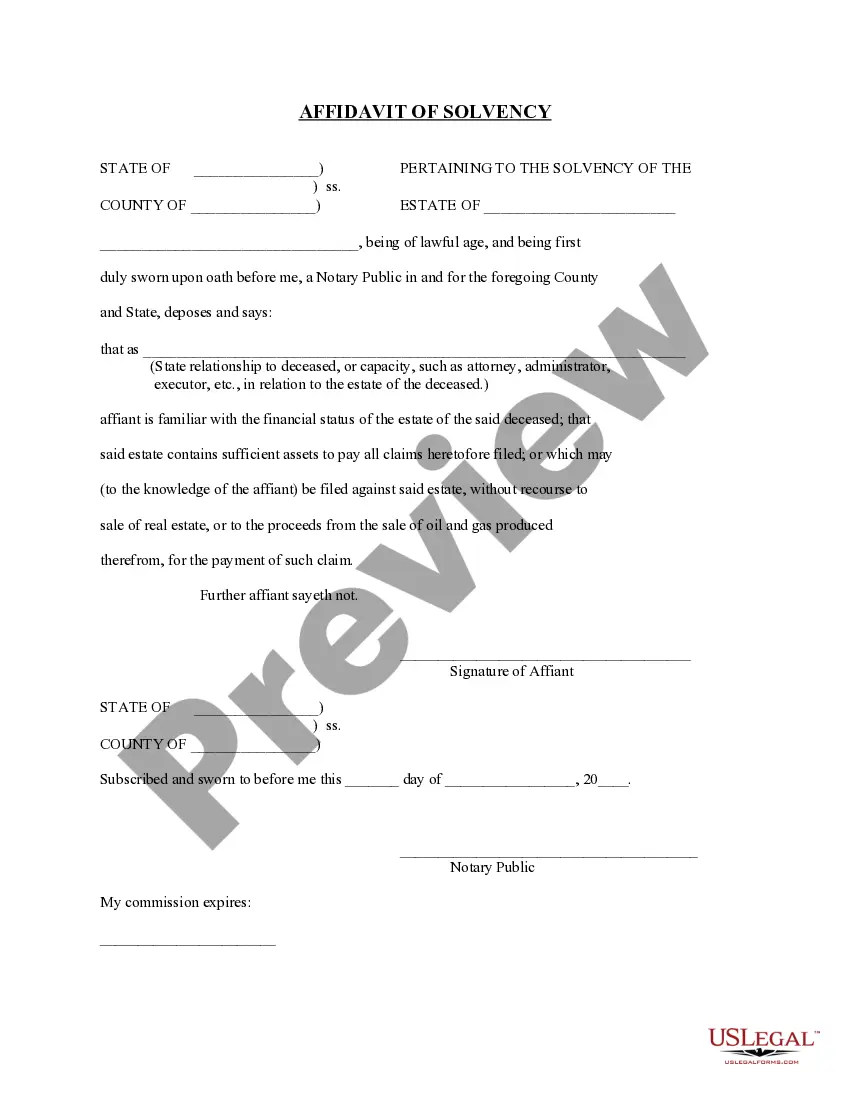

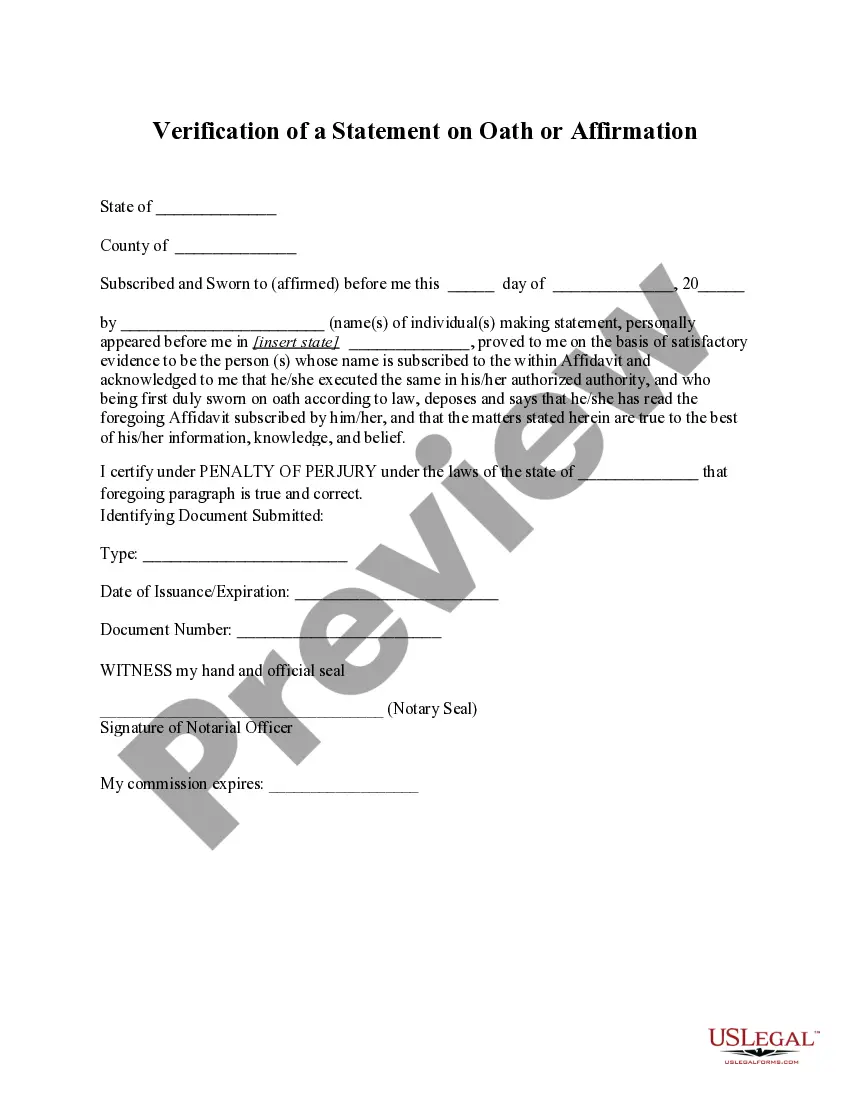

An account is an unsettled claim or demand by one person against another based on a transaction creating a debtor-creditor relationship between the parties. A verified account usually takes the form of an affidavit, in which a statement of an account is verified under oath as to the accuracy of the account. Ordinarily, where an action is based on an itemized account, the correctness of which is verified, the account is taken as true. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Oregon Verification of an Account

Description

How to fill out Verification Of An Account?

You may spend hrs online attempting to find the lawful document template which fits the state and federal demands you need. US Legal Forms supplies a large number of lawful varieties that are evaluated by experts. You can actually acquire or produce the Oregon Verification of an Account from the assistance.

If you already have a US Legal Forms account, you may log in and click the Down load switch. After that, you may total, revise, produce, or sign the Oregon Verification of an Account. Each and every lawful document template you purchase is your own property eternally. To obtain an additional duplicate of any purchased type, go to the My Forms tab and click the corresponding switch.

Should you use the US Legal Forms internet site the first time, keep to the simple guidelines below:

- Very first, make sure that you have selected the right document template for the county/area of your choosing. Read the type description to make sure you have picked the right type. If accessible, take advantage of the Review switch to search through the document template too.

- If you want to locate an additional edition of the type, take advantage of the Look for discipline to find the template that fits your needs and demands.

- Upon having located the template you desire, click on Get now to continue.

- Select the pricing plan you desire, key in your qualifications, and register for an account on US Legal Forms.

- Full the transaction. You can utilize your Visa or Mastercard or PayPal account to purchase the lawful type.

- Select the formatting of the document and acquire it to your product.

- Make changes to your document if necessary. You may total, revise and sign and produce Oregon Verification of an Account.

Down load and produce a large number of document templates utilizing the US Legal Forms website, which provides the biggest variety of lawful varieties. Use specialist and express-specific templates to tackle your company or person requirements.

Form popularity

FAQ

The Oregon Medical Board offers several ways to obtain verification of licensure in Oregon: Anyone can access the on-line License Verification Service to obtain primary source licensure verification, free of charge. To access the License Verification Service, click here.

You must file an Oregon Annual Withholding Reconciliation Report, Form WR, even if you submit your W-2 information electronically. Form WR is due January 31 in the year after the tax year. If you stop doing business during the year, the report is due within 30 days of your final payroll.

Free electronic preparation and filing services for both federal and Oregon tax returns to eligible Oregon taxpayers. For a taxpayer to be eligible to use our free services, they will need to meet the following requirements: AGI is $46,000 or less.

In order to send verification of your Oregon registration or examination information to another state board or entity, please submit the Request for Verification form and verification fee. You may submit this form and payment to the Board office by mail or email at osbeels.info@osbeels.oregon.gov.

Oregon State Tax Forms If you filed a paper form last year, you will receive a paper form in the mail this year. If you need a booklet, call Oregon Department of Revenue at 503.378. 4988 or 1.800. 356.4222 or e-mail questions.dor@state.or.us.

To request a License Verification, the licensee must log into the License Portal , then navigate to the Document Request form and complete and submit the form. Note- If the Licensee has never logged into the License Portal, they will need to first activate their account!

The OSBN provides licensing data as part of its official website, at . This website is the primary source for nurse and nursing assistant licensure status and other related OSBN information and data.

?From the Revenue Online homepage, select Sign Up, located below the log in fields. Enter the required information.

Find Your Oregon Tax ID Numbers and Rates Look this up online or on any correspondence received from the OR Department of Revenue. If you have a Business Identification Number that is 8 digits long, please add a 0 to the beginning. If you're unsure, contact the agency at 503-945-8091 or 800-356-4222.

Although there are a variety of factors that can impact processing times, most applications are processed in 4-6 weeks. It's also important to note that you can track the status of your application online!