Are you in a situation in which you require files for possibly business or individual functions nearly every day? There are a lot of lawful papers web templates available online, but discovering types you can rely is not straightforward. US Legal Forms provides a large number of develop web templates, like the Oregon Complaint Against Guarantor of Open Account Credit Transactions - Breach of Oral or Implied Contracts, that are published to meet federal and state needs.

Should you be presently familiar with US Legal Forms website and get an account, just log in. After that, you can obtain the Oregon Complaint Against Guarantor of Open Account Credit Transactions - Breach of Oral or Implied Contracts web template.

Unless you provide an accounts and wish to begin using US Legal Forms, follow these steps:

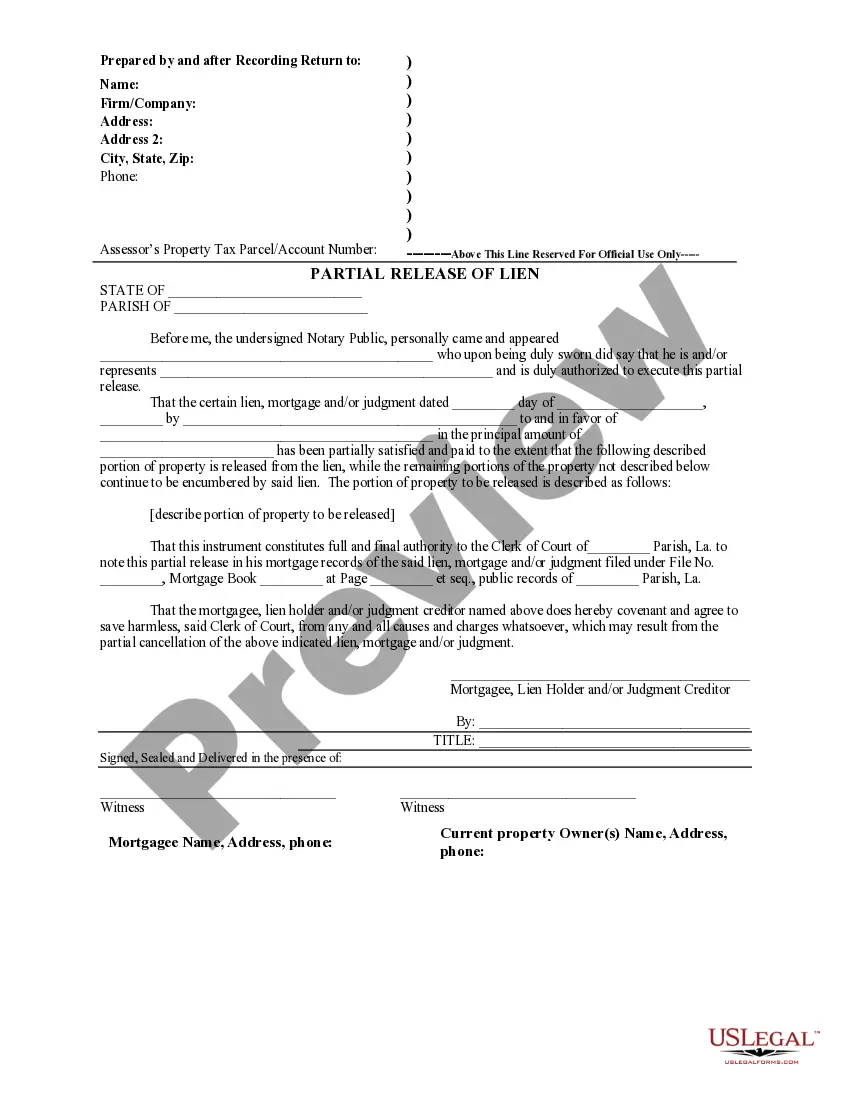

- Get the develop you need and ensure it is to the appropriate metropolis/state.

- Make use of the Review key to review the form.

- Browse the information to ensure that you have selected the right develop.

- In the event the develop is not what you`re trying to find, make use of the Search area to obtain the develop that meets your needs and needs.

- When you discover the appropriate develop, click Purchase now.

- Select the pricing plan you desire, complete the required info to create your account, and buy an order with your PayPal or charge card.

- Choose a practical data file file format and obtain your version.

Find all of the papers web templates you possess purchased in the My Forms food selection. You can aquire a extra version of Oregon Complaint Against Guarantor of Open Account Credit Transactions - Breach of Oral or Implied Contracts at any time, if required. Just go through the required develop to obtain or print the papers web template.

Use US Legal Forms, probably the most considerable selection of lawful varieties, to save some time and stay away from errors. The service provides skillfully produced lawful papers web templates which you can use for a selection of functions. Make an account on US Legal Forms and start creating your daily life a little easier.