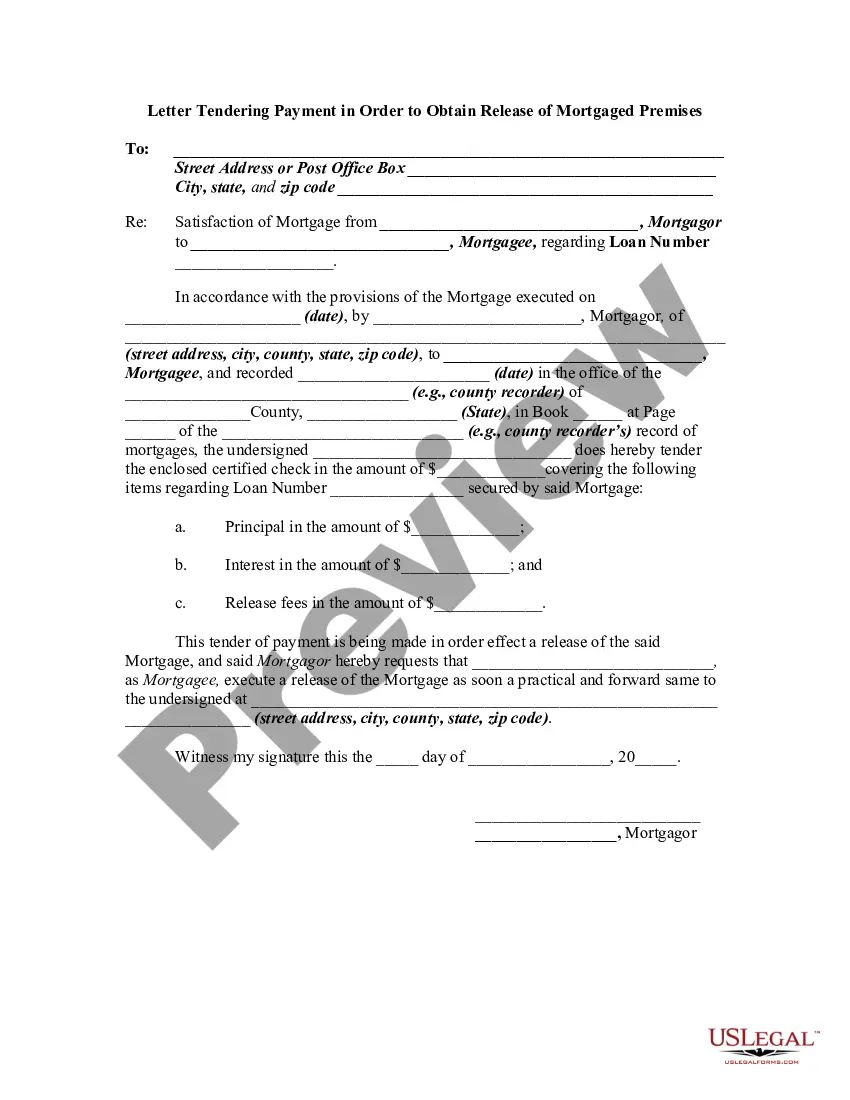

An agreement that creates an interest in real property as security for an obligation, such as the payment of a note, and that is to cease upon the performance of the obligation, is called a mortgage. The person whose interest in the property is given as security is the mortgagor. The person who receives the security is the mortgagee (e.g., lender). A release, deed of reconveyance, deed of release, or authority to cancel is used by a mortgagee to renounce a claim upon a person's real property subject to the mortgage.

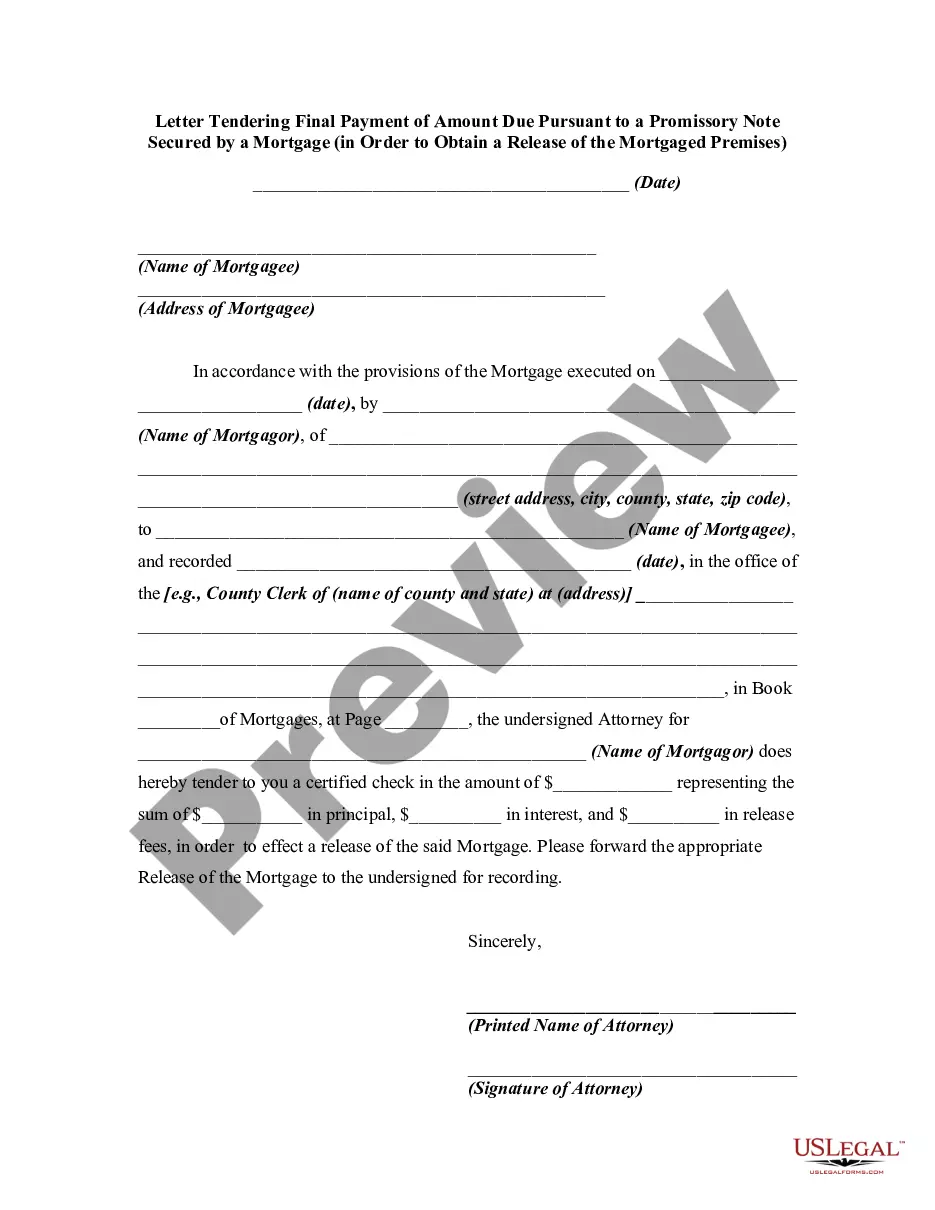

Oregon Letter Tendering Final Payment of Amount Due Pursuant to a Promissory Note Secured by a Mortgage in Order to Obtain a Release of the Mortgaged Premises

Description

How to fill out Letter Tendering Final Payment Of Amount Due Pursuant To A Promissory Note Secured By A Mortgage In Order To Obtain A Release Of The Mortgaged Premises?

Discovering the right legitimate record template can be quite a battle. Obviously, there are plenty of layouts accessible on the Internet, but how would you get the legitimate type you want? Take advantage of the US Legal Forms website. The support offers a huge number of layouts, including the Oregon Letter Tendering Final Payment of Amount Due Pursuant to a Promissory Note Secured by a Mortgage in Order to Obtain a Release of the Mortgaged Premises, which can be used for business and private needs. Each of the types are checked by pros and satisfy state and federal demands.

In case you are already registered, log in for your accounts and click the Obtain switch to find the Oregon Letter Tendering Final Payment of Amount Due Pursuant to a Promissory Note Secured by a Mortgage in Order to Obtain a Release of the Mortgaged Premises. Utilize your accounts to search throughout the legitimate types you have ordered formerly. Check out the My Forms tab of your own accounts and obtain one more version from the record you want.

In case you are a whole new customer of US Legal Forms, listed here are straightforward instructions that you should comply with:

- Very first, ensure you have selected the right type to your town/region. It is possible to look through the shape using the Preview switch and study the shape outline to guarantee it will be the right one for you.

- When the type fails to satisfy your needs, utilize the Seach field to get the correct type.

- Once you are positive that the shape is suitable, click on the Acquire now switch to find the type.

- Pick the prices plan you desire and enter the required info. Make your accounts and pay for an order using your PayPal accounts or bank card.

- Choose the document structure and obtain the legitimate record template for your device.

- Full, change and print out and sign the received Oregon Letter Tendering Final Payment of Amount Due Pursuant to a Promissory Note Secured by a Mortgage in Order to Obtain a Release of the Mortgaged Premises.

US Legal Forms is definitely the most significant local library of legitimate types for which you can find different record layouts. Take advantage of the service to obtain expertly-manufactured documents that comply with express demands.

Form popularity

FAQ

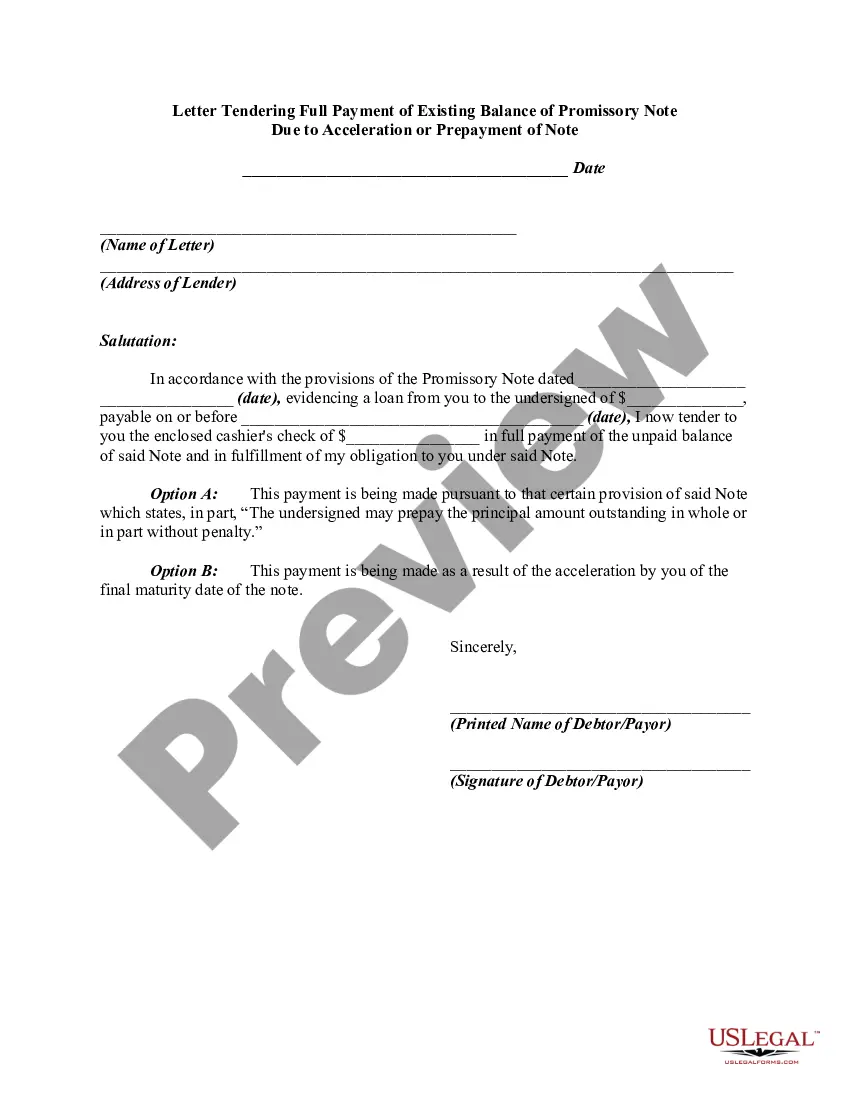

Promissory notes may also be referred to as an IOU, a loan agreement, or just a note. It's a legal lending document that says the borrower promises to repay to the lender a certain amount of money in a certain time frame.

Secured promissory notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

Secured promissory notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

In foreclosures and contract breaches, promissory notes under CPLR 5001 allow creditors to recover prejudgement interest from the date interest is due until liability is established. For loans between individuals, writing and signing a promissory note are often instrumental for tax and record keeping.

A promissory note is a document between the lender and the borrower in which the borrower promises to pay back the lender, it is a separate contract from the mortgage. The mortgage is a legal document that ties or "secures" a piece of real estate to an obligation to repay money.

A promissory note is a document between the lender and the borrower in which the borrower promises to pay back the lender, it is a separate contract from the mortgage. The mortgage is a legal document that ties or "secures" a piece of real estate to an obligation to repay money.

Due to the fact that a real estate note is backed by the real estate property itself, a real estate note is considered a secured note. If you're going to invest in commercial real estate, you will likely need to secure a loan in order to purchase the property.

Your promissory note, which is your promise to repay the mortgage loan to your lender. The mortgage, also known as the security instrument or deed of trust. By signing this document, you agree that the lender may foreclose on your home if you fail to repay your mortgage.