An invoice is a document or electronic statement stating the items sold and the amount payable. It is also called a bill. Invoicing is when invoices are produced and sent to customers. It is used to communicate to a buyer the specific items, price, and quantities they have delivered and now must be paid for by the buyer. Payment terms will usually accompany the billing information. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

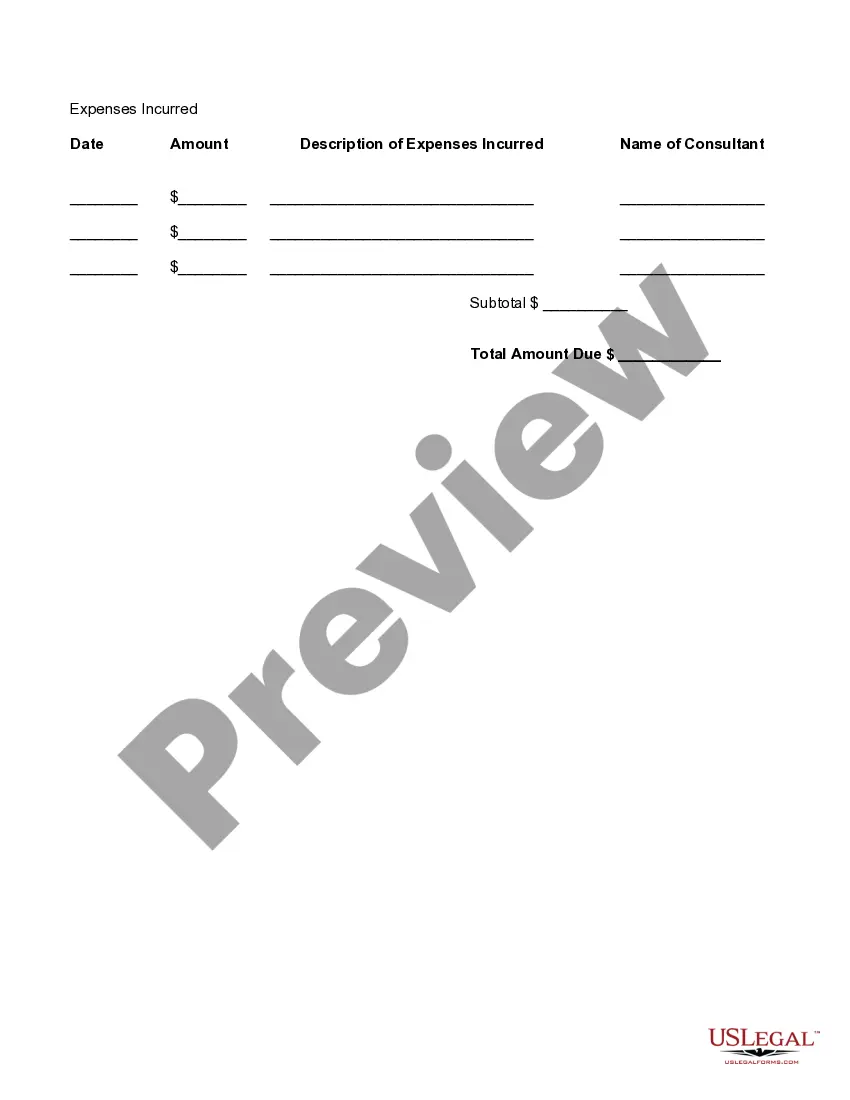

Oregon Detailed Consultant Invoice is a comprehensive and structured document that provides a breakdown of services rendered by a consultant in the state of Oregon. It serves as an essential tool for both consultants and clients, facilitating transparent financial transactions and ensuring accurate billing processes. The Oregon Detailed Consultant Invoice contains various sections that cover crucial information related to the consultant's services, such as: 1. Consultant Information: This section includes details about the consultant, including their name, address, contact information, and any relevant business identification numbers. 2. Client Information: Here, the invoice lists the client's name, address, and contact information. It is crucial to accurately identify the client to ensure invoicing accuracy and establish a clear client-consultant relationship. 3. Invoice Number and Date: Every Oregon Detailed Consultant Invoice should have a unique invoice number, which aids record-keeping and helps both parties track the payment status. The invoice date indicates the precise date when the invoice is issued to the client. 4. Service Details: This section provides a comprehensive breakdown of the consultant's services, highlighting the details of each service provided. It includes the description of the service, the number of hours or units provided, and the applicable rate or cost per unit. 5. Subtotal: The subtotal section calculates the total cost for each service delivered, incorporating the quantity and rate for each line item. 6. Taxes and Fees: If applicable, taxes and additional fees such as sales tax, service fees, or other charges are clearly itemized separately or included in the subtotal. It is important to follow Oregon's tax regulations while preparing the invoice. 7. Total Amount Due: The total amount due section provides a concise summation of the services' costs, including any taxes or fees that apply. This final figure represents the total amount the client is obligated to pay the consultant. Types of Oregon Detailed Consultant Invoices: 1. Standard Consultant Invoice: This is the most common type of consultant invoice used in Oregon. It includes all the necessary sections and fields to outline the consultant's services, rates, taxes, and fees. 2. Hourly Rate Consultant Invoice: Some consultants charge an hourly rate for their services. In this type of invoice, the hours worked on each task or project are detailed along with the corresponding hourly rate, resulting in a precise calculation of the total amount due. In conclusion, an Oregon Detailed Consultant Invoice is an essential document for consultants operating in the state of Oregon. It ensures transparency, accuracy, and fair billing practices for both the consultant and the client. By providing a breakdown of services rendered, rates, taxes, and fees, this invoice facilitates smooth financial transactions and fosters a professional working relationship.