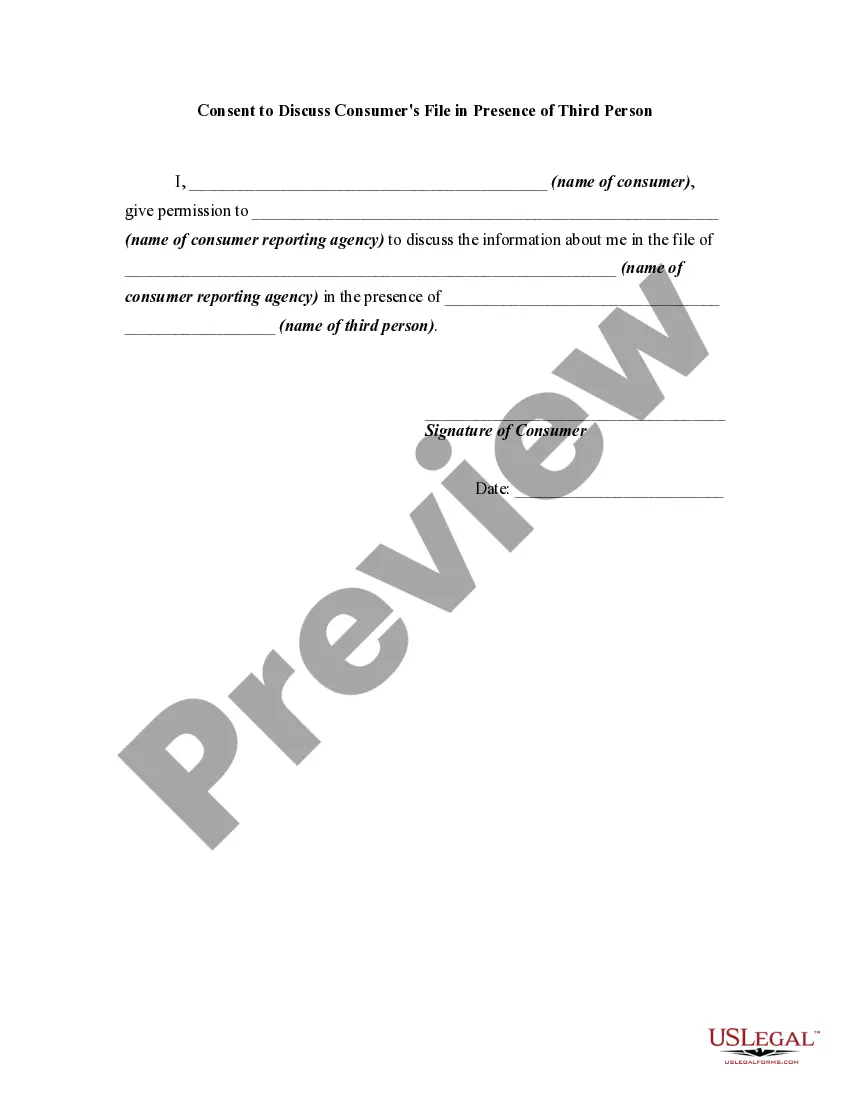

The Fair Credit Reporting Act provides that the consumer, in obtaining disclosure of information in the consumer's file from a consumer reporting agency personally, is permitted to be accompanied by one other person of the consumer's choosing, which person must provide reasonable identification. The act further provides that the consumer reporting agency may require the consumer to furnish a written statement granting permission to the consumer reporting agency to discuss the consumer's file in such person's presence.

Title: Understanding Oregon Consent to Discuss Consumer's File in Presence of Third Person Keyword: Oregon consent, consumer's file, third person Introduction: The Oregon Consent to Discuss Consumer's File in Presence of Third Person is a legal agreement that allows designated individuals or entities to discuss personal financial information of a consumer with a third party. In this detailed description, we will explore the concept of Oregon Consent to Discuss Consumer's File in the presence of a third person, its types, and its importance in maintaining privacy and data protection. Types of Oregon Consent to Discuss Consumer's File in Presence of Third Person: 1. General Oregon Consent to Discuss Consumer's File: This type of consent allows third-party access to a consumer's financial records for discussion and consultation purposes. It enables designated individuals or entities to share necessary information while ensuring privacy rights are maintained. 2. Limited Oregon Consents to Discuss Consumer's File: This type of consent provides a narrower scope for discussing a specific aspect of a consumer's file. It limits the extent of disclosure to only certain information or parties, ensuring sensitive details remain confidential. 3. Oregon Consents to Discuss Consumer's File for Financial Institutions: Recognizing the importance of privacy in the finance industry, this type of consent applies specifically to financial institutions. It grants them permission to discuss a consumer's financial records with third parties involved in transactions, such as mortgage brokers or loan officers. Key aspects of Oregon Consent to Discuss Consumer's File in Presence of Third Person: 1. Privacy Protection: The Oregon Consent to Discuss Consumer's File ensures that consumers have control over their personal and financial information. It prohibits any unauthorized disclosure and limits access to only those who have explicit consent. This safeguard ensures sensitive data is not exploited or misused. 2. Clear Authorization: The consent form must clearly state the purpose, duration, and scope of the consent, as well as identify the third party or parties involved. It serves as a legal document that protects both the consumer and the entities receiving the consent, establishing transparency and preventing misunderstandings. 3. Consumer Empowerment: By providing consent, consumers retain control over who can access and discuss their financial information. It enables them to actively participate in transactions, seek advice or support from trusted individuals, and make informed decisions regarding their finances. 4. Limitations: It is crucial for consumers to understand that providing consent does not grant complete access to their entire file. The consent is typically limited to discussing specific aspects relevant to the authorized parties and purposes stated in the consent form. This ensures that personal information not pertaining to the discussion remains private. Conclusion: The Oregon Consent to Discuss Consumer's File in Presence of Third Person is an important legal measure that aims to uphold individual privacy and data protection. It allows consumers to grant authorized individuals or entities access to their personal financial records for the purpose of consultation or transaction-related discussions. By understanding the types and implications of this consent, consumers can actively manage and maintain control over their confidential information, ensuring their financial privacy is respected.Title: Understanding Oregon Consent to Discuss Consumer's File in Presence of Third Person Keyword: Oregon consent, consumer's file, third person Introduction: The Oregon Consent to Discuss Consumer's File in Presence of Third Person is a legal agreement that allows designated individuals or entities to discuss personal financial information of a consumer with a third party. In this detailed description, we will explore the concept of Oregon Consent to Discuss Consumer's File in the presence of a third person, its types, and its importance in maintaining privacy and data protection. Types of Oregon Consent to Discuss Consumer's File in Presence of Third Person: 1. General Oregon Consent to Discuss Consumer's File: This type of consent allows third-party access to a consumer's financial records for discussion and consultation purposes. It enables designated individuals or entities to share necessary information while ensuring privacy rights are maintained. 2. Limited Oregon Consents to Discuss Consumer's File: This type of consent provides a narrower scope for discussing a specific aspect of a consumer's file. It limits the extent of disclosure to only certain information or parties, ensuring sensitive details remain confidential. 3. Oregon Consents to Discuss Consumer's File for Financial Institutions: Recognizing the importance of privacy in the finance industry, this type of consent applies specifically to financial institutions. It grants them permission to discuss a consumer's financial records with third parties involved in transactions, such as mortgage brokers or loan officers. Key aspects of Oregon Consent to Discuss Consumer's File in Presence of Third Person: 1. Privacy Protection: The Oregon Consent to Discuss Consumer's File ensures that consumers have control over their personal and financial information. It prohibits any unauthorized disclosure and limits access to only those who have explicit consent. This safeguard ensures sensitive data is not exploited or misused. 2. Clear Authorization: The consent form must clearly state the purpose, duration, and scope of the consent, as well as identify the third party or parties involved. It serves as a legal document that protects both the consumer and the entities receiving the consent, establishing transparency and preventing misunderstandings. 3. Consumer Empowerment: By providing consent, consumers retain control over who can access and discuss their financial information. It enables them to actively participate in transactions, seek advice or support from trusted individuals, and make informed decisions regarding their finances. 4. Limitations: It is crucial for consumers to understand that providing consent does not grant complete access to their entire file. The consent is typically limited to discussing specific aspects relevant to the authorized parties and purposes stated in the consent form. This ensures that personal information not pertaining to the discussion remains private. Conclusion: The Oregon Consent to Discuss Consumer's File in Presence of Third Person is an important legal measure that aims to uphold individual privacy and data protection. It allows consumers to grant authorized individuals or entities access to their personal financial records for the purpose of consultation or transaction-related discussions. By understanding the types and implications of this consent, consumers can actively manage and maintain control over their confidential information, ensuring their financial privacy is respected.