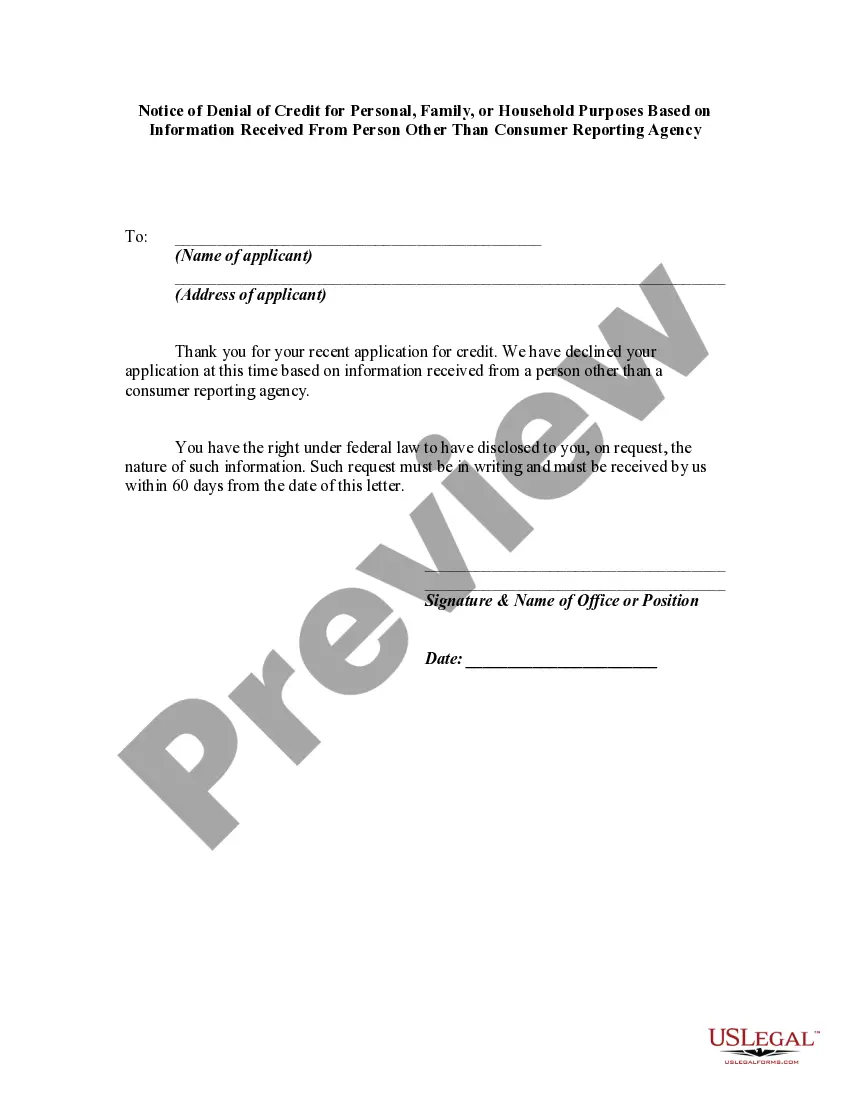

Whenever credit for personal, family, or household purposes involving a consumer is denied or the charge for the credit is increased either wholly or partly because of information obtained from a person other than a credit reporting agency bearing on the consumer's creditworthiness, credit standing, credit capacity, character, general reputation, personal characteristics, or mode of living, certain requirements must be met. The user of such information, when the adverse action is communicated to the consumer, must clearly and accurately disclose the consumer's right to make a written request for disclosure of the information.

Oregon Notice of Denial of Credit for Personal, Family, or Household Purposes Based on Information Received From Person Other Than Consumer Reporting Agency

Description

How to fill out Notice Of Denial Of Credit For Personal, Family, Or Household Purposes Based On Information Received From Person Other Than Consumer Reporting Agency?

You can invest hrs on-line attempting to find the authorized document web template which fits the state and federal specifications you need. US Legal Forms offers 1000s of authorized kinds that are examined by experts. You can easily obtain or print the Oregon Notice of Denial of Credit for Personal, Family, or Household Purposes Based on Information Received From Person Other Than Consumer Reporting Agency from my service.

If you already possess a US Legal Forms profile, it is possible to log in and click the Download key. Next, it is possible to full, revise, print, or indicator the Oregon Notice of Denial of Credit for Personal, Family, or Household Purposes Based on Information Received From Person Other Than Consumer Reporting Agency. Each authorized document web template you buy is your own permanently. To get another backup associated with a bought form, check out the My Forms tab and click the related key.

Should you use the US Legal Forms internet site for the first time, stick to the straightforward directions below:

- First, make certain you have selected the best document web template for that area/city that you pick. Read the form outline to make sure you have picked the right form. If readily available, utilize the Review key to look through the document web template too.

- If you would like find another version of your form, utilize the Search area to obtain the web template that suits you and specifications.

- After you have located the web template you want, simply click Acquire now to carry on.

- Pick the rates program you want, type in your accreditations, and register for a merchant account on US Legal Forms.

- Comprehensive the deal. You may use your bank card or PayPal profile to purchase the authorized form.

- Pick the format of your document and obtain it for your device.

- Make modifications for your document if necessary. You can full, revise and indicator and print Oregon Notice of Denial of Credit for Personal, Family, or Household Purposes Based on Information Received From Person Other Than Consumer Reporting Agency.

Download and print 1000s of document templates while using US Legal Forms website, which offers the largest assortment of authorized kinds. Use expert and status-particular templates to take on your small business or personal needs.

Form popularity

FAQ

Dear [Applicant Name], We regret to inform you that based on our hiring criteria, we are unable to consider you further for an employment opportunity with our organization. This decision was made in part from the information we received from _____________________, our employment screening vendor.

The credit score exception notice (model forms H-3, H-4, H-5) is a disclosure that is provided in lieu of the risk-based-pricing notice (RBPN, which are H-1, H-2, H-6 & H-7). The RBPN is required any time a financial institution provides different rates based on the credit score of the applicant.

Notice Exception means the right, as described in Section 4.2, of either party to this Agreement to terminate the Agreement upon giving the required written notice.

A credit score disclosure alerts a consumer about their credit score and other sources of information as required by the Fair Credit Reporting Act (FCRA). The FCRA is a U.S. government legislation that aims to protect consumer information that is collected by consumer reporting agencies or credit bureaus.

Notice is not required if: The transaction does not involve credit; A credit applicant accepts a counteroffer; A credit applicant expressly withdraws an application; or.

In the credit score exception notices, creditors are required to disclose the distribution of credit scores among consumers who are scored under the same scoring model that is used to generate the consumer's credit score using the same scale as that of the credit score provided to the consumer.

A creditor must disclose a consumer's credit score and information relating to a credit score on a risk-based pricing notice when the score of the consumer to whom the creditor extends credit or whose extension of credit is under review is used in setting the material terms of credit.