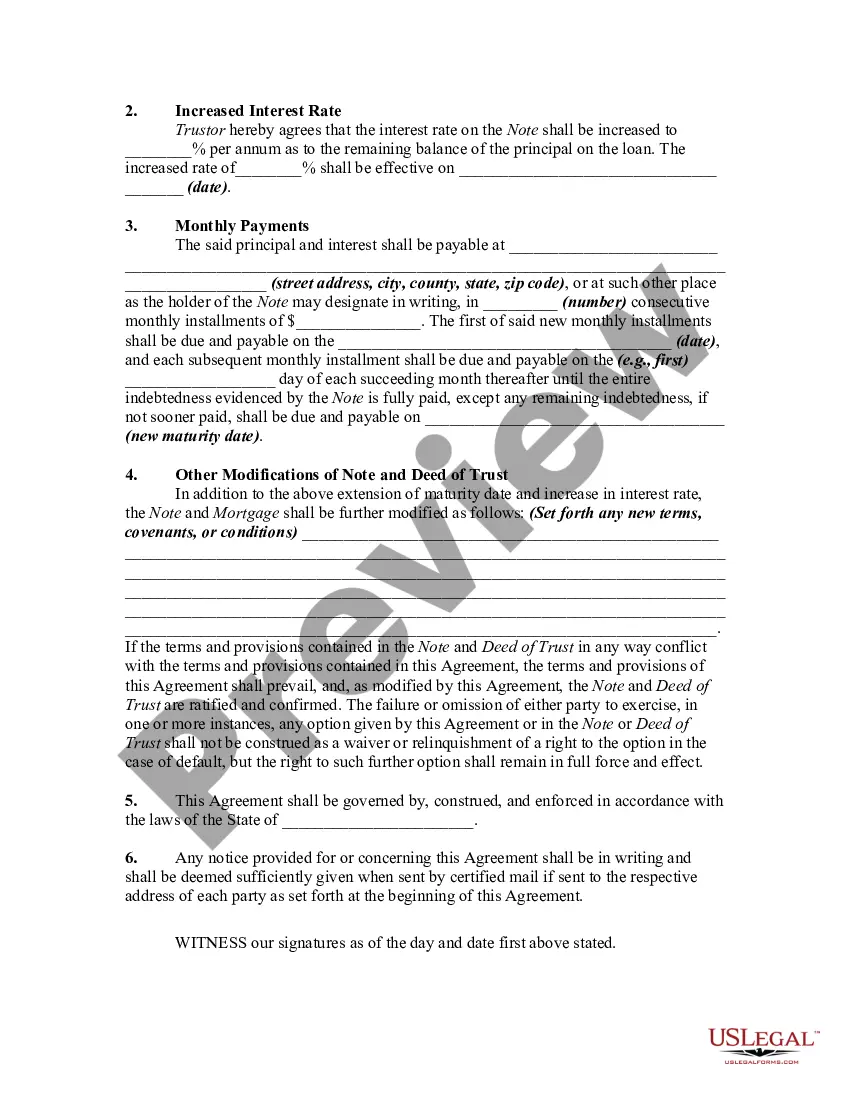

An agreement modifying a loan agreement and a deed of trust should be signed by both parties to the transaction and recorded in the office of the register of deeds and deeds of trust where the original deed of trust was recorded. Such a modification or extension is contractual in nature and must be supported by consideration. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Oregon Extension of Loan Agreement Secured by a Deed of Trust as to Maturity Date and Increase in Interest Rate

Description

How to fill out Extension Of Loan Agreement Secured By A Deed Of Trust As To Maturity Date And Increase In Interest Rate?

You are able to commit hrs on the web trying to find the legitimate file format that fits the federal and state demands you require. US Legal Forms gives thousands of legitimate forms that are examined by professionals. It is simple to obtain or printing the Oregon Extension of Loan Agreement Secured by a Deed of Trust as to Maturity Date and Increase in Interest Rate from our support.

If you currently have a US Legal Forms profile, you are able to log in and click on the Download switch. Afterward, you are able to full, revise, printing, or sign the Oregon Extension of Loan Agreement Secured by a Deed of Trust as to Maturity Date and Increase in Interest Rate . Each legitimate file format you buy is the one you have permanently. To obtain another backup of the obtained develop, proceed to the My Forms tab and click on the corresponding switch.

If you use the US Legal Forms site the first time, adhere to the straightforward guidelines listed below:

- Initially, make certain you have chosen the best file format for your state/town of your choosing. Read the develop explanation to make sure you have selected the correct develop. If readily available, use the Review switch to appear throughout the file format too.

- If you wish to locate another variation from the develop, use the Research industry to discover the format that meets your needs and demands.

- Once you have located the format you need, just click Acquire now to move forward.

- Pick the rates program you need, type in your credentials, and register for an account on US Legal Forms.

- Complete the financial transaction. You may use your charge card or PayPal profile to purchase the legitimate develop.

- Pick the formatting from the file and obtain it for your system.

- Make alterations for your file if necessary. You are able to full, revise and sign and printing Oregon Extension of Loan Agreement Secured by a Deed of Trust as to Maturity Date and Increase in Interest Rate .

Download and printing thousands of file templates utilizing the US Legal Forms website, which provides the most important variety of legitimate forms. Use specialist and express-particular templates to handle your small business or individual requires.

Form popularity

FAQ

Limitations Period: Six years for an action on the Note. Ten years for foreclosure under a deed of trust. [7] It is unsettled in Oregon whether a non-judicial foreclosure is barred if the limitations period on an action under the Note has already expired.

Virtually all voluntary liens secured by Oregon real estate are trust deeds and are therefore governed by the Oregon Trust Deed Act, ORS 86.705 ? 86.795, which has been in existence since 1959.

Satisfaction Of A Deed Of Trust The deed of reconveyance is an instrument that transfers legal title, after the outstanding debt has been paid in full, from the trustee under a deed of trust to the borrower or owner of the land upon which the deed of trust or trust deed was a lien.

A deed of trust is satisfied when the debt it secures is paid or when the obligation it secures is fulfilled. A deed of trust is no longer a lien on the property if the debt or obligation it secures has been satisfied but it will remain a cloud on title until removed from the chain of title.

A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.

At the end of the trust deed, your trustee will decide if you can be discharged from the trust deed. To be discharged you must have met all the agreed conditions, such as making payments on time.

In a deed of trust, both the borrower and the lender entrust an independent third party ? typically the title company ? to hold legal rights over the real estate securing the loan. Once the borrower fully repays the loan, the third party ? the trustee ? releases all rights to the owner.