An agreement modifying a loan agreement and mortgage should be signed by both parties to the transaction and recorded in the office of the register of deeds and mortgages where the original mortgage was recorded. Such a modification or extension is contractual in nature and must be supported by consideration. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Oregon Mortgage Extension Agreement with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest

Description

How to fill out Mortgage Extension Agreement With Assumption Of Debt By New Owner Of Real Property Covered By The Mortgage And Increase Of Interest?

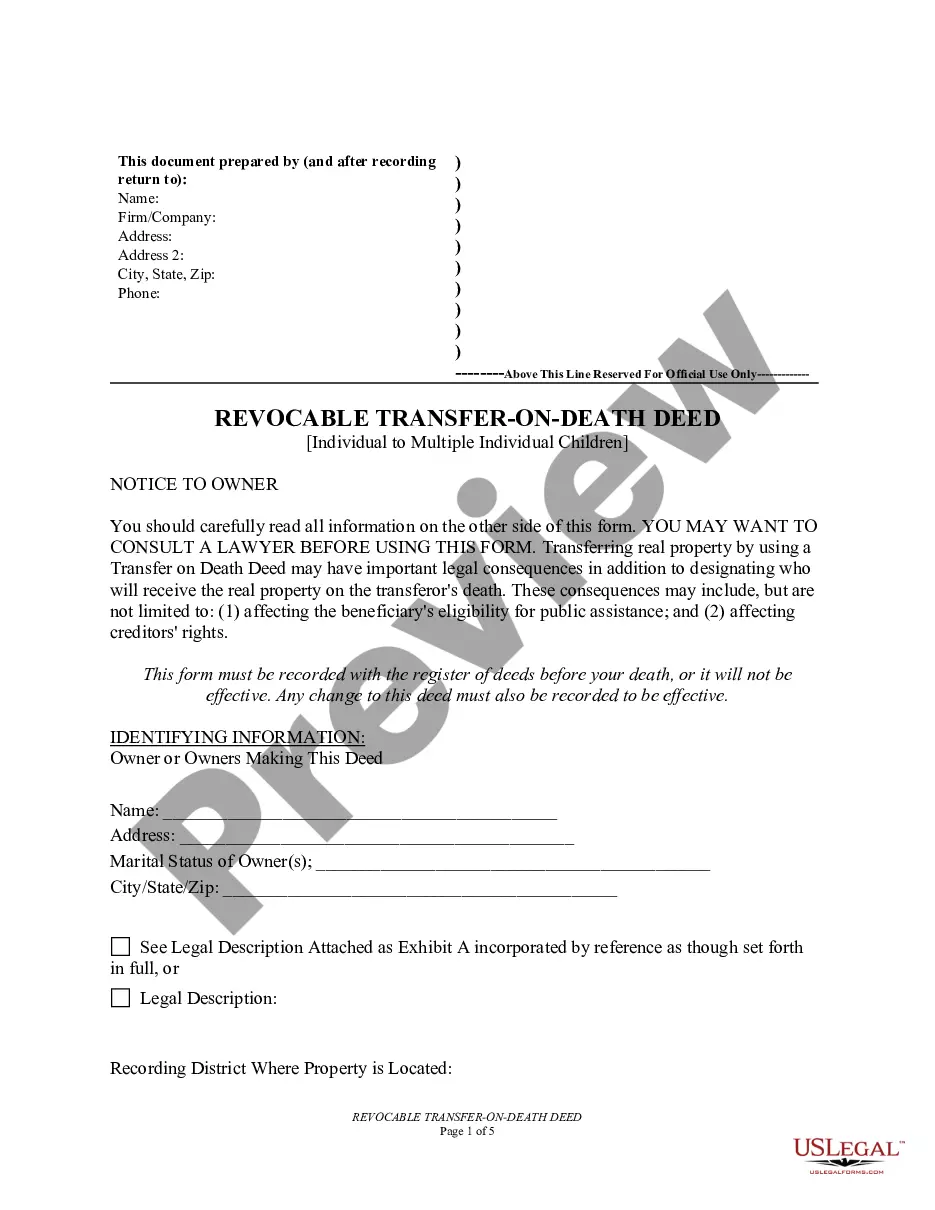

Are you presently within a placement the place you will need files for both business or person functions nearly every day? There are tons of lawful papers themes available on the Internet, but locating types you can trust isn`t straightforward. US Legal Forms provides 1000s of type themes, like the Oregon Mortgage Extension Agreement with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest, which are written to fulfill federal and state needs.

Should you be previously familiar with US Legal Forms website and also have an account, just log in. Afterward, you can obtain the Oregon Mortgage Extension Agreement with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest format.

Should you not offer an bank account and would like to begin to use US Legal Forms, follow these steps:

- Get the type you require and ensure it is for your proper area/region.

- Use the Preview switch to review the form.

- See the description to actually have chosen the appropriate type.

- In the event the type isn`t what you`re searching for, utilize the Search area to discover the type that meets your needs and needs.

- Once you find the proper type, simply click Get now.

- Select the rates strategy you desire, submit the required information and facts to make your money, and purchase the order with your PayPal or Visa or Mastercard.

- Pick a handy document format and obtain your backup.

Locate all the papers themes you possess purchased in the My Forms food selection. You can get a extra backup of Oregon Mortgage Extension Agreement with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest at any time, if necessary. Just click the necessary type to obtain or print the papers format.

Use US Legal Forms, by far the most comprehensive variety of lawful varieties, to conserve time and steer clear of blunders. The service provides professionally produced lawful papers themes which you can use for a variety of functions. Make an account on US Legal Forms and begin making your life a little easier.

Form popularity

FAQ

An assumable mortgage allows a homebuyer to assume the current principal balance, interest rate, repayment period, and any other contractual terms of the seller's mortgage. Rather than going through the rigorous process of obtaining a home loan from the bank, a buyer can take over an existing mortgage.

An arrangement where the purchaser, or grantee, obtains title to real property and assumes the seller's liability for payment of an existing note secured by a mortgage that encumbers the real property at the time title is transferred.

One way to significantly cut down on closing and recurring costs relative to buying a home is to buy a home subject to an existing loan. This basically means that you, as the buyer, unofficially take over the seller's existing mortgage payments.

One risk is that the seller remains legally liable for the mortgage even after they've sold the property. If the buyer does not make the mortgage payments, the lender may still be able to come after the seller for payment.

Buying a property "subject-to" means a buyer essentially takes over the seller's remaining mortgage balance without making it official with the lender. It's a popular strategy among real estate investors. When interest rates rise, it may also be an attractive financing option for general homebuyers.

Although the buyer makes the mortgage payments, the seller remains responsible for the loan. When the property is sold subject to the loan the buyer is not liable to pay the lender, the original borrower is still primarily liable to the lender.

A defeasance clause is a provision in some mortgage contracts indicating that the borrower will receive the title to the property once all of the mortgage payments have been made.

A subject to mortgage will have the buyer take control of the property and make payments to the seller, who will then pay off the mortgage in their own name. A good subject to mortgage clause should be viewed by a real estate attorney before any decisions are made.