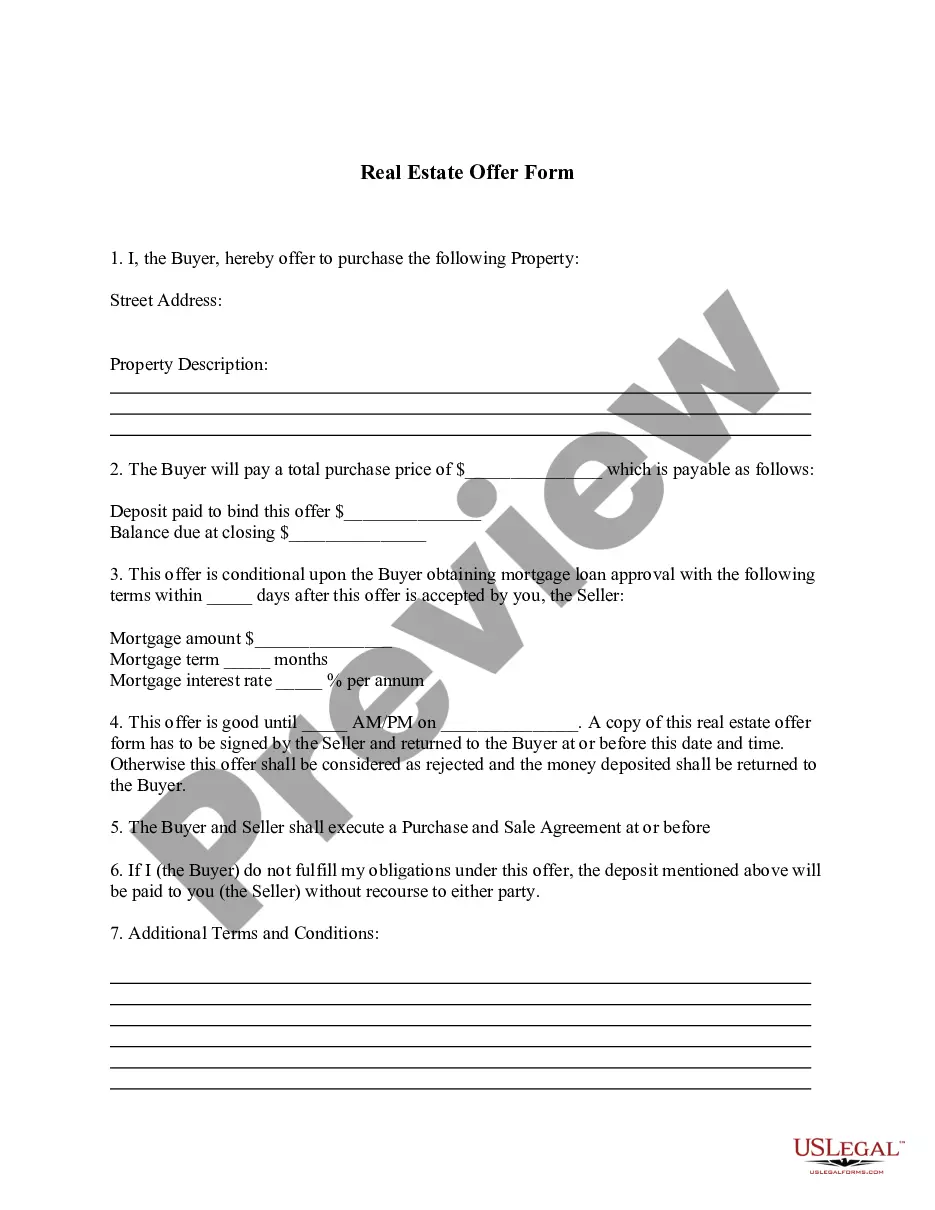

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

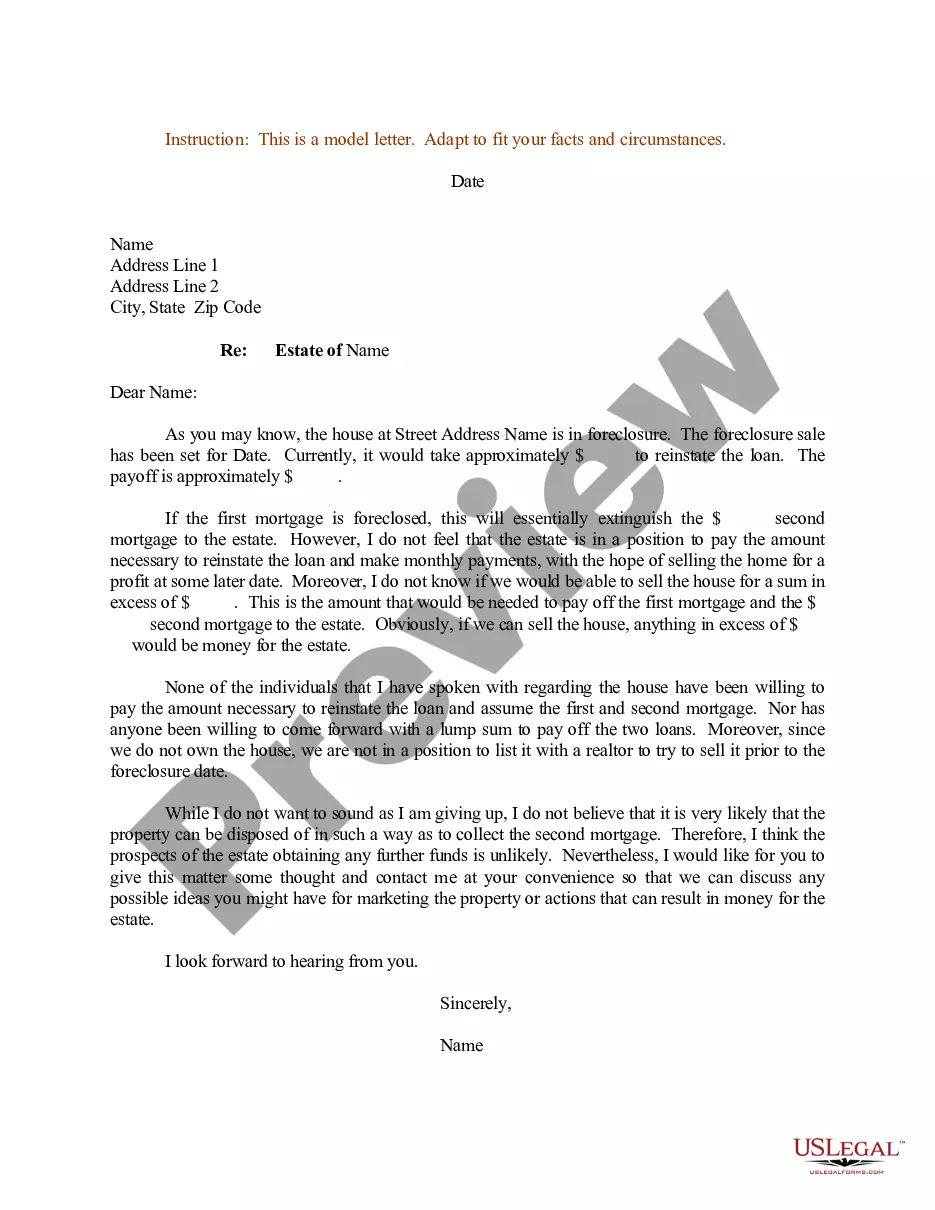

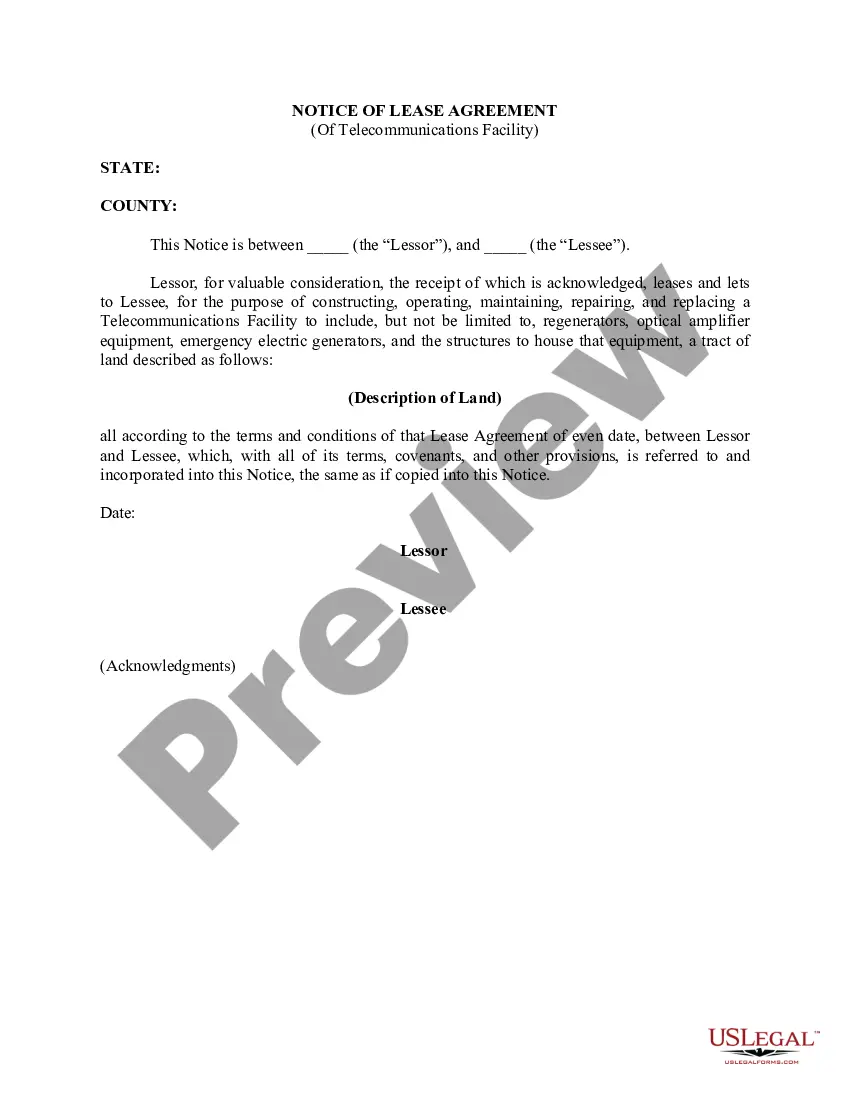

Oregon Receipt and Acceptance of Residential Mortgage Loan Commitment is a legally binding document that signifies the acknowledgment and acceptance of a mortgage loan commitment by the borrower. This agreement outlines the terms and conditions of the loan, including the loan amount, interest rate, repayment terms, and any additional provisions. In Oregon, there are different types of receipt and acceptance of residential mortgage loan commitments, each catering to specific scenarios or loan programs. Some of these variations include: 1. Conventional Mortgage Loan Commitment: This type of loan commitment is applicable to borrowers who meet the standard requirements set by traditional lenders. It typically involves a down payment, income verification, and a good credit score. 2. FHA Loan Commitment: This commitment is specific to loans insured by the Federal Housing Administration (FHA). FHA loans are popular among first-time homebuyers or individuals with lower credit scores, as they offer more lenient qualification criteria and flexible down payment options. 3. VA Loan Commitment: Reserved for eligible veterans, active-duty service members, and surviving spouses, VA loan commitments are provided by the Department of Veterans Affairs. They offer favorable terms, including no down payment requirements and competitive interest rates. 4. USDA Loan Commitment: This commitment relates to loans guaranteed by the U.S. Department of Agriculture (USDA), specifically meant for rural or suburban homebuyers. USDA loan commitments often feature low or zero down payments and reduced interest rates. When a borrower receives an Oregon Receipt and Acceptance of Residential Mortgage Loan Commitment, it is crucial to review the document thoroughly. Key details to pay attention to include the loan amount, the interest rate (fixed or adjustable), any prepayment penalties, and the deadline for accepting the commitment. Upon reviewing and accepting the commitment, the borrower typically signs the document and returns it to the lender, indicating their willingness to proceed with the loan. It is essential to understand that signing the commitment does not guarantee final loan approval but signifies the borrower's commitment to fulfilling the loan requirements and moving forward in the mortgage process. In summary, the Oregon Receipt and Acceptance of Residential Mortgage Loan Commitment is a critical step in the mortgage loan process. It ensures that borrowers understand the terms of their loan and accept the responsibility of repaying it. Different types of commitments cater to specific loan programs or borrower circumstances, such as conventional loans, FHA loans, VA loans, and USDA loans.