Oregon Change of Beneficiary

Description

How to fill out Change Of Beneficiary?

It is possible to commit several hours on-line searching for the legal document template that meets the federal and state specifications you require. US Legal Forms supplies 1000s of legal varieties which are reviewed by specialists. It is simple to acquire or print out the Oregon Change of Beneficiary from our service.

If you have a US Legal Forms account, you can log in and then click the Download switch. Afterward, you can complete, modify, print out, or indication the Oregon Change of Beneficiary. Each legal document template you buy is your own forever. To have an additional backup associated with a acquired develop, go to the My Forms tab and then click the corresponding switch.

If you use the US Legal Forms internet site the first time, keep to the basic directions listed below:

- First, ensure that you have chosen the proper document template for your area/city of your choice. Look at the develop description to ensure you have chosen the proper develop. If offered, use the Review switch to appear throughout the document template at the same time.

- If you want to find an additional edition of your develop, use the Research discipline to find the template that meets your requirements and specifications.

- After you have discovered the template you need, click on Purchase now to carry on.

- Choose the rates program you need, type in your qualifications, and sign up for an account on US Legal Forms.

- Full the financial transaction. You should use your Visa or Mastercard or PayPal account to purchase the legal develop.

- Choose the formatting of your document and acquire it to your product.

- Make adjustments to your document if necessary. It is possible to complete, modify and indication and print out Oregon Change of Beneficiary.

Download and print out 1000s of document web templates while using US Legal Forms website, that offers the most important selection of legal varieties. Use skilled and express-specific web templates to deal with your small business or specific requirements.

Form popularity

FAQ

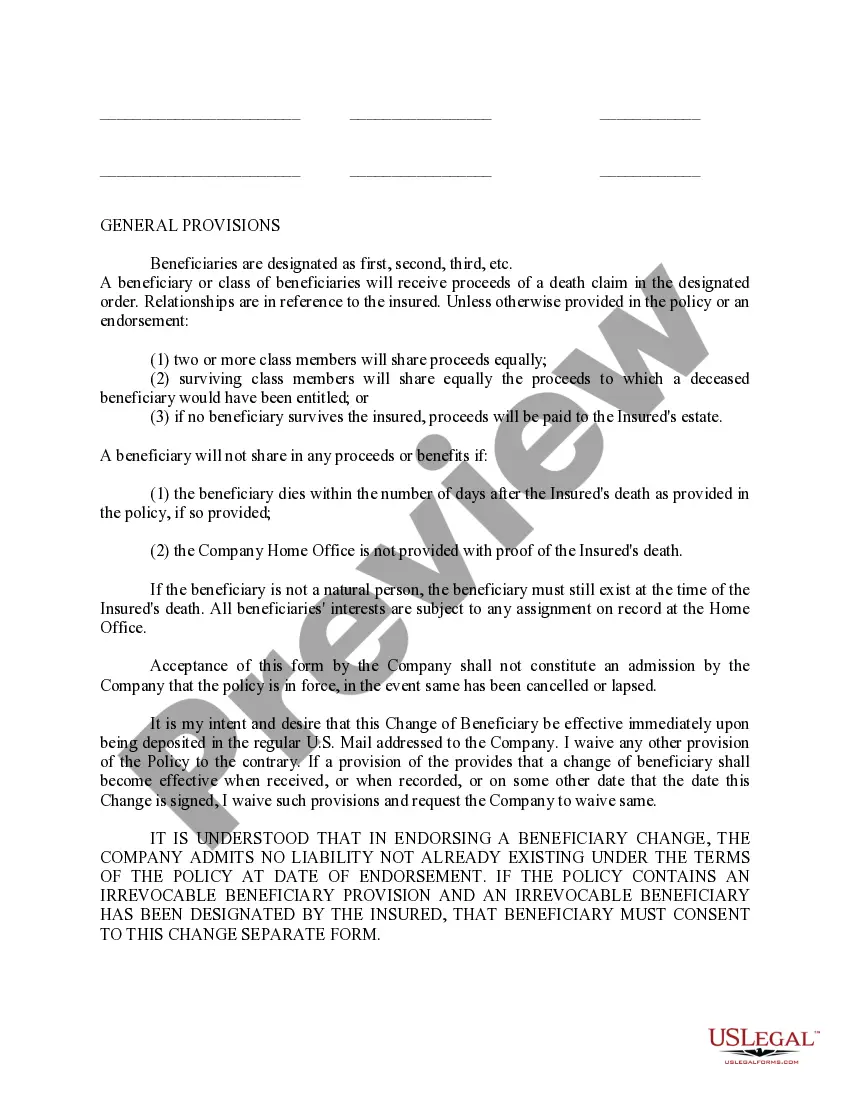

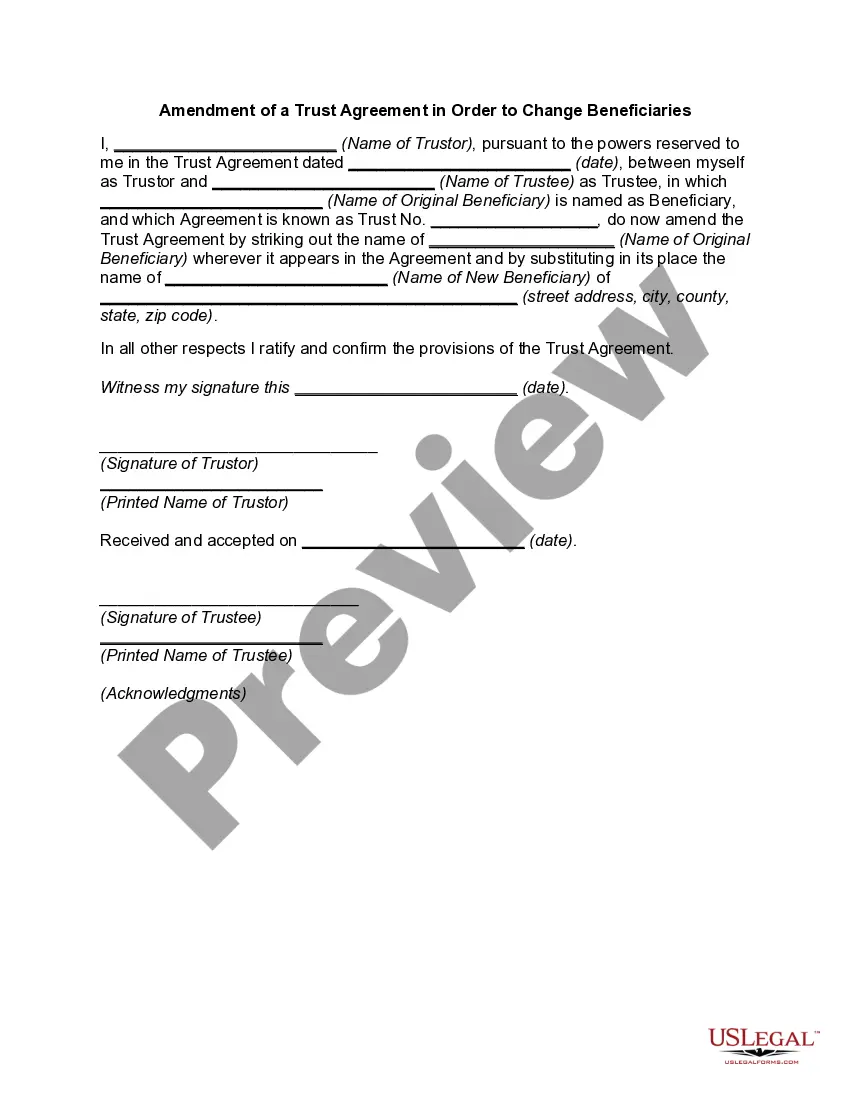

CHANGE OF BENEFICIARY means the act of changing a Beneficiary on a Change of Beneficiary Designation form to another individual, trust or estate of the Participant using a form acceptable to the Insurer and Administrator.

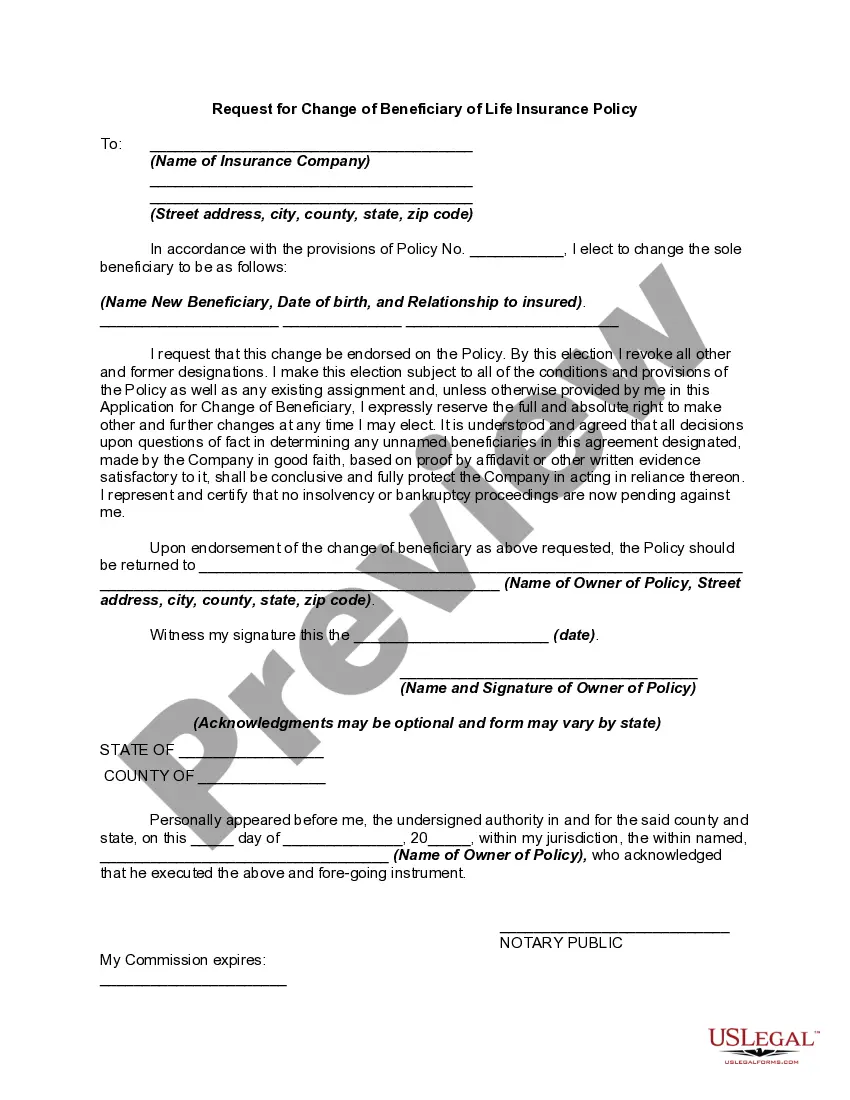

Generally, you will need to fill out a change of beneficiary form which includes information such as the policyholder's name, the new beneficiary's name, and the reason for the change. You may also need to provide a copy of the policyholder's death certificate if the beneficiary is being changed due to their death.

As the policyholder, only you ? or someone who holds durable power of attorney for you ? can change your life insurance beneficiaries. However, if your policy names an irrevocable beneficiary, you will also need to get that beneficiary's consent before making changes.

The policyowner can change the beneficiary. A policyowner may change a beneficiary at any time. However, consent may be needed by the current beneficiary if designated as irrevocable.

A beneficiary designation from an insurance product or financial account overrules wishes you state in a will. Wills are malleable documents, subject to interpretation from probate court and contestable by family members demonstrating an interest in your estate (even if you don't list them in your will).

A revocable beneficiary designation gives the policyholder the right to change the beneficiary without the consent of the named beneficiary.

The policyholderPolicyholderThe person who owns an insurance policy is the only person allowed to make changes to your life insurance beneficiaries. The only exception is if you've granted someone power of attorney, a legal document that lets someone make financial, legal, or medical decisions on your behalf.

The policy owner is the only person who can change the beneficiary designation in most cases. If you have an irrevocable beneficiary or live in a community property state you need approval to make policy changes. A power of attorney can give someone else the ability to change your beneficiaries.