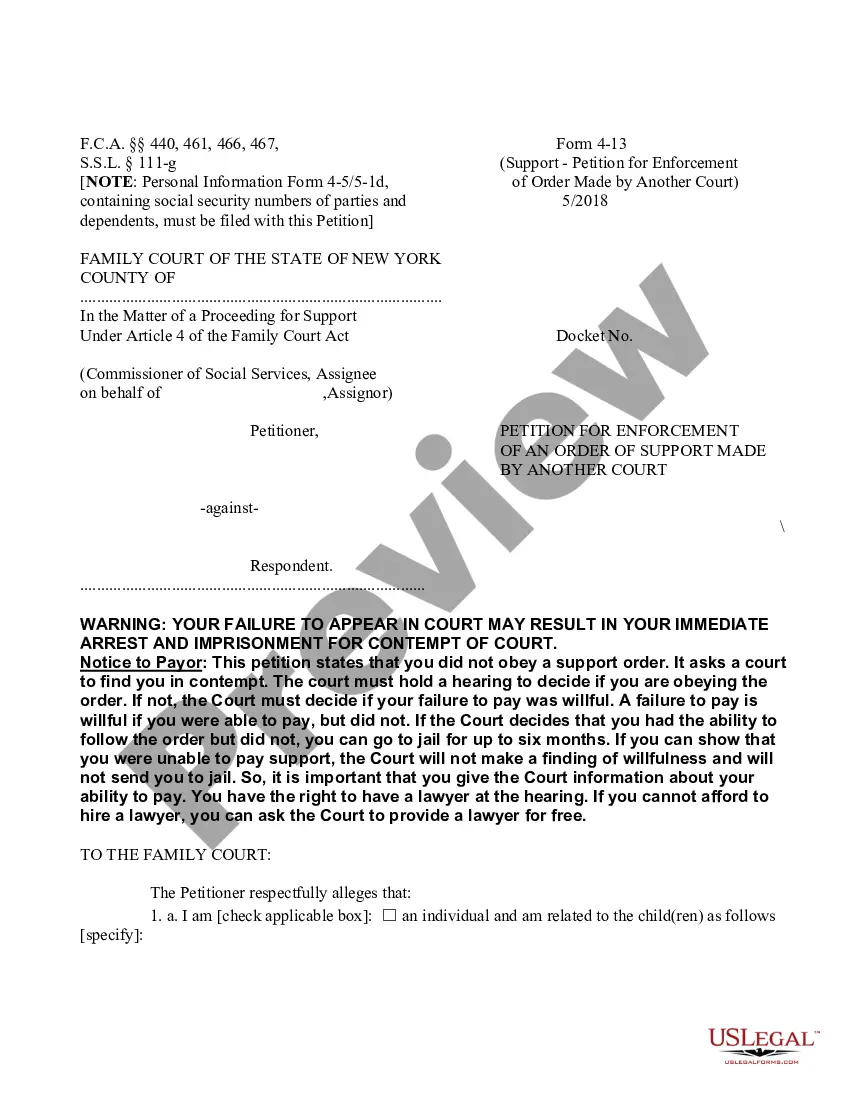

This form is a notice of a failure to make a required payment when due pursuant to a promissory note. The form also contains a warning to the breaching party that legal action will be taken unless the breach is remedied on or before a certain date. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a notice in a particular jurisdiction.

Oregon Notice of Default in Payment Due on Promissory Note

Description

How to fill out Notice Of Default In Payment Due On Promissory Note?

If you wish to total, obtain, or print legitimate document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the website’s straightforward and convenient search tool to find the documents you need.

Various templates for business and personal purposes are categorized by types and states, or keywords. Use US Legal Forms to locate the Oregon Notice of Default in Payment Due on Promissory Note in just a few clicks.

Every legal document template you obtain is your permanent property. You will have access to every form you’ve downloaded in your account. Click on the My documents section and select a form to print or download again.

Complete and obtain, and print the Oregon Notice of Default in Payment Due on Promissory Note with US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal needs.

- If you are currently a US Legal Forms user, Log In to your account and click the Acquire button to obtain the Oregon Notice of Default in Payment Due on Promissory Note.

- You can also access forms you previously downloaded from the My documents tab of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Make sure you have selected the form for the correct city/state.

- Step 2. Utilize the Review option to examine the form’s content. Don’t forget to read the information.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form format.

- Step 4. Once you have identified the form you need, click the Acquire now button. Choose your preferred pricing plan and enter your credentials to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it onto your device.

- Step 7. Fill out, edit, and print or sign the Oregon Notice of Default in Payment Due on Promissory Note.

Form popularity

FAQ

To find a notice of default related to an Oregon Notice of Default in Payment Due on Promissory Note, you can start by checking public records at your local county clerk's office. Additionally, online legal platforms like US Legal Forms offer access to various legal documents, including notices of default. Simply visit their site and search for the specific document you need. This approach ensures you have the most accurate and relevant information at your fingertips.

To be defaulted on a promissory note means the borrower has not made the due payments according to the terms of the note. This status triggers serious consequences, including potential legal action and damage to your credit score. Familiarizing yourself with the Oregon Notice of Default in Payment Due on Promissory Note can provide insights into what to expect next. Consider consulting a legal professional to manage your situation effectively.

When a payment is defaulted, it means that the borrower has failed to fulfill the payment obligation outlined in the promissory note. This typically activates specific clauses in the agreement, leading to potential penalties or legal actions. In Oregon, being aware of the Notice of Default in Payment Due on Promissory Note can help borrowers understand their rights and responsibilities. You might want legal assistance to navigate through this process.

This phrase highlights systemic economic inequalities affecting citizens of color. It suggests that America has not fulfilled its financial or moral commitments to these communities. In a broader sense, it reflects societal obligations similar to those outlined in the Oregon Notice of Default in Payment Due on Promissory Note, emphasizing accountability and equity. Understanding this context can foster discussions on social justice and economic reform.

If you default on a promissory note, the lender can initiate collection actions against you. This may include assessing late fees, reporting the default to credit bureaus, or eventually seeking legal action. Understanding the Oregon Notice of Default in Payment Due on Promissory Note is crucial, as it outlines the formal process a lender must follow in Oregon. The lender typically must notify you before taking further action.

A notice of default on a promissory note is a formal declaration that the borrower has not met the repayment terms set in the agreement. This notice serves as a warning and outlines the consequences of continuing to default. Issuing an Oregon Notice of Default in Payment Due on Promissory Note allows the lender to inform the borrower of their obligations and the potential actions that may follow. It is an essential step for lenders in safeguarding their rights.

Yes, a handwritten promissory note is legal as long as it includes the necessary details required to outline the agreement. This includes the names of the parties involved, the amount borrowed, repayment terms, and proper signatures. If a dispute arises, an Oregon Notice of Default in Payment Due on Promissory Note can invoke legal rights based on this written document. However, clarity and detail are important to prevent misunderstandings.

A written promise to repay a debt is typically documented as a promissory note. This legally binding document outlines the terms of repayment, including the amount owed and the timeline for repayment. In situations involving the Oregon Notice of Default in Payment Due on Promissory Note, this document serves as crucial evidence of the borrowing agreement. It's essential for both lenders and borrowers to maintain accurate records of such agreements.

Yes, promissory notes can hold up in court if they are properly executed and contain clear terms. Courts often enforce these agreements, especially if the Oregon Notice of Default in Payment Due on Promissory Note has been issued. To strengthen your case, ensure that the note includes signatures and details about repayment terms. Having proper documentation can significantly increase your chances of a favorable outcome in legal proceedings.

When someone defaults on a promissory note, the first step is to review the terms of the note. You should attempt to communicate with the borrower to understand their situation and possibly negotiate a solution. If negotiations fail, you may need to issue an Oregon Notice of Default in Payment Due on Promissory Note, which formally alerts the borrower of their default. This step is crucial if you consider taking legal action to recover the owed amount.