Oregon Simple Equipment Lease

Description

How to fill out Simple Equipment Lease?

If you require extensive, obtain, or producing sanctioned documents templates, utilize US Legal Forms, the largest collection of legal forms, which are accessible online.

Utilize the site’s straightforward and user-friendly search to find the documents you require.

Diverse templates for corporate and personal uses are categorized by types and states, or keywords.

Step 3. If you are not satisfied with the form, use the Search field at the top of the page to locate alternative versions of the legal form model.

Step 4. Once you have located the form you want, click the Buy now button. Choose the payment plan you prefer and provide your details to register for an account.

- Use US Legal Forms to obtain the Oregon Simple Equipment Lease with a few clicks.

- If you are already a US Legal Forms user, Log In to your profile and select the Download button to retrieve the Oregon Simple Equipment Lease.

- You can also access forms you have previously downloaded from the My documents tab in your account.

- If you’re utilizing US Legal Forms for the first time, refer to the guidelines below.

- Step 1. Confirm you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form’s content. Don’t forget to check the description.

Form popularity

FAQ

An agreement for use of equipment outlines the terms under which one party can use another's equipment. This document specifies responsibilities, usage guidelines, and financial terms. Creating an effective Oregon Simple Equipment Lease can help clarify these aspects for both parties involved.

term lease agreement in Oregon typically lasts for less than a year. These agreements can be flexible and are often ideal for temporary arrangements. If you’re considering a shortterm equipment lease, think about using an Oregon Simple Equipment Lease to ensure all terms are explicitly outlined.

Writing a handwritten lease agreement involves clearly stating the terms and conditions in legible handwriting. Include essential details, such as the parties' names, equipment description, and payment terms. While a handwritten document can work, utilizing uslegalforms can help create a more standardized Oregon Simple Equipment Lease.

In Oregon, notarization is not a requirement for most leases, including equipment leases. However, having a lease notarized can add an extra layer of credibility. If you want to ensure your Oregon Simple Equipment Lease is robust and respected, consider seeking professional guidance.

Setting up an equipment lease requires clear communication with the other party about terms and conditions. Begin by drafting the lease agreement, specifying details like payment amounts and conditions for use. Using a reliable service like uslegalforms can help you create a robust Oregon Simple Equipment Lease that protects your interests.

To write a lease agreement for equipment, start by detailing the parties involved, the equipment description, and lease terms. Be sure to include payment schedules and any additional fees. For ease, you might consider using a platform like uslegalforms to generate a compliant Oregon Simple Equipment Lease.

When structuring an equipment lease, it’s important to outline the lease term, payment structure, and responsibilities of both parties. Specify the equipment details, including condition and maintenance obligations. This structured approach will help both lessor and lessee understand their rights and obligations in the Oregon Simple Equipment Lease.

Yes, Microsoft Word offers various templates, including lease agreements. However, while these templates can serve as a starting point, it is advisable to customize them to meet specific needs. For an Oregon Simple Equipment Lease, consider tailoring a template to ensure compliance with local laws.

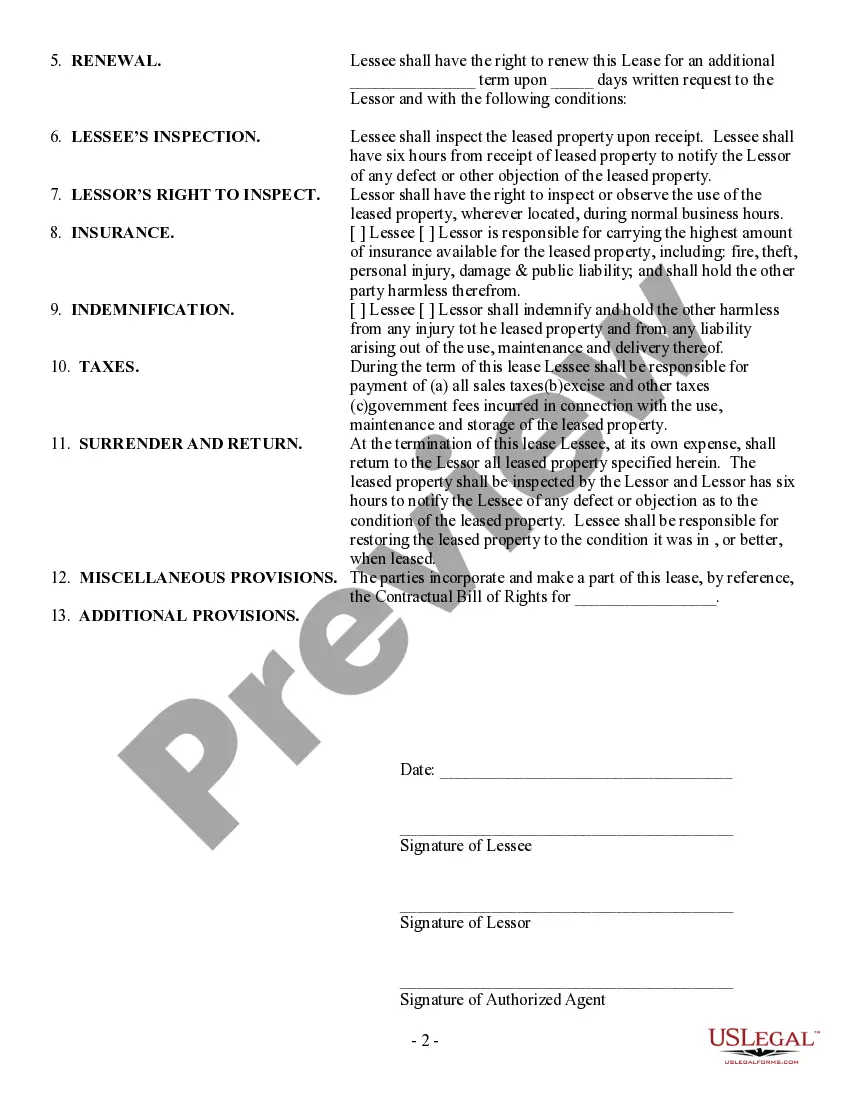

The structure of an Oregon Simple Equipment Lease involves an agreement between the lessor, who owns the equipment, and the lessee, who wants to use it. This lease outlines the terms, duration, and payment schedules for the use of the equipment. It typically includes details such as maintenance responsibilities and conditions for termination. By choosing the Oregon Simple Equipment Lease, you can ensure clarity and simplicity in your equipment leasing process, making it easier to manage your business needs.

To lease equipment to your LLC, start by drafting a formal lease agreement that specifies terms and conditions for the rental. Clearly outline things like payments, duration, and equipment maintenance. The Oregon Simple Equipment Lease template from US Legal Forms is a reliable tool that can assist you in crafting a compliant and clear agreement.