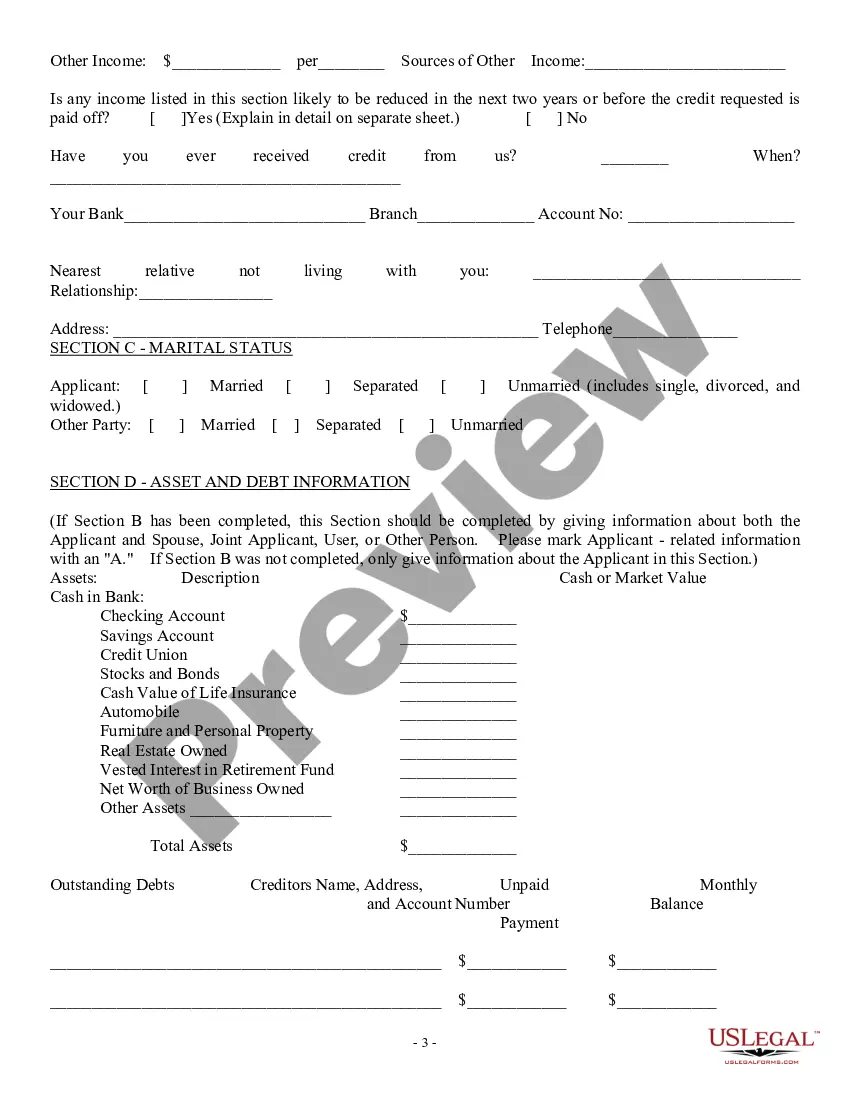

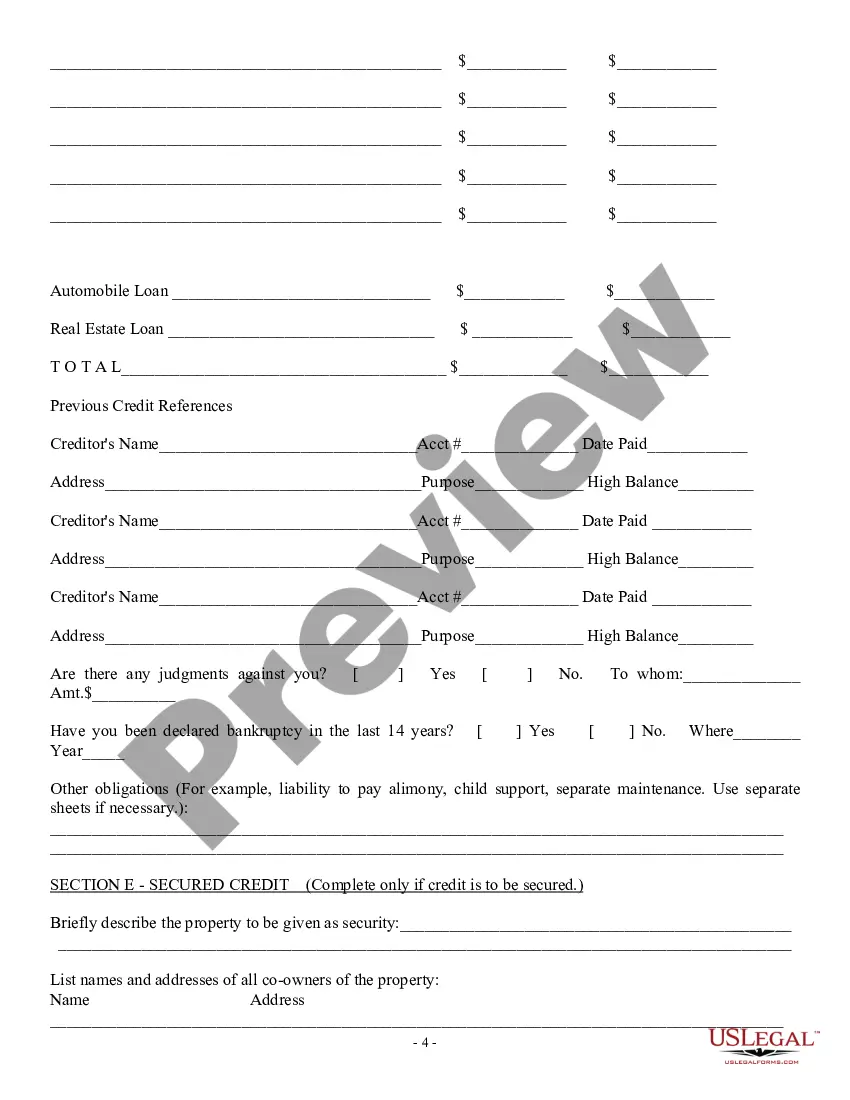

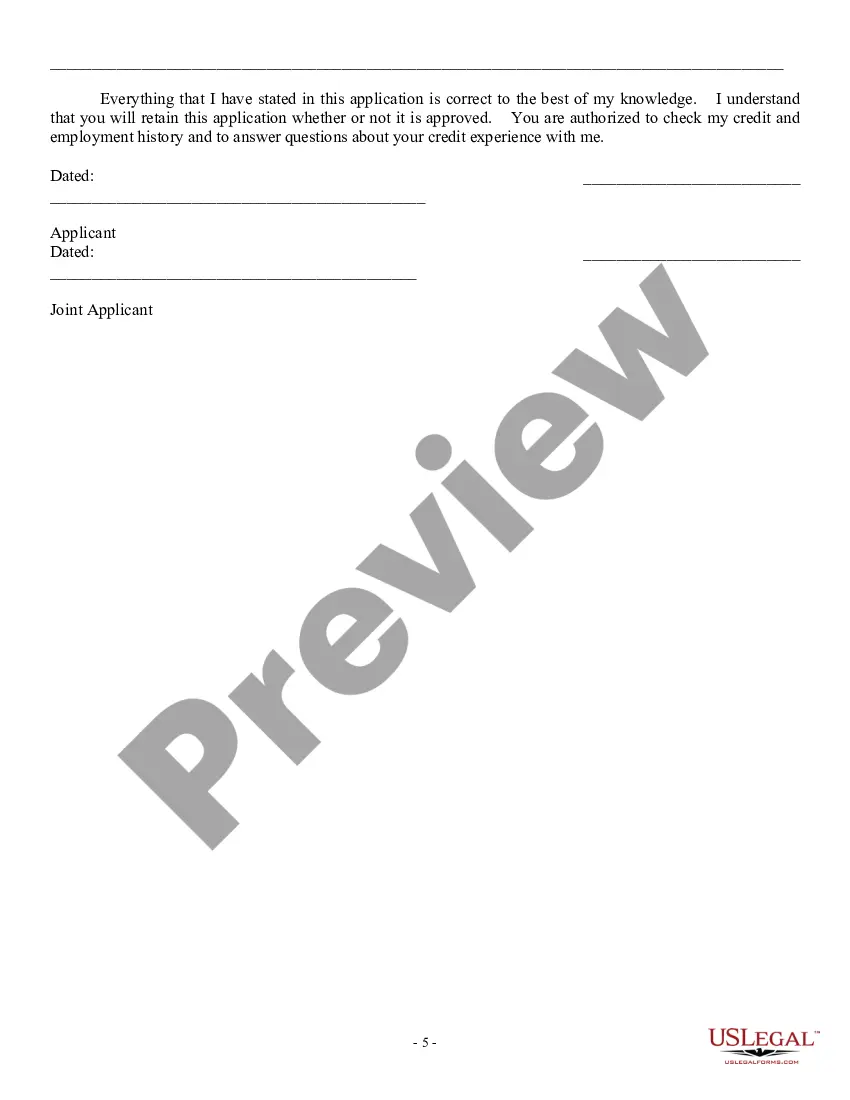

The Oregon Consumer Loan Application — Personal Loan Agreement is a legal document that outlines the terms and conditions of obtaining a personal loan in the state of Oregon. This agreement is designed to protect both lenders and borrowers by specifying the rights, responsibilities, and obligations of each party involved in the loan transaction. The Oregon Consumer Loan Application — Personal Loan Agreement includes key details, such as the names and contact information of the lender and borrower, the loan amount, the interest rate, and the repayment terms. It provides a comprehensive framework that governs the entire loan process, ensuring transparency and fairness for all parties. By executing this agreement, both the lender and borrower agree to abide by the terms and conditions outlined within. It is important for borrowers to carefully review the agreement and understand their rights and obligations before signing. Different types of Oregon Consumer Loan Application — Personal Loan Agreement can vary depending on several factors, including: 1. Secured Personal Loan Agreement: This type of agreement involves collateral provided by the borrower to secure the loan. The collateral may be in the form of property, such as a car or real estate, which the lender can seize in case of default. 2. Unsecured Personal Loan Agreement: In this type of agreement, there is no collateral required. The loan is solely based on the borrower's creditworthiness and ability to repay. As there is no collateral, lenders typically charge higher interest rates to compensate for the increased risk. 3. Fixed-Rate Personal Loan Agreement: This agreement defines a fixed interest rate for the duration of the loan. The interest rate remains constant throughout the repayment period, ensuring predictable monthly payments for the borrower. 4. Variable-Rate Personal Loan Agreement: This type of agreement allows the interest rate to fluctuate over time. The rate is usually tied to a benchmark index, such as the prime rate, and can change periodically. Borrowers should be aware that their monthly payments may vary with market conditions. 5. Short-Term Personal Loan Agreement: This type of agreement defines a repayment period typically ranging from a few weeks to a few months. Short-term personal loans are often used to cover immediate expenses or financial emergencies. 6. Long-Term Personal Loan Agreement: In contrast, this agreement has a longer repayment period, often spanning several years. Long-term personal loans are commonly used for major purchases, such as home renovations or higher education. It is important for borrowers to carefully review and understand the specific terms and conditions of the Oregon Consumer Loan Application — Personal Loan Agreement that they are entering into to ensure they are making an informed decision and are aware of their rights and obligations as borrowers.

Oregon Consumer Loan Application - Personal Loan Agreement

Description

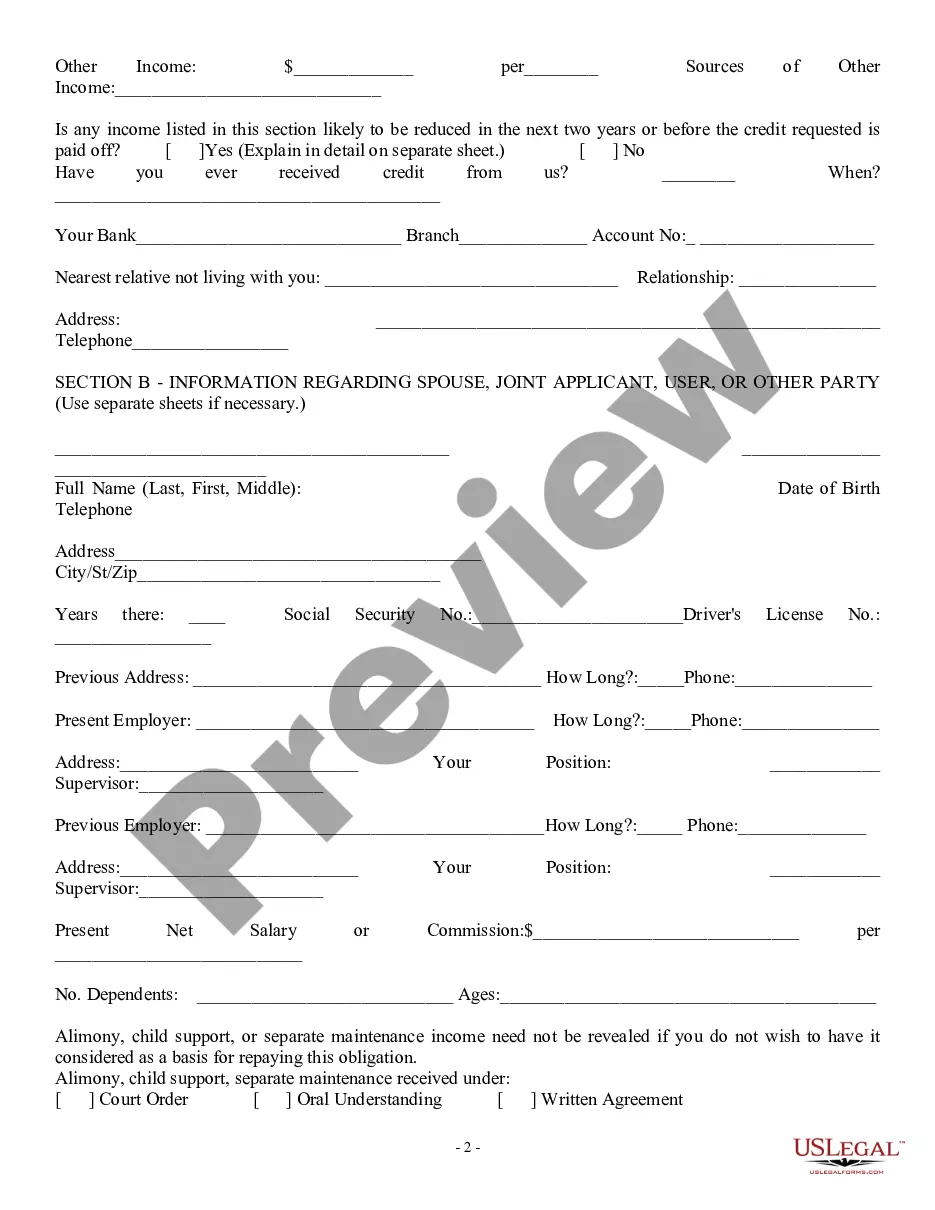

How to fill out Oregon Consumer Loan Application - Personal Loan Agreement?

If you want to complete, down load, or print legitimate file layouts, use US Legal Forms, the greatest assortment of legitimate types, which can be found on the web. Use the site`s simple and hassle-free look for to get the documents you need. Different layouts for enterprise and specific reasons are sorted by classes and suggests, or key phrases. Use US Legal Forms to get the Oregon Consumer Loan Application - Personal Loan Agreement in just a couple of clicks.

Should you be currently a US Legal Forms consumer, log in to your account and click the Down load key to obtain the Oregon Consumer Loan Application - Personal Loan Agreement. You can also accessibility types you in the past downloaded inside the My Forms tab of the account.

If you are using US Legal Forms initially, follow the instructions below:

- Step 1. Make sure you have selected the shape to the appropriate area/land.

- Step 2. Make use of the Review solution to look through the form`s content material. Do not forget about to read through the explanation.

- Step 3. Should you be not happy with the kind, take advantage of the Look for area towards the top of the display screen to find other models of your legitimate kind design.

- Step 4. Upon having discovered the shape you need, go through the Buy now key. Choose the rates plan you like and include your credentials to register on an account.

- Step 5. Process the financial transaction. You should use your Мisa or Ьastercard or PayPal account to complete the financial transaction.

- Step 6. Find the file format of your legitimate kind and down load it on your product.

- Step 7. Total, revise and print or signal the Oregon Consumer Loan Application - Personal Loan Agreement.

Every legitimate file design you get is yours eternally. You may have acces to every kind you downloaded with your acccount. Click on the My Forms portion and pick a kind to print or down load yet again.

Contend and down load, and print the Oregon Consumer Loan Application - Personal Loan Agreement with US Legal Forms. There are many specialist and express-specific types you may use to your enterprise or specific requires.

Form popularity

FAQ

A secured loan uses an asset you own as collateral; the lender can take the asset if you don't repay the loan. An unsecured loan requires no collateral. They usually have higher interest rates than secured loans because they are riskier for lenders.

Consumer credit, or consumer debt, is personal debt taken on to purchase goods and services. Although any type of personal loan could be labeled consumer credit, the term is more often used to describe unsecured debt of smaller amounts.

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.

Consumer lending includes closed- and open-end credit extended to individuals for household, family, and other personal expenditures and includes credit cards, auto loans, and student loans.

You can get a personal loan with a job offer letter through Upstart, as long as the offer letter states your future start date and compensation. Some other lenders may also accept a job offer letter as proof of employment, but it's not common for major personal loan providers.

The biggest difference between a consumer loan and a personal loan is that consumer loans can include revolving credit. Personal loans are nonrevolving financial lending products that provide borrowers with a lump sum of money and payment schedule for repaying the loan.

First and foremost, understand that personal loan agreements fall into the classification of contracts. Technically, you don't have to notarize these documents. But if you want to make this document legally binding, then notarization is the best course of action.

A personal loan (also known as a consumer loan) describes any situation in which an individual borrows money for personal need, including making investments in a company. All personal loans have three common elements: Evidence of the debt (promissory note)