Oregon Retirement Cash Flow

Description

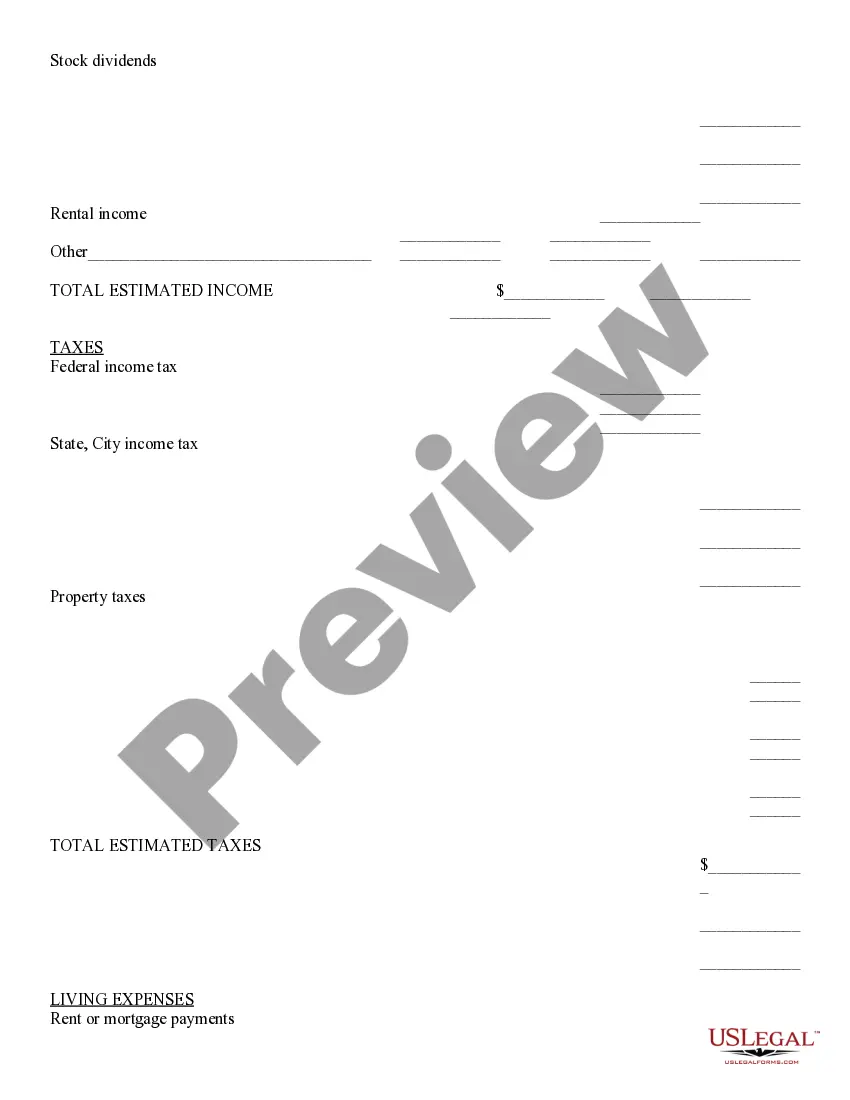

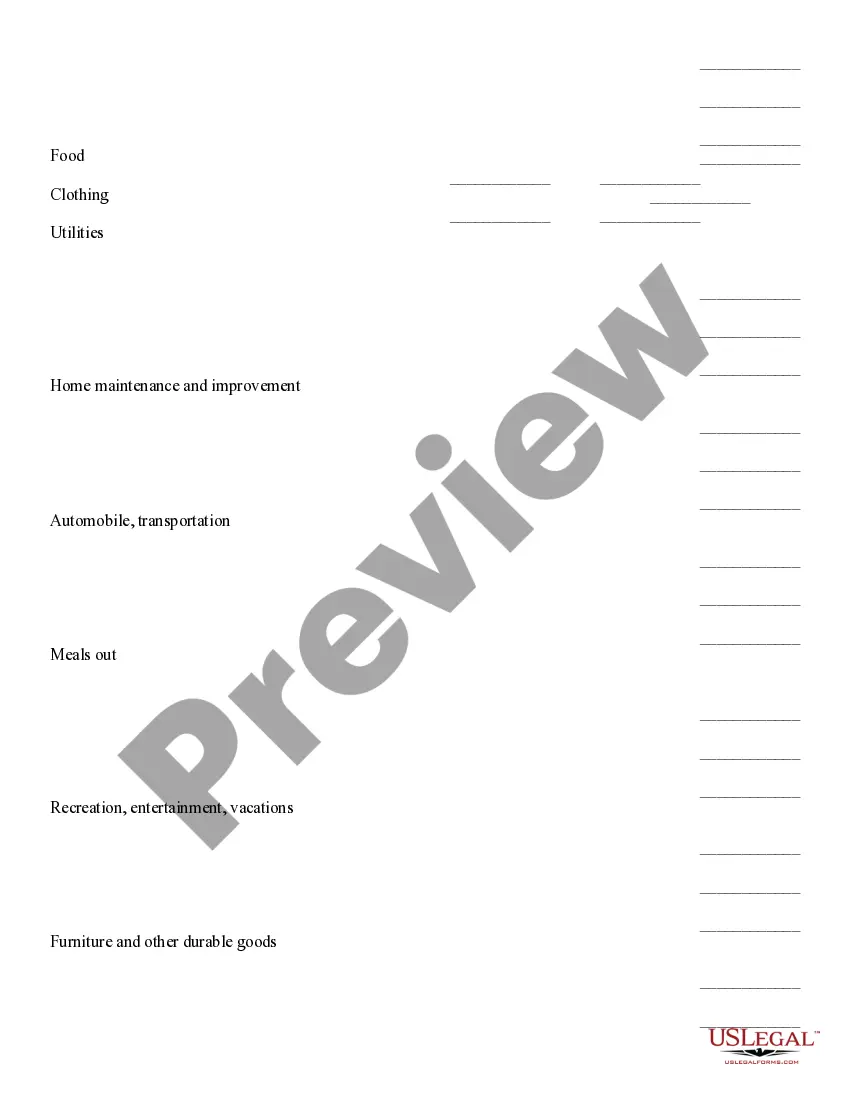

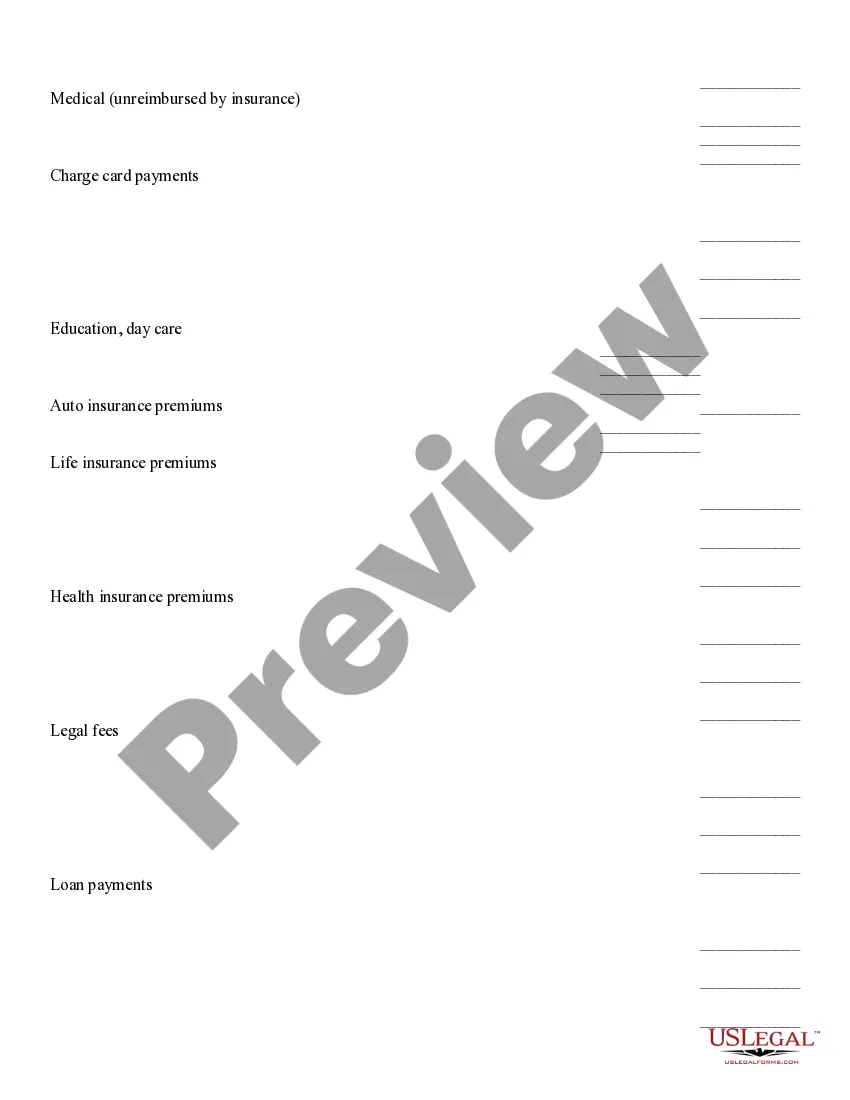

How to fill out Retirement Cash Flow?

Are you presently in a predicament where you have to obtain documents for both corporate or specific needs nearly every day.

There is an abundance of authorized document templates accessible on the web, but discovering versions you can trust is not simple.

US Legal Forms offers a vast number of form templates, including the Oregon Retirement Cash Flow, which are crafted to comply with federal and state regulations.

Once you find the appropriate form, click Get now.

Choose the pricing plan you prefer, fill in the required information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Oregon Retirement Cash Flow template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Identify the form you need and confirm it is for your specific state/region.

- Use the Review button to inspect the form.

- Read the summary to ensure that you have selected the correct form.

- If the form is not what you are looking for, utilize the Search field to find the document that meets your needs.

Form popularity

FAQ

The additions push the number of retirees collecting from the Oregon Public Employee Retirement System to more than 141,000. Those retirees collect $34,680 a year on average, or about 74% of final pay, with an average tenure of about 20 years.

The OPSRP Pension Program is funded by your employer and provides a lifetime pension. It is designed to provide approximately 45 percent of your final average salary at retirement (for a general service member with a 30-year career or a police and firefighter member with a 25-year career).

Service retirement is a lifetime benefit. Employees can retire as early as age 50 with five years of CalPERS pensionable service credit unless all service was earned on or after January 1, 2013, then employees must be at least age 52 to retire.

With a graded vesting schedule, your company's contributions must vest at least 20% after two years, 40% after three years, 60% after four years, 80% after five years and 100% after six years. If enrollment is automatic and employer contributions are required, they must vest within two years.

Service retirement is a lifetime benefit. You can retire as early as age 50 with five years of service credit unless all service was earned on or after January 1, 2013. Then you must be at least age 52 to retire. There are some exceptions to the 5-year requirement.

The Individual Account Program (IAP) is an account-based retirement benefit for members of the Public Employees Retirement System (PERS). Oregon State Treasury oversees the investment of IAP funds and the Oregon Public Employees Retirement Fund.

The program has a normal retirement age of 65 or 58 with 30 years of retirement credit. The IAP contains all member contributions made on and after January 1, 2004.

The IAP: 2022 Informs incident personnel of the incident objectives for the operational. period, the specific resources that will be applied, actions taken during the. operational period to achieve the objectives, and other operational information. (e.g., weather, constraints, limitations, etc.

You are automatically vested in your IAP account when your account is established. Earnings or losses are credited annually to member accounts. Administrative fees are deducted from the fund's earnings as part of the annual crediting process. Your IAP is subject to earnings or losses until you receive the funds.

The Individual Account Program (IAP) is an account-based retirement benefit for members of the Public Employees Retirement System (PERS). Oregon State Treasury oversees the investment of IAP funds and the Oregon Public Employees Retirement Fund.