Title: Oregon Sale of Deceased Partner's Interest — Types and DetaileDescriptionon: In the state of Oregon, the Sale of Deceased Partner's Interest refers to the legal process through which a deceased partner's ownership stake or interest in a business partnership is transferred or sold to another party. This procedure ensures the smooth transition of ownership and allows the surviving partner(s) to continue operating the business. Here, we will explore the various types of Oregon Sale of Deceased Partner's Interest and provide a comprehensive understanding of this process. 1. Voluntary Sale of Deceased Partner's Interest: This type of sale occurs when the surviving partner(s) or the estate of the deceased partner mutually agree to transfer the deceased partner's interest to a new individual or entity. Both parties negotiate and agree upon the terms, including the purchase price, payment method, and any other relevant conditions. 2. Court-Ordered Sale of Deceased Partner's Interest: In some cases, when disputes arise among surviving partners or beneficiaries about the ownership of the deceased partner's interest, a court may intervene and order the sale of the interest. This type of sale is typically initiated through legal proceedings, where the court oversees the process to ensure fairness and compliance with applicable laws. 3. Private Sale of Deceased Partner's Interest: Occasionally, surviving partners have the right to privately sell the deceased partner's interest without seeking court intervention. This type of sale usually occurs when specific provisions are included in the partnership agreement, granting the surviving partners the authority to privately negotiate and complete the sale. The Sale of Deceased Partner's Interest process typically involves several key steps, such as: a. Valuation of the Deceased Partner's Interest: A crucial initial step is conducting a fair valuation of the deceased partner's ownership stake. This assessment helps determine the accurate value of the interest being sold and forms the basis of negotiations between the parties involved. b. Offering the Interest for Sale: Once the valuation is complete, the surviving partner(s) or the executor of the deceased partner's estate advertise the interest for sale to potential buyers. This may involve notifying interested parties, advertising in relevant publications or online platforms, and seeking professional assistance if necessary. c. Negotiating and Finalizing the Sale: Interested buyers may submit offers or express their intention to acquire the deceased partner's interest. Negotiations take place to agree upon the terms, which may cover aspects like price, payment arrangements, transfer of rights, and any other relevant conditions. Once both parties reach a mutual agreement, the sale is finalized by signing legal documents and transferring the ownership. d. Legal Procedures and Documentation: Sale of Deceased Partner's Interest requires the preparation and execution of legal documents, such as a Sale Agreement, Assignment of Interest, and possibly updating the partnership agreement or notifying relevant authorities about the transfer. Seeking legal guidance is strongly encouraged to ensure compliance with Oregon state laws and safeguard the interests of all parties involved. In conclusion, the Oregon Sale of Deceased Partner's Interest involves different types of sales, including voluntary, court-ordered, and private sale. Valuation, offering, negotiating, and fulfilling legal requirements are pivotal throughout the process. Seeking professional legal support throughout this procedure is highly recommended navigating the intricacies and protect the rights of all parties involved.

Oregon Sale of Deceased Partner's Interest

Description

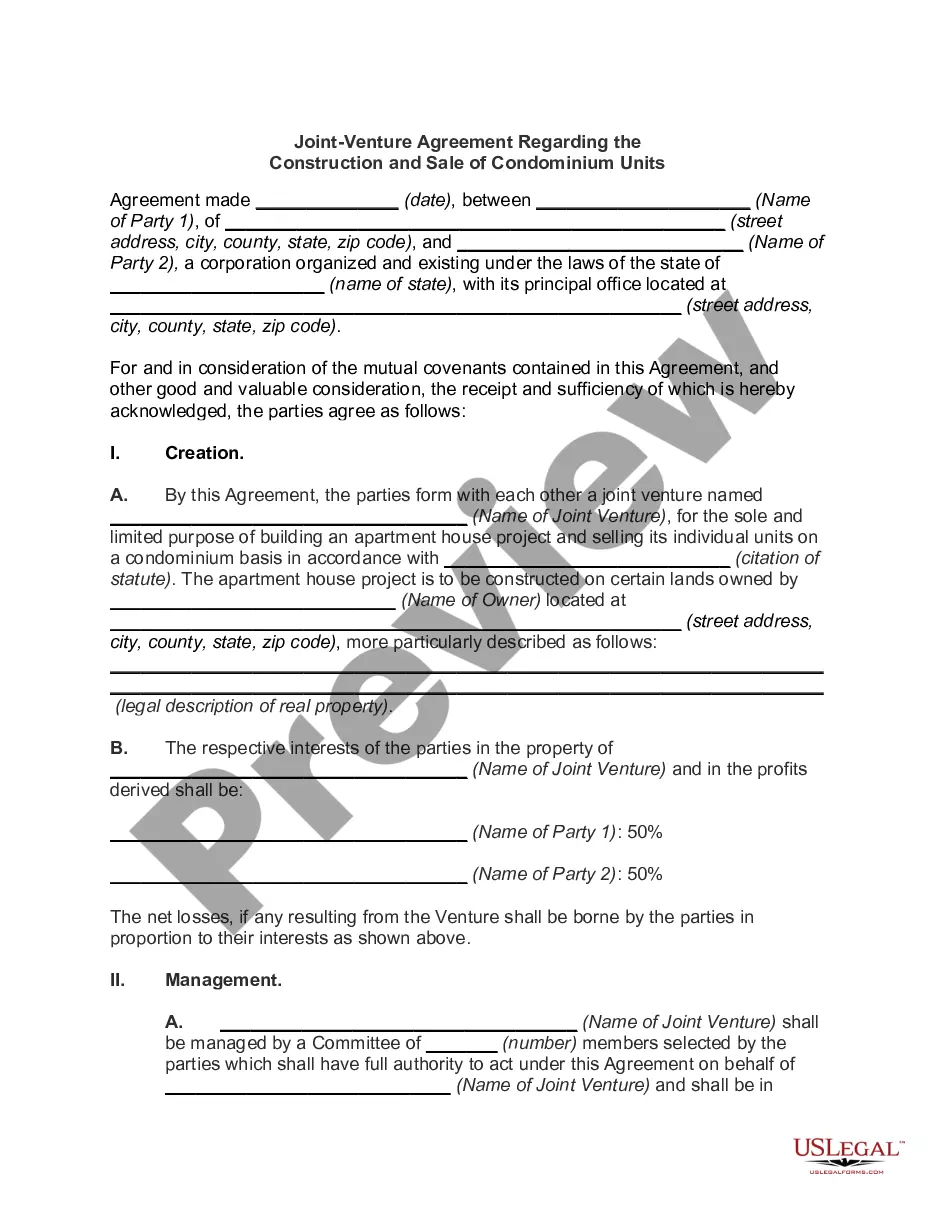

How to fill out Oregon Sale Of Deceased Partner's Interest?

US Legal Forms - one of the largest repositories of legal documents in the United States - provides a vast assortment of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Oregon Sale of Deceased Partner's Interest in moments.

If you already have an account, Log In and download the Oregon Sale of Deceased Partner's Interest from the US Legal Forms library. The Download button will appear on each document you view. You can access all previously saved documents from the My documents section of your account.

Then, choose the payment plan you prefer and provide your details to create an account.

Process the payment. Use a credit card or PayPal account to finalize the transaction. Choose the format and download the form to your device. Make edits. Fill out, modify, and print and sign the saved Oregon Sale of Deceased Partner's Interest.

Every document you add to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the document you want. Access the Oregon Sale of Deceased Partner's Interest with US Legal Forms, the largest repository of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs.

- If you intend to use US Legal Forms for the first time, here are simple steps to get you started.

- Ensure you have selected the correct form for your city/state.

- Click the Preview button to review the form’s details.

- Check the form summary to confirm that you have selected the correct document.

- If the form does not meet your needs, use the Search field at the top of the page to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

Form popularity

FAQ

Inheritances are not considered income for federal tax purposes, whether you inherit cash, investments or property. However, any subsequent earnings on the inherited assets are taxable, unless it comes from a tax-free source.

Form 1099INT: This interest is taxable, both federally and in Oregon. You need to report the income on your returns.

The estate tax is not applied when a surviving spouse is inheriting all of a person's wealth. When the second spouse dies, though, the estate is still only allowed to apply a $1 million exemption for the purpose of the Oregon estate tax.

Oregon has no inheritance tax. When state residents and individuals who own property in the state begin their estate planning process, they may need to take Oregon's estate tax into consideration.

What Is the Federal Inheritance Tax Rate? There is no federal inheritance taxthat is, a tax on the sum of assets an individual receives from a deceased person. However, a federal estate tax applies to estates larger than $11.7 million for 2021 and $12.06 million for 2022.

Two common strategies to reduce the Oregon estate tax are the use of a credit-shelter or bypass trust and lifetime gifting: Credit-Shelter or Bypass Trust. A married couple moving to Oregon can update their estate planning to include the use of a credit-shelter or bypass trust at the first spouse's death.

All assets you own at death, including life insurance, real estate, investment accounts, and retirement accounts, regardless of how they will pass to your heirs, all count towards your exemption.

I mentioned a few of these in the last section, but there are certain types of assets that are not considered to be a part of your taxable estate: Anything you leave to a surviving spouse. This is known as the unlimited marital deduction. Any amount of money or property you leave to a charity.

Oregon has no inheritance tax.

The estate tax rate in Oregon ranges from 10% to 16% and applies to estates above $1 million. If you are estate planning in Oregon and your estate is worth more than $1 million, you'll have to consider the impact of the tax on your estate.

More info

The Wolters Kluwer Company is a global leader in the development, management, manufacturing, and distribution of transportation solutions. Wolters Kluwer's products are employed in the automotive, industrial, telecommunications, electronic business and consumer markets.