Title: Oregon Sample Letter for Debtor's Motion for Hardship Discharge and Notice of Motion Keywords: Oregon bankruptcy law, debtor's motion, hardship discharge, notice of motion, Chapter 7 bankruptcy, financial hardship, discharge request, court hearing, legal document, debt relief, financial struggle, legal assistance. Introduction: In the state of Oregon, individuals filing for Chapter 7 bankruptcy due to financial hardship may need to draft a Sample Letter for a Debtor's Motion for Hardship Discharge and include a Notice of Motion. This legal document serves as a formal request to the court for a discharge of debts when the debtor is unable to fulfill their financial obligations. This article aims to provide a detailed description of the content that should be included in such a letter and the importance of notifying the court about the motion. 1. Heading and introduction: Begin the letter with a heading containing essential information such as the debtor's name, case number, and contact details. In the introduction, mention the intent of the letter, explaining that it is a motion for a hardship discharge. 2. Background and hardship explanation: Provide a concise summary of the debtor's financial situation, explaining the circumstances that led to their hardship. This section should highlight aspects such as unexpected medical expenses, loss of income, or other compelling factors contributing to the financial struggle. 3. Supporting documentation: Include relevant evidence to support the claim of hardship in the form of documents, such as medical bills, termination notices, bank statements, or any other pertinent records. Properly reference each document to ensure credibility. 4. Analysis of statutory requirements: Articulate how the debtor meets the statutory requirements for obtaining a hardship discharge under Oregon bankruptcy law. Refer to specific sections of the state's bankruptcy code and demonstrate how the debtor's circumstances qualify them for this form of debt relief. 5. Proposed repayment plan: Present a proposed repayment plan for any debts not eligible for discharge, emphasizing the debtor's commitment to make meaningful efforts to repay their creditors. This plan should demonstrate that the debtor has considered the best interests of both parties involved. 6. Statement of good faith effort: Include a statement affirming that the debtor has made a genuine effort to meet their obligations and has exhausted all alternatives before seeking a hardship discharge. This shows the debtor's intention to act responsibly and honor their financial commitments. 7. Notice of Motion: Append the Notice of Motion to the letter, which officially informs the court and the debtor's creditors of the intent to file for a hardship discharge. This notice should include the date, time, and location of the court hearing where the motion will be addressed. Conclusion: Crafting a comprehensive and well-structured Oregon Sample Letter for Debtor's Motion for Hardship Discharge and Notice of Motion is essential when seeking a hardship discharge under Chapter 7 bankruptcy. By providing a detailed explanation of financial hardship, supporting documentation, proposed repayment plan, and a notice of motion, debtors increase their chances of obtaining the desired debt relief. It is crucial to consult with a legal professional to ensure the letter meets all necessary requirements and accurately presents the debtor's case.

Oregon Sample Letter for Debtor's Motion for Hardship Discharge and Notice of Motion

Description

How to fill out Oregon Sample Letter For Debtor's Motion For Hardship Discharge And Notice Of Motion?

Are you presently within a position that you require documents for either enterprise or person reasons almost every day time? There are a variety of legitimate document themes available online, but finding types you can rely on is not simple. US Legal Forms delivers a huge number of develop themes, such as the Oregon Sample Letter for Debtor's Motion for Hardship Discharge and Notice of Motion, which are written in order to meet state and federal needs.

If you are presently acquainted with US Legal Forms site and possess an account, just log in. After that, you can down load the Oregon Sample Letter for Debtor's Motion for Hardship Discharge and Notice of Motion design.

If you do not offer an account and want to begin using US Legal Forms, adopt these measures:

- Find the develop you want and ensure it is to the right area/county.

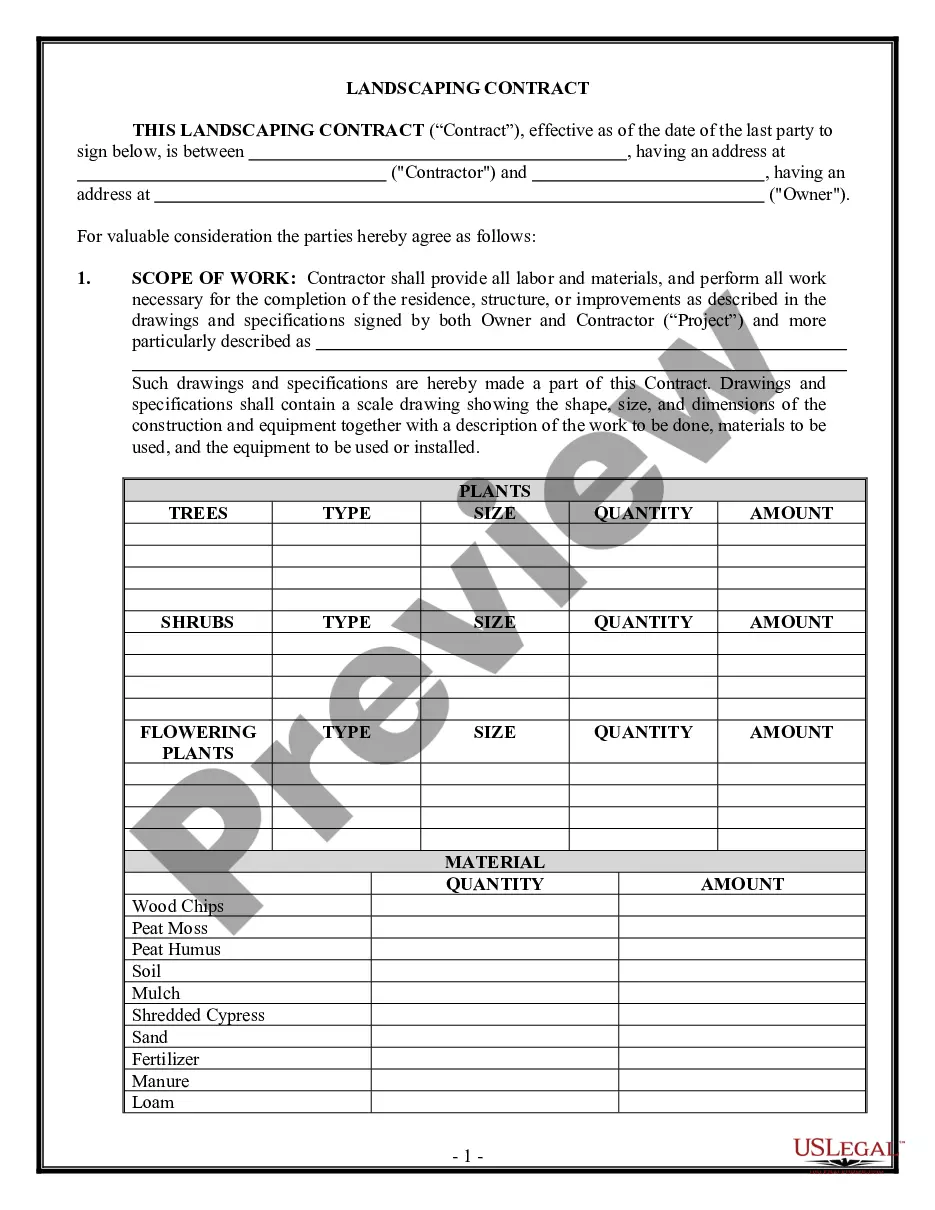

- Utilize the Review button to check the form.

- Look at the information to actually have selected the correct develop.

- If the develop is not what you are trying to find, use the Look for discipline to get the develop that suits you and needs.

- When you obtain the right develop, click on Acquire now.

- Pick the rates plan you want, complete the desired information to make your account, and purchase an order using your PayPal or bank card.

- Decide on a hassle-free data file formatting and down load your backup.

Locate all the document themes you possess purchased in the My Forms food list. You may get a further backup of Oregon Sample Letter for Debtor's Motion for Hardship Discharge and Notice of Motion at any time, if necessary. Just click the needed develop to down load or printing the document design.

Use US Legal Forms, probably the most comprehensive collection of legitimate kinds, in order to save time as well as avoid errors. The support delivers expertly made legitimate document themes that you can use for a selection of reasons. Create an account on US Legal Forms and start creating your daily life a little easier.