Compiled financial statements represent the most basic level of service that certified public accountants provide with respect to financial statements. In a compilation, the CPA must comply with certain basic requirements of professional standards, such as having a knowledge of the client's industry and applicable accounting principles, having a clear understanding with the client as to the services to be provided, and reading the financial statements to determine whether there are any obvious departures from generally accepted accounting principles (or, in some cases, another comprehensive basis of accounting used by the entity). It may be necessary for the CPA to perform "other accounting services" (such as creating a general ledger for the client, or assisting the client with adjusting entries for the books of the client (before the financial statements can be prepared). Upon completion, a report on the financial statements is issued that states a compilation was performed in accordance with AICPA professional standards, but no assurance is expressed that the statements are in conformity with generally accepted accounting principles. This is known as the expression of "no assurance." Compiled financial statements are often prepared for privately-held entities that do not need a higher level of assurance expressed by the CPA.

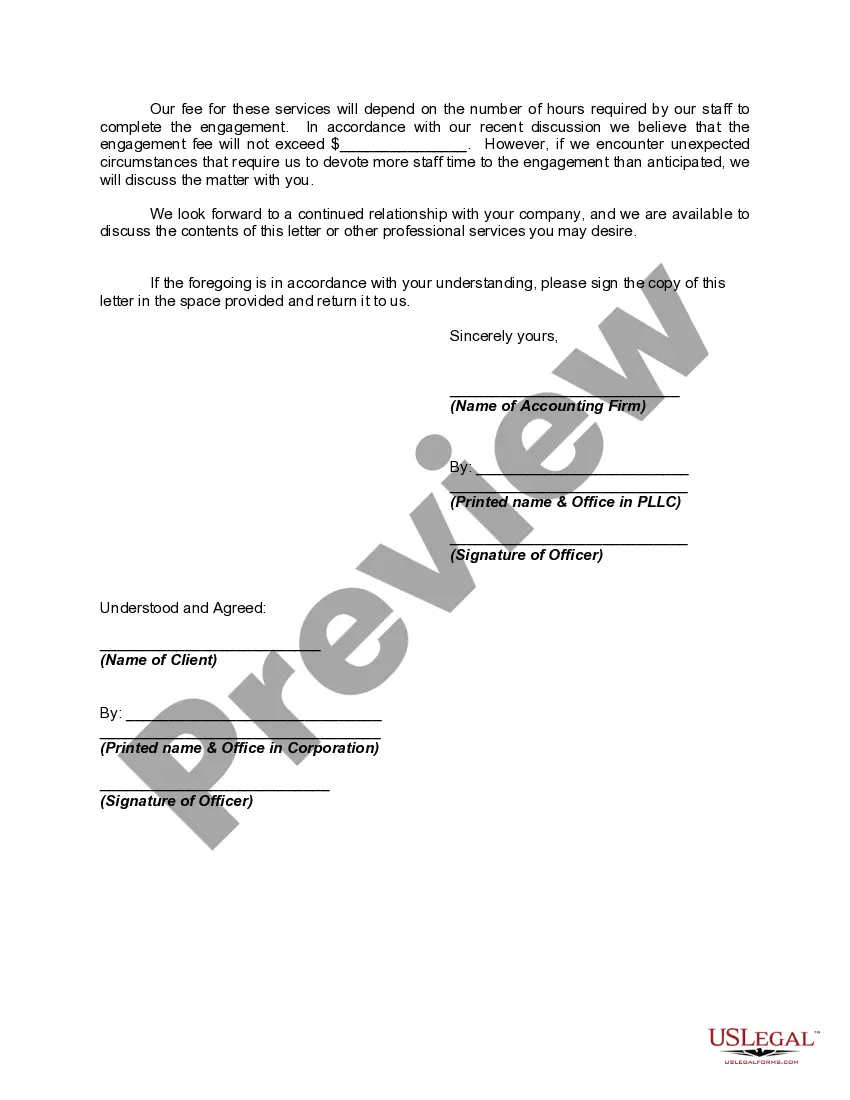

An Oregon engagement letter is a formal document used by an accounting firm to establish the terms and conditions of their engagement in reviewing or compiling financial statements for a client. This letter serves as a contract between the accounting firm and the client, outlining the responsibilities, limitations, and expectations of both parties involved in the engagement process. The purpose of an Oregon engagement letter for the review of financial statements is to outline the scope of services that the accounting firm will provide. It typically includes a description of the financial statements to be reviewed, such as balance sheets, income statements, and cash flow statements. The letter also defines the objectives of the review engagement, which could be to express limited assurance or to provide reasonable assurance regarding the financial statements. An Oregon engagement letter for a compilation of financial statements is slightly different. In a compilation engagement, the accounting firm assists the client in presenting their financial information in the form of financial statements without providing any assurance on the accuracy or completeness of the information. The emphasis is on organizing and presenting the data in a suitable format rather than verifying the accuracy of the information. The engagement letter for both review and compilation engagements typically includes key details such as the timeframe within which the services will be conducted, the fee structure, the responsibilities of the client in providing accurate and complete information, and any confidential or proprietary information that should be kept secure. It may also define the reporting responsibilities and limitations imposed by Generally Accepted Accounting Principles (GAAP) or other regulatory bodies. The different types of Oregon engagement letters for review or compilation of financial statements can vary based on the specific nature of the engagement, such as for-profit or nonprofit organizations, governmental entities, or specific industries. Some accounting firms may have standard templates that can be customized, while others might tailor the engagement letter to meet the specific needs of individual clients or engagements. In summary, an Oregon engagement letter for the review of financial statements and compilation by an accounting firm is a crucial contract that outlines the terms, responsibilities, and expectations of both the firm and the client. It helps establish clear communication and sets the groundwork for a successful engagement while adhering to the relevant regulatory and professional standards.