The U.S. Bankruptcy Code also allows individual debtors who meet certain financial criteria to adopt extended time payment plans for the payment of debts. An individual debtor on a regular income may submit a plan for installment payment of outstanding debts. This is called a Chapter 13 Plan. This plan must be confirmed by the court. Once it is confirmed, debts are paid in the manner specified in the plan. After all payments called for by the plan are made, the debtor is given a discharge. The plan is, in effect, a budget of the debtor's future income with respect to outstanding debts. The plan must provide for the eventual payment in full of all claims entitled to priority under the Bankruptcy Code. The plan will be confirmed if it is submitted in good faith and is in the best interest of the creditors.

A Chapter 13 plan must provide for the submission of all or such portion of future earnings or other future income of the debtor to the supervision and control of the trustee as is necessary for the execution of the plan. After the confirmation of a Chapter 13 plan, the court may exercise its discretion and order any entity from whom the debtor receives income to pay all or part of such income to the trustee.

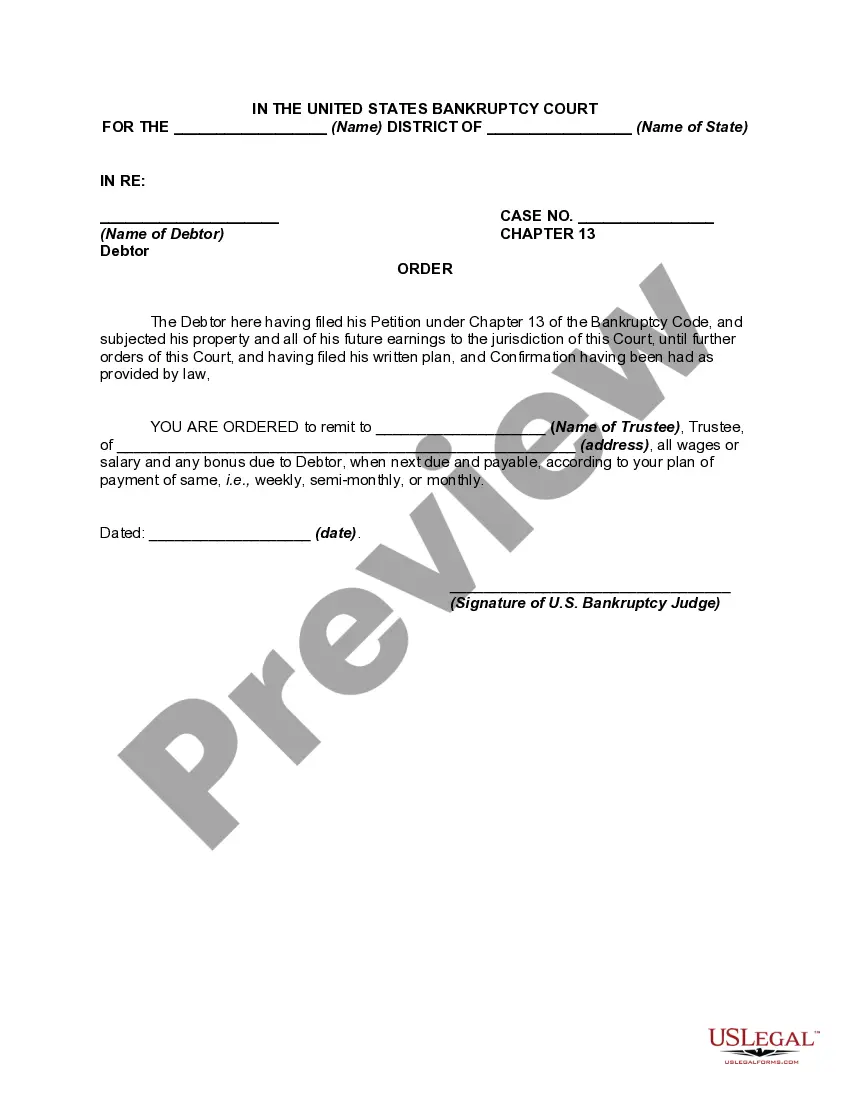

Title: Understanding the Oregon Order Requiring Debtor's Employer to Remit Deductions from a Debtor's Paycheck to Trustee Introduction: The Oregon Order Requiring Debtor's Employer to Remit Deductions from a Debtor's Paycheck to Trustee plays a vital role in bankruptcy cases. It provides a mechanism for the trustee to receive regular payments from the debtor's employer, ensuring that obligations are met and creditors are fairly compensated. In this article, we will delve into the details of this order, exploring its purpose, process, and variations. I. Purpose and Background: The Oregon Order Requiring Debtor's Employer to Remit Deductions from a Debtor's Paycheck to Trustee serves to streamline the payment process in bankruptcy cases. Its primary purpose is to provide a reliable method for the trustee to collect a portion of the debtor's income directly from their employer. This helps facilitate the distribution of funds to creditors and ensures the debtor's compliance with the bankruptcy plan. II. Process and Mechanism: 1. Filing the Order: To initiate the Oregon Order, the trustee must file a motion with the bankruptcy court, seeking approval for the order. This motion outlines the debtor's financial situation and demonstrates the need for a wage garnishment mechanism. 2. Notice and Consent: Once the motion is filed, a notice is sent to the debtor, their employer, and other relevant parties, informing them of the request. The debtor has the opportunity to object or consent to the order. 3. Court Approval: The bankruptcy court reviews the motion, considering the debtor's objections if any. If the court determines that the order is necessary and reasonable, it grants approval. The court may also decide on the specific terms and conditions of the wage garnishment. 4. Implementation: Upon court approval, the order is served to the debtor's employer. The employer is legally obligated to deduct the specified amount from the debtor's paycheck and remit it directly to the trustee. The deducted funds are subsequently distributed to creditors according to the bankruptcy plan. III. Types of Oregon Order Requiring Debtor's Employer to Remit Deductions: 1. Chapter 7 Bankruptcy: In Chapter 7 cases, the Oregon Order allows the trustee to collect funds from the debtor's paycheck over a specific period following the bankruptcy filing. This order ensures a fair distribution of assets to creditors. 2. Chapter 13 Bankruptcy: In Chapter 13 cases, the Oregon Order plays a crucial role in implementing the debtor's repayment plan. It enables the trustee to receive regular payments from the debtor's employer throughout the plan's duration, ensuring the timely payment of obligations to creditors. 3. Modification or Termination: Under certain circumstances, either the debtor or the trustee can seek a modification or termination of the Oregon Order. However, such requests require court approval and must demonstrate significant changes in the debtor's financial situation or necessary adjustments to the repayment plan. Conclusion: The Oregon Order Requiring Debtor's Employer to Remit Deductions from a Debtor's Paycheck to Trustee is an essential tool for ensuring the smooth operation of bankruptcy cases in Oregon. It provides a structured mechanism for the trustee to collect funds directly from the debtor's employer, facilitating fair distribution to creditors. Understanding the purpose, process, and variations of this order is crucial for debtors, employers, trustees, and all stakeholders involved in bankruptcy proceedings.Title: Understanding the Oregon Order Requiring Debtor's Employer to Remit Deductions from a Debtor's Paycheck to Trustee Introduction: The Oregon Order Requiring Debtor's Employer to Remit Deductions from a Debtor's Paycheck to Trustee plays a vital role in bankruptcy cases. It provides a mechanism for the trustee to receive regular payments from the debtor's employer, ensuring that obligations are met and creditors are fairly compensated. In this article, we will delve into the details of this order, exploring its purpose, process, and variations. I. Purpose and Background: The Oregon Order Requiring Debtor's Employer to Remit Deductions from a Debtor's Paycheck to Trustee serves to streamline the payment process in bankruptcy cases. Its primary purpose is to provide a reliable method for the trustee to collect a portion of the debtor's income directly from their employer. This helps facilitate the distribution of funds to creditors and ensures the debtor's compliance with the bankruptcy plan. II. Process and Mechanism: 1. Filing the Order: To initiate the Oregon Order, the trustee must file a motion with the bankruptcy court, seeking approval for the order. This motion outlines the debtor's financial situation and demonstrates the need for a wage garnishment mechanism. 2. Notice and Consent: Once the motion is filed, a notice is sent to the debtor, their employer, and other relevant parties, informing them of the request. The debtor has the opportunity to object or consent to the order. 3. Court Approval: The bankruptcy court reviews the motion, considering the debtor's objections if any. If the court determines that the order is necessary and reasonable, it grants approval. The court may also decide on the specific terms and conditions of the wage garnishment. 4. Implementation: Upon court approval, the order is served to the debtor's employer. The employer is legally obligated to deduct the specified amount from the debtor's paycheck and remit it directly to the trustee. The deducted funds are subsequently distributed to creditors according to the bankruptcy plan. III. Types of Oregon Order Requiring Debtor's Employer to Remit Deductions: 1. Chapter 7 Bankruptcy: In Chapter 7 cases, the Oregon Order allows the trustee to collect funds from the debtor's paycheck over a specific period following the bankruptcy filing. This order ensures a fair distribution of assets to creditors. 2. Chapter 13 Bankruptcy: In Chapter 13 cases, the Oregon Order plays a crucial role in implementing the debtor's repayment plan. It enables the trustee to receive regular payments from the debtor's employer throughout the plan's duration, ensuring the timely payment of obligations to creditors. 3. Modification or Termination: Under certain circumstances, either the debtor or the trustee can seek a modification or termination of the Oregon Order. However, such requests require court approval and must demonstrate significant changes in the debtor's financial situation or necessary adjustments to the repayment plan. Conclusion: The Oregon Order Requiring Debtor's Employer to Remit Deductions from a Debtor's Paycheck to Trustee is an essential tool for ensuring the smooth operation of bankruptcy cases in Oregon. It provides a structured mechanism for the trustee to collect funds directly from the debtor's employer, facilitating fair distribution to creditors. Understanding the purpose, process, and variations of this order is crucial for debtors, employers, trustees, and all stakeholders involved in bankruptcy proceedings.