Oregon Simple Promissory Note for Personal Loan

Description

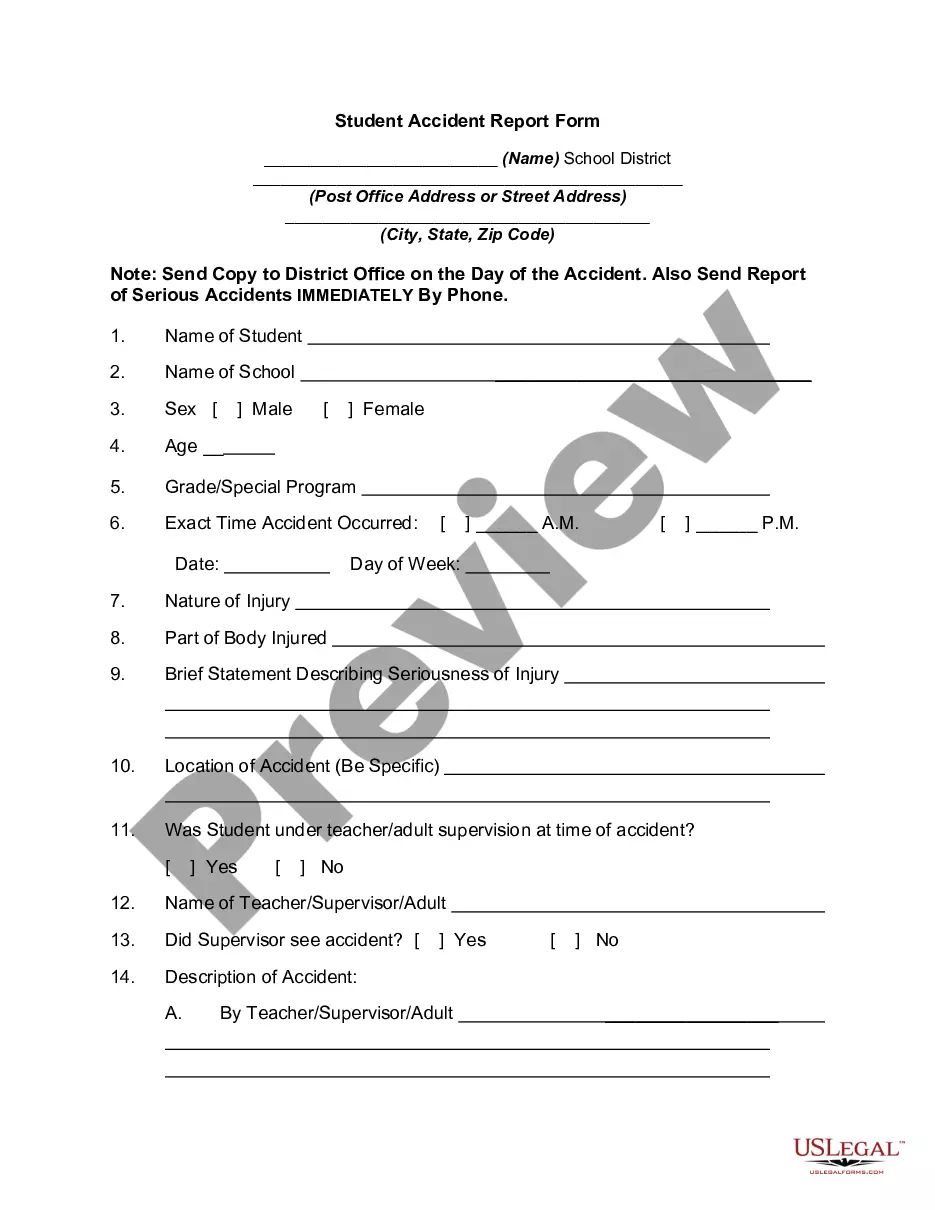

How to fill out Simple Promissory Note For Personal Loan?

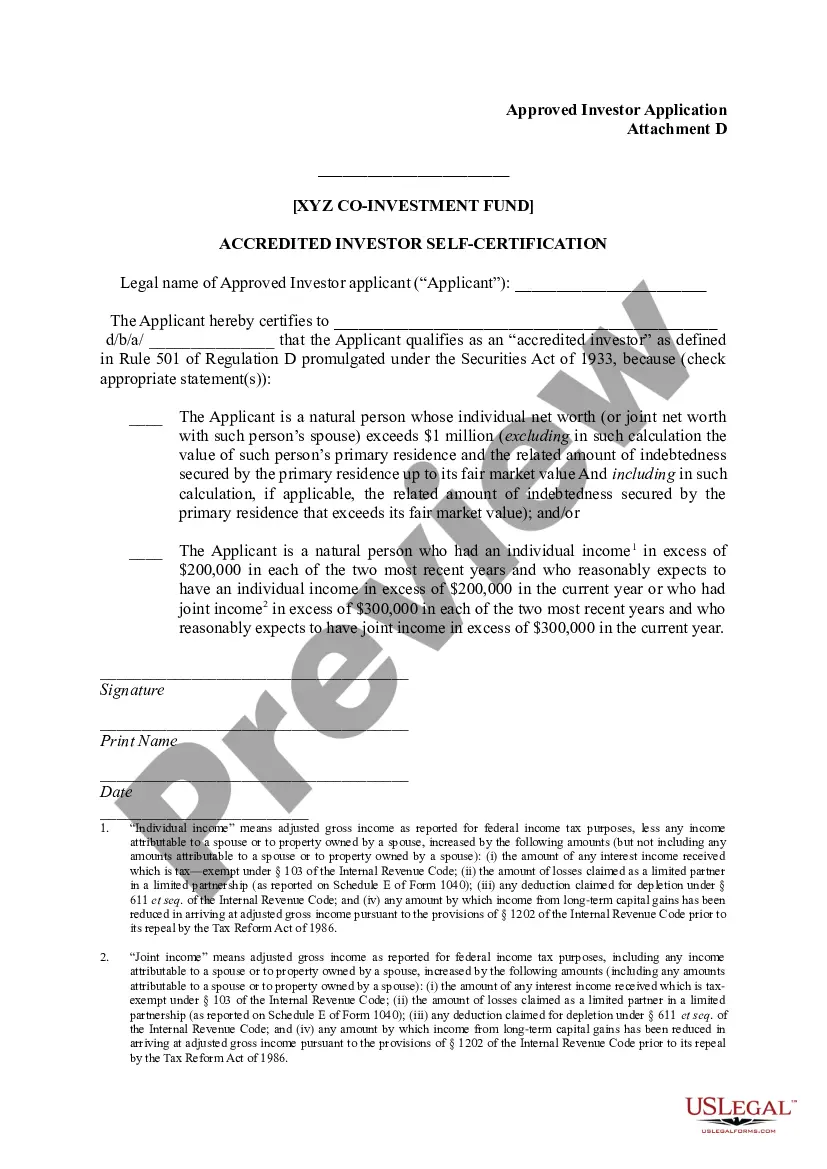

You can invest hours online looking for the legal document template that meets the state and federal criteria you require.

US Legal Forms offers thousands of legal forms that are reviewed by professionals.

It's easy to obtain or print the Oregon Simple Promissory Note for Personal Loan from our service.

If available, utilize the Review button to preview the document template as well.

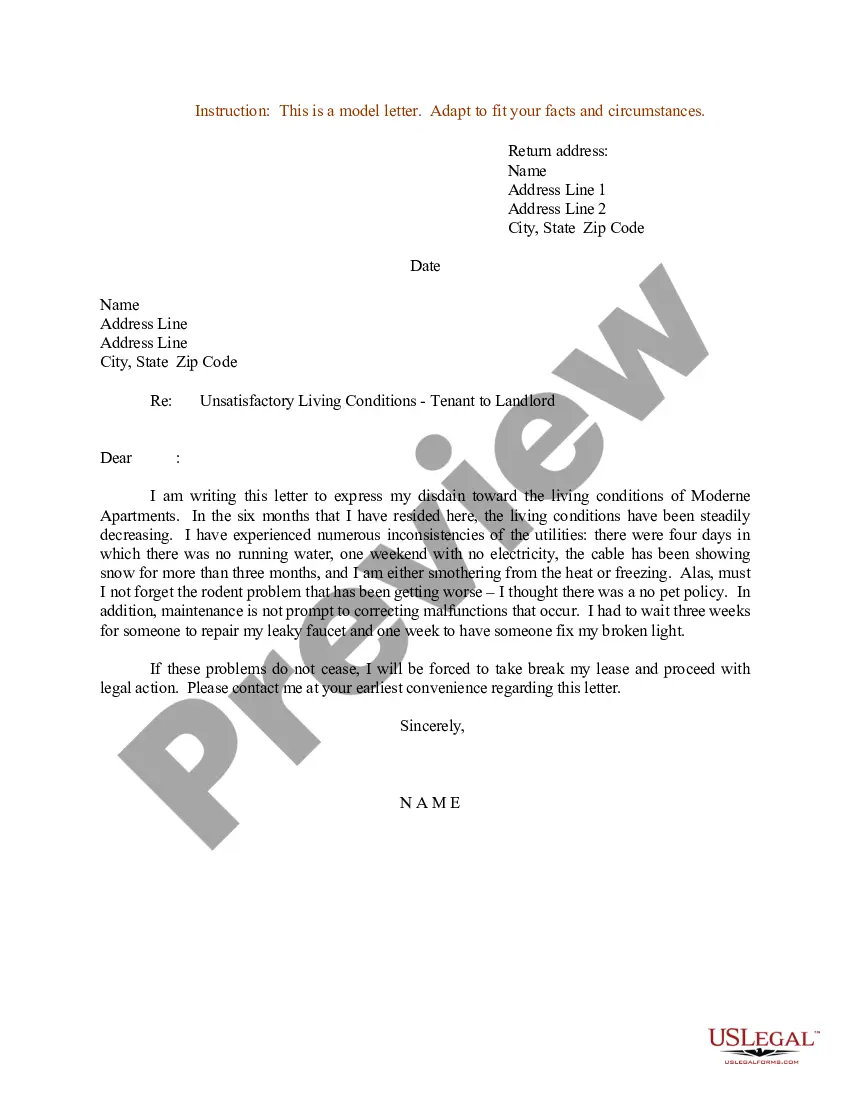

- If you possess a US Legal Forms account, you can Log In and click on the Obtain button.

- Then, you can complete, edit, print, or sign the Oregon Simple Promissory Note for Personal Loan.

- Every legal document template you purchase is yours indefinitely.

- To get another copy of any purchased form, go to the My documents section and click on the relevant button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county or area of your choice.

- Review the form description to confirm you have chosen the right form.

Form popularity

FAQ

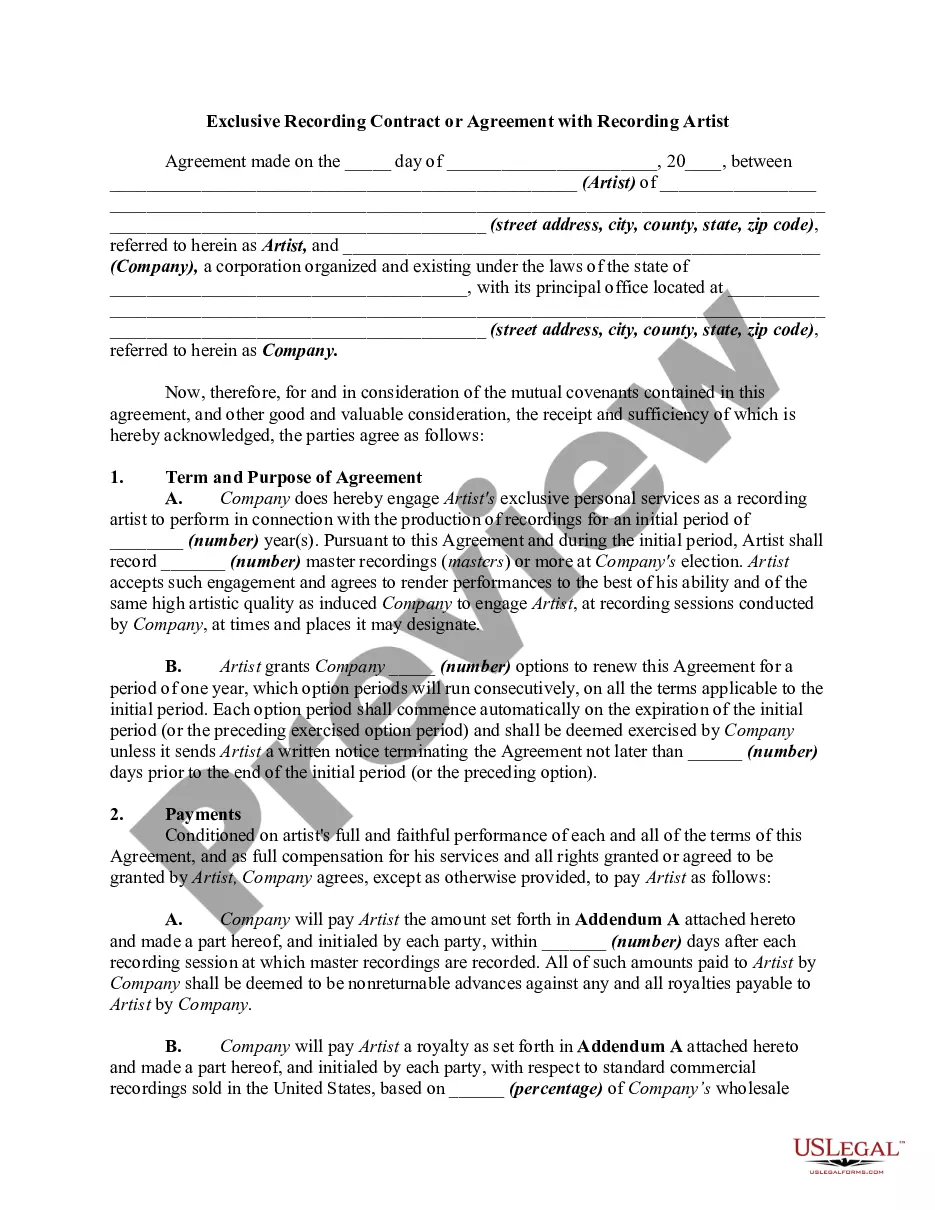

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

Any two parties who wish to enter into a loan agreement can draft a promissory note, which states the intention of the lender to loan the borrower a specific amount of money, as well as the terms and conditions for repayment of that loan, to which both parties have agreed.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

Generally, as long as the promissory note contains legally acceptable interest rates, the signatures of the two contracted parties, and are within the applicable Statute of Limitations, they can be upheld in a court of law.

Generally, promissory notes do not need to be notarized. Typically, legally enforceable promissory notes must be signed by individuals and contain unconditional promises to pay specific amounts of money.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

There is no legal requirement for most Oregon promissory notes to be notarized. Promissory notes related to real estate loans may require notarization. Most promissory notes in Oregon need to be signed and dated by the borrower and any applicable co-signer.

To draft a Loan Agreement, you should include the following:The addresses and contact information of all parties involved.The conditions of use of the loan (what the money can be used for)Any repayment options.The payment schedule.The interest rates.The length of the term.Any collateral.The cancellation policy.More items...