Oregon Debt Agreement is a legal arrangement designed to help individuals, families, and businesses facing overwhelming debt by providing a structured method for repayment and financial recovery. Also referred to as debt settlement or debt management program, this agreement is tailored to meet the unique financial circumstances of residents in the state of Oregon. During an Oregon Debt Agreement, a debtor works with a reputable debt relief agency or credit counseling service to devise a manageable plan for repaying their outstanding debts. The debtor's specific financial situation is assessed, taking into account factors such as income, expenses, assets, and outstanding debts. A realistic budget is created to determine the amount that the debtor can reasonably allocate towards debt repayment each month. The Oregon Debt Agreement generally involves negotiating with creditors to reduce the overall amount of debt owed. Creditors are contacted to offer a reduced settlement amount as an alternative to the full repayment of the debt. This helps to alleviate the financial burden on the debtor, who may be unable to meet their debt obligations due to financial hardships or other circumstances. There are several types of Oregon Debt Agreements, each tailored to meet specific needs: 1. Debt Management Plan: A type of Oregon Debt Agreement where a credit counseling agency negotiates reduced interest rates and fees with creditors, allowing debtors to make affordable monthly payments. 2. Debt Settlement: This agreement involves negotiating a lump-sum payment with creditors to settle the debt for an amount less than the total owed. Debt settlement is typically employed when a debtor has a significant amount of debt and is unable to pay the full amount. 3. Chapter 13 Bankruptcy: Although not technically considered a debt agreement, it is an option worth mentioning. Chapter 13 bankruptcy allows individuals with a regular income to reorganize their debts and create a repayment plan over three to five years. This provides a chance to catch up on missed payments and avoid asset liquidation. 4. Oregon Individual Voluntary Arrangement (IVA): Although less common in the United States, an IVA is a legally binding agreement between a debtor and their creditors to repay debts over a fixed period, often lasting five years. This option is more prevalent in the United Kingdom, but it's mentioned here for informative purposes. It is important for debtors considering an Oregon Debt Agreement to thoroughly research and choose a reputable debt relief agency or credit counseling service to guide them through the process. This ensures their interests are protected and the agreement is structured to aid their financial recovery.

Oregon Debt Agreement

Description

How to fill out Oregon Debt Agreement?

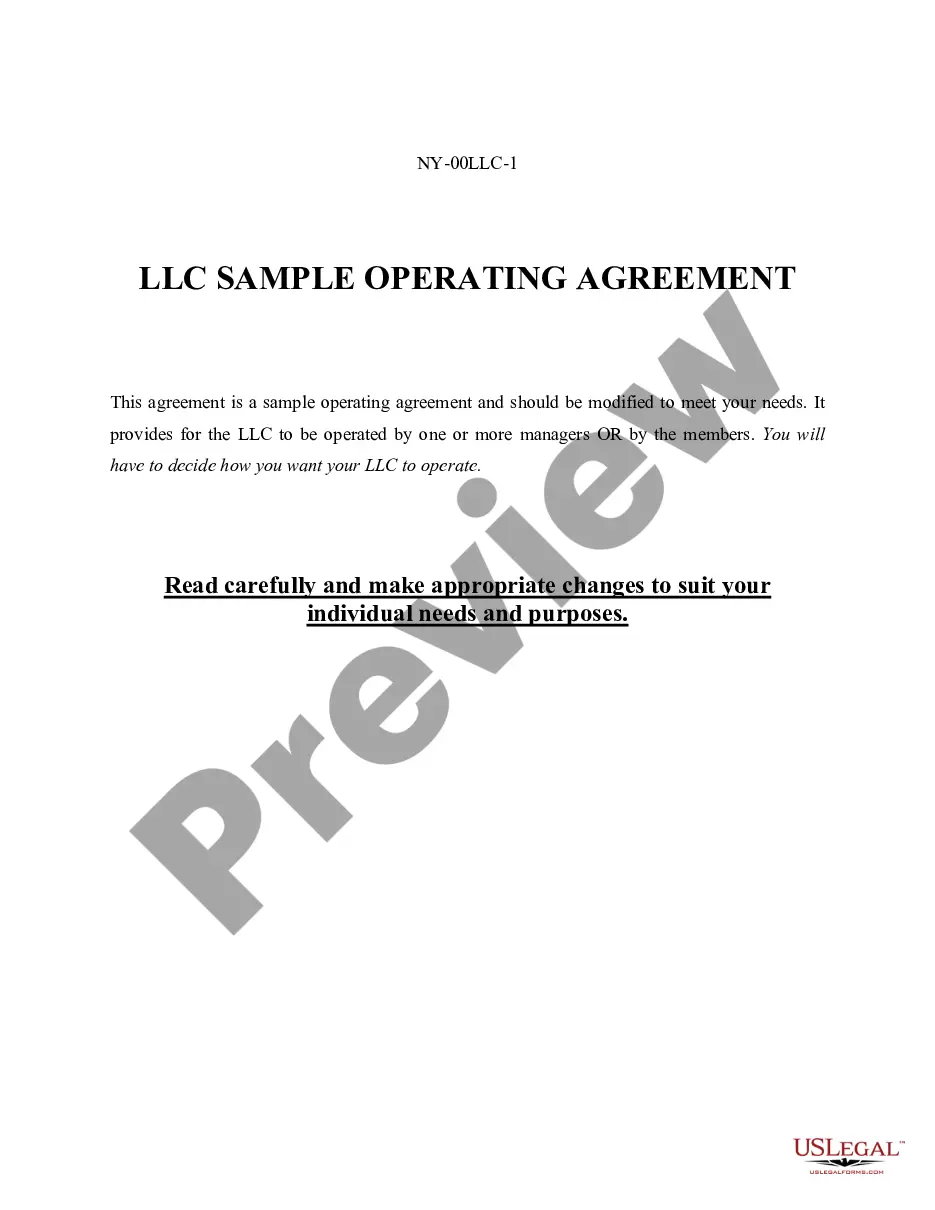

You can devote hours online searching for the authorized papers web template which fits the federal and state needs you will need. US Legal Forms supplies thousands of authorized types which are examined by pros. You can easily down load or print the Oregon Debt Agreement from your service.

If you have a US Legal Forms accounts, you may log in and then click the Download key. Afterward, you may total, edit, print, or indicator the Oregon Debt Agreement . Every single authorized papers web template you acquire is the one you have eternally. To acquire another backup for any acquired kind, visit the My Forms tab and then click the related key.

If you are using the US Legal Forms site the very first time, keep to the easy instructions listed below:

- Very first, make certain you have chosen the proper papers web template for your state/metropolis of your liking. Read the kind outline to make sure you have picked the appropriate kind. If accessible, use the Preview key to look throughout the papers web template also.

- If you want to get another variation from the kind, use the Look for field to get the web template that meets your requirements and needs.

- Once you have found the web template you want, click on Purchase now to proceed.

- Select the costs program you want, enter your qualifications, and sign up for a merchant account on US Legal Forms.

- Comprehensive the financial transaction. You can use your credit card or PayPal accounts to cover the authorized kind.

- Select the formatting from the papers and down load it for your product.

- Make adjustments for your papers if needed. You can total, edit and indicator and print Oregon Debt Agreement .

Download and print thousands of papers themes using the US Legal Forms Internet site, which offers the most important selection of authorized types. Use professional and state-distinct themes to tackle your organization or personal requirements.

Form popularity

FAQ

To write a debt settlement agreement, start with the basic details of the parties involved and the nature of the debt. Clearly outline the settlement amount and payment terms, including the date by which the settlement must be fulfilled. Including a clause regarding the release of further claims is essential for both parties. You might find guidance through resources on platforms like US Legal Forms to ensure you've covered all necessary components.

A good debt settlement letter should clearly state your intention to settle the debt and outline your offer. Include your account details, the reasons for negotiating a settlement, and any supporting documents that back your claim. Be concise and polite, as maintaining a positive tone can help in reaching an agreement. Utilizing templates from US Legal Forms can improve your letter writing process.

When negotiating a debt settlement, it's important to express your understanding of the debt and willingness to resolve it. You can say something like, 'I would like to discuss a manageable repayment plan or a settlement that allows me to clear this debt.' Being honest about your financial situation will foster an open dialogue. Offering a specific amount you can afford can facilitate quicker agreement.

An example of a debt settlement might involve a creditor agreeing to accept a lump sum payment that is less than the total amount owed. For instance, if you owe $10,000, the creditor may settle for $6,000 to close the account. This can provide relief to the debtor while ensuring the creditor recovers some of the owed amount. Exploring methods for such settlements can lead to successful negotiations.

Writing a settlement agreement in Oregon involves specifying the parties involved, the terms of the settlement, and any obligations each party must fulfill. Be sure to include a release clause to protect both sides from future claims related to the debt. Clarity is key, and using a template from a trusted source such as US Legal Forms can facilitate this process.

To write a debt agreement in Oregon, start by outlining the total amount owed and the terms of repayment. Clearly state any interest rates and due dates. It’s recommended to include a section detailing consequences for missed payments. For assistance in drafting this document, consider using a reliable platform like US Legal Forms.

Writing a debt settlement agreement involves several clear steps. First, you should start by outlining the terms of the settlement, including the total amount being settled and any payment arrangements. Next, ensure that both parties understand the implications of the Oregon Debt Agreement, which should detail any rights being waived and confirm the mutual agreement. Finally, both parties need to sign the agreement, preferably after having each section reviewed to avoid any potential disputes.

Engaging in a debt agreement can be a beneficial step towards financial relief. It allows you to negotiate terms that are manageable for your situation, potentially reducing the total amount owed. An Oregon Debt Agreement can help you regain control of your finances while protecting your assets. Evaluating this option with a trusted resource can lead to significant benefits for your financial future.

After 7 years of not paying debt, the creditor may write off your debt as uncollectible. However, this does not eliminate the debt; it may still affect your credit report. Collections can still occur unless you reach a resolution through an Oregon Debt Agreement. Engaging with professionals can help you understand how to proceed and manage your financial health.

Yes, a 10 year old debt can still be collected, depending on state laws. In Oregon, creditors may pursue debts as long as they are within the statute of limitations for collection. However, after a certain period, like 10 years, you may have defenses available to contest the collection. Consider consulting an Oregon Debt Agreement expert to explore your options.