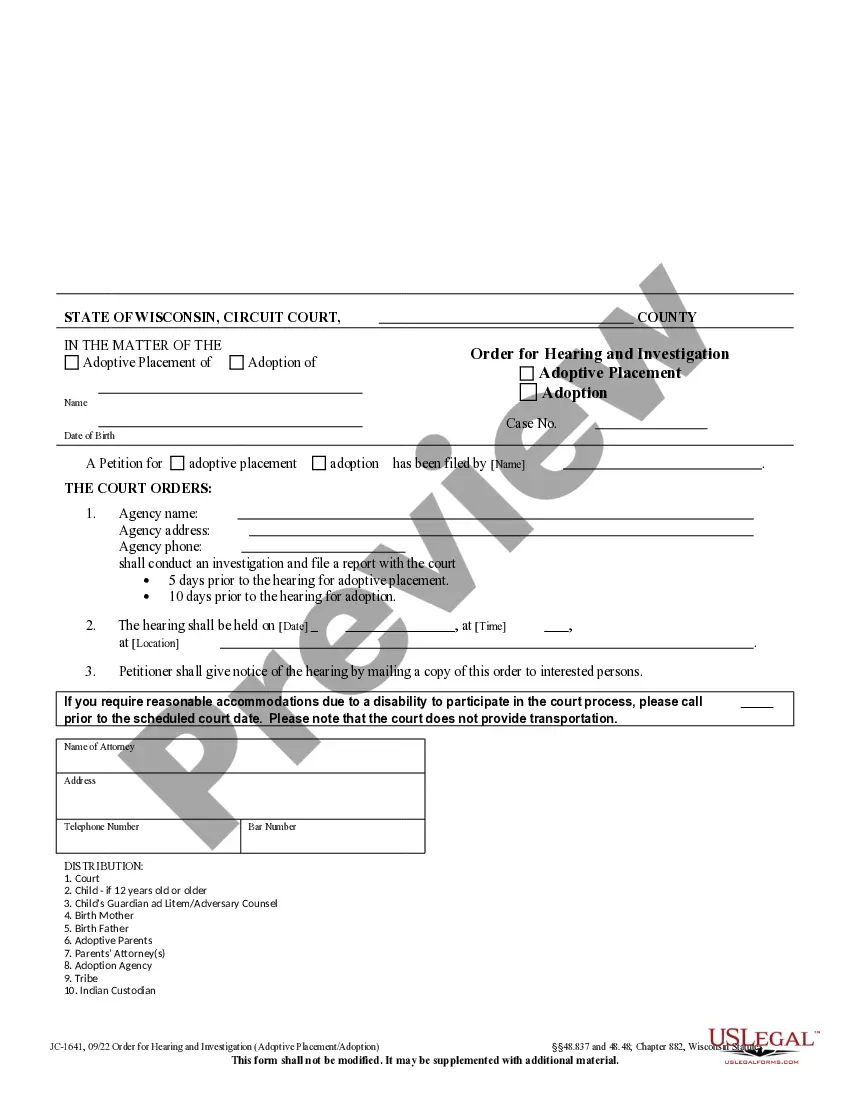

Oregon Agreement to Exchange Property - Barter Agreement with Assumption of

Description

How to fill out Agreement To Exchange Property - Barter Agreement With Assumption Of?

Selecting the optimal legal document template can be challenging.

Of course, there is a wide range of designs available online, but how can you obtain the legal form you require.

Utilize the US Legal Forms website. This service provides numerous templates, including the Oregon Agreement to Exchange Property - Barter Agreement with Assumption of, suitable for both business and personal requirements.

You can preview the form using the Review button and read the form description to confirm it is suitable for your needs.

- All forms are reviewed by experts and comply with state and federal regulations.

- If you are already a member, Log In to your account and click the Download button to access the Oregon Agreement to Exchange Property - Barter Agreement with Assumption of.

- Use your account to search through the legal documents you have previously purchased.

- Navigate to the My documents section of your account and acquire another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, ensure you have selected the correct form for your area/county.

Form popularity

FAQ

One potential downside of a 1031 exchange is the strict timeline and rules governing the process. Failing to meet these requirements can result in unexpected tax liabilities. Additionally, the complex nature of these transactions often necessitates professional guidance, which can involve additional costs.

A seller may want a 1031 exchange to defer paying capital gains taxes when selling a property. This tax strategy encourages reinvestment in like-kind properties, promoting growth and wealth accumulation. The Oregon Agreement to Exchange Property - Barter Agreement with Assumption of can facilitate this process while providing essential legal protection.

The key benefit of pursuing an exchange in real estate, such as the Oregon Agreement to Exchange Property - Barter Agreement with Assumption of, is the potential tax deferral on capital gains. This allows property owners to reinvest their assets without immediate tax implications. Moreover, it fosters flexibility in property ownership, enabling individuals to upgrade or change their investments effectively.

A clear description of the properties involved is a required element in an Oregon property management agreement. Additionally, the agreement must outline the responsibilities of each party to ensure a successful partnership. This legal framework protects both the property owner and the manager, laying the groundwork for effective communication and management.

An exchange agreement, specifically the Oregon Agreement to Exchange Property - Barter Agreement with Assumption of, is a legal document outlining the terms under which two parties agree to trade properties. This agreement clarifies the rights, obligations, and conditions of the exchange. By formalizing this contract, both parties can facilitate a smooth transfer of ownership while potentially minimizing tax burdens.

A transfer and assumption agreement is a legal document that allows one party to transfer their rights and obligations under a contract to another party. This agreement is especially relevant in property exchanges, such as those detailed in the Oregon Agreement to Exchange Property - Barter Agreement with Assumption of. It ensures that the new party steps into the previous party’s role, maintaining continuity and clarity in the agreement.

The simple agreement between a buyer and seller is a basic contract that outlines the essential details of a transaction, including the property involved, payment terms, and other key conditions. This agreement should be clear and concise to avoid misunderstandings. You can use the Oregon Agreement to Exchange Property - Barter Agreement with Assumption of as a streamlined option for these types of transactions.

Writing a simple contract agreement involves identifying the parties, defining the terms of the contract, and specifying the obligations of each party. You should also include provisions for dispute resolution and termination of the agreement. Resources such as USLegalForms can provide templates to help you draft an Oregon Agreement to Exchange Property - Barter Agreement with Assumption of in a straightforward manner.

An assumption and release agreement is a contract where one party assumes the responsibilities of another under an existing agreement, while releasing the original party from liability. This type of agreement is particularly useful in transactions like the Oregon Agreement to Exchange Property - Barter Agreement with Assumption of, where parties may want to shift obligations while ensuring clarity and protection for all involved.

Some investors seek out loopholes in 1031 exchange rules, such as structuring the transactions creatively or using related party exchanges. However, this often involves greater risks and potential scrutiny from tax authorities. When considering an Oregon Agreement to Exchange Property - Barter Agreement with Assumption of, it is wise to consult professionals to navigate these complex regulations safely.