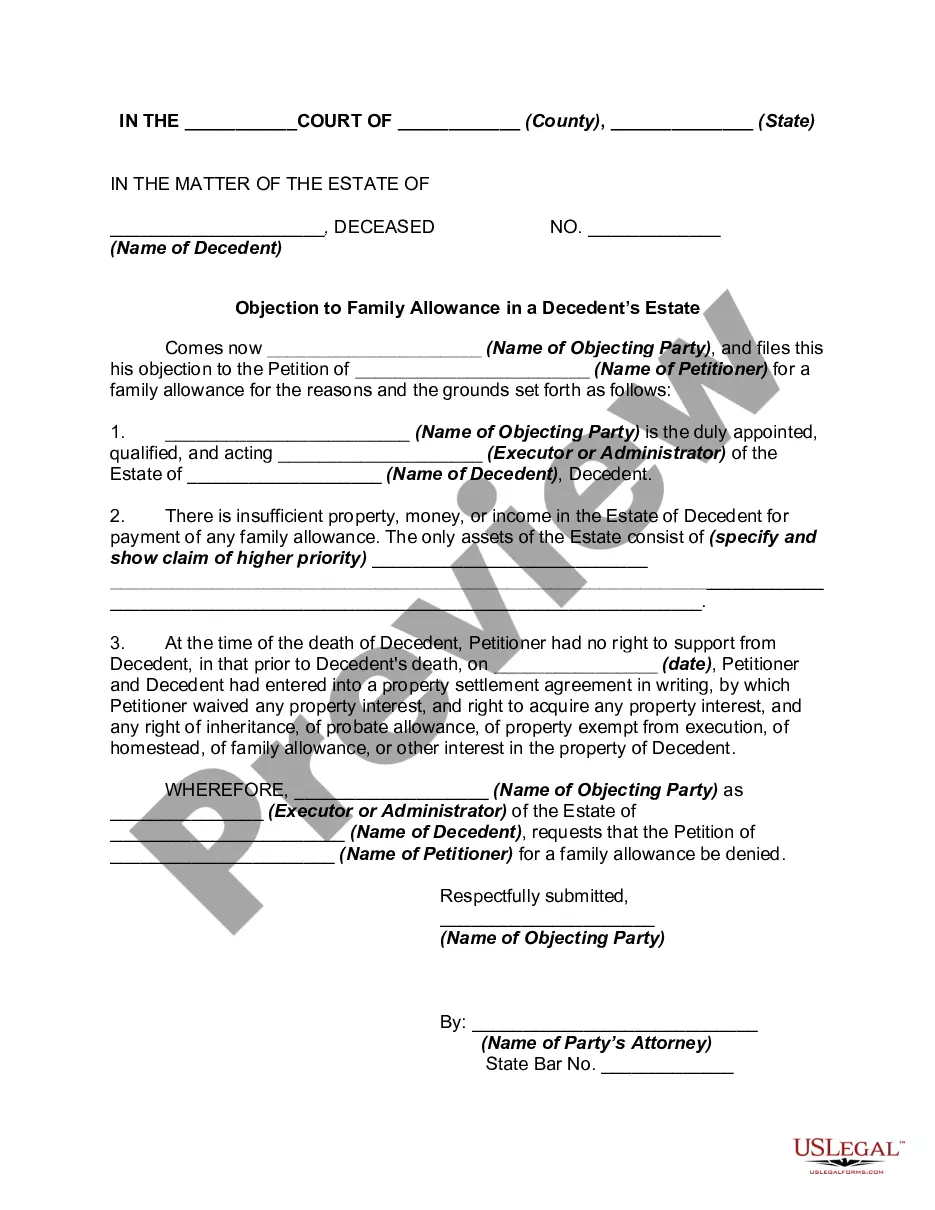

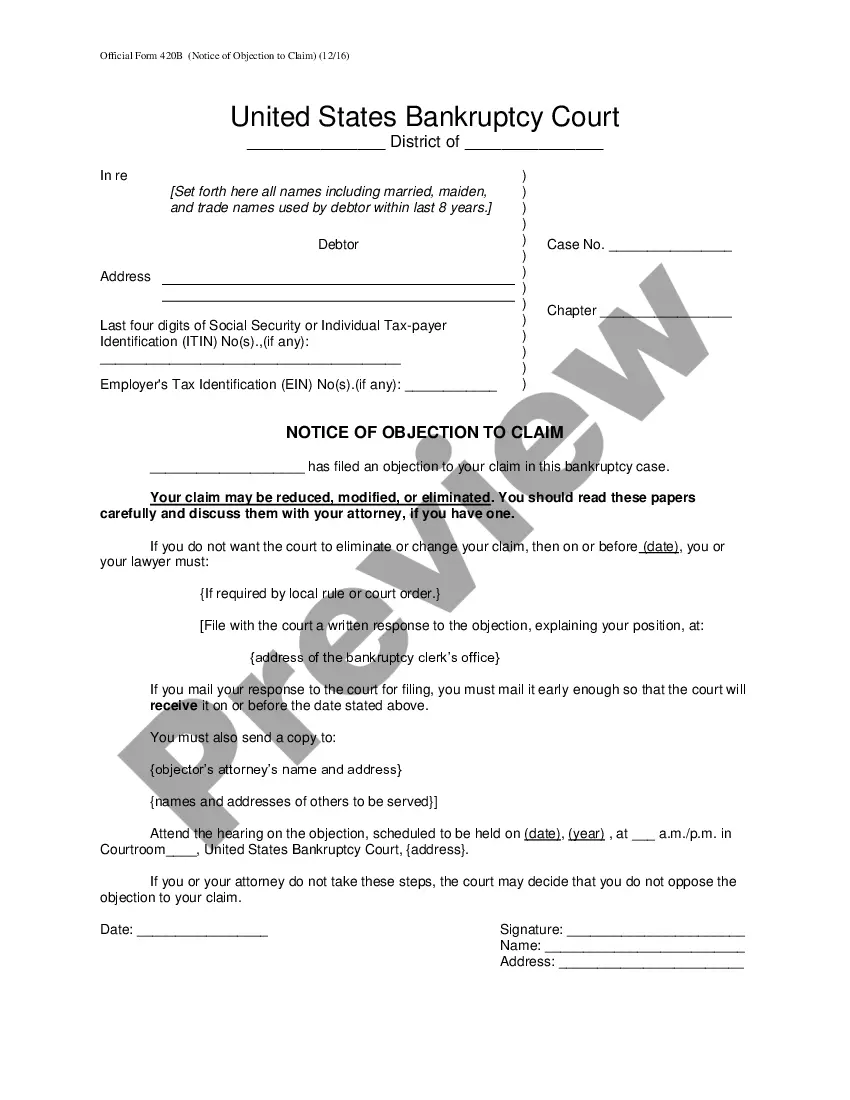

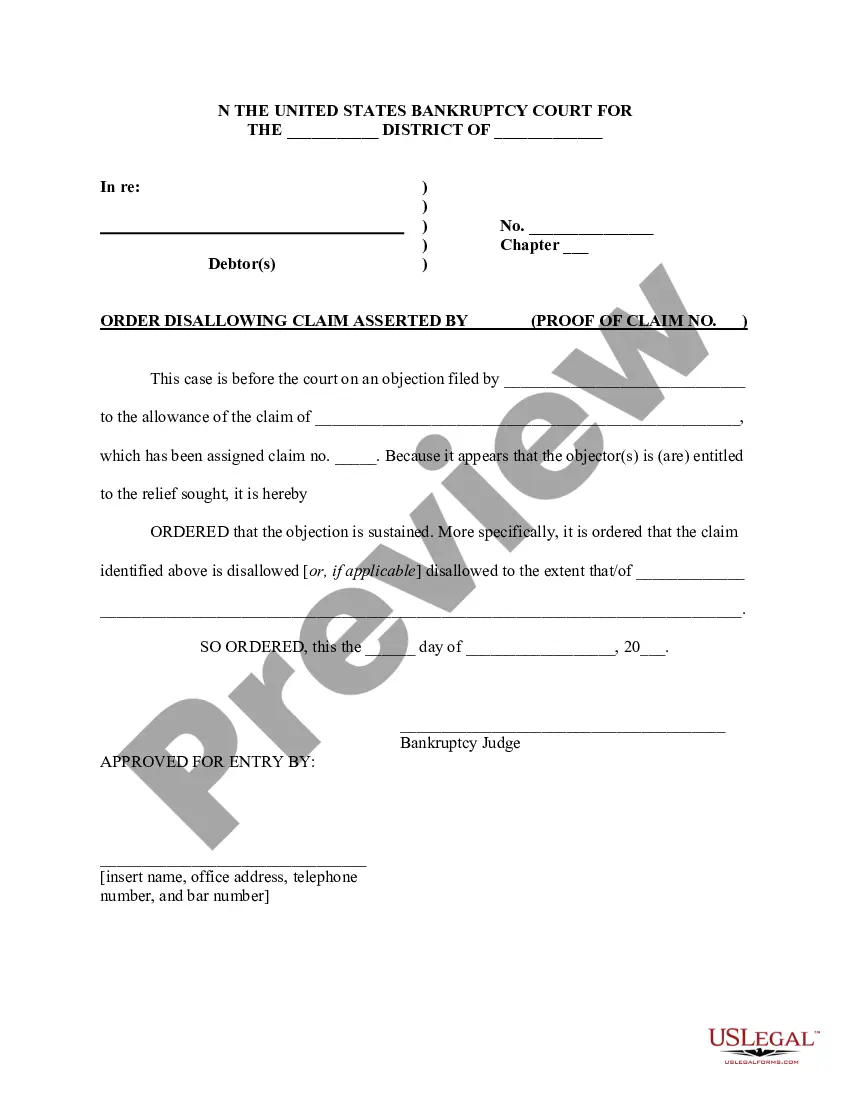

If you have to full, download, or print legitimate papers layouts, use US Legal Forms, the largest variety of legitimate varieties, which can be found on-line. Use the site`s basic and hassle-free lookup to discover the files you will need. Various layouts for company and person uses are categorized by types and says, or key phrases. Use US Legal Forms to discover the Oregon Objection to Allowed Claim in Accounting in a handful of mouse clicks.

If you are previously a US Legal Forms consumer, log in for your bank account and click on the Down load key to obtain the Oregon Objection to Allowed Claim in Accounting. You may also entry varieties you in the past acquired in the My Forms tab of the bank account.

If you are using US Legal Forms the very first time, refer to the instructions listed below:

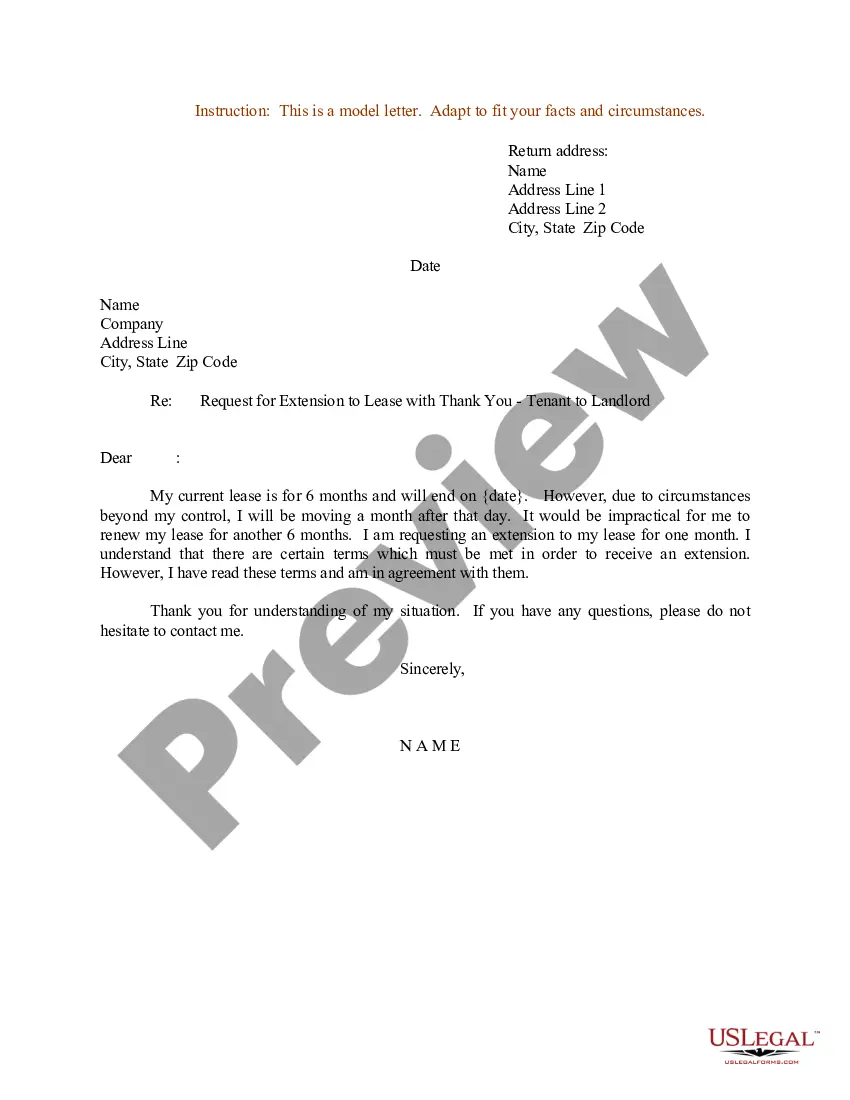

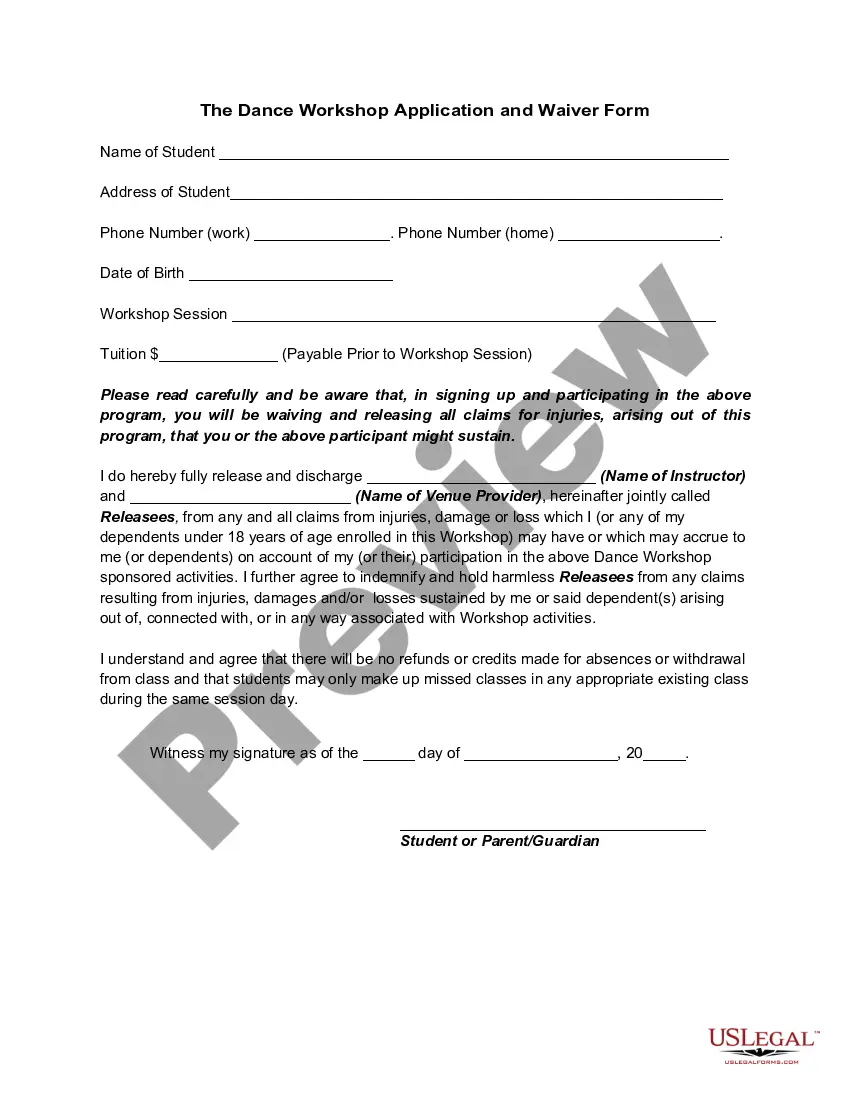

- Step 1. Be sure you have selected the form for the right city/nation.

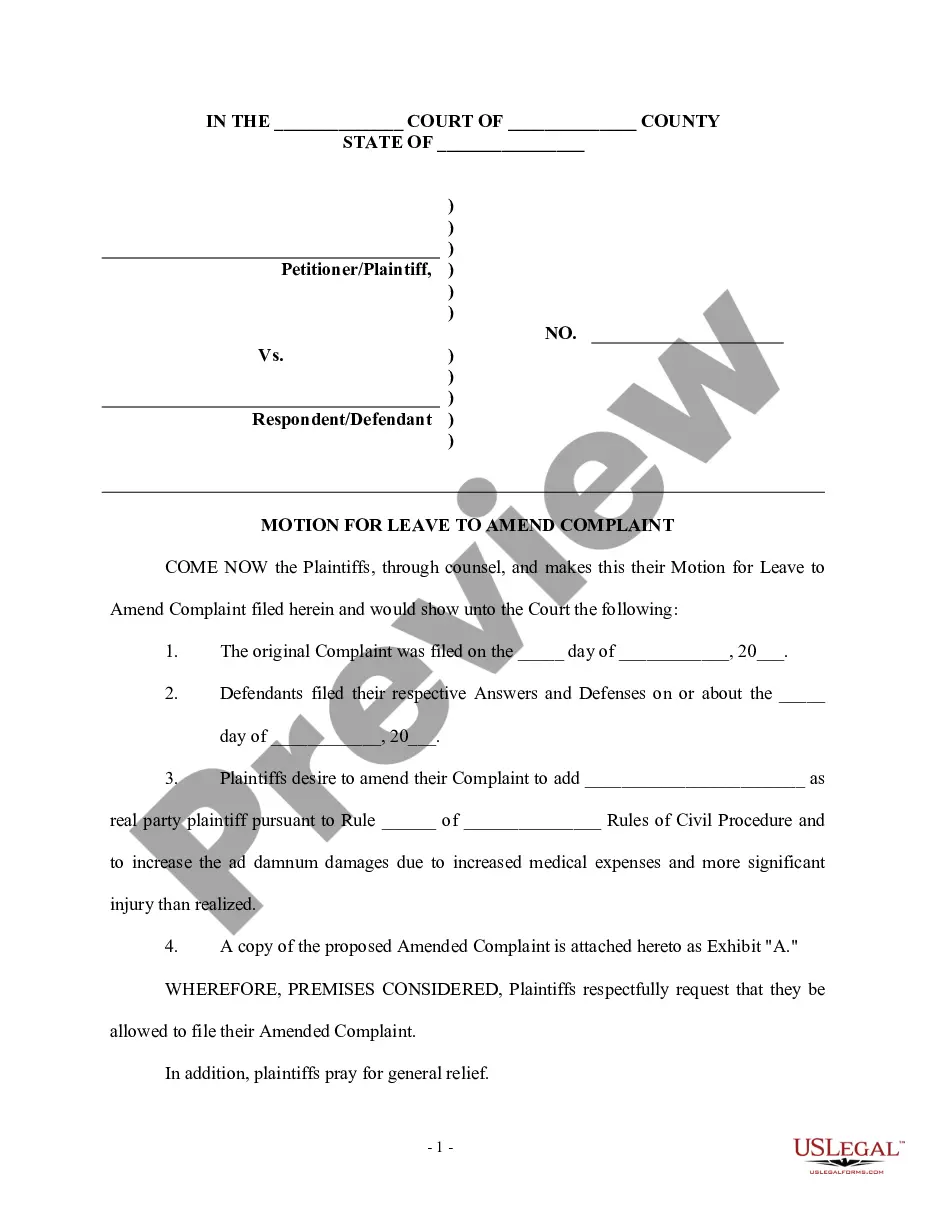

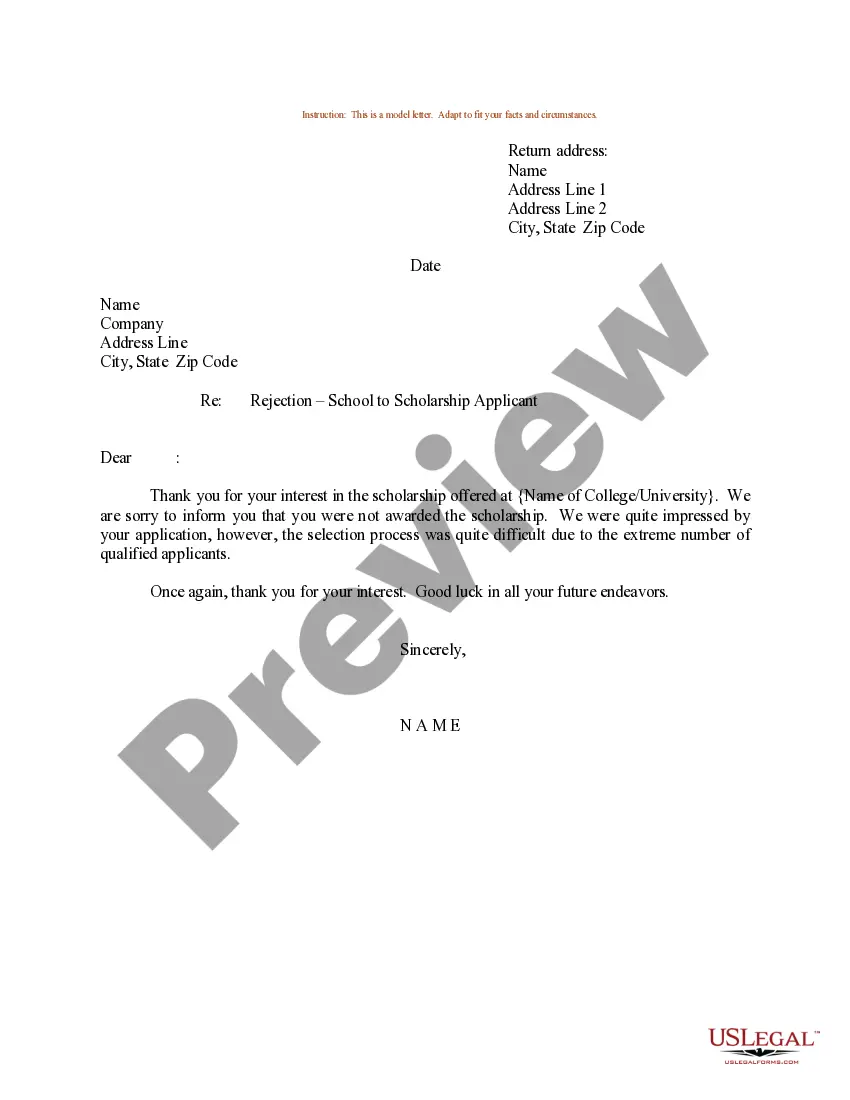

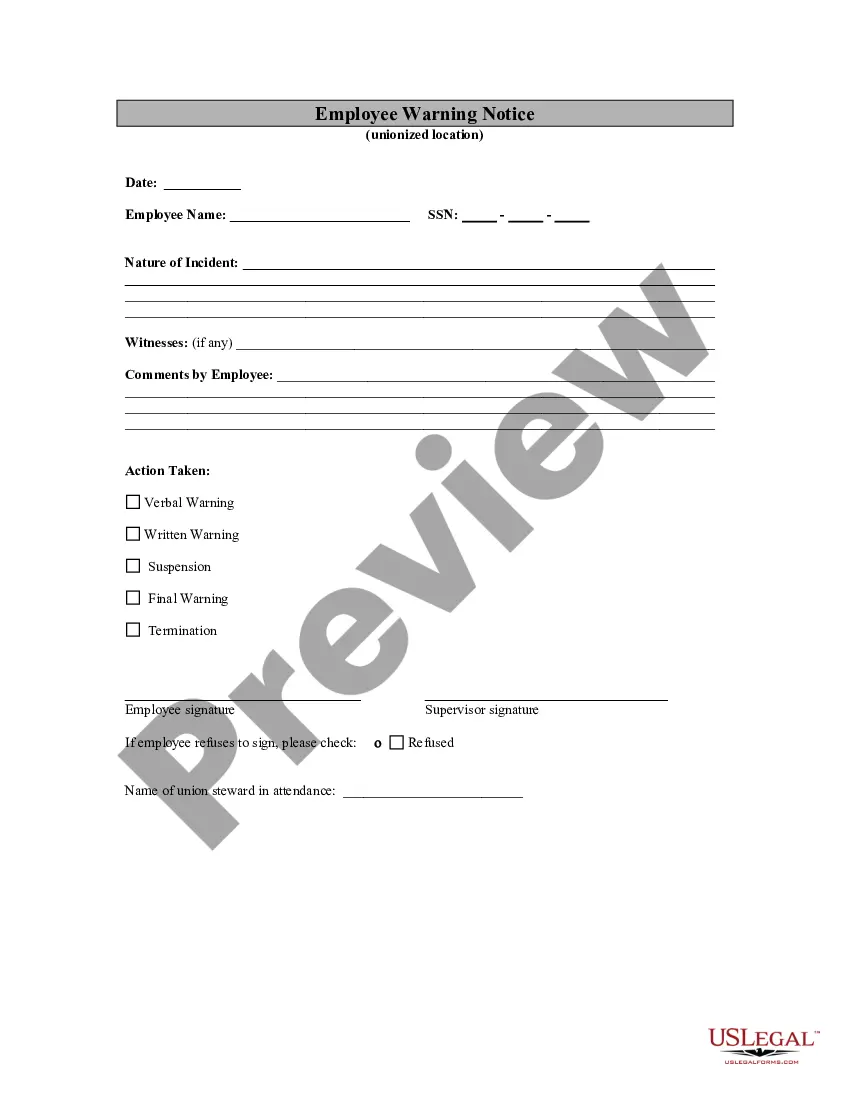

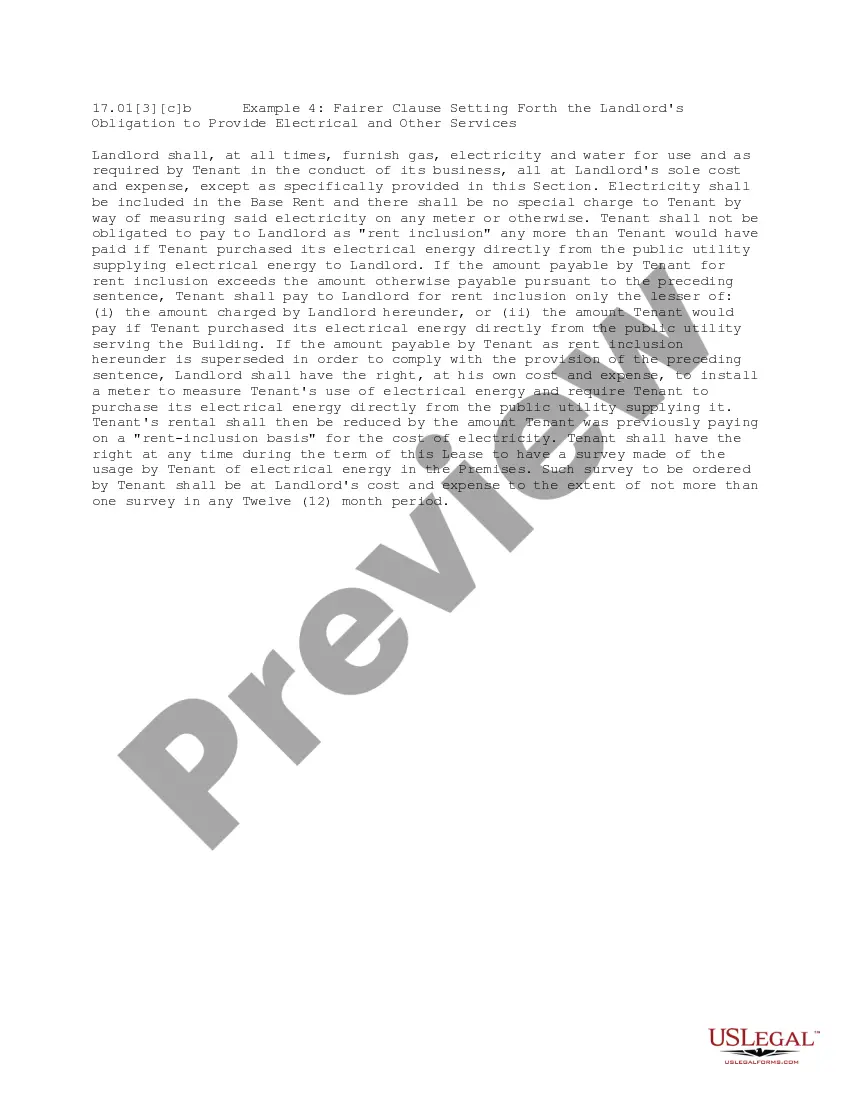

- Step 2. Take advantage of the Preview option to check out the form`s articles. Never forget to read the explanation.

- Step 3. If you are unsatisfied with all the form, make use of the Research field near the top of the screen to discover other types of the legitimate form template.

- Step 4. Upon having identified the form you will need, click the Acquire now key. Opt for the rates program you like and put your qualifications to sign up to have an bank account.

- Step 5. Method the deal. You may use your Мisa or Ьastercard or PayPal bank account to accomplish the deal.

- Step 6. Pick the formatting of the legitimate form and download it on the system.

- Step 7. Total, change and print or signal the Oregon Objection to Allowed Claim in Accounting.

Every single legitimate papers template you buy is your own property forever. You may have acces to each form you acquired with your acccount. Go through the My Forms area and pick a form to print or download once again.

Remain competitive and download, and print the Oregon Objection to Allowed Claim in Accounting with US Legal Forms. There are many expert and state-particular varieties you can utilize for the company or person needs.