Oregon Assignment of Rents by Lessor is a legal document that grants the lessor the right to collect rental income from a property that has been leased to a lessee. This arrangement allows the lessor to assign their rights to the rental income to another party, typically a lender or financial institution, as a form of collateral. In Oregon, there are two main types of Assignment of Rents by Lessor: 1. Absolute Assignment: This type of assignment gives the lender full control over the rental income generated by the leased property. The lessor assigns all their rights, title, and interest in the rental income to the lender. In case of default, the lender has the authority to collect the rents directly from the lessee. 2. Conditional Assignment: This type of assignment is more common in Oregon and provides the lender with the right to collect rents from the lessee only if certain conditions are met. These conditions usually revolve around default or non-payment by the borrower. If the borrower fails to meet their repayment obligations, the lender can step in and collect the rental income. The purpose of an Oregon Assignment of Rents by Lessor is to provide security for the lender by creating a secondary source of repayment in case of default. By assigning the rental income, the lessor adds a layer of protection for the lender, as they can recoup their investment by collecting the rents directly. It is important to note that an Oregon Assignment of Rents by Lessor typically requires the consent of the lessee. This ensures that the lessee is aware of the arrangement and will direct their rental payments to the designated assignee, often the lender. It is also crucial to consult with an attorney to draft a legally binding and enforceable agreement. In summary, an Oregon Assignment of Rents by Lessor is a legal tool that allows the lessor to assign their rights to rental income to a lender or financial institution as collateral. The two main types of assignments are absolute and conditional, offering different degrees of control and conditions for the lender. The agreement grants the lender the ability to collect rental income in case of default, enhancing their security and potential for repayment.

Oregon Assignment of Rents by Lessor

Description

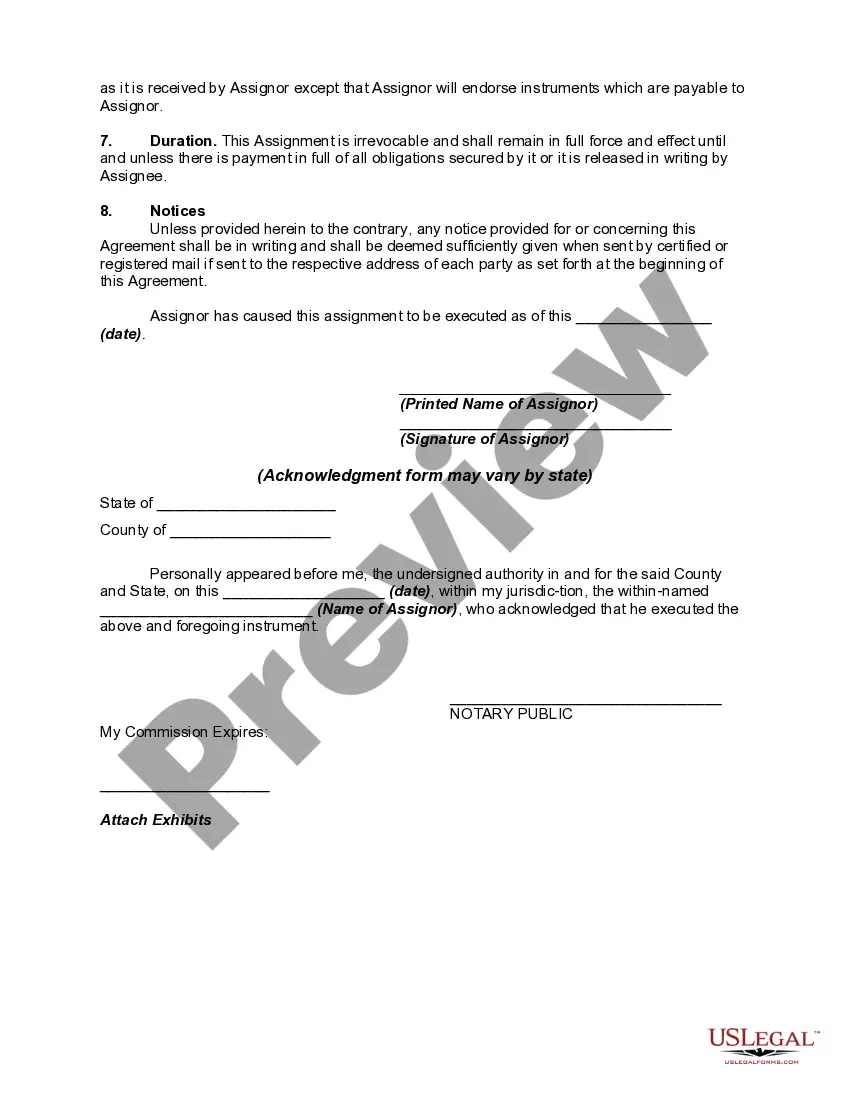

How to fill out Oregon Assignment Of Rents By Lessor?

If you have to full, acquire, or print out authorized papers layouts, use US Legal Forms, the most important selection of authorized varieties, which can be found online. Take advantage of the site`s simple and easy hassle-free look for to obtain the papers you will need. Numerous layouts for business and specific functions are sorted by groups and says, or search phrases. Use US Legal Forms to obtain the Oregon Assignment of Rents by Lessor within a few mouse clicks.

When you are previously a US Legal Forms buyer, log in to your accounts and click on the Download option to get the Oregon Assignment of Rents by Lessor. You can also accessibility varieties you formerly acquired within the My Forms tab of the accounts.

If you work with US Legal Forms initially, refer to the instructions listed below:

- Step 1. Be sure you have chosen the form for that correct town/country.

- Step 2. Utilize the Preview option to check out the form`s content material. Do not forget about to see the explanation.

- Step 3. When you are unhappy together with the develop, make use of the Lookup field towards the top of the display to find other variations in the authorized develop format.

- Step 4. When you have discovered the form you will need, go through the Purchase now option. Select the prices plan you like and add your credentials to register for an accounts.

- Step 5. Procedure the transaction. You may use your charge card or PayPal accounts to finish the transaction.

- Step 6. Pick the formatting in the authorized develop and acquire it on the gadget.

- Step 7. Total, revise and print out or sign the Oregon Assignment of Rents by Lessor.

Each authorized papers format you get is your own property forever. You have acces to every develop you acquired inside your acccount. Click the My Forms area and choose a develop to print out or acquire once more.

Be competitive and acquire, and print out the Oregon Assignment of Rents by Lessor with US Legal Forms. There are thousands of specialist and express-certain varieties you can use for your personal business or specific needs.