A Bill of Sale with encumbrances means that whatever product is being sold has some sort of lien, mortgage, or monies owing, and the Buyer is agreeing that they will take on these obligations upon purchase.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

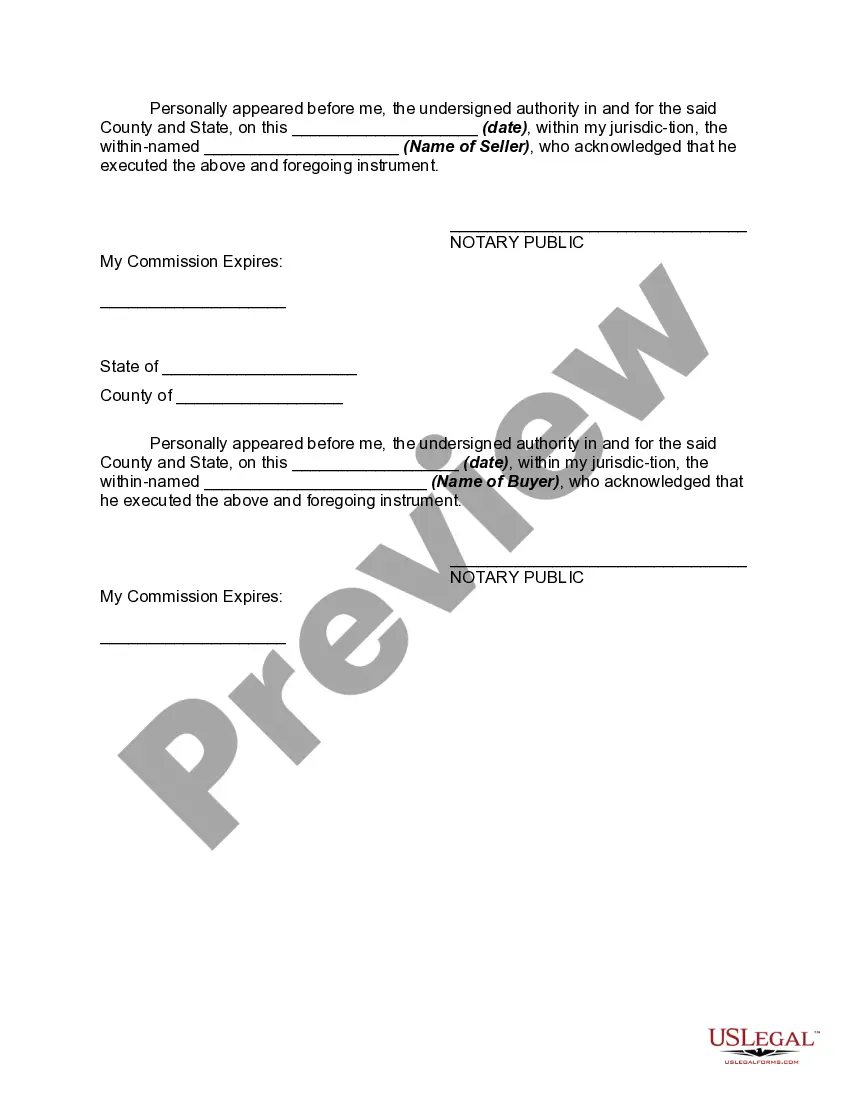

The Oregon Bill of Sale with Encumbrances is a legal document that establishes a legal transfer of ownership for a particular item or property, including any existing encumbrances. This bill of sale is essential in documenting the sale, ensuring that both parties are aware of and agree to the encumbrances on the property. Encumbrances refer to any claims, liens, or debts associated with the property being sold. These encumbrances may include mortgages, tax liens, easements, or other financial obligations that affect the title or use of the property. It is crucial to disclose and address these encumbrances during a sale to avoid any potential disputes or legal issues. The Oregon Bill of Sale with Encumbrances typically includes the following key information: 1. Parties Involved: The bill of sale identifies the buyer (purchaser) and seller (seller) with their complete names, addresses, contact information, and any other relevant identifying details. 2. Description of the Property: A detailed description of the property being sold is provided, including the location, address, legal description, and any identification numbers or serial numbers if applicable. 3. Purchase Details: This section outlines the terms of the sale, such as the sale price, payment method, and any agreed-upon conditions or warranties. It may also include provisions for a down payment, installment payments, or financing arrangements. 4. Encumbrances: The bill of sale specifically addresses any existing encumbrances attached to the property, including the type of encumbrance, the amount owed (if applicable), and any specific terms or conditions related to these encumbrances. 5. Seller's Representation: The seller typically provides a warranty stating that they are the rightful owner of the property and have the legal authority to sell it and transfer ownership. This section may also include a statement declaring that there are no undisclosed encumbrances other than those stated in the bill of sale. Different types of Oregon Bill of Sale with Encumbrances may depend on the nature of the property being transferred. For example, there may be separate bills of sale for real estate, vehicles, boats, or personal property. It is crucial to use the appropriate bill of sale form that aligns with the specific item or property type to ensure legality and accuracy. In conclusion, the Oregon Bill of Sale with Encumbrances is a vital legal document that outlines the transfer of ownership for a property while addressing any existing encumbrances. By documenting these encumbrances, both the buyer and seller can be aware of their respective rights and obligations, reducing the chances of disputes or legal complications in the future.The Oregon Bill of Sale with Encumbrances is a legal document that establishes a legal transfer of ownership for a particular item or property, including any existing encumbrances. This bill of sale is essential in documenting the sale, ensuring that both parties are aware of and agree to the encumbrances on the property. Encumbrances refer to any claims, liens, or debts associated with the property being sold. These encumbrances may include mortgages, tax liens, easements, or other financial obligations that affect the title or use of the property. It is crucial to disclose and address these encumbrances during a sale to avoid any potential disputes or legal issues. The Oregon Bill of Sale with Encumbrances typically includes the following key information: 1. Parties Involved: The bill of sale identifies the buyer (purchaser) and seller (seller) with their complete names, addresses, contact information, and any other relevant identifying details. 2. Description of the Property: A detailed description of the property being sold is provided, including the location, address, legal description, and any identification numbers or serial numbers if applicable. 3. Purchase Details: This section outlines the terms of the sale, such as the sale price, payment method, and any agreed-upon conditions or warranties. It may also include provisions for a down payment, installment payments, or financing arrangements. 4. Encumbrances: The bill of sale specifically addresses any existing encumbrances attached to the property, including the type of encumbrance, the amount owed (if applicable), and any specific terms or conditions related to these encumbrances. 5. Seller's Representation: The seller typically provides a warranty stating that they are the rightful owner of the property and have the legal authority to sell it and transfer ownership. This section may also include a statement declaring that there are no undisclosed encumbrances other than those stated in the bill of sale. Different types of Oregon Bill of Sale with Encumbrances may depend on the nature of the property being transferred. For example, there may be separate bills of sale for real estate, vehicles, boats, or personal property. It is crucial to use the appropriate bill of sale form that aligns with the specific item or property type to ensure legality and accuracy. In conclusion, the Oregon Bill of Sale with Encumbrances is a vital legal document that outlines the transfer of ownership for a property while addressing any existing encumbrances. By documenting these encumbrances, both the buyer and seller can be aware of their respective rights and obligations, reducing the chances of disputes or legal complications in the future.