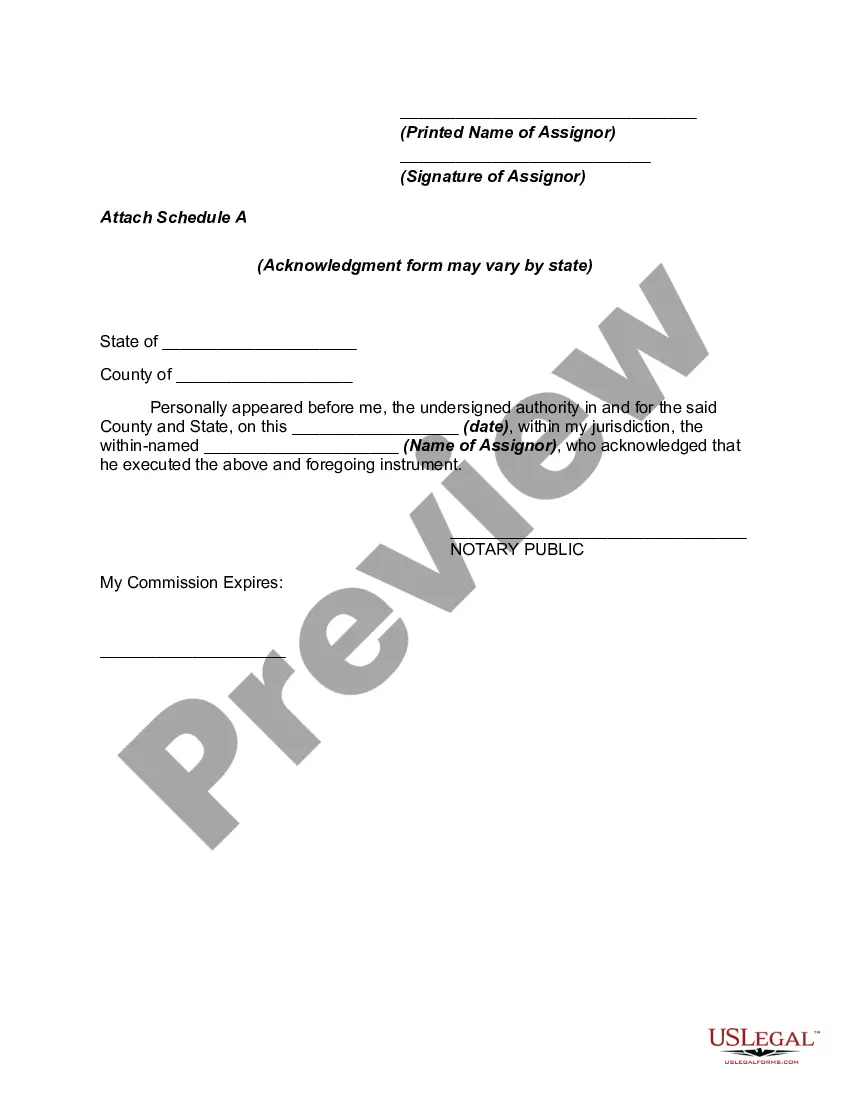

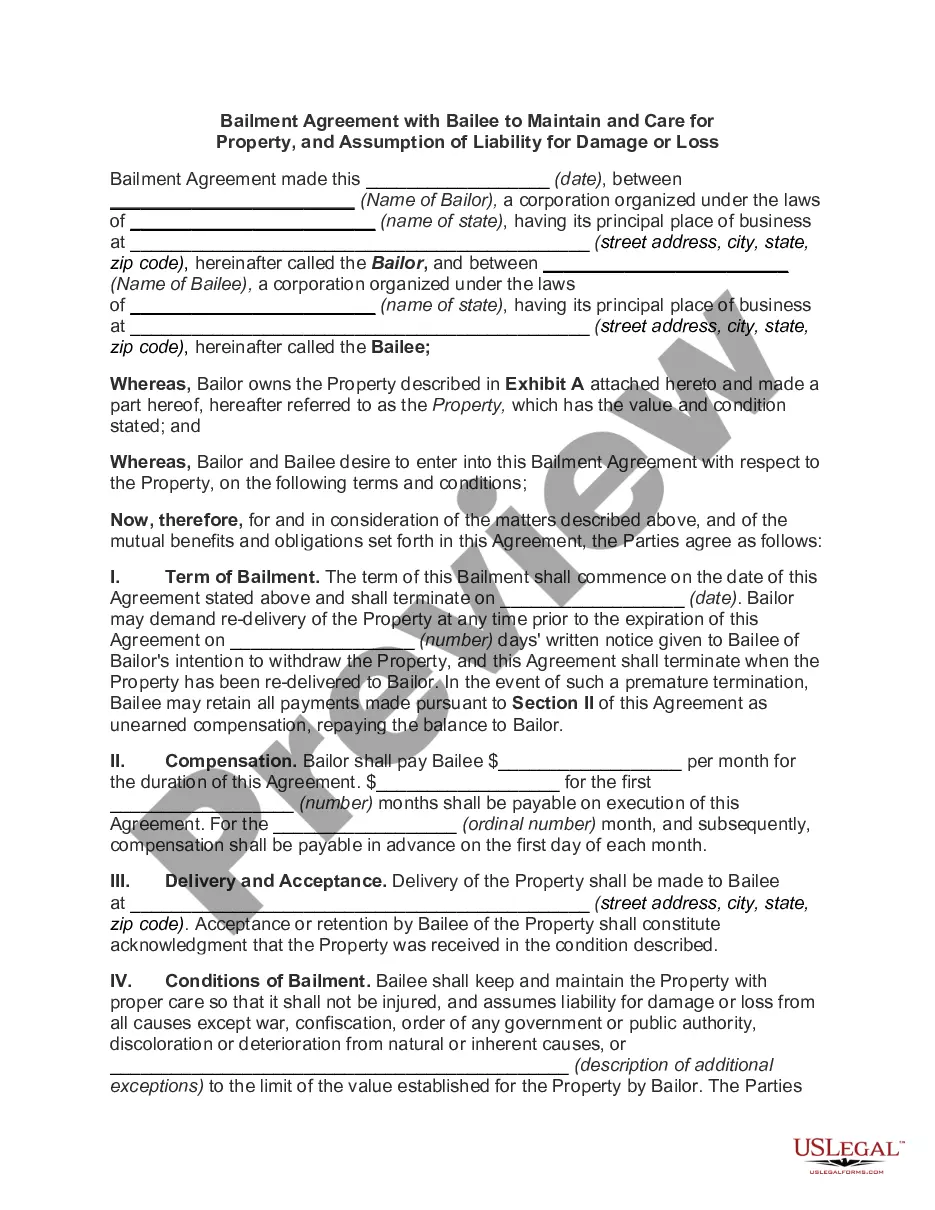

Title: Understanding the Oregon Assignment and Bill of Sale to Corporation Description: The Oregon Assignment and Bill of Sale to Corporation is an essential legal document that facilitates the transfer of ownership of assets, rights, or interests from an individual or entity to a corporation. This comprehensive description will shed light on the purpose, components, and various types of Oregon Assignment and Bill of Sale to Corporation. 1. Oregon Assignment to Corporation: This type of assignment refers to the transfer of intellectual property rights, contractual obligations, or any other legal rights from an individual or entity to a corporation. Key elements of an Oregon Assignment to Corporation may include: — Names and contact information of both parties involved in the assignment. — A clear and concise description of the rights or assets being assigned. — The effective date of the assignment— - Any restrictions or limitations on the assignment. — Signatures of all parties involved, along with the date. 2. Oregon Bill of Sale to Corporation: An Oregon Bill of Sale to Corporation involves a transaction where the ownership of physical or tangible assets is transferred from an individual or entity to a corporation. These assets can include machinery, equipment, vehicles, real estate, or any item with a monetary value. Important components of an Oregon Bill of Sale to Corporation may include: — Detailed information about the buyer, seller, and the corporation. — A comprehensive description of the assets being sold, including their condition and any applicable warranties. — Purchase price, payment terms, and any applicable taxes or fees. — Signatures of all parties involved, accompanied by the date of the sale. Different types or variations of the Oregon Assignment and Bill of Sale to Corporation may exist, depending on the nature of the transaction and specific requirements. Some notable variations include: — Intellectual Property Assignment: Used when transferring patents, trademarks, copyrights, or other intangible assets held by an individual or entity to a corporation. — Real Estate Assignment and Bill of Sale: Pertains to the transfer of ownership of real property, such as land, buildings, or houses, from an individual or entity to a corporation. — Equipment or Machinery Assignment and Bill of Sale: Deals with the transfer of ownership of machinery, equipment, or vehicles from an individual or entity to a corporation. It is crucial to consult legal professionals or seek expert advice to draft and execute the Oregon Assignment and Bill of Sale to Corporation accurately. Remember, each transaction may have unique requirements, and customizing the document to fulfill those needs is crucial for a seamless transfer of ownership.

Oregon Assignment and Bill of Sale to Corporation

Description

How to fill out Oregon Assignment And Bill Of Sale To Corporation?

If you wish to total, acquire, or print authorized document templates, use US Legal Forms, the biggest variety of authorized types, which can be found online. Use the site`s simple and easy practical search to find the paperwork you will need. A variety of templates for business and specific uses are sorted by categories and states, or keywords and phrases. Use US Legal Forms to find the Oregon Assignment and Bill of Sale to Corporation within a number of mouse clicks.

When you are presently a US Legal Forms client, log in for your accounts and then click the Acquire key to find the Oregon Assignment and Bill of Sale to Corporation. You may also access types you in the past delivered electronically inside the My Forms tab of your accounts.

Should you use US Legal Forms initially, follow the instructions under:

- Step 1. Be sure you have chosen the shape for that appropriate town/nation.

- Step 2. Use the Preview solution to look over the form`s content. Don`t neglect to see the outline.

- Step 3. When you are not happy with all the kind, utilize the Lookup field towards the top of the display screen to locate other types in the authorized kind template.

- Step 4. Upon having located the shape you will need, click the Buy now key. Pick the prices program you like and add your accreditations to register to have an accounts.

- Step 5. Process the financial transaction. You can use your charge card or PayPal accounts to perform the financial transaction.

- Step 6. Find the file format in the authorized kind and acquire it on the system.

- Step 7. Total, modify and print or indicator the Oregon Assignment and Bill of Sale to Corporation.

Each and every authorized document template you acquire is your own forever. You possess acces to every kind you delivered electronically within your acccount. Go through the My Forms area and pick a kind to print or acquire once again.

Remain competitive and acquire, and print the Oregon Assignment and Bill of Sale to Corporation with US Legal Forms. There are millions of specialist and express-particular types you can use for your business or specific demands.

Form popularity

FAQ

How to Fill Out an Application for Title or Registration FormVehicle Information.The Owner's Information.Title Holder's Information.Fill in the Cost and Operation Information.The Owner's Signature.The Owner's Second Signature.Recheck the Vehicle Information.Verify Proper Assignation of the title.More items...?27-Jan-2012

In Oregon, anyone can draft a bill of sale. Any bill of sale can be considered legally binding if it has been signed by all involved parties. Getting a bill of sale notarized can help it hold up in court. You can draft your own or work with a solution like to create a streamlined document.

How Do I Write an Oregon Bill of Sale?Their full legal name (printed)The date the bill of sale is created.Certain information about the item being sold, including a disclosure about whether the item is being sold as-is.The amount of money the item was sold for.The signatures of the involved parties.

Although not legally required in Oregon, a Bill of Sale can be helpful if problems arise when the buyer goes to transfer the title or register the vehicle in their name. Many private owners notarize their Bill of Sale as a best practice.

Provide your current vehicle title. Complete an Application for Title and Registration (Form 735-226) Provide an odometer disclosure (listed on the vehicle application) The odometer disclosure statement is required if your car is less than 20 years old. Pay all applicable Oregon vehicle title fees.

What Do You Need To Transfer A Car Title? To transfer a car title, the buyer needs to bring the old title, a completed Application for Title and Registration, and money to pay the fee to an Oregon DMV office. In some cases, a completed bill of sales is also required. You can find this form on the DMV website.

What Do You Need To Transfer A Car Title? To transfer a car title, the buyer needs to bring the old title, a completed Application for Title and Registration, and money to pay the fee to an Oregon DMV office. In some cases, a completed bill of sales is also required. You can find this form on the DMV website.

You'll find the necessary forms by heading to OregonDMV.com and clicking on the Vehicles link. Assuming the buyer is an Oregon resident, the buyer will take a copy of the bill of sale and the signed-over title, and submit an Application for Title and Registration.

Before you sell or trade your vehicle, you'll need to make sure you have the title to begin with....This can be pretty basic, as long as it includes the following:The make and model of the vehicle.The date of the sale.The sale price.The names and signatures of both the buyer and seller.

An Oregon bill of sale is a document that is used as proof of ownership of an item. There is no legal requirement to notarize an Oregon bill of sale. In addition to being required to transfer the ownership through a state agency, an Oregon bill of sale is an important part of personal record keeping.