Oregon Charge Account Terms and Conditions

Description

How to fill out Charge Account Terms And Conditions?

If you wish to comprehensive, down load, or produce authorized papers templates, use US Legal Forms, the biggest collection of authorized forms, which can be found on-line. Make use of the site`s simple and convenient research to obtain the papers you want. Numerous templates for enterprise and specific uses are categorized by groups and says, or keywords. Use US Legal Forms to obtain the Oregon Charge Account Terms and Conditions in just a handful of mouse clicks.

When you are currently a US Legal Forms customer, log in for your bank account and click on the Acquire option to get the Oregon Charge Account Terms and Conditions. You can even access forms you in the past downloaded from the My Forms tab of your bank account.

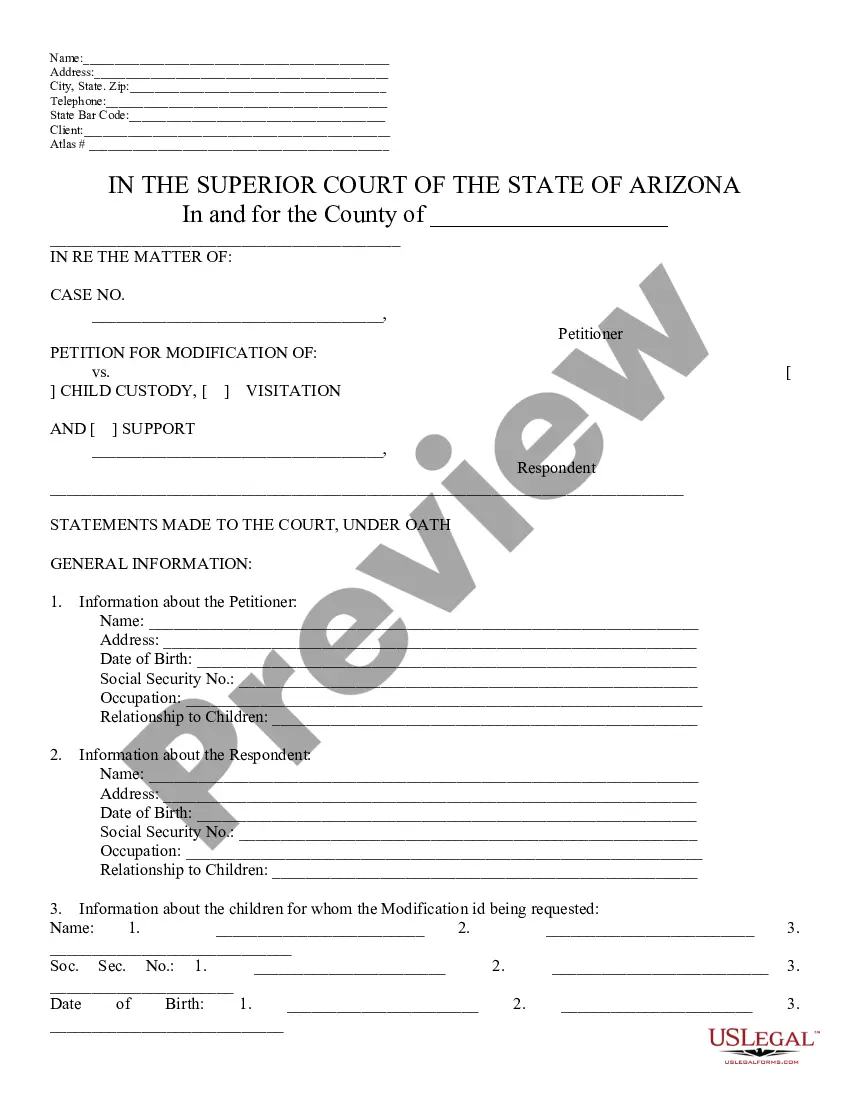

If you use US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Be sure you have selected the shape for the proper metropolis/country.

- Step 2. Utilize the Preview choice to look over the form`s content material. Don`t forget about to read through the outline.

- Step 3. When you are unsatisfied together with the kind, make use of the Research area near the top of the screen to get other variations of the authorized kind web template.

- Step 4. Upon having discovered the shape you want, click the Get now option. Choose the costs strategy you choose and put your accreditations to sign up to have an bank account.

- Step 5. Procedure the purchase. You can use your bank card or PayPal bank account to finish the purchase.

- Step 6. Choose the structure of the authorized kind and down load it on your own system.

- Step 7. Comprehensive, modify and produce or indicator the Oregon Charge Account Terms and Conditions.

Each and every authorized papers web template you purchase is the one you have forever. You have acces to every single kind you downloaded within your acccount. Select the My Forms portion and decide on a kind to produce or down load again.

Remain competitive and down load, and produce the Oregon Charge Account Terms and Conditions with US Legal Forms. There are many specialist and state-particular forms you may use for the enterprise or specific requirements.

Form popularity

FAQ

2022?23 Undergraduate Cost of Attendance ResidentsNonresidentsOn-campus residence halls (Room and board) Based on the average cost of a common type of room and middle meal plan. There is a live-on campus requirement for incoming first-year undergraduate students.$14,640$14,640UO Costs Total$29,694$56,3401 more row

The 2023-2024 cost of tuition and fees for in-state students is $15,669, and $43,302 for nonresidents, ing to UO. While the Oregon Guarantee covers all tuition and most fees for undergraduates, it does not cover lab fees, health insurance, and room and board, which may fluctuate in price over time.

University of Oregon costs $18,556 after scholarships and grants, with 43% of students receiving financial aid and an average aid package of $13,059.

Students can make a payment online, by mail, or in person at the UO Cashiers Office. The total due listed on each monthly bill must be paid in full by the due date to avoid interest and billing fees.

But, what tuition and financial aid look like across the Oregon higher education landscape varies from school to school and can get confusing quickly. Higher education leaders in Oregon note that tuition often climbs higher in Oregon, because of low funding levels from the state Legislature.