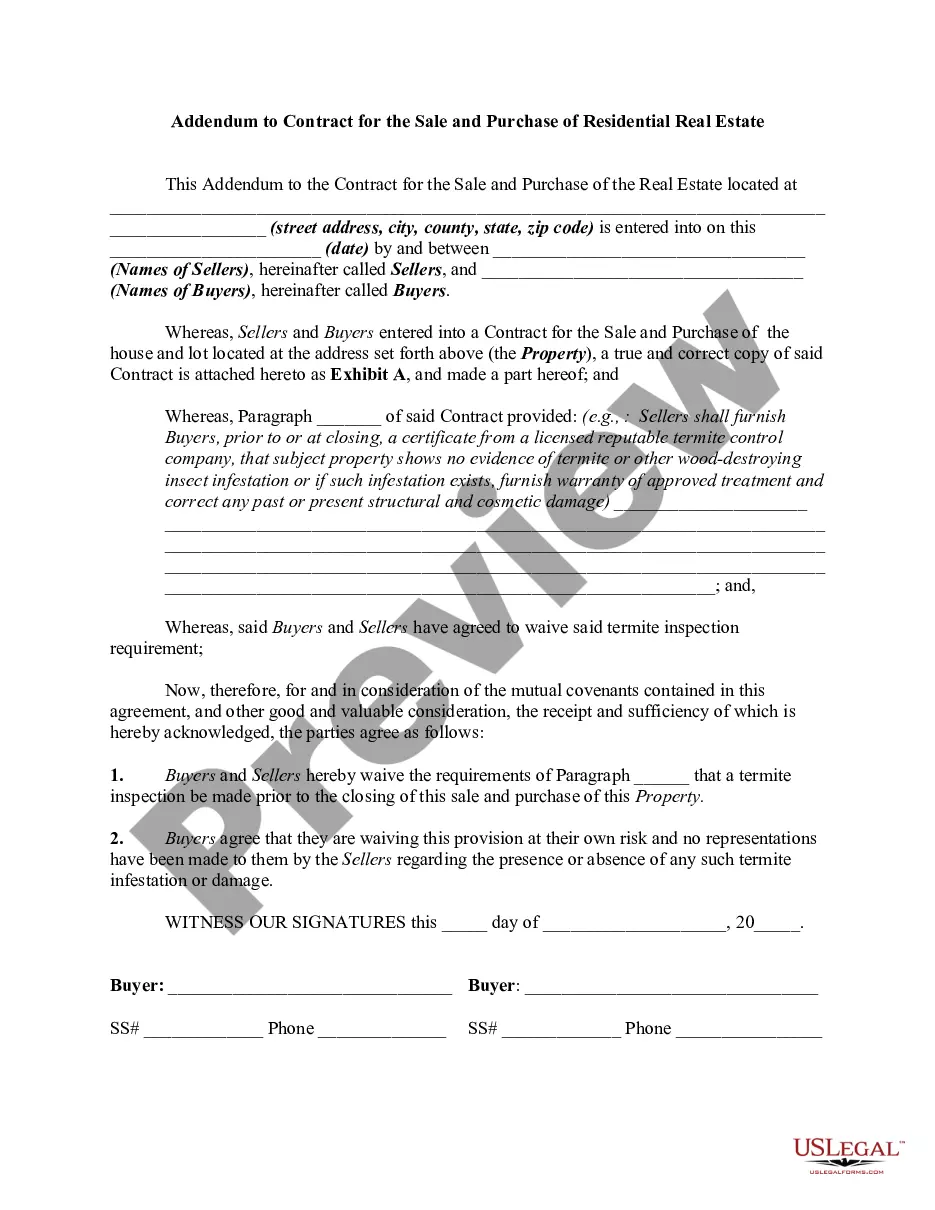

Oregon Customer Invoice is a legal document containing detailed information about a transaction between a seller and a buyer in the state of Oregon. It is a valuable financial record that outlines the services rendered, goods provided, and the corresponding costs involved. The invoice serves as evidence of the agreement between the two parties and aids in facilitating smooth business operations and financial transactions. The Oregon Customer Invoice typically includes essential details such as the seller's and buyer's names, addresses, contact information, and tax identification numbers. It also includes an invoice number, date of issue, and payment terms, which specify the due date and any discounts or penalties applicable for late payment. A critical component of the Oregon Customer Invoice is the itemized list of products or services provided. This section outlines each item's description, quantity, unit price, and the total amount charged. It aids in providing a clear breakdown of the transaction, making it easier for both parties to understand the charges and verify the accuracy of the invoice. In addition to the basic information, the Oregon Customer Invoice may also include specific details relating to taxes, shipping, and additional fees incurred during the transaction. Depending on the nature of the business and the specific requirements, there may be different types or variations of the Oregon Customer Invoice, such as: 1. Standard Oregon Customer Invoice: The most common type used across various industries, comprising the essential details mentioned above. 2. Oregon Sales Tax Invoice: If the business is subject to sales tax, this type of invoice includes the applicable tax rates and calculates the total tax owed for compliance with state tax regulations. 3. Oregon Service Invoice: Specifically used by service-based businesses, it emphasizes the description of services provided, including labor time, rate per hour, and any additional costs associated with the service. 4. Oregon Retail Invoice: Primarily used by retail establishments, it focuses on the detailed breakdown of individual products sold, including their SKU or identification numbers, prices per unit, and any discounts offered. Overall, the Oregon Customer Invoice is a crucial tool for conducting business transactions in the state. It not only helps in maintaining accurate financial records but also ensures transparency between the buyer and seller, facilitates efficient payment processing, and meets the legal requirements of the state.

Oregon Customer Invoice

Description

How to fill out Oregon Customer Invoice?

Discovering the right authorized record template might be a battle. Obviously, there are tons of templates available on the net, but how will you discover the authorized kind you want? Utilize the US Legal Forms internet site. The services delivers a large number of templates, like the Oregon Customer Invoice, that can be used for enterprise and private needs. Every one of the kinds are checked by professionals and meet up with state and federal requirements.

In case you are already registered, log in to the accounts and click on the Obtain switch to get the Oregon Customer Invoice. Make use of accounts to appear from the authorized kinds you might have ordered previously. Visit the My Forms tab of the accounts and acquire yet another copy of your record you want.

In case you are a brand new user of US Legal Forms, listed here are basic recommendations so that you can adhere to:

- First, be sure you have selected the proper kind for the town/state. You can check out the form while using Review switch and read the form outline to make sure this is basically the best for you.

- In the event the kind does not meet up with your expectations, use the Seach area to find the right kind.

- Once you are certain that the form is proper, click the Acquire now switch to get the kind.

- Choose the rates program you need and enter in the necessary details. Build your accounts and pay money for the transaction utilizing your PayPal accounts or credit card.

- Choose the submit format and down load the authorized record template to the gadget.

- Total, change and printing and indication the attained Oregon Customer Invoice.

US Legal Forms may be the most significant collection of authorized kinds for which you can find numerous record templates. Utilize the company to down load professionally-produced papers that adhere to condition requirements.

Form popularity

FAQ

If you sell a customer a product or a service, you need to give them an invoice (bill) by law if both you and the customer are registered for VAT (a business to business transaction). An invoice is not the same as a receipt, which is an acknowledgement of payment.

An invoice should be issued after a company has fulfilled a client's order. This could be for a product or service (or both). For a company providing a product, that's after delivery has been completed. In a service-oriented business, the invoice is generated once the service has been provided.

It's best to send your invoice as soon as an order is filled or the work is done especially if you do one-off projects and odd jobs. If you're working on a big project, you might send interim invoices every two to four weeks.

There are two kinds of invoice, purchase invoice and sales invoice. While a sales invoice is used as a document given to the customer as purchasing evidence, a purchase invoice is a bit different. It's given to the buyer by the seller as a confirmation that the sale has occurred.

Invoices - what they must includea unique identification number.your company name, address and contact information.the company name and address of the customer you're invoicing.a clear description of what you're charging for.the date the goods or service were provided (supply date)the date of the invoice.More items...

In relation to whether a receipt should have been provided, there is no legal obligation under consumer protection law for a business to provide a receipt for the goods you buy. However, the vast majority of traders will automatically issue receipts to consumers or when requested by a consumer.

How to Make an Invoice: A Step-By-Step GuideCreate an Invoice Header with Your Business Information.Include Your Client's Contact Details.Provide Invoice Information.Specify Your Payment Terms.Include an Itemized List of Services.List Applicable Taxes.Consider Adding Notes.

The law states that if you and the other party are registered for VAT, you have to provide an invoice. There might be times when a private individual asks for an invoice, but in most circumstances, B2C (business-to-consumer) invoices are not compulsory.

A sales invoice is presented to the customer upon delivery of goods and services. It provides details of the sale, including the terms of payment and the total amount owed to the seller. When you issue a sales invoice to your customer, you are yet to be paid for goods or services.