The Oregon Notice of Default on Promissory Note Installment is a legal document used to notify a borrower about their default on payments required under a promissory note installment agreement. This notice is crucial in the foreclosure process in Oregon and serves as a warning to the borrower that further action may be taken by the lender. When a borrower fails to make the required payments on time, the lender can issue a Notice of Default on Promissory Note Installment. This notice outlines specific information related to the default and provides the borrower with a certain period to rectify the situation to avoid foreclosure. The key elements included in an Oregon Notice of Default on Promissory Note Installment are: 1. Borrower's Information: This section provides details about the borrower, such as their name, address, and contact information. It is important to accurately identify the borrower to ensure the notice is properly received. 2. Lender's Information: Here, the lender's name, address, and contact details are mentioned. If the borrower has any questions or wishes to discuss the default, they can reach out to the lender using the provided information. 3. Promissory Note Details: This section specifies the relevant information about the promissory note, including the original loan amount, interest rate, and date of the agreement. It is crucial to identify the promissory note correctly to avoid any confusion. 4. Default Information: The Notice of Default on Promissory Note Installment should clearly state the payment(s) that have become delinquent, the amount of the outstanding balance, and the due date(s) for those payments. Specific payment history details help the borrower understand the reasons for the default. 5. Cure Period: The notice provides the borrower with a specific time frame within which they must cure or rectify the default by making the overdue payments. If the borrower fails to comply within this period, further action may be taken by the lender. Types of Oregon Notice of Default on Promissory Note Installment may vary depending on the circumstances and specific terms of the promissory note. Some common variations include: 1. Initial Notice of Default: This is the first notice issued by the lender to inform the borrower about the delinquency and provide an opportunity to rectify the default before initiating foreclosure proceedings. 2. Notice of Default Acceleration: If the borrower fails to cure the default within the specified cure period, the lender can issue a notice of acceleration. This notice informs the borrower that the entire loan amount is due immediately, accelerating the repayment timeline. 3. Notice of Pending Foreclosure: If the borrower consistently fails to rectify the default, the lender may issue a notice of pending foreclosure. This notice informs the borrower about the intention to foreclose on the property and initiates the legal process. Understanding the Oregon Notice of Default on Promissory Note Installment is essential for both lenders and borrowers involved in installment agreements. It provides a written record of the default and establishes a timeline for resolution or further action. Borrowers should carefully review the notice and promptly address any delinquencies to avoid the serious repercussions of foreclosure.

Oregon Notice of Default on Promissory Note Installment

Description

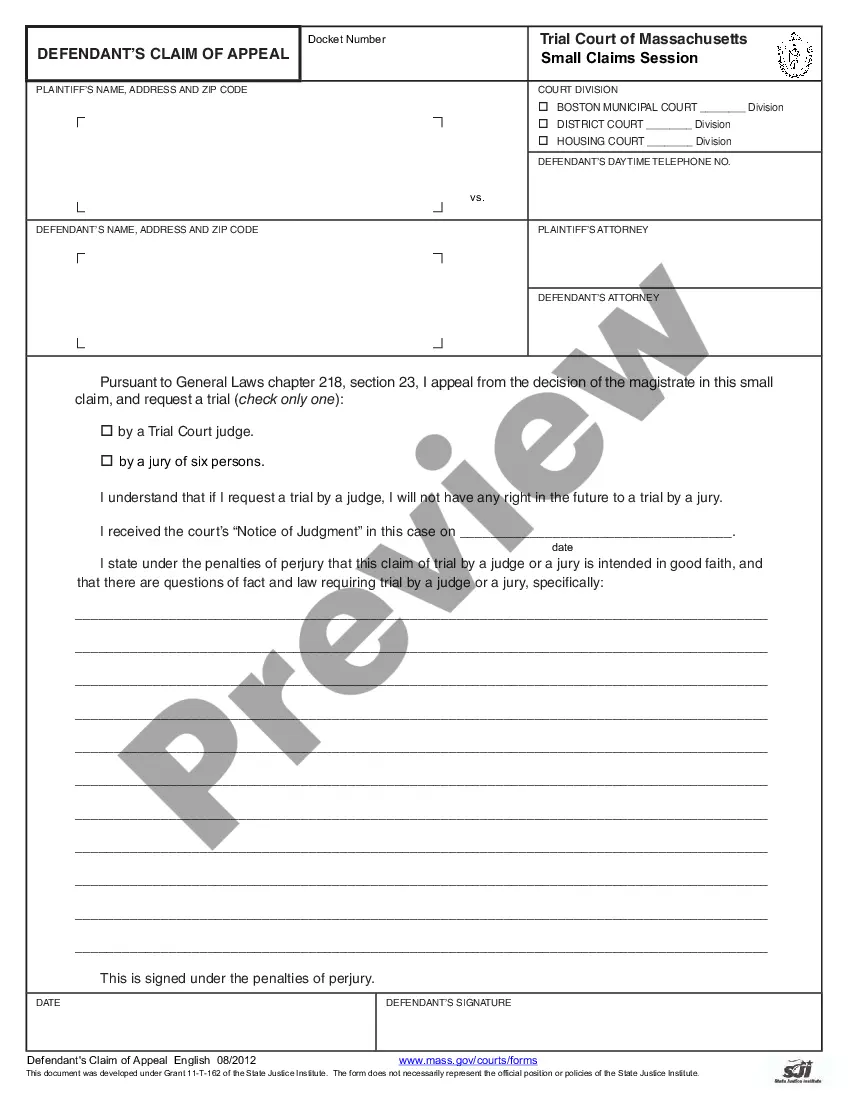

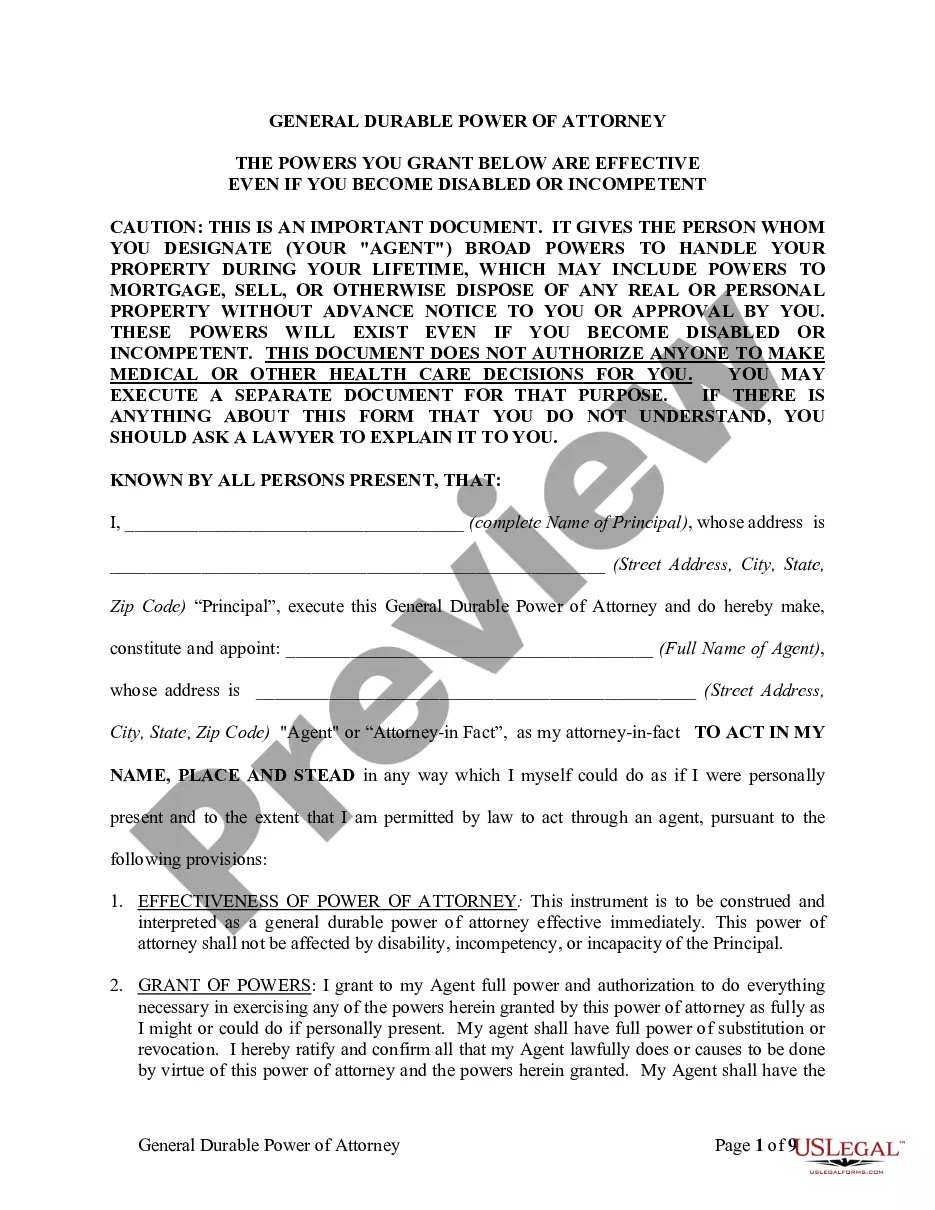

How to fill out Oregon Notice Of Default On Promissory Note Installment?

US Legal Forms - one of many largest libraries of authorized types in the USA - gives a wide array of authorized file themes you can acquire or print out. While using site, you can find 1000s of types for enterprise and person reasons, sorted by categories, says, or keywords.You will discover the latest models of types such as the Oregon Notice of Default on Promissory Note Installment within minutes.

If you already possess a registration, log in and acquire Oregon Notice of Default on Promissory Note Installment from your US Legal Forms collection. The Download button can look on each and every form you look at. You have access to all in the past delivered electronically types from the My Forms tab of your profile.

If you would like use US Legal Forms the very first time, listed below are straightforward recommendations to help you get started:

- Make sure you have picked out the correct form to your city/region. Select the Preview button to analyze the form`s articles. Read the form outline to actually have chosen the appropriate form.

- When the form doesn`t match your specifications, use the Lookup industry at the top of the display screen to get the one which does.

- When you are pleased with the form, verify your choice by clicking the Buy now button. Then, opt for the rates prepare you favor and supply your accreditations to sign up on an profile.

- Approach the financial transaction. Make use of your credit card or PayPal profile to complete the financial transaction.

- Find the formatting and acquire the form on your own device.

- Make adjustments. Complete, change and print out and indicator the delivered electronically Oregon Notice of Default on Promissory Note Installment.

Each and every format you added to your bank account lacks an expiry particular date and is also the one you have for a long time. So, if you want to acquire or print out one more duplicate, just visit the My Forms segment and then click on the form you need.

Obtain access to the Oregon Notice of Default on Promissory Note Installment with US Legal Forms, the most comprehensive collection of authorized file themes. Use 1000s of skilled and state-specific themes that meet up with your business or person demands and specifications.

Form popularity

FAQ

Default could happen with one missed payment or might not occur until after several payments have been missed, depending on the terms of the note. The promissory note itself should set out what constitutes default, so that both the lender and the borrower are clear on the terms.

Even if you have the original note, it may be void if it was not written correctly. If the person you're trying to collect from didn't sign it and yes, this happens the note is void. It may also become void if it failed some other law, for example, if it was charging an illegally high rate of interest.

In general, if you have a contractual debt in Oregon that you have not repaid, the creditor has six years to pursue you with legal action before the Oregon statute of limitations expires.

A default on a loan happens when the borrower fails to make the scheduled payments in full. Default could happen with one missed payment or might not occur until after several payments have been missed, depending on the terms of the note.

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.

A Promissory Note will only be enforceable if it includes all the elements which are necessary to make it a legal document.

Prepayment. Maker may prepay all or any part of the principal balance of this Promissory Note at any time without premium or penalty. Amounts prepaid may not be reborrowed.

A promissory note is a written agreement to pay someone essentially an IOU. But it's not something to be taken lightly. "It is a legally binding written document effectuating a promise to repay money," says Andrea Wheeler, a business attorney and owner of Wheeler Legal PLLC of Florida.