As a general matter, a loan by a bank is the borrowing of money by a person or entity who promises to return it on or before a specific date, with interest, or who pledges collateral as security for the loan and promises to redeem it at a specific later date. Loans are usually made on the basis of applications, together with financial statements submitted by the applicants.

The Federal Truth in Lending Act and the regulations promulgated under the Act apply to certain credit transactions, primarily those involving loans made to a natural person and intended for personal, family, or household purposes and for which a finance charge is made, or loans that are payable in more than four installments. However, said Act and regulations do not apply to a business loan of this type.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

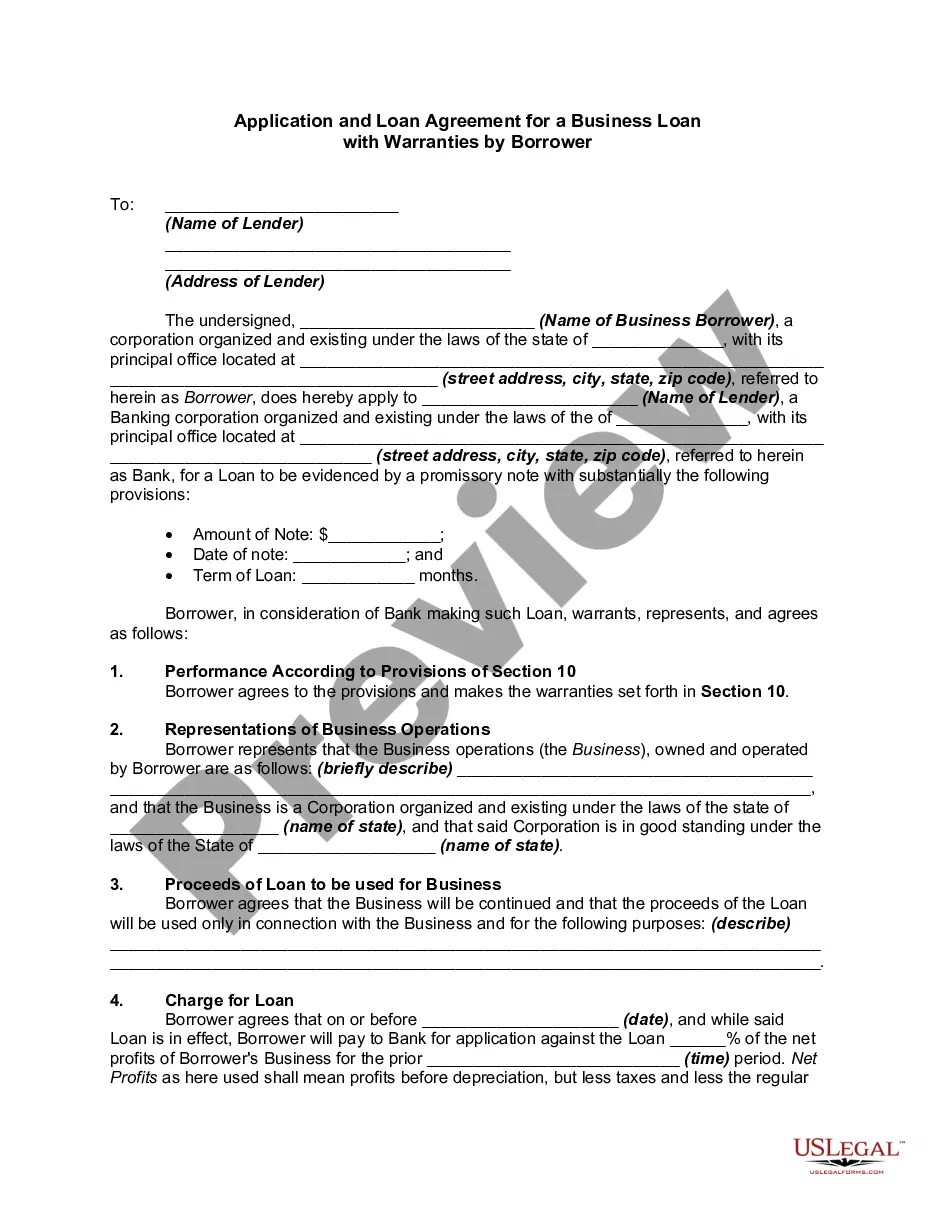

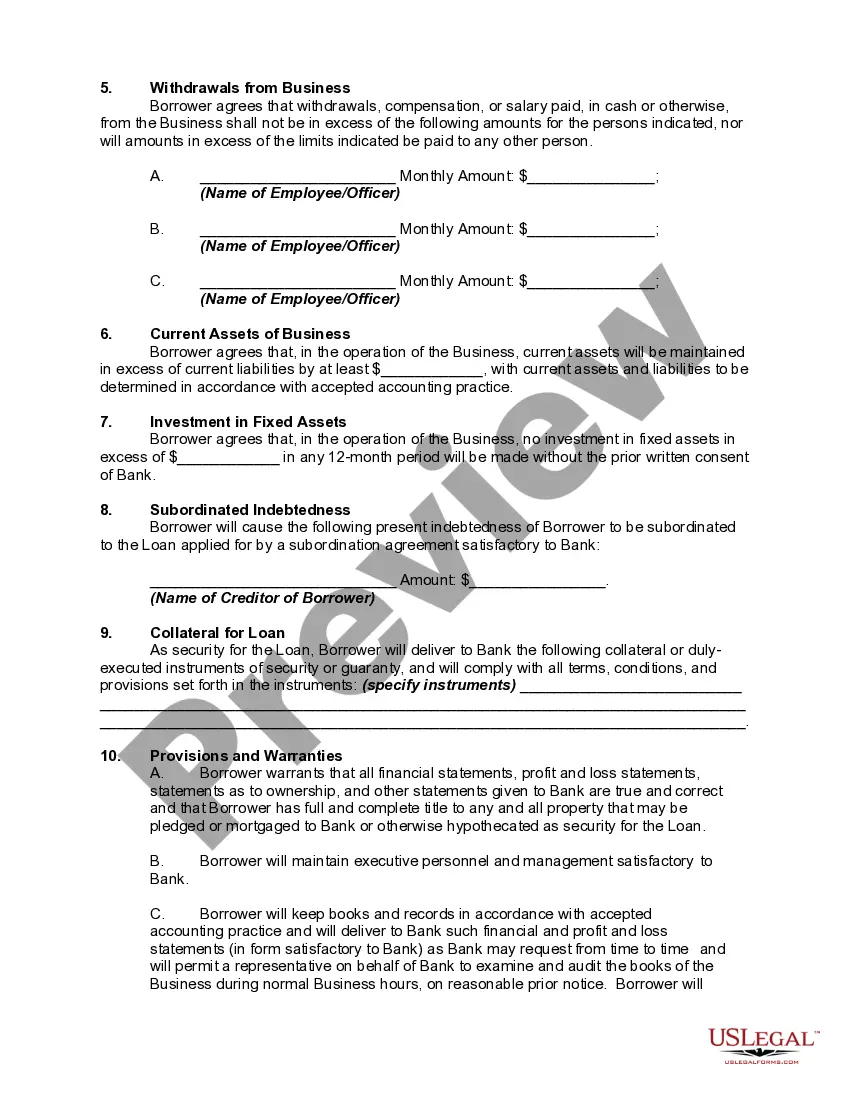

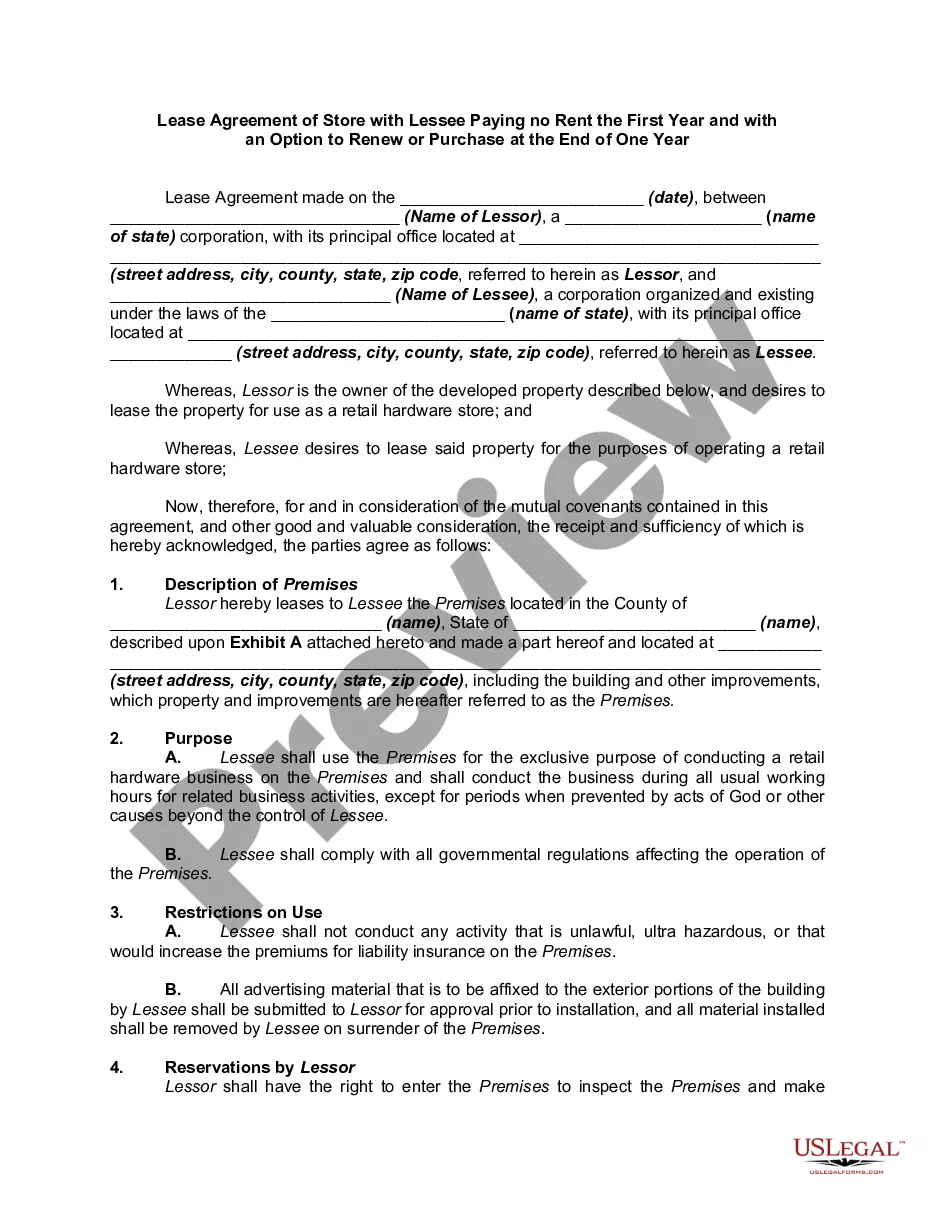

Oregon Application and Loan Agreement for a Business Loan with Warranties by Borrower is a legal document that outlines the terms and conditions under which a business can apply for and obtain a loan in the state of Oregon. This agreement serves as a safeguard for both the lender and the borrower, ensuring that all parties involved are aware of their rights, obligations, and responsibilities. The Oregon Application and Loan Agreement for a Business Loan with Warranties by Borrower typically includes the following key provisions: 1. Loan Amount: This section specifies the principal amount of the loan being sought by the borrower. 2. Purpose of the Loan: The agreement outlines the specific purpose for which the loan funds will be utilized, such as new equipment purchase, working capital, or business expansion. 3. Interest Rate and Repayment Terms: This section details the interest rate applicable to the loan, the repayment schedule, and any late payment penalties or fees. 4. Security: The borrower may be required to provide collateral or security to secure the loan, which will be forfeited in the event of default. 5. Warranties by Borrower: This agreement includes warranties made by the borrower, guaranteeing the accuracy of all information provided, the absence of any undisclosed debts or legal issues, and the compliance with all applicable laws and regulations. 6. Confidentiality and Non-Disclosure: The agreement may contain provisions regarding the confidentiality of the loan terms and the borrower's business information. 7. Defaults and Remedies: This section outlines the consequences of defaulting on the loan, including potential legal action and the lender's rights to demand immediate repayment. 8. Governing Law: The agreement states that the laws of the state of Oregon will govern the interpretation and enforcement of the agreement. Different types of Oregon Application and Loan Agreement for a Business Loan with Warranties by Borrower may vary based on specific loan programs or requirements. Some common variations include: 1. Small Business Administration (SBA) Loan Agreement: This is a specific loan agreement that complies with the guidelines set by the Small Business Administration for securing loans for small businesses. 2. Commercial Loan Agreement: This type of agreement is tailored for commercial loans typically extended to larger businesses for various purposes like real estate acquisition, equipment purchase, or expansion plans. 3. Microloan Agreement: A microloan agreement is specifically designed for providing small loans to startups or businesses with limited financial history or creditworthiness. 4. Construction Loan Agreement: This agreement is applicable when the loan is intended for the construction or development of a commercial property or building. It is crucial for both lenders and borrowers to carefully review and understand all the provisions within the Oregon Application and Loan Agreement for a Business Loan with Warranties by Borrower before signing to ensure compliance with the law and protection of their respective rights and interests. It is advisable to seek legal counsel to draft or review the agreement to ensure its accuracy and appropriateness for the specific loan transaction.Oregon Application and Loan Agreement for a Business Loan with Warranties by Borrower is a legal document that outlines the terms and conditions under which a business can apply for and obtain a loan in the state of Oregon. This agreement serves as a safeguard for both the lender and the borrower, ensuring that all parties involved are aware of their rights, obligations, and responsibilities. The Oregon Application and Loan Agreement for a Business Loan with Warranties by Borrower typically includes the following key provisions: 1. Loan Amount: This section specifies the principal amount of the loan being sought by the borrower. 2. Purpose of the Loan: The agreement outlines the specific purpose for which the loan funds will be utilized, such as new equipment purchase, working capital, or business expansion. 3. Interest Rate and Repayment Terms: This section details the interest rate applicable to the loan, the repayment schedule, and any late payment penalties or fees. 4. Security: The borrower may be required to provide collateral or security to secure the loan, which will be forfeited in the event of default. 5. Warranties by Borrower: This agreement includes warranties made by the borrower, guaranteeing the accuracy of all information provided, the absence of any undisclosed debts or legal issues, and the compliance with all applicable laws and regulations. 6. Confidentiality and Non-Disclosure: The agreement may contain provisions regarding the confidentiality of the loan terms and the borrower's business information. 7. Defaults and Remedies: This section outlines the consequences of defaulting on the loan, including potential legal action and the lender's rights to demand immediate repayment. 8. Governing Law: The agreement states that the laws of the state of Oregon will govern the interpretation and enforcement of the agreement. Different types of Oregon Application and Loan Agreement for a Business Loan with Warranties by Borrower may vary based on specific loan programs or requirements. Some common variations include: 1. Small Business Administration (SBA) Loan Agreement: This is a specific loan agreement that complies with the guidelines set by the Small Business Administration for securing loans for small businesses. 2. Commercial Loan Agreement: This type of agreement is tailored for commercial loans typically extended to larger businesses for various purposes like real estate acquisition, equipment purchase, or expansion plans. 3. Microloan Agreement: A microloan agreement is specifically designed for providing small loans to startups or businesses with limited financial history or creditworthiness. 4. Construction Loan Agreement: This agreement is applicable when the loan is intended for the construction or development of a commercial property or building. It is crucial for both lenders and borrowers to carefully review and understand all the provisions within the Oregon Application and Loan Agreement for a Business Loan with Warranties by Borrower before signing to ensure compliance with the law and protection of their respective rights and interests. It is advisable to seek legal counsel to draft or review the agreement to ensure its accuracy and appropriateness for the specific loan transaction.