Oregon Letter to Confirm Accounts Receivable is an official document used in the state of Oregon to verify and validate the outstanding accounts receivable of a business or organization. This letter is often sent by auditors, accountants, or financial professionals to companies or individuals having financial dealings with the organization. The purpose of the Oregon Letter to Confirm Accounts Receivable is to obtain confirmation of the accuracy and completeness of a company's accounts receivable balance from its customers or clients. It helps in verifying the legitimacy of financial figures presented by a business, ensuring transparency, and maintaining the integrity of financial statements. Keywords: Oregon, Letter to Confirm Accounts Receivable, verification, validation, outstanding accounts receivable, auditors, accountants, financial professionals, businesses, organizations, financial dealings, confirmation, accuracy, completeness, customers, clients, financial figures, transparency, integrity, financial statements. Different types of Oregon Letters to Confirm Accounts Receivable may include: 1. Standard Oregon Letter to Confirm Accounts Receivable: This is a generic template used to request confirmation of accounts receivable balances from customers or clients. It is suitable for a wide range of industries and businesses. 2. Industry-Specific Oregon Letter to Confirm Accounts Receivable: These letters are tailored for specific industries, such as manufacturing, retail, healthcare, or services. They include industry-specific jargon and information relevant to the particular sector. 3. Oregon Letter to Confirm Accounts Receivable for Auditing Purposes: These letters contain additional details required by auditors to facilitate the auditing process. They might have sections for providing supporting documentation, contact information for auditors, and specific deadlines for response. 4. Oregon Letter to Confirm Accounts Receivable for Legal Proceedings: In certain situations, businesses may need to obtain confirmation of accounts receivable balances to substantiate legal claims or disputes. These letters may include a legal context, reference to legal proceedings, and any necessary documentation required by the legal process. It is crucial for businesses and individuals receiving an Oregon Letter to Confirm Accounts Receivable to respond promptly and provide accurate information. Failure to do so may result in delays, misunderstandings, or potential legal consequences.

Oregon Letter to Confirm Accounts Receivable

Description

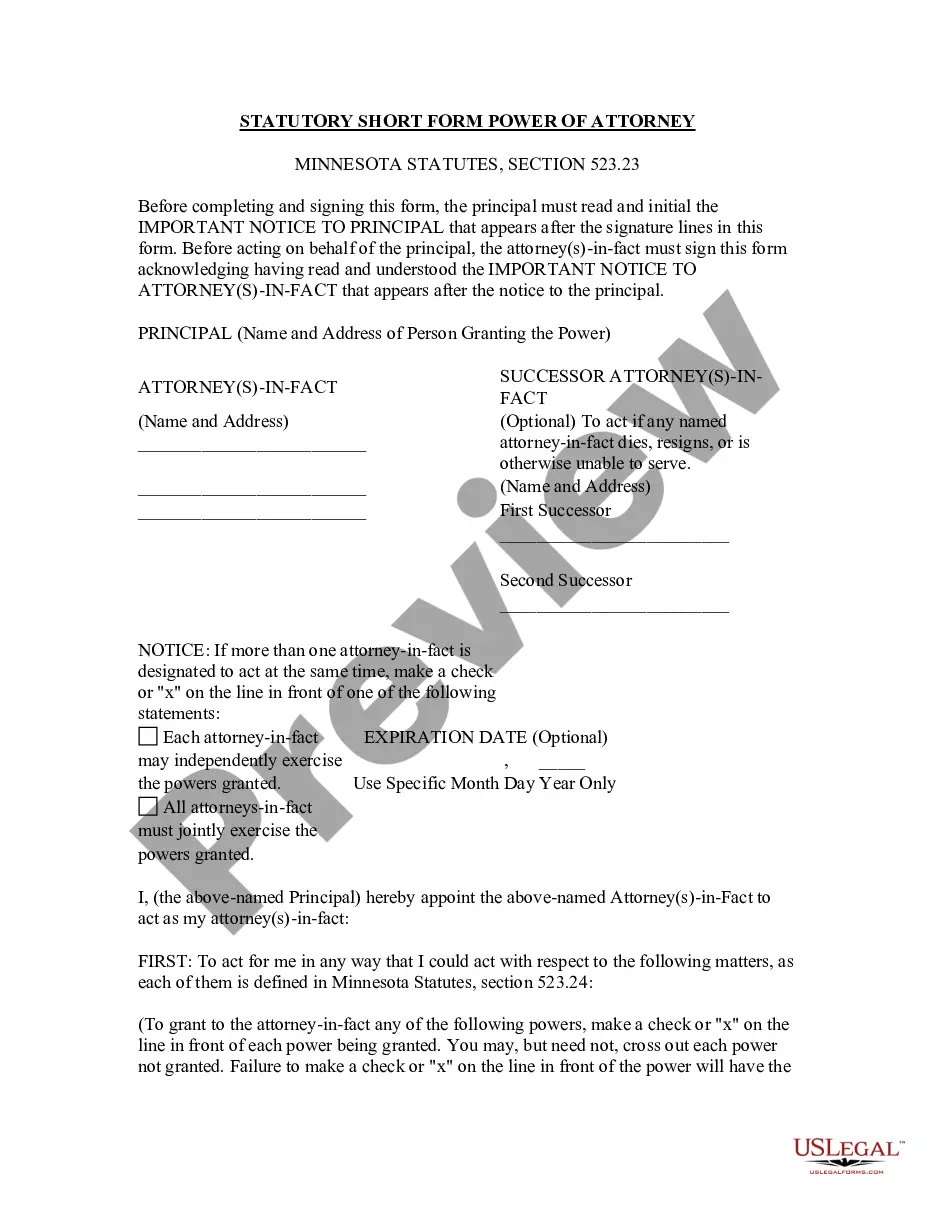

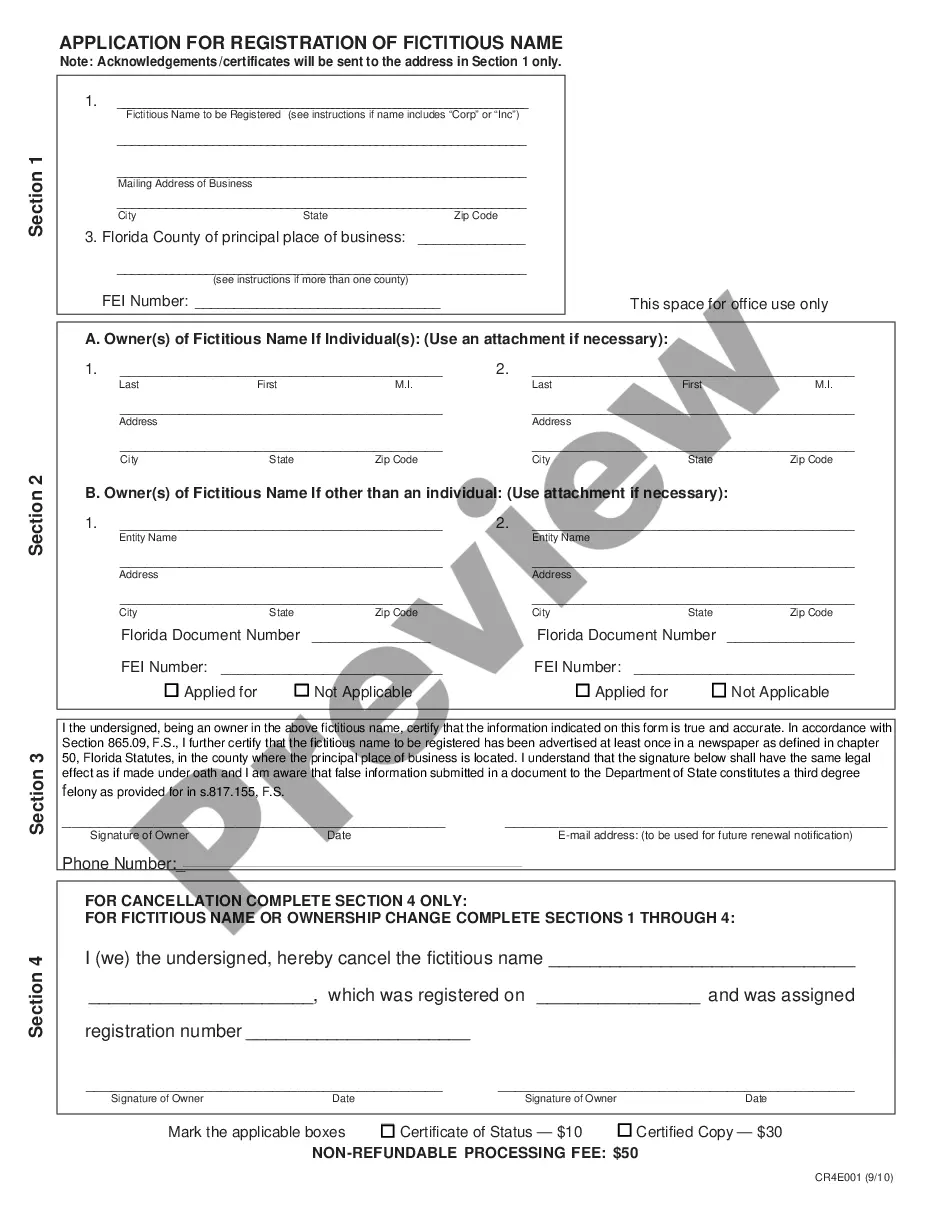

How to fill out Oregon Letter To Confirm Accounts Receivable?

If you have to full, acquire, or printing legal document web templates, use US Legal Forms, the biggest collection of legal forms, that can be found online. Make use of the site`s simple and easy handy search to discover the documents you need. A variety of web templates for business and personal uses are sorted by groups and says, or search phrases. Use US Legal Forms to discover the Oregon Letter to Confirm Accounts Receivable with a couple of mouse clicks.

If you are already a US Legal Forms consumer, log in for your profile and click on the Down load button to find the Oregon Letter to Confirm Accounts Receivable. You may also entry forms you earlier downloaded in the My Forms tab of the profile.

If you work with US Legal Forms the first time, refer to the instructions beneath:

- Step 1. Make sure you have selected the form for the correct city/nation.

- Step 2. Make use of the Preview option to examine the form`s content. Don`t forget about to read the explanation.

- Step 3. If you are not happy with all the form, take advantage of the Lookup area at the top of the display to discover other versions from the legal form web template.

- Step 4. Once you have located the form you need, click on the Get now button. Opt for the costs plan you prefer and put your references to sign up for the profile.

- Step 5. Process the transaction. You can use your charge card or PayPal profile to perform the transaction.

- Step 6. Choose the format from the legal form and acquire it on your system.

- Step 7. Full, modify and printing or indication the Oregon Letter to Confirm Accounts Receivable.

Every legal document web template you purchase is yours eternally. You may have acces to each form you downloaded within your acccount. Go through the My Forms segment and decide on a form to printing or acquire yet again.

Be competitive and acquire, and printing the Oregon Letter to Confirm Accounts Receivable with US Legal Forms. There are millions of specialist and status-particular forms you can use for your personal business or personal demands.

Form popularity

FAQ

7 Tips to Improve Your Accounts Receivable CollectionCreate an A/R Aging Report and Calculate Your ART.Be Proactive in Your Invoicing and Collections Effort.Move Fast on Past-Due Receivables.Consider Offering an Early Payment Discount.Consider Offering a Payment Plan.Diversify Your Client Base.More items...?02-Sept-2019

The accounts receivable confirmation is sent to the customers to confirm whether the balances on the auditee business' ledgers match the balances on the customer's ledgers. In case these balances do no match, the valuation on the ledgers should be questioned.

During an audit, the auditor will try to determine whether: Your balance sheet reflects your accounts receivable accurately. Refund records for returned items are accurate. Proper measures are taken to prevent misappropriation of non-electronic payments in the form of cash and checks.

The auditor does so with an accounts receivable confirmation. This is a letter signed by a company officer (but mailed by the auditor) to customers selected by the auditors from the company's accounts receivable aging report.

How to Audit Accounts ReceivableTrace receivable report to general ledger.Calculate the receivable report total.Investigate reconciling items.Test invoices listed in receivable report.Match invoices to shipping log.Confirm accounts receivable.Review cash receipts.Assess the allowance for doubtful accounts.More items...?15-May-2017

Test invoices listed in receivable report. Match invoices to shipping log. Confirm accounts receivable. Review cash receipts.

RECEIVABLE CONFIRMATIONS ARE NOT ALWAYS required if accounts receivable are immaterial, the use of confirmations would be ineffective or combined inherent risk and control risk are low and analytics or other substantive tests would detect misstatements.

To document any accounts receivable, create an invoice (see below) which details the products or services your business provided to a customer, the amount owed for that product or service, including any sales taxes and extra fees (like for shipping a product) and the due date for payment.

RECEIVABLE CONFIRMATIONS ARE NOT ALWAYS required if accounts receivable are immaterial, the use of confirmations would be ineffective or combined inherent risk and control risk are low and analytics or other substantive tests would detect misstatements.

Accounts receivable confirmation is a technique used in the auditing process to verify a company's records. The auditor sends communications directly to customers, asking them to confirm the records maintained by the company.