Oregon Checklist — Key Employee Life Insurance: A Comprehensive Guide to Protecting Your Business and Employees Introduction: Key employees play a crucial role in the success of any business. To safeguard the financial stability and continuity of your organization, it is essential to consider Oregon Checklist — Key Employee Life Insurance. This type of insurance provides protection against the unexpected loss of a key employee, ensuring your business can withstand the financial impact of such a situation. In this detailed description, we will explore the importance of Key Employee Life Insurance in Oregon, its benefits, and the different types available. 1. Key Employee Life Insurance Explained: Key Employee Life Insurance is a policy that covers a business in the event of the death of a key employee. It provides a financial safety net to the company, enabling it to bear the costs associated with losing a highly valued employee. This insurance can help businesses overcome financial uncertainties, maintain operations, and even attract additional investments. 2. Importance of Key Employee Life Insurance in Oregon: Oregon businesses, whether small or large, greatly depend on the skills, knowledge, and experience of key employees. Losing such individuals unexpectedly can have a significant financial impact on the company's bottom line. Key Employee Life Insurance in Oregon assists in mitigating financial risks, ensuring the business can continue its operations, pay debts, recruit and train new employees, and manage potential financial hardships resulting from the loss of a key employee. 3. Benefits of Key Employee Life Insurance in Oregon: — Financial Protection: Key Employee Life Insurance offers essential financial support when dealing with the loss of a key employee. It helps cover expenses such as recruitment, training, and potential revenue loss. — Business Continuity: By providing funds to overcome financial disruptions, this insurance ensures continuity of operations and minimizes the negative impact on the company's productivity. — Employee Retention and Attraction: Offering Key Employee Life Insurance can be an attractive employee benefit, helping retain top talent and attract new valuable professionals to your organization. — Peace of Mind: Business owners and stakeholders can have peace of mind knowing that their company is protected against unforeseen circumstances and can continue functioning even after the loss of a key employee. 4. Types of Key Employee Life Insurance in Oregon: — Term Life Insurance: This policy type provides coverage for a specific term, usually 10, 20, or 30 years. It pays out a death benefit if the key employee passes away within the policy's term. — Whole Life Insurance: Whole Life Insurance is a permanent policy that covers the key employee throughout their lifetime. It offers an accumulated cash value component and serves both as insurance and an investment. — Universal Life Insurance: Universal Life Insurance combines a death benefit with a cash value component, allowing flexibility in premium payments and potential growth of cash value. — Variable Life Insurance: This policy type offers investment options, allowing the cash value component to fluctuate based on the performance of investment accounts. — Key Person Insurance: Key Person Insurance focuses on insuring individuals who are vital to the business's success, allowing the company to protect its financial interests in case of their death. Conclusion: Oregon Checklist — Key Employee Life Insurance is an indispensable risk management tool for businesses in Oregon. By safeguarding against the loss of key employees, it ensures business continuity, financial stability, and peace of mind for owners and stakeholders. With different types of life insurance policies available, business owners should consult with insurance professionals to identify the most suitable coverage based on their specific needs and preferences. Investing in Key Employee Life Insurance is a proactive measure that demonstrates responsible business management and preparedness for future uncertainties.

Oregon Checklist - Key Employee Life Insurance

Description

How to fill out Oregon Checklist - Key Employee Life Insurance?

If you wish to full, acquire, or printing legal papers themes, use US Legal Forms, the greatest variety of legal varieties, which can be found on the Internet. Use the site`s basic and hassle-free look for to get the documents you require. A variety of themes for enterprise and personal functions are categorized by classes and claims, or search phrases. Use US Legal Forms to get the Oregon Checklist - Key Employee Life Insurance within a few click throughs.

Should you be currently a US Legal Forms client, log in in your profile and click on the Acquire button to find the Oregon Checklist - Key Employee Life Insurance. You can also gain access to varieties you formerly delivered electronically within the My Forms tab of your profile.

If you are using US Legal Forms the very first time, follow the instructions under:

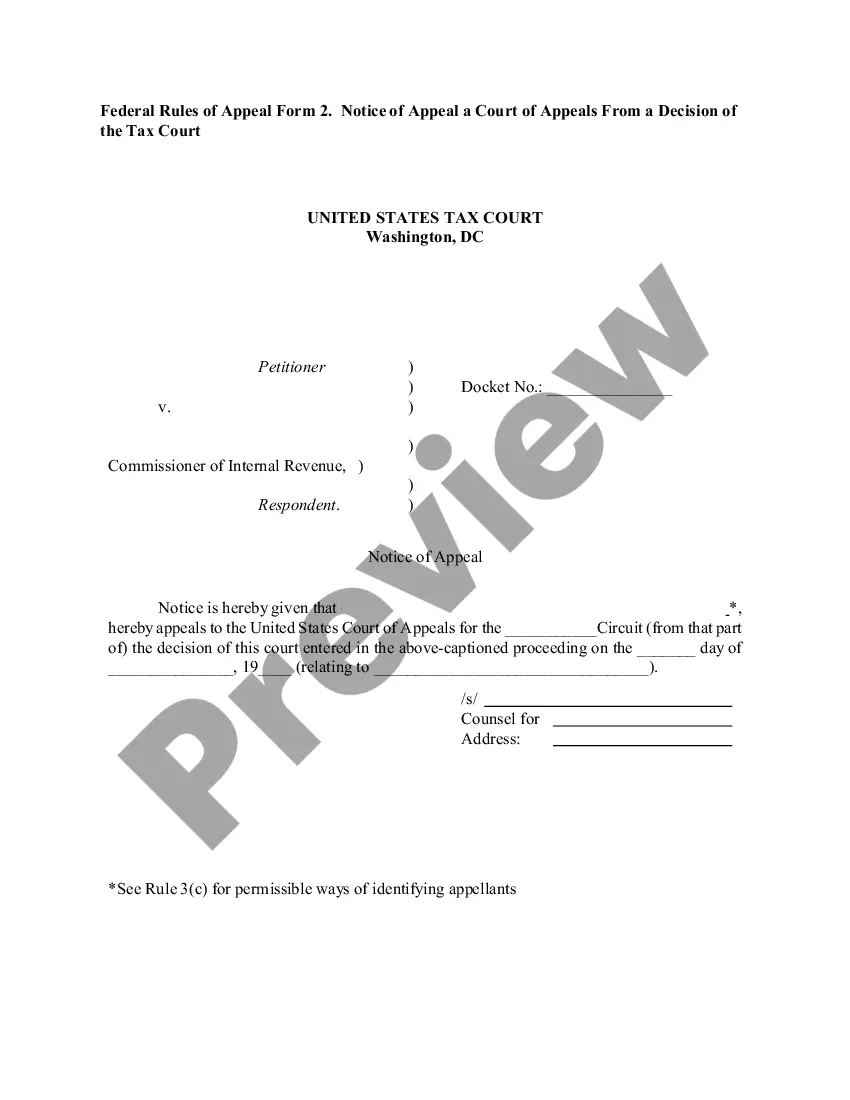

- Step 1. Make sure you have selected the shape to the appropriate city/country.

- Step 2. Make use of the Review option to examine the form`s content. Don`t forget to see the description.

- Step 3. Should you be not satisfied together with the develop, make use of the Research industry on top of the monitor to locate other versions in the legal develop template.

- Step 4. When you have identified the shape you require, select the Get now button. Opt for the prices plan you choose and add your credentials to sign up on an profile.

- Step 5. Approach the financial transaction. You should use your credit card or PayPal profile to perform the financial transaction.

- Step 6. Choose the format in the legal develop and acquire it in your system.

- Step 7. Total, change and printing or indicator the Oregon Checklist - Key Employee Life Insurance.

Every single legal papers template you purchase is the one you have for a long time. You have acces to each and every develop you delivered electronically within your acccount. Select the My Forms area and select a develop to printing or acquire yet again.

Contend and acquire, and printing the Oregon Checklist - Key Employee Life Insurance with US Legal Forms. There are millions of specialist and condition-certain varieties you may use for the enterprise or personal needs.