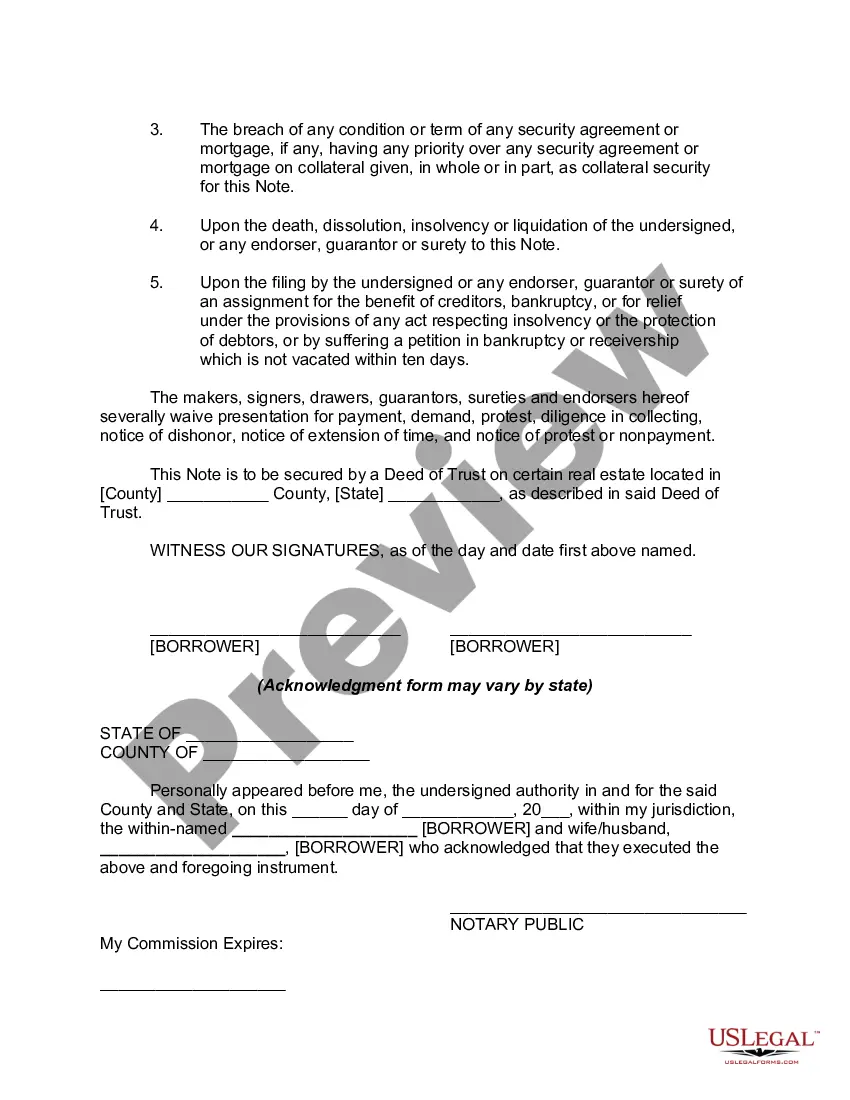

The acknowledgement is the section at the end of a document where a notary public verifies that the signer of the document states he/she actually signed it. Typical language is: "State of ______, County of ______ (signed and sealed) On ____, 20__, before me, a notary public for said state, personally appeared _______, personally known to me, or proved to be said person by proper proof, and acknowledged that he executed the above Deed." Then the notary signs the acknowledgment and puts on his/her seal, which is usually a rubber stamp, although some still use a metal seal. The person acknowledging that he/she signed must be prepared to verify their identity with a driver's license or other accepted form of identification, and must sign the notary's journal. The acknowledgment is required for many official forms and vital for any document which must be recorded by the County Recorder or Recorder of Deeds, including deeds, deeds of trust, mortgages, powers of attorney that may involve real estate, some leases and various other papers.

Acknowledgments may also be drafted to affirm a variety of matters, acting in effect as a written confirmation of an act such as receipt of goods, services, or payment.

A promissory note is a legally-binding document that outlines the terms and conditions of lending or borrowing money. In the state of Oregon, a promissory note can be accompanied by an acknowledgment, providing additional legal protection to both parties involved in the transaction. The Oregon Promissory Note — With Acknowledgment is a specific type of promissory note that includes an acknowledgment clause. This clause requires the borrower to officially recognize and affirm their obligation to repay the stated amount of money to the lender. It validates the agreement and helps prevent any future disputes or claims against the validity of the document. When drafting an Oregon Promissory Note — With Acknowledgment, it is crucial to include essential details such as the names and addresses of the lender and borrower, the principal amount being borrowed, the interest rate (if any), repayment terms, late payment penalties (if applicable), and the date of repayment. This information ensures clarity and transparency, protecting both parties from misunderstandings or ambiguities. There can be various types of Oregon Promissory Note — With Acknowledgment, depending on the specific circumstances or requirements of the parties involved: 1. Straight Promissory Note: This type of promissory note is the most common and straightforward form. It indicates a simple borrowing arrangement where the lender lends a specific amount of money to the borrower with a promise to repay it within an agreed-upon timeframe. 2. Installment Promissory Note: An installment promissory note breaks down the repayment into periodic installments rather than requiring a one-time payment. This structure may be more suitable for long-term loans or higher loan amounts. 3. Balloon Promissory Note: A balloon promissory note involves smaller payments over the course of the loan term, with a larger final payment due at the end. It allows the borrower to make more manageable payments initially and a lump sum payment at the conclusion of the loan. 4. Revolving Promissory Note: This type of promissory note sets a maximum borrowing limit, similar to a line of credit, where the borrower can borrow and repay repeatedly without needing to create new notes. It provides flexibility and convenience for both parties. Overall, an Oregon Promissory Note — With Acknowledgment is a vital legal document that protects the rights and obligations of lenders and borrowers in financial transactions. By incorporating an acknowledgment clause, it ensures the authenticity and enforceability of the agreement. It is essential to consult with legal professionals to create a customized promissory note that aligns with the specific needs and requirements of the involved parties while adhering to Oregon state laws and regulations.A promissory note is a legally-binding document that outlines the terms and conditions of lending or borrowing money. In the state of Oregon, a promissory note can be accompanied by an acknowledgment, providing additional legal protection to both parties involved in the transaction. The Oregon Promissory Note — With Acknowledgment is a specific type of promissory note that includes an acknowledgment clause. This clause requires the borrower to officially recognize and affirm their obligation to repay the stated amount of money to the lender. It validates the agreement and helps prevent any future disputes or claims against the validity of the document. When drafting an Oregon Promissory Note — With Acknowledgment, it is crucial to include essential details such as the names and addresses of the lender and borrower, the principal amount being borrowed, the interest rate (if any), repayment terms, late payment penalties (if applicable), and the date of repayment. This information ensures clarity and transparency, protecting both parties from misunderstandings or ambiguities. There can be various types of Oregon Promissory Note — With Acknowledgment, depending on the specific circumstances or requirements of the parties involved: 1. Straight Promissory Note: This type of promissory note is the most common and straightforward form. It indicates a simple borrowing arrangement where the lender lends a specific amount of money to the borrower with a promise to repay it within an agreed-upon timeframe. 2. Installment Promissory Note: An installment promissory note breaks down the repayment into periodic installments rather than requiring a one-time payment. This structure may be more suitable for long-term loans or higher loan amounts. 3. Balloon Promissory Note: A balloon promissory note involves smaller payments over the course of the loan term, with a larger final payment due at the end. It allows the borrower to make more manageable payments initially and a lump sum payment at the conclusion of the loan. 4. Revolving Promissory Note: This type of promissory note sets a maximum borrowing limit, similar to a line of credit, where the borrower can borrow and repay repeatedly without needing to create new notes. It provides flexibility and convenience for both parties. Overall, an Oregon Promissory Note — With Acknowledgment is a vital legal document that protects the rights and obligations of lenders and borrowers in financial transactions. By incorporating an acknowledgment clause, it ensures the authenticity and enforceability of the agreement. It is essential to consult with legal professionals to create a customized promissory note that aligns with the specific needs and requirements of the involved parties while adhering to Oregon state laws and regulations.