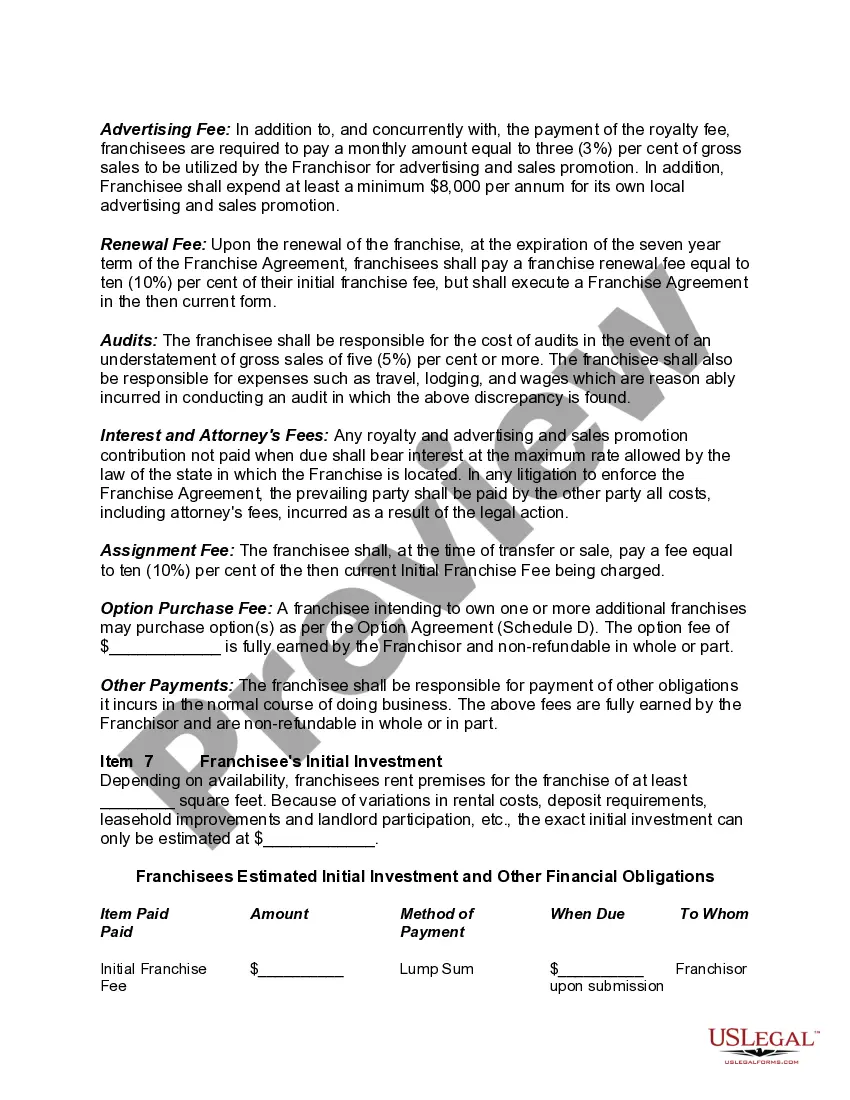

Someone interested in franchising should be knowledgeable about the strengths and weaknesses of companies that offer such arrangements. Perhaps the best source of information on these and many other issues is the franchisor's disclosure document. This important document, which must be given to prospective franchise owners at least ten business days before any contract is signed or any deposits are owed, usually takes the form of the Uniform Franchise Offering Circular (UFOC). The UFOC contains important information on key aspects of the franchisor's business and the nature of its dealings with franchisees. Information contained in the UFOC includes a franchise history; audited financial statements and other financial history documents; franchise fee and royalty structures; background on the franchise's leading executives; terms of franchise agreements; estimated start-up costs for franchisees (including equipment, inventory, operating capital, and insurance); circumstances under which the franchisor can terminate its relationship with a franchisee; franchisor training and assistance programs; franchisee advertising costs (if any); data on the success (or lack thereof) of current and former franchisee operations; and litigation history.

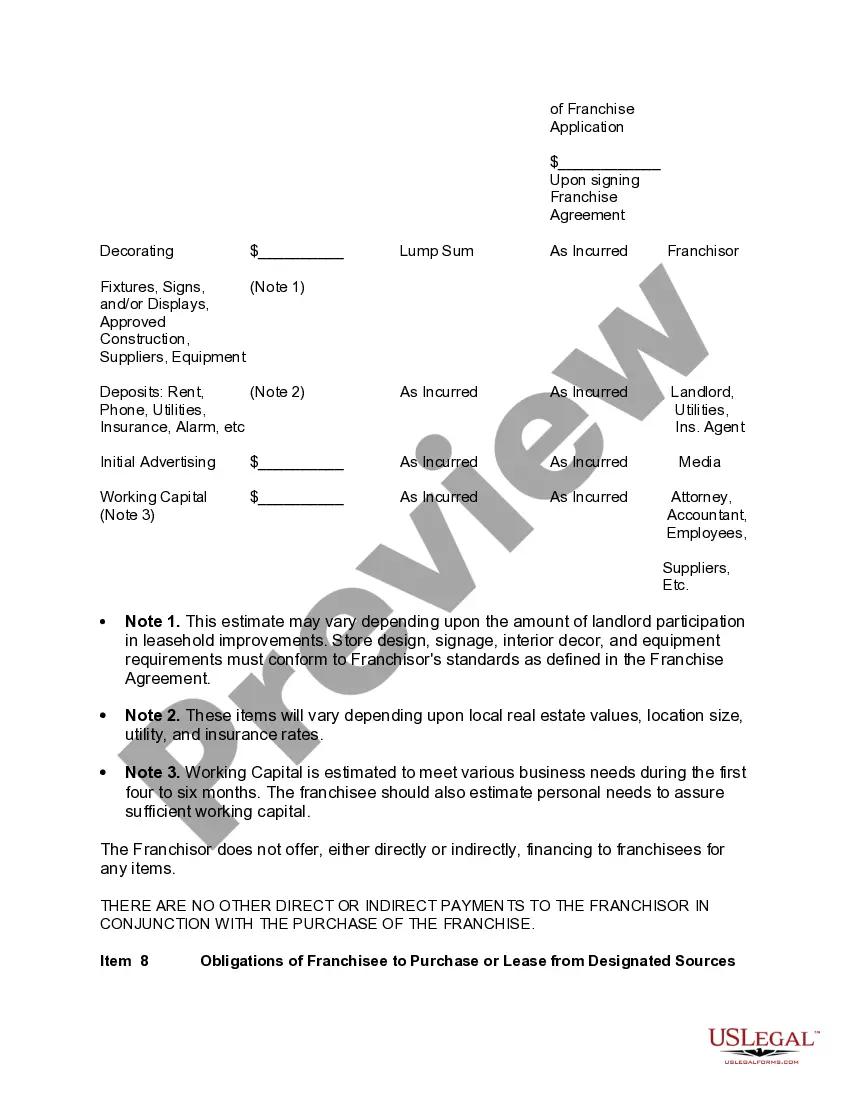

Title: Understanding the Oregon Form of Uniform Franchise Offering Prospectus Keywords: Oregon Form of Uniform Franchise Offering Prospectus, Disclosure Document, Franchise Opportunity, Franchise Regulations Introduction: The Oregon Form of Uniform Franchise Offering Prospectus (FLOP) is a crucial document that provides comprehensive information and disclosures to prospective franchisees in the state of Oregon. The FLOP aims to ensure transparency and protect franchise investors by providing essential details about the franchisor, the franchise opportunity, and the associated risks. Types of Oregon Form of Uniform Franchise Offering Prospectus: 1. Long-Form Uniform Franchise Offering Prospectus: The Long-Form FLOP is typically used by franchisors who have a complex business model or extensive operations. It contains detailed information about the franchise system, such as financial statements, background details of the franchise owners and key executives, and the nature of the products/services offered. Additionally, it provides comprehensive details of the franchise agreement, fees, ongoing support, obligations, territorial rights, and marketing requirements. 2. Short-Form Uniform Franchise Offering Prospectus: The Short-Form FLOP is employed by franchisors with relatively simple business models or those that operate under exemptions provided by Oregon law. It presents a condensed version of the Long-Form FLOP, focusing on key information required by potential franchisees but excluding more extensive details covered in the long form. Key Components of the Oregon Form of Uniform Franchise Offering Prospectus: 1. Franchisor Information: The FLOP provides detailed background information about the franchisor, including its history, ownership structure, business model, and relevant experience in the industry. This is to help prospective franchisees gauge the credibility and expertise of the franchisor. 2. Initial Investment: The document discloses the required initial investment for setting up a franchise, outlining various costs involved, such as franchise fees, equipment, real estate, inventory, and working capital. Transparency in this section helps potential franchisees evaluate the financial feasibility of the opportunity. 3. Franchise Agreement: The FLOP includes an overview of the terms and conditions contained within the franchise agreement. This section typically covers the duration of the agreement, renewal options, territorial rights, restrictions, royalties, and advertising/marketing obligations. It is essential for franchisees to thoroughly review this section to understand the contractual relationship and their associated rights and obligations. 4. Financial Information: Franchisors are required to provide audited financial statements, which include balance sheets, income statements, and cash flow statements. These statements offer insights into the franchisor’s financial health, stability, and potential growth prospects. 5. Litigation History: Any past or ongoing litigation involving the franchisor or its key executives, such as bankruptcies, legal disputes, or breaches of franchise agreements, must be highlighted in the FLOP. This ensures transparency and helps potential franchisees make informed decisions. Conclusion: The Oregon Form of Uniform Franchise Offering Prospectus is a critical document that provides valuable information for individuals interested in owning a franchise within the state. Whether one opts for the Long-Form or Short-Form version, franchisees must carefully review the FLOP, considering its various sections, such as franchisor details, investment requirements, franchise agreement terms, financial information, and litigation history, before making an educated decision.