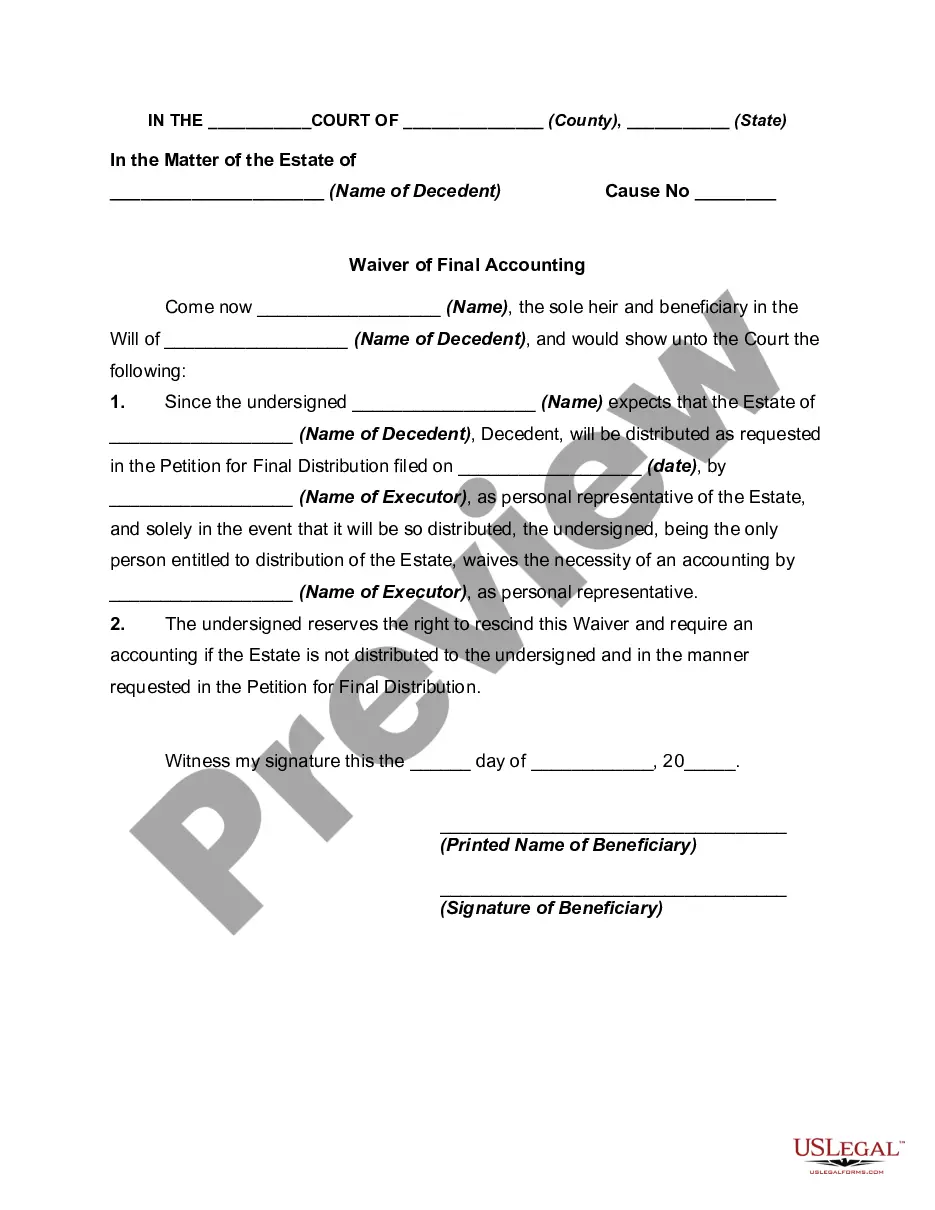

In order to close an estate a petition for final distribution should be filed before the court showing that the estate can be closed and requesting distribution to be made to the beneficiaries. Usually when a petition for final distribution is filed, the court requires detailed accounting of all the monies and other items received and all monies paid out during administration. However, the accounting may be waived when all persons entitled to receive property from the estate have executed a written waiver of accounting. Waiver simplifies the closing of the estate. When all the beneficiaries are friendly obtaining waiver is not a problem.

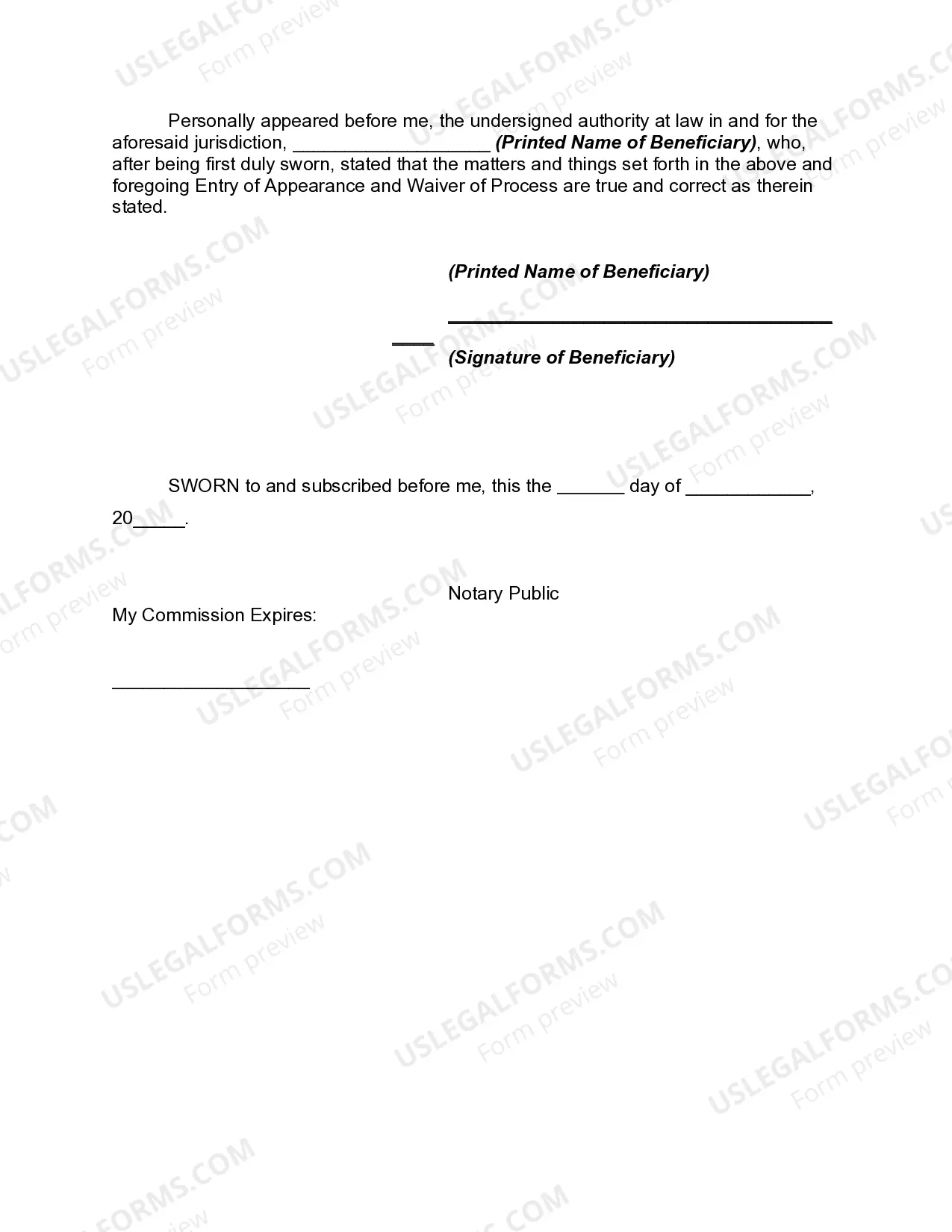

A detailed description of the Oregon Waiver of Final Accounting by Sole Beneficiary: The Oregon Waiver of Final Accounting by Sole Beneficiary is a legal document that allows a sole beneficiary to waive their right to receive a final accounting of the estate's assets and transactions. This waiver can be used in situations where the beneficiary trusts the personal representative or executor of the estate and does not feel the need to review a detailed account of the financial transactions and distributions. This waiver is often used to simplify the probate process and save time and costs associated with compiling and providing a final accounting. By signing this waiver, the beneficiary acknowledges that they have been provided with all necessary documentation and information about the estate's administration and that they are satisfied with the executor's handling of the estate. Keywords: Oregon, Waiver of Final Accounting, Sole Beneficiary, probate process, personal representative, executor, estate's assets, financial transactions, distributions, documentation, administration. Different types of Oregon Waiver of Final Accounting by Sole Beneficiary: 1. Full Waiver of Final Accounting: This type of waiver indicates that the sole beneficiary is fully satisfied with the information and documentation provided by the personal representative or executor. The beneficiary acknowledges that they have received everything they need and waive any right to receive a detailed final accounting of the estate's assets and transactions. 2. Partial Waiver of Final Accounting: In cases where the sole beneficiary wants some level of transparency but does not require a full accounting, they can choose to sign a partial waiver. This allows the beneficiary to specify which specific aspects of the accounting they would like to receive while waiving the rest. 3. Limited Waiver of Final Accounting: Similar to a partial waiver, a limited waiver allows the sole beneficiary to request specific information concerning particular aspects of the estate's administration. The beneficiary can waive the need for a comprehensive final accounting but still request specific details. 4. Conditional Waiver of Final Accounting: This type of waiver is used when the sole beneficiary would like to reserve the right to request a final accounting in the future based on certain conditions. These conditions could include suspicions of misconduct or fraud by the personal representative or executor or any other unforeseen circumstances that may arise. Keywords: Full Waiver, Partial Waiver, Limited Waiver, Conditional Waiver, estate's administration, transparency, beneficiary, personal representative, executor, suspicions, misconduct, fraud.A detailed description of the Oregon Waiver of Final Accounting by Sole Beneficiary: The Oregon Waiver of Final Accounting by Sole Beneficiary is a legal document that allows a sole beneficiary to waive their right to receive a final accounting of the estate's assets and transactions. This waiver can be used in situations where the beneficiary trusts the personal representative or executor of the estate and does not feel the need to review a detailed account of the financial transactions and distributions. This waiver is often used to simplify the probate process and save time and costs associated with compiling and providing a final accounting. By signing this waiver, the beneficiary acknowledges that they have been provided with all necessary documentation and information about the estate's administration and that they are satisfied with the executor's handling of the estate. Keywords: Oregon, Waiver of Final Accounting, Sole Beneficiary, probate process, personal representative, executor, estate's assets, financial transactions, distributions, documentation, administration. Different types of Oregon Waiver of Final Accounting by Sole Beneficiary: 1. Full Waiver of Final Accounting: This type of waiver indicates that the sole beneficiary is fully satisfied with the information and documentation provided by the personal representative or executor. The beneficiary acknowledges that they have received everything they need and waive any right to receive a detailed final accounting of the estate's assets and transactions. 2. Partial Waiver of Final Accounting: In cases where the sole beneficiary wants some level of transparency but does not require a full accounting, they can choose to sign a partial waiver. This allows the beneficiary to specify which specific aspects of the accounting they would like to receive while waiving the rest. 3. Limited Waiver of Final Accounting: Similar to a partial waiver, a limited waiver allows the sole beneficiary to request specific information concerning particular aspects of the estate's administration. The beneficiary can waive the need for a comprehensive final accounting but still request specific details. 4. Conditional Waiver of Final Accounting: This type of waiver is used when the sole beneficiary would like to reserve the right to request a final accounting in the future based on certain conditions. These conditions could include suspicions of misconduct or fraud by the personal representative or executor or any other unforeseen circumstances that may arise. Keywords: Full Waiver, Partial Waiver, Limited Waiver, Conditional Waiver, estate's administration, transparency, beneficiary, personal representative, executor, suspicions, misconduct, fraud.