A joint venture is a relationship between two or more people who combine their labor or property for a single business undertaking. They share profits and losses equally, or as otherwise provided in the joint venture agreement. The single business undertaking aspect is a key to determining whether or not a business entity is a joint venture as opposed to a partnership.

A joint venture is very similar to a partnership. In fact, some States treat joint ventures the same as partnerships with regard to partnership statutes such as the Uniform Partnership Act. The main difference between a partnership and a joint venture is that a joint venture usually relates to the pursuit of a single transaction or enterprise even though this may require several years to accomplish. A partnership is generally a continuing or ongoing business or activity. While a partnership may be expressly created for a single transaction, this is very unusual. Most Courts hold that joint ventures are subject to the same principles of law as partnerships. The duties owed by joint venturers to each are the same as those that partners owe to each other.

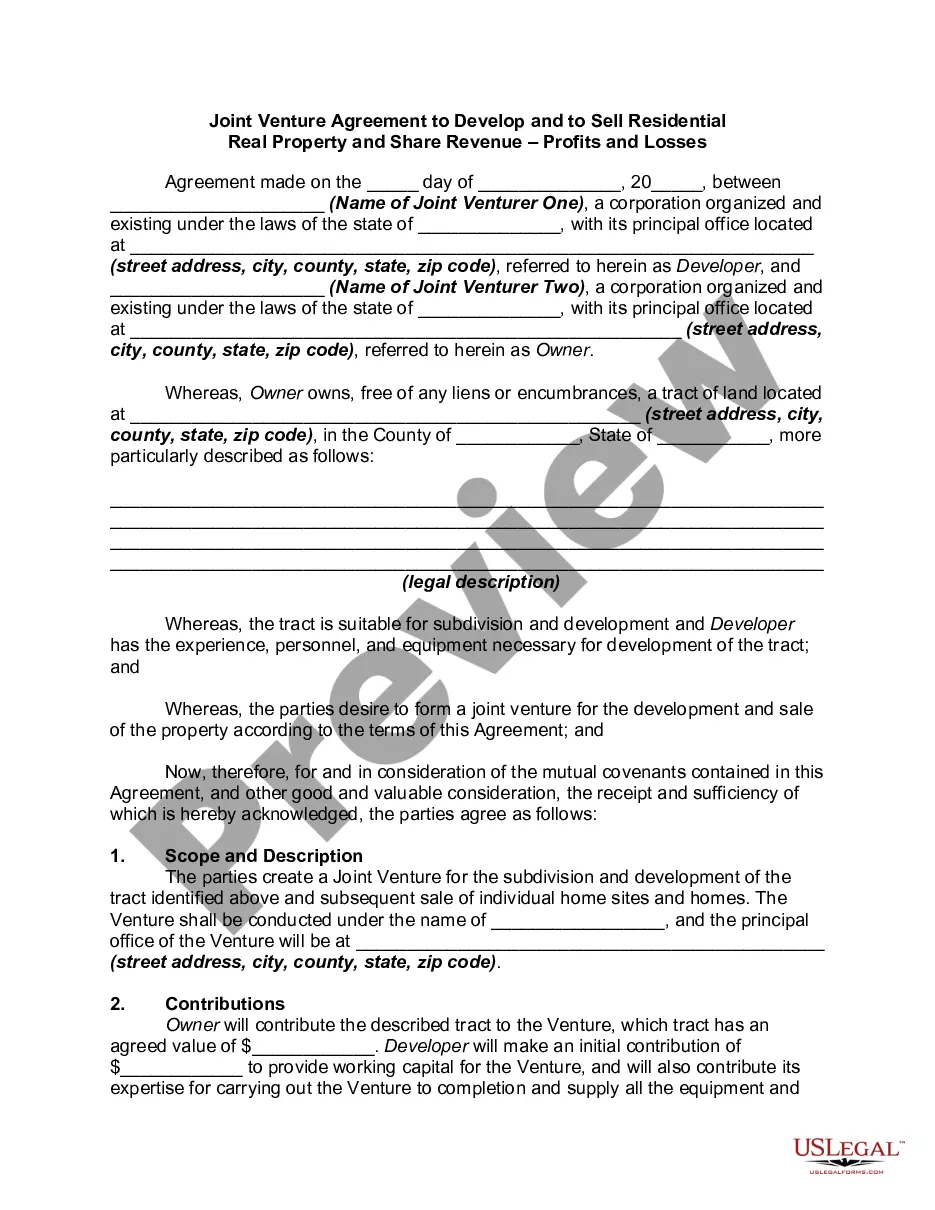

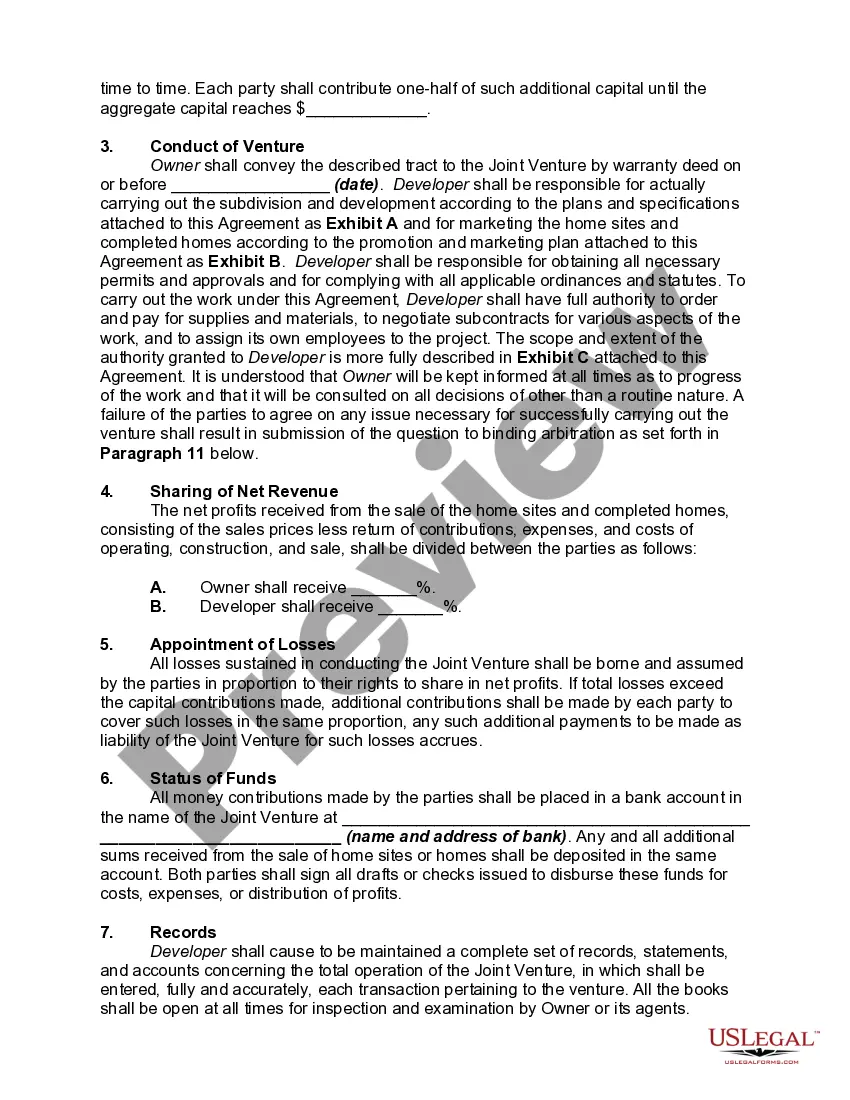

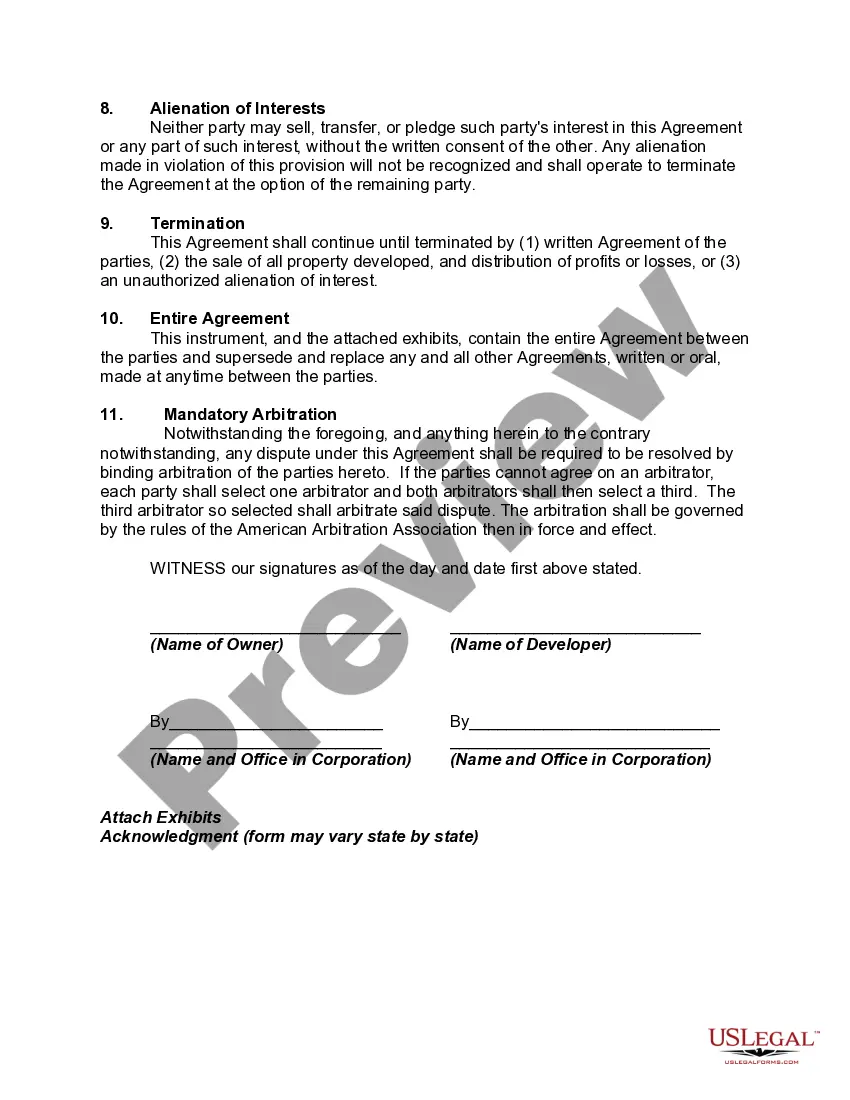

Oregon Joint Venture Agreement to Develop and to Sell Residential Real Property and Share Revenue — Profits and Losses is a legal document that outlines the partnership between two or more parties to jointly develop and sell residential real property in the state of Oregon. This agreement also focuses on the sharing of revenue, profits, and losses resulting from the venture. In this joint venture, the parties combine their resources, expertise, and capital to undertake a residential real estate development project. This could include activities such as acquiring land, securing permits, designing and constructing residential properties, marketing and selling the completed units. The Oregon Joint Venture Agreement to Develop and to Sell Residential Real Property and Share Revenue — Profits and Losses encompasses several key elements to ensure a successful collaboration: 1. Identification of the Parties: The agreement clearly identifies all the parties involved in the joint venture. This includes their legal names, addresses, and contact information. 2. Purpose and Scope: The document outlines the purpose and objectives of the joint venture, emphasizing the development and subsequent sale of residential real property. The scope may specify the type of residential properties (e.g., single-family homes, condominiums, townhouses) to be developed. 3. Financial Contributions: Each party's financial investments, whether in the form of cash, assets, or services, are clearly defined in the agreement. This includes initial capital contributions, ongoing funding requirements, and the responsibility for any additional financing. 4. Allocation of Profits and Losses: The agreement establishes the manner in which profits and losses will be distributed among the joint venture partners. This could be based on financial contributions, equity stakes, or any other agreed-upon formula. 5. Decision-Making Authority: The document delineates how decisions will be made within the joint venture, including matters related to property acquisition, project design, construction, financing, marketing, and sale. It may specify the formation of a management committee or designate a lead partner responsible for decision-making. 6. Exit Strategy: The agreement outlines the procedures and conditions for terminating the joint venture, including circumstances that may trigger an exit, the distribution of remaining assets, and the resolution of any outstanding obligations or liabilities. Different types of Oregon Joint Venture Agreements to Develop and to Sell Residential Real Property and Share Revenue — Profits and Losses may include variations based on the size of the project, the number of parties involved, the geographical location, and specific legal considerations. For example, a joint venture agreement for a large-scale residential development project may have more complex financial provisions or allocate profits and losses differently among partners compared to a smaller-scale joint venture. It is essential to consult legal professionals in Oregon to ensure compliance with state-specific laws and regulations when drafting and executing a Joint Venture Agreement for developing and selling residential real property.Oregon Joint Venture Agreement to Develop and to Sell Residential Real Property and Share Revenue — Profits and Losses is a legal document that outlines the partnership between two or more parties to jointly develop and sell residential real property in the state of Oregon. This agreement also focuses on the sharing of revenue, profits, and losses resulting from the venture. In this joint venture, the parties combine their resources, expertise, and capital to undertake a residential real estate development project. This could include activities such as acquiring land, securing permits, designing and constructing residential properties, marketing and selling the completed units. The Oregon Joint Venture Agreement to Develop and to Sell Residential Real Property and Share Revenue — Profits and Losses encompasses several key elements to ensure a successful collaboration: 1. Identification of the Parties: The agreement clearly identifies all the parties involved in the joint venture. This includes their legal names, addresses, and contact information. 2. Purpose and Scope: The document outlines the purpose and objectives of the joint venture, emphasizing the development and subsequent sale of residential real property. The scope may specify the type of residential properties (e.g., single-family homes, condominiums, townhouses) to be developed. 3. Financial Contributions: Each party's financial investments, whether in the form of cash, assets, or services, are clearly defined in the agreement. This includes initial capital contributions, ongoing funding requirements, and the responsibility for any additional financing. 4. Allocation of Profits and Losses: The agreement establishes the manner in which profits and losses will be distributed among the joint venture partners. This could be based on financial contributions, equity stakes, or any other agreed-upon formula. 5. Decision-Making Authority: The document delineates how decisions will be made within the joint venture, including matters related to property acquisition, project design, construction, financing, marketing, and sale. It may specify the formation of a management committee or designate a lead partner responsible for decision-making. 6. Exit Strategy: The agreement outlines the procedures and conditions for terminating the joint venture, including circumstances that may trigger an exit, the distribution of remaining assets, and the resolution of any outstanding obligations or liabilities. Different types of Oregon Joint Venture Agreements to Develop and to Sell Residential Real Property and Share Revenue — Profits and Losses may include variations based on the size of the project, the number of parties involved, the geographical location, and specific legal considerations. For example, a joint venture agreement for a large-scale residential development project may have more complex financial provisions or allocate profits and losses differently among partners compared to a smaller-scale joint venture. It is essential to consult legal professionals in Oregon to ensure compliance with state-specific laws and regulations when drafting and executing a Joint Venture Agreement for developing and selling residential real property.