Sample Letter for Delinquent Taxes in Oregon When individuals or businesses fail to pay their taxes in Oregon, the Oregon Department of Revenue may issue a Sample Letter for Delinquent Taxes to inform them of their outstanding tax liabilities and the potential consequences of non-payment. This letter serves as an official notice that demands payment and outlines the necessary steps to resolve the delinquency. There are different types of Sample Letters for Delinquent Taxes in Oregon, including: 1. Initial Notification Letter: This is the first letter sent by the Oregon Department of Revenue to taxpayers who have overdue taxes. It states the amount owed, provides a breakdown of the outstanding balance, and urges prompt payment to avoid further actions. 2. Second Notice: If the initial notification letter goes unanswered or the tax debt remains unpaid, the Oregon Department of Revenue may send a second notice. This letter emphasizes the urgency of resolving the delinquency and may include additional penalties and interest calculations. 3. Intent to Levy Letter: If the taxpayer continues to neglect their tax obligation, the Oregon Department of Revenue may issue an Intent to Levy Letter. This notice warns the recipient that the department intends to take further legal action, such as bank levies or wage garnishments, to recover the unpaid taxes. 4. Final Demand Letter: When the previous letters fail to elicit a response or payment, the Oregon Department of Revenue may send a Final Demand Letter. This letter acts as a final notice before initiating aggressive collection efforts, such as seizing assets or filing liens against the taxpayer's property. The content of an Oregon Sample Letter for Delinquent Taxes typically includes: 1. Header: The letterhead of the Oregon Department of Revenue, including official contact information and logo. 2. Salutation: A personalized greeting addressing the taxpayer by name (if available). 3. Introduction: Clear identification of the letter as a Sample Letter for Delinquent Taxes, along with a reference to the taxpayer's account number and type of tax (income tax, property tax, etc.) owed. 4. Summary of the Delinquency: Detailed information on the amount owed, the tax period in question, any penalties or interest applied, and the total outstanding balance. 5. Payment Options: Explanation of available payment methods, such as online payment, payment by check, or setting up an installment agreement. Instructions on where and how to submit payments are provided. 6. Consequences of Non-payment: Explanation of the consequences of ignoring or delaying tax payment, including potential legal actions, penalties, interest accrual, and damage to credit rating. 7. Contact Information: Clear instructions on who to contact within the Oregon Department of Revenue for assistance, including phone numbers, email addresses, and hours of operation. 8. Signature and Date: A final closing, including the name, title, and contact information of the sender, along with the date of the letter. Oregon Sample Letters for Delinquent Taxes are serious official notices that demand immediate attention. Taxpayers who receive these letters should carefully review the content, seek professional advice if needed, and take appropriate action to settle their outstanding tax liabilities.

Oregon Sample Letter for Delinquent Taxes

Description

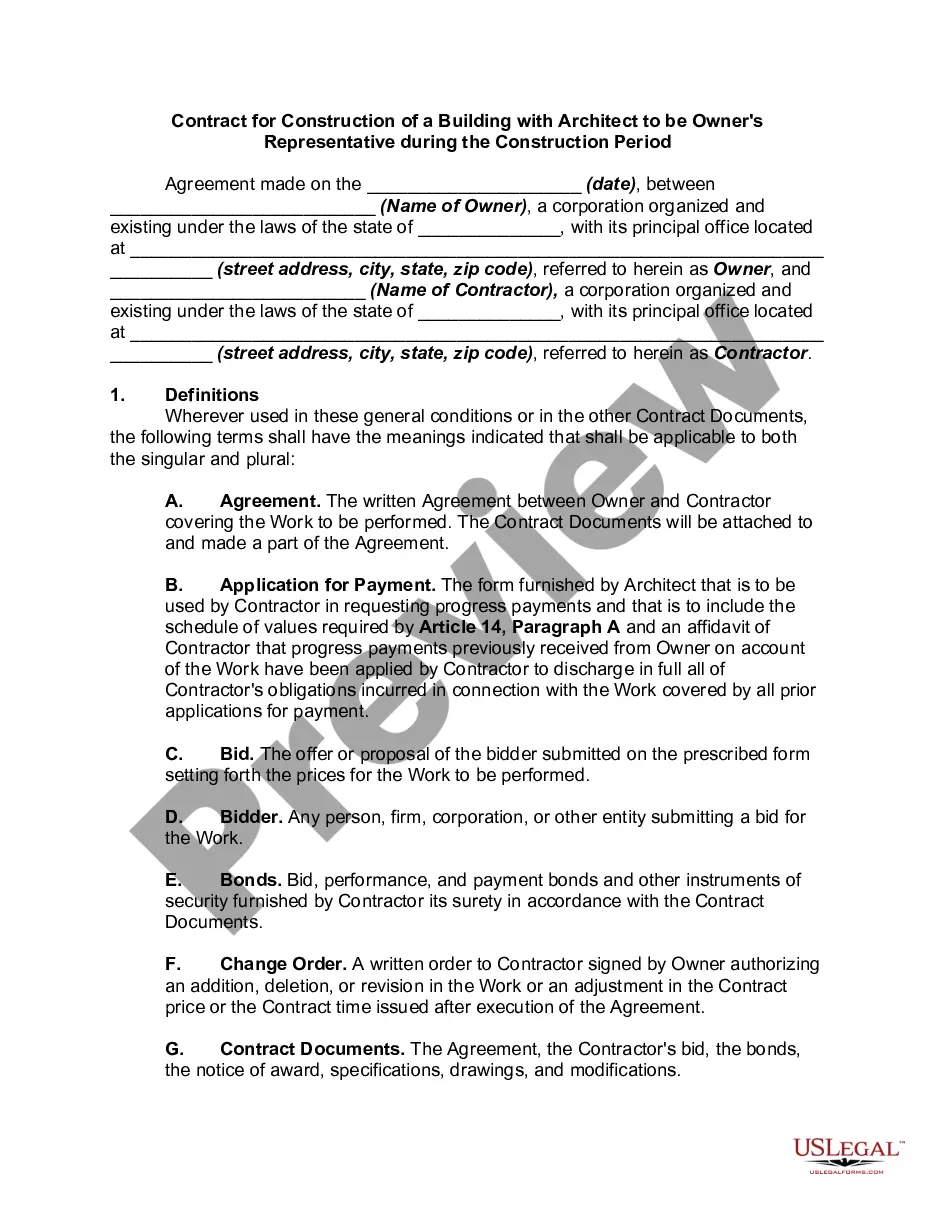

How to fill out Oregon Sample Letter For Delinquent Taxes?

US Legal Forms - among the largest libraries of lawful kinds in America - gives a wide range of lawful record layouts you can download or produce. Utilizing the internet site, you will get a huge number of kinds for enterprise and individual uses, sorted by classes, states, or search phrases.You will discover the latest types of kinds like the Oregon Sample Letter for Delinquent Taxes in seconds.

If you already possess a subscription, log in and download Oregon Sample Letter for Delinquent Taxes through the US Legal Forms collection. The Obtain switch can look on every single develop you perspective. You have accessibility to all earlier saved kinds from the My Forms tab of your own accounts.

If you would like use US Legal Forms for the first time, here are straightforward guidelines to get you began:

- Be sure to have picked the right develop for your personal city/region. Click on the Review switch to analyze the form`s information. See the develop information to actually have selected the proper develop.

- If the develop doesn`t satisfy your needs, take advantage of the Look for industry near the top of the display to obtain the the one that does.

- When you are satisfied with the form, affirm your option by clicking on the Purchase now switch. Then, choose the rates plan you favor and offer your credentials to register for the accounts.

- Method the purchase. Utilize your credit card or PayPal accounts to perform the purchase.

- Pick the formatting and download the form on the device.

- Make alterations. Fill up, change and produce and indicator the saved Oregon Sample Letter for Delinquent Taxes.

Each web template you put into your account does not have an expiry time and is also your own property for a long time. So, if you would like download or produce yet another copy, just check out the My Forms portion and then click on the develop you will need.

Obtain access to the Oregon Sample Letter for Delinquent Taxes with US Legal Forms, by far the most substantial collection of lawful record layouts. Use a huge number of professional and condition-certain layouts that meet your company or individual needs and needs.