The Oregon Self-Assessment Worksheet is a valuable tool that individuals can utilize to evaluate their personal financial situation and make informed decisions about their finances. This comprehensive worksheet is specifically designed to assist Oregon residents in assessing their income, expenses, and debts, thus enabling them to create a realistic budget and manage their financial resources effectively. The Oregon Self-Assessment Worksheet encompasses various aspects of personal finance, allowing individuals to analyze and track their income sources accurately. This includes detailed sections for documenting wages, salary, tips, freelance income, self-employment earnings, rental income, and any other sources of revenue. It prompts individuals to provide accurate and up-to-date information, ensuring an accurate assessment of their financial circumstances. Moreover, the worksheet provides an organized framework to list and categorize various expenses, both fixed and variable. It encompasses sections to record housing costs, utilities, transportation expenses, healthcare, groceries, entertainment, and much more. Users of the worksheet can examine their spending patterns and identify areas where they can potentially cut costs or reallocate funds to meet their financial goals. In addition to income and expenses, the Oregon Self-Assessment Worksheet delves into debts and liabilities. It allows individuals to include details of outstanding debts, such as credit card balances, student loans, car loans, and mortgages. This enables users to understand their debt-to-income ratio and evaluate the impact of their debts on their overall financial health. By using the Oregon Self-Assessment Worksheet, individuals can gain a comprehensive understanding of their financial situation and identify areas where they can make improvements. It encourages users to be honest and realistic about their income, expenses, and debts to ensure an accurate assessment. This worksheet helps Oregon residents take charge of their finances, set achievable financial goals, and develop a practical plan to achieve financial stability. As for the different types of Oregon Self-Assessment Worksheets, there may be variations tailored to specific financial situations or goals. For instance, there could be specialized worksheets for individuals seeking to assess their retirement savings, plan for higher education expenses, or navigate through a significant life event such as buying a home or starting a business. These variations provide individuals with targeted tools to address their specific financial needs and aspirations.

Oregon Self-Assessment Worksheet

Description

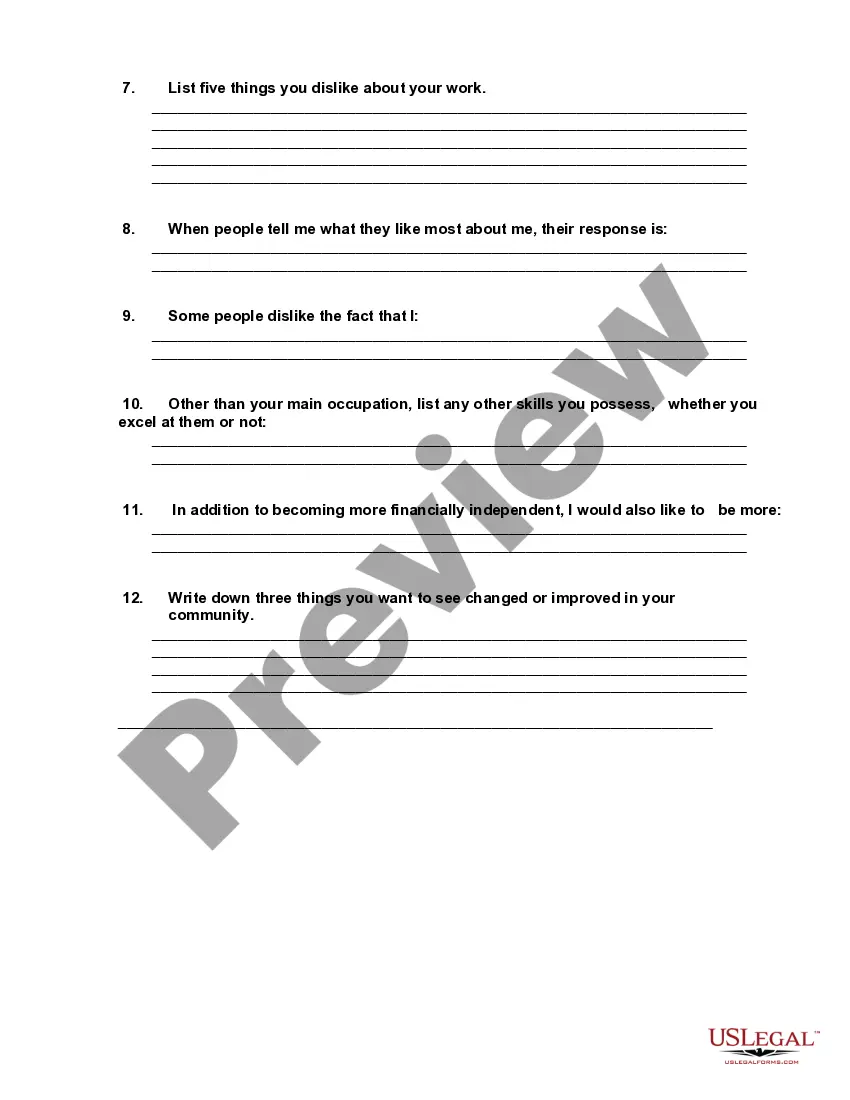

How to fill out Oregon Self-Assessment Worksheet?

If you need to total, obtain, or print out lawful papers themes, use US Legal Forms, the most important variety of lawful types, which can be found on-line. Take advantage of the site`s simple and easy hassle-free research to obtain the documents you will need. Numerous themes for company and specific reasons are sorted by classes and suggests, or keywords and phrases. Use US Legal Forms to obtain the Oregon Self-Assessment Worksheet with a handful of mouse clicks.

If you are currently a US Legal Forms consumer, log in to the account and then click the Obtain option to find the Oregon Self-Assessment Worksheet. You can even access types you in the past delivered electronically in the My Forms tab of the account.

Should you use US Legal Forms for the first time, follow the instructions under:

- Step 1. Be sure you have selected the shape for that right metropolis/nation.

- Step 2. Make use of the Review choice to examine the form`s content material. Never forget to see the description.

- Step 3. If you are not satisfied with the form, take advantage of the Research field at the top of the display to locate other types from the lawful form web template.

- Step 4. Once you have located the shape you will need, click the Acquire now option. Select the rates prepare you choose and add your qualifications to register for the account.

- Step 5. Procedure the transaction. You can utilize your Мisa or Ьastercard or PayPal account to perform the transaction.

- Step 6. Pick the formatting from the lawful form and obtain it in your product.

- Step 7. Complete, change and print out or indicator the Oregon Self-Assessment Worksheet.

Each and every lawful papers web template you get is your own property permanently. You might have acces to each form you delivered electronically in your acccount. Select the My Forms portion and pick a form to print out or obtain once again.

Compete and obtain, and print out the Oregon Self-Assessment Worksheet with US Legal Forms. There are thousands of expert and status-particular types you can use for the company or specific requires.