An accountant is one who is skilled in keeping accounts and books of accounts correctly and properly. An accountant plays a variety of roles including the review, audit, organization and certification of financial information. The various types of accountants include; auditors, forensic accountants, public accountants, tax professionals, financial advisers and consultants. Accountants have a minimum of a bachelor’s degree, but often have other advanced degrees, and all accountants must be certified through the appropriate state board.

Most states have statutes that provide for a state board of accountancy or a board of certified public accountants. Statutes may require the registration of accountants and accounting firms with the state board of accountancy. A state has the power to revoke the license which grants the right to practice public accountancy. Regulations relating to accountants in various states are discussed in the links below.

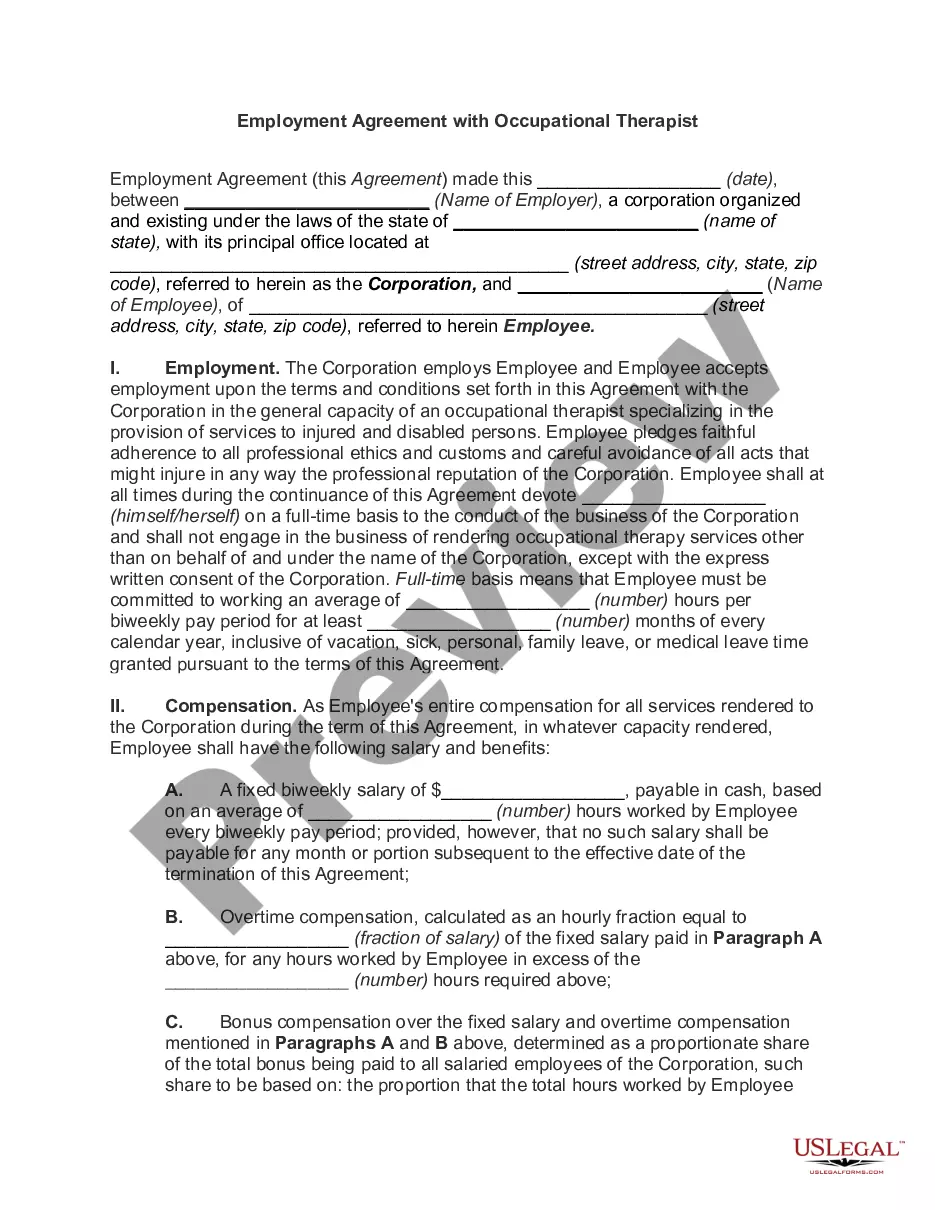

Oregon Employment Agreement with Staff Accountant: An Oregon Employment Agreement with a Staff Accountant is a legally binding document that outlines the terms and conditions of employment between an employer and a staff accountant in the state of Oregon. This agreement ensures clarity and protection for both parties involved. Key elements included in an Oregon Employment Agreement with Staff Accountant: 1. Job Title and Description: The agreement will clearly state the position of the staff accountant and provide a detailed description of their roles, responsibilities, and duties within the company. 2. Compensation: The agreement will outline the salary, benefits, and any additional perks the staff accountant will receive as part of their employment package. This may include bonuses, retirement plans, health insurance, paid time off, and educational reimbursements. 3. Work Schedule: The agreement will specify the staff accountant's regular working hours, including any flexibility or potential for overtime work. It may also include details about remote work options. 4. Confidentiality and Non-Disclosure: To protect the company's sensitive information, the agreement will likely include clauses requiring the staff accountant to maintain confidentiality regarding proprietary data and trade secrets. Non-disclosure agreements may also be required. 5. Termination: This section will detail the circumstances under which either party can terminate the employment agreement. It will address notice periods, grounds for termination, and any severance package or payment due upon termination. 6. Intellectual Property: If applicable, the agreement should include provisions regarding the ownership and protection of intellectual property created by the staff accountant during their employment. 7. Non-Compete and Non-Solicitation: Depending on the nature of the business, the agreement might prohibit the staff accountant from competing with the company or soliciting its clients for a certain period after employment termination. 8. Governing Law and Jurisdiction: This section will specify that the agreement is subject to the laws of the state of Oregon and that any disputes arising from it shall be resolved in the courts of Oregon. Types of Oregon Employment Agreements with Staff Accountants: 1. Full-Time Employment Agreement: This agreement is used when hiring a staff accountant for full-time, regular employment positions with comprehensive benefits and a set number of working hours per week. 2. Part-Time Employment Agreement: This type of agreement is suitable for hiring staff accountants for fewer hours than traditional full-time positions. It outlines the specific hours, duties, and compensation for the part-time staff accountant. 3. Contract Employment Agreement: When engaging a staff accountant for a specific project or a fixed term, such as during a busy season or for a short-term assignment, a contract employment agreement is used. It defines the duration, scope of work, payment terms, and other project-specific details. 4. Internship/Trainee Employment Agreement: This agreement is tailored for staff accountants participating in internships or training programs. It focuses on learning objectives, duration, compensation (if any), and the intern's academic institution requirements. Employers should ensure that their Oregon Employment Agreement with Staff Accountant complies with relevant state and federal employment laws to protect the rights of both the employer and the employee. It is advisable to consult with an attorney specializing in employment law to create a comprehensive and customized agreement.