Oregon Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife

Description

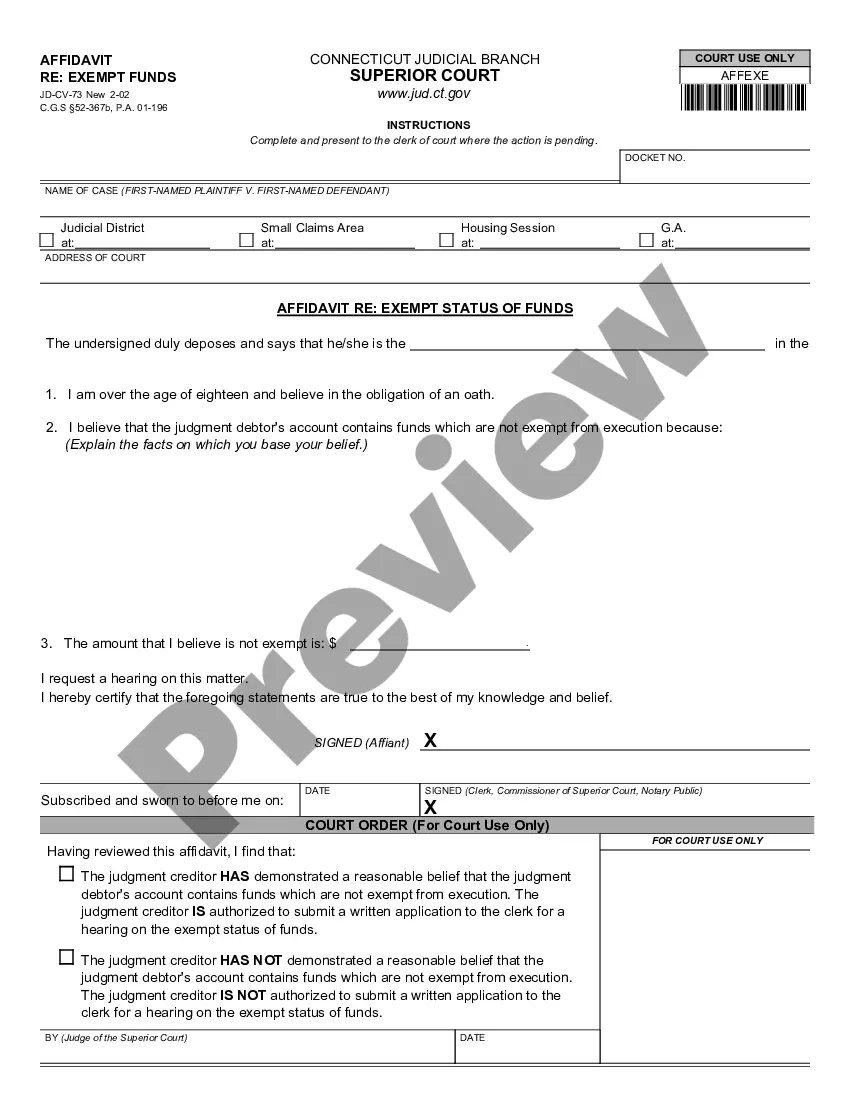

How to fill out Testamentary Trust Of The Residue Of An Estate For The Benefit Of A Wife With The Trust To Continue For Benefit Of Children After The Death Of The Wife?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a variety of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can quickly find the most current versions of forms like the Oregon Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife.

Read the form's description to confirm you have the correct form.

If the form does not meet your needs, utilize the Search box at the top of the page to find one that does.

- If you have an account, Log In to download the Oregon Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife from the US Legal Forms library.

- The Download button will be visible on every form you view.

- You can find all previously downloaded forms under the My documents section of your account.

- To use US Legal Forms for the first time, here are the essential steps to get started.

- Ensure you have chosen the right form for your area/county.

- Click the Preview button to review the form's details.

Form popularity

FAQ

Living trusts and testamentary trustsA living trust (sometimes called an inter vivos trust) is one created by the grantor during his or her lifetime, while a testamentary trust is a trust created by the grantor's will.

Taxation of Testamentary Trusts Once a testamentary trust has been created, it becomes a taxable entity in its own right and is thus subject to income taxes. If it has $600 or more in annual income, it must file a U.S. Income Tax Return for Estates and Trusts (Form 1041) for that year.

Most A Trusts are actually also QTIP Trusts. However, for it to be a QTIP Trust, only the surviving spouse can be the beneficiary of the trust during his or her lifetime, and the trust is required to pay all income generated by the trust (e.g. dividends and interest) to the surviving spouse at least annually.

Simply put, if you have a legally binding will when you pass away then the dictates of that document will determine what happens to your assets- so if you have listed your spouse as sole beneficiary, they will receive everything, or exactly how much you have given to them in the will.

Under Oregon inheritance laws, If you have a spouse but no descendants (children, grandchildren), your spouse will inherit everything. If you have children but no spouse, your children will inherit everything. If you have a spouse and descendants (with that spouse), your spouse inherits everything.

How does it save tax? A testamentary trust allows the person who controls it to split the income generated by the trust between family members. Importantly, children who receive income from a testamentary trust are taxed at adult tax rates, instead of penalty rates (up to 66%) which apply to other types of trusts.

Well, because a testamentary trust allows the grantor some control over the assets during his or her lifetime. After the grantor passes away, the testamentary trust, which is considered an irrevocable trust, is created. Irrevocable trusts can sometimes protect assets against judgments and creditors.

A testamentary trust is created to manage the assets of the deceased on behalf of the beneficiaries. It is also used to reduce estate tax liabilities and ensure professional management of the assets of the deceased.

While many people assume surviving spouses automatically inherit everything, this is not the case in California. If your deceased spouse dies with a will, their share of community property and their separate property will be distributed according to the terms of that will, with some exceptions.

Trusts are a crucial element to Estate Planning as they help provide more control over asset distribution after death. Among the various types available, a Testamentary Trust can be one of the best options for those thinking of their young children or grandchildren.