Title: Oregon Sample Letter Requesting Client Pension Plan Account Statements Description: This article provides a comprehensive guide on how to write a detailed letter requesting client pension plan account statements in Oregon. We offer relevant keywords and outline different types of account statements that may be requested. Introduction: When managing client pension plans in Oregon, it is crucial to stay updated on their account statements for smooth financial management. In this article, we will guide you through an effective sample letter format for requesting different types of client pension plan account statements. Sample Letter Requesting Client Pension Plan Account Statements: [Your Name] [Your Address] [City, State, Zip Code] [Email Address] [Phone Number] [Date] [Recipient's Name] [Recipient's Designation] [Company Name] [Company Address] [City, State, Zip Code] Dear [Recipient's Name], I am writing to kindly request the provision of comprehensive account statements for [Client's Name]'s pension plan account(s), as managed by your esteemed organization. The information will assist in ensuring accurate financial reporting and facilitate effective decision-making on their retirement funds. Kindly provide the following account statements: 1. Quarterly Account Statements: Please send the most recent quarterly account statement for the specified pension plan(s) [Client's Name] is enrolled in. These statements should include a breakdown of contributions, account balance(s), interest earned, investment performance, and any associated fees. Additionally, kindly include any relevant legal notices or updates regarding plan changes. 2. Annual Summary Statement: In addition to the quarterly account statements, I would appreciate receiving an annual summary statement for [Client's Name]'s pension plan account(s) at the end of each calendar year. This summary should provide an overview of the account's performance, growth, withdrawals, and additional contributions made during the year. Including any tax-related information would also be highly beneficial. 3. Investment Holdings Statement: To ensure transparency and track the diversification of investment holdings, please provide a comprehensive investment holdings statement. This document should list each investment option within the pension plan(s), along with the corresponding allocation percentages, current value, and any changes to the portfolio. 4. Transaction History: To maintain accurate records and track any recent account activities, it would be greatly appreciated if you could also provide a detailed transaction history statement. This statement should cover the specified period, showcasing all contributions, withdrawals, investment changes, and any related fees charged during that time. 5. Legal Documents: If there have been recent updates to the pension plan(s) in terms of legal documents, regulations, or disclosures, please provide copies of the updated versions. This will help ensure compliance and allow us to communicate any necessary changes to [Client's Name]. I kindly request that the requested account statements be provided in both hard copy format and electronically via email. Should you need any additional information or require any clarification on the requested documents, please do not hesitate to contact me using the information provided above. Thank you for your prompt attention to this matter. We greatly value your services and appreciate your cooperation. Sincerely, [Your Name] [Your Designation/Position] [Company Name] [Company Address] [City, State, Zip Code] [Email Address] [Phone Number] Keywords: Oregon, sample letter, requesting, client, pension plan, account statements, types, quarterly account statements, annual summary statement, investment holdings statement, transaction history, legal documents.

Oregon Sample Letter Requesting Client Pension Plan Account Statements

Description

How to fill out Oregon Sample Letter Requesting Client Pension Plan Account Statements?

Are you presently inside a situation in which you require files for both organization or individual reasons nearly every working day? There are a lot of authorized file layouts accessible on the Internet, but getting ones you can depend on is not straightforward. US Legal Forms provides 1000s of type layouts, such as the Oregon Sample Letter Requesting Client Pension Plan Account Statements, which can be written to fulfill state and federal requirements.

Should you be previously informed about US Legal Forms internet site and possess your account, merely log in. Next, you can acquire the Oregon Sample Letter Requesting Client Pension Plan Account Statements template.

If you do not come with an bank account and would like to begin using US Legal Forms, adopt these measures:

- Discover the type you require and ensure it is for that right metropolis/county.

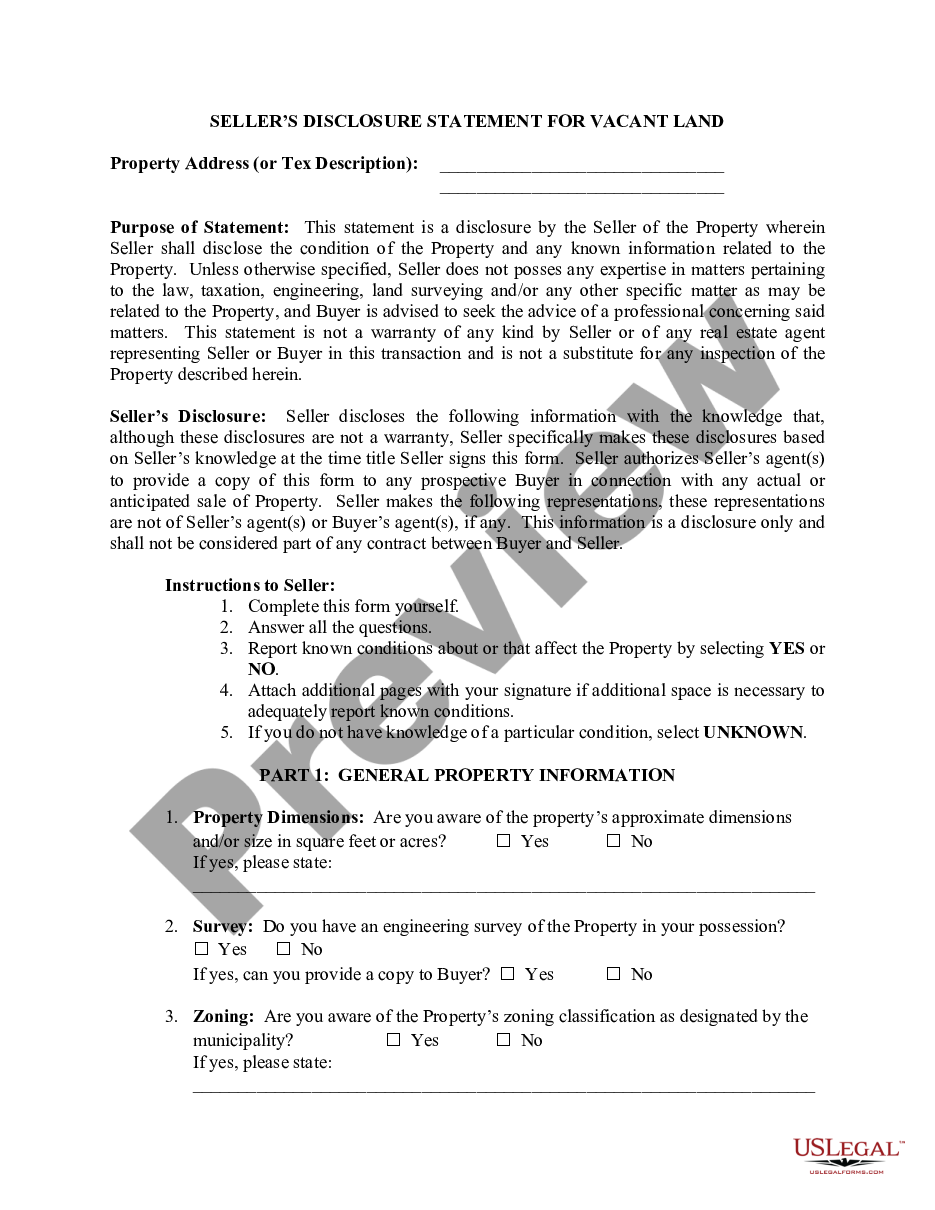

- Make use of the Preview key to examine the form.

- Browse the information to ensure that you have selected the proper type.

- In case the type is not what you are searching for, use the Search area to obtain the type that meets your requirements and requirements.

- Once you obtain the right type, click on Acquire now.

- Choose the prices program you want, fill in the required information and facts to create your money, and pay for your order using your PayPal or bank card.

- Choose a hassle-free data file file format and acquire your backup.

Locate all the file layouts you have bought in the My Forms menus. You can get a additional backup of Oregon Sample Letter Requesting Client Pension Plan Account Statements at any time, if necessary. Just click the essential type to acquire or print out the file template.

Use US Legal Forms, one of the most comprehensive collection of authorized types, to save lots of efforts and steer clear of errors. The support provides expertly produced authorized file layouts which can be used for a variety of reasons. Produce your account on US Legal Forms and initiate making your life a little easier.