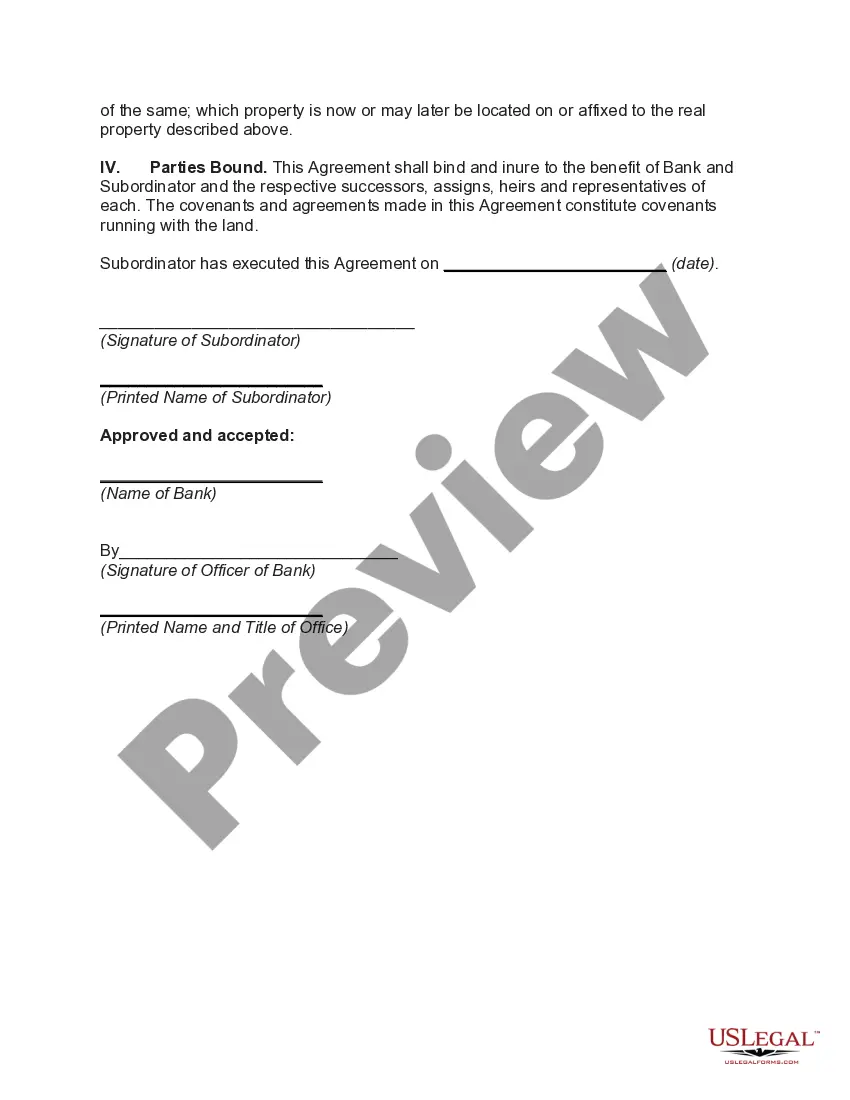

A subordination agreement regarding fixtures in Oregon is a legal document that outlines the priority of liens or mortgages against a property's fixtures. Fixtures refer to permanent attachments to a property, such as appliances, built-in furniture, lighting fixtures, and heating systems. This agreement helps determine the order in which creditors have the right to claim these fixtures in case of foreclosure or bankruptcy. In Oregon, there are primarily two types of subordination agreements regarding fixtures: 1. Voluntary Subordination Agreement: This type of agreement is entered into willingly by all parties involved, typically the property owner, mortgage lender, and any secondary lien holders. It allows for the rearrangement of lien priority, where the mortgage lender agrees to subordinate its interest in the fixtures to another lien holder's interest. This agreement is often made when the property owner intends to take on additional financing or refinancing and needs to secure the consent of the existing lender. 2. Involuntary Subordination Agreement: Unlike the voluntary agreement, an involuntary subordination occurs when a superior lien holder takes precedence over a junior lien holder's interested in fixtures. This could happen when a property owner defaults on their mortgage, leading to foreclosure proceedings. During the foreclosure process, the superior lien holder, typically the first mortgage lender, will have priority in claiming the fixtures over other creditors. Key terms often included in an Oregon subordination agreement regarding fixtures may include: — Identification of the parties involved: It explicitly states the names, addresses, and roles of the property owner, mortgage lender, and any secondary lien holders or creditors participating in the agreement. — Description of the fixtures: It provides a detailed list or description of the fixtures to be covered by the agreement. This can include serial numbers, manufacturer names, or any other relevant identification details. — Lien priority: The agreement clearly establishes the priority of interests, indicating the rank of each lien holder's claim on the fixtures, especially during foreclosure or bankruptcy proceedings. — Recording of the agreement: To protect all parties involved, the agreement should be properly recorded with the county recorder's office where the property is located. This ensures the agreement's visibility to any potential future creditors or interested parties. — Termination provisions: In some cases, the agreement may include termination conditions, specifying the circumstances or events that will nullify or terminate the subordination agreement. It is important to consult with an attorney or legal professional experienced in Oregon real estate law to ensure that the subordination agreement meets all necessary legal requirements and adequately protects the rights and interests of the parties involved.

Oregon Subordination Agreement Regarding Fixtures

Description

How to fill out Oregon Subordination Agreement Regarding Fixtures?

If you have to comprehensive, download, or produce lawful papers themes, use US Legal Forms, the biggest variety of lawful kinds, that can be found on the Internet. Make use of the site`s simple and convenient research to obtain the documents you require. Various themes for enterprise and person uses are categorized by types and states, or search phrases. Use US Legal Forms to obtain the Oregon Subordination Agreement Regarding Fixtures within a couple of clicks.

Should you be presently a US Legal Forms buyer, log in to your bank account and click on the Down load key to find the Oregon Subordination Agreement Regarding Fixtures. You can also access kinds you previously saved from the My Forms tab of the bank account.

If you work with US Legal Forms the first time, follow the instructions under:

- Step 1. Be sure you have selected the form for the right city/country.

- Step 2. Take advantage of the Review method to look through the form`s articles. Never overlook to read through the outline.

- Step 3. Should you be unsatisfied with the type, use the Lookup industry near the top of the monitor to locate other types of the lawful type template.

- Step 4. When you have identified the form you require, click on the Acquire now key. Pick the costs prepare you favor and add your accreditations to register for the bank account.

- Step 5. Method the purchase. You can use your charge card or PayPal bank account to accomplish the purchase.

- Step 6. Choose the structure of the lawful type and download it on your own device.

- Step 7. Total, edit and produce or indicator the Oregon Subordination Agreement Regarding Fixtures.

Every single lawful papers template you get is your own property permanently. You have acces to every type you saved with your acccount. Click on the My Forms section and select a type to produce or download yet again.

Be competitive and download, and produce the Oregon Subordination Agreement Regarding Fixtures with US Legal Forms. There are many expert and state-distinct kinds you can use for your personal enterprise or person requires.

Form popularity

FAQ

If you own property jointly with someone else, and this ownership includes the "right of survivorship," then the surviving owner automatically owns the property when the other owner dies. This is called a "survivorship estate" in Oregon.

Ing to Oregon's laws of intestate succession (when someone dies without a Will or Living Trust), the spouse inherits 50% of the decedent's Estate, while the decedent's children (from someone other than the current spouse) inherit the other 50%.

Under the right of survivorship, each tenant possesses an undivided interest in the whole estate. When one tenant dies, the tenant's interest disappears and the others tenants' shares increase proportionally and obtain the rights to the entire estate.

Survivorship means there are joint owners with right of survivorship of personal property. The front of Oregon titles shows survivorship information. When DMV issued a title with survivorship and one of the owners is deceased, the surviving owner(s) may transfer with proof of death of the deceased owner.

Tenancy in common provides no right of survivorship The important distinction between tenancy in common and other types of co-ownership is that, upon death, each owner's interest passes to his heirs or those named in his will.