Oregon Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor

Description

How to fill out Special Needs Irrevocable Trust Agreement For Benefit Of Disabled Child Of Trustor?

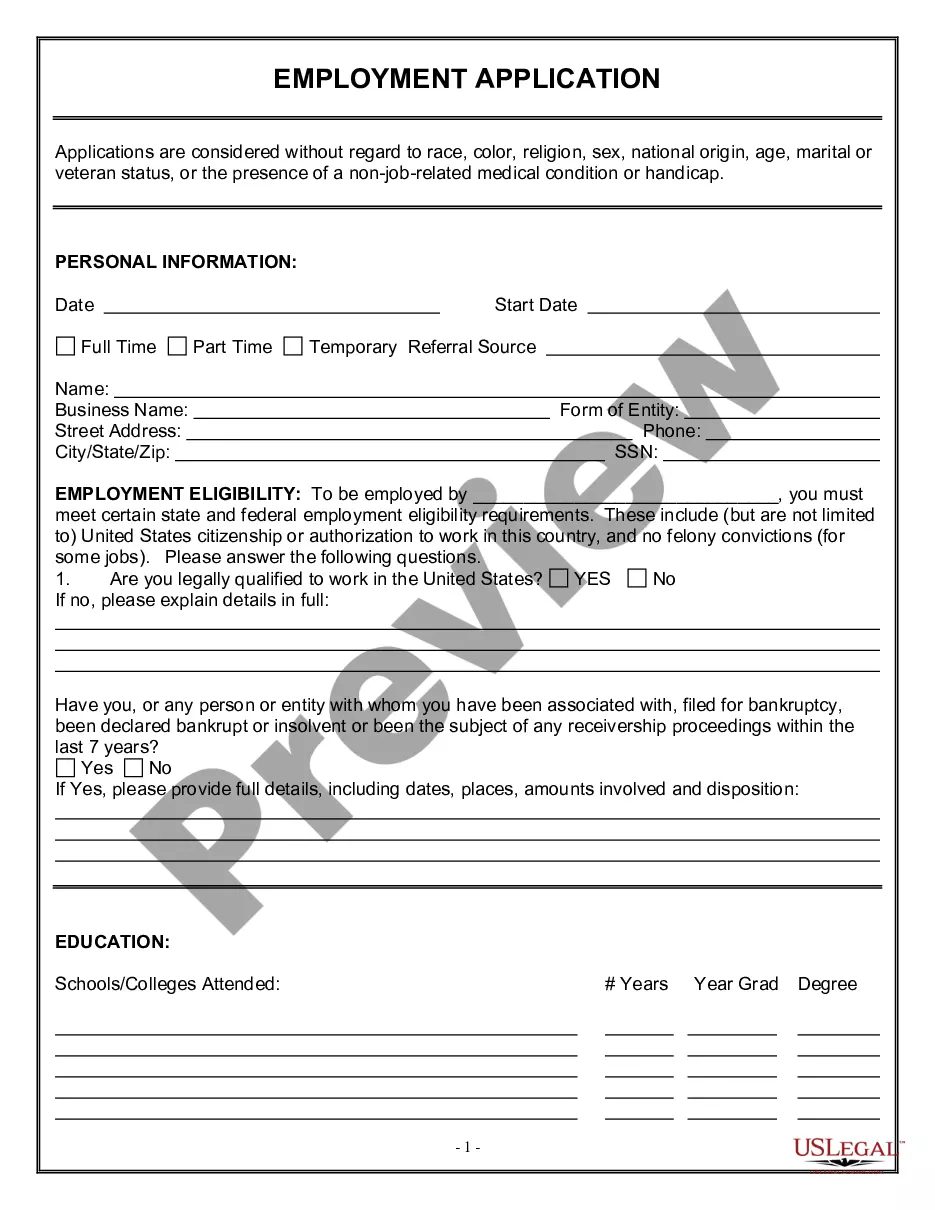

Locating the appropriate authentic document template can be a challenge. Naturally, numerous templates exist online, but how do you identify the correct form that you need? Utilize the US Legal Forms site. This service provides thousands of templates, such as the Oregon Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor, suitable for both business and personal purposes. All forms are reviewed by professionals and meet state and federal regulations.

If you are already registered, Log In to your account and click on the Obtain button to acquire the Oregon Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor. Use your account to view the legal forms you have previously purchased. Navigate to the My documents section of your account to download another copy of the document you require.

If you are a new user of US Legal Forms, here are straightforward steps to follow: First, ensure you have selected the appropriate form for your area/county. You can review the form using the Preview button and read the form details to confirm it is suitable for your needs. If the form does not fulfill your requirements, use the Search field to find the correct form. Once you are certain the form is appropriate, click the Buy now button to purchase the form. Choose the pricing plan you prefer and input the necessary information. Create your account and complete the purchase using your PayPal account or credit card. Select the document format and download the legal document template to your device. Complete, modify, print, and sign the acquired Oregon Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor.

US Legal Forms is the premier repository of legal forms where you can access numerous document templates. Take advantage of this service to obtain professionally created documents that comply with state requirements.

- Ensure correct form selection for area/county.

- Use the Preview button to review the form.

- Read the form description for suitability.

- Utilize the Search field for alternative forms.

- Click Buy now if the form is acceptable.

- Choose a pricing plan and input necessary information.

Form popularity

FAQ

One major mistake parents often make when setting up a trust fund is not clearly defining their wishes regarding the distribution of funds. Without an Oregon Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trustor, parents may leave room for confusion among family members, potentially leading to disputes. Clearly outlining your intentions helps ensure that your disabled child's needs are met effectively. Consider using a reliable platform like US Legal Forms to navigate these complexities.

The term special needs trust refers to the purpose of the trust to pay for the beneficiary's unique or special needs. In short, the name is focused more on the beneficiary, while the name supplemental needs trust addresses the shortfalls of our public benefits programs.

Money paid directly to you from the trust reduces your SSI benefit. Money paid directly to someone to provide you with food or shelter reduces your SSI benefit but only up to a certain limit.

A Disabled Person's Trust can be a way of ring-fencing assets for the beneficiary so that their means-tested benefits are not affected. A Trust can protect a disabled person who could otherwise be vulnerable to financial abuse or exploitation from others.

Disadvantages to SNTCost. Annual fees and a high cost to set up a SNT can make it financially difficult to create a SNT The yearly costs to manage the trust can be high.Lack of independence.Medicaid payback.

So the special-needs trust is a type of trust that is used to provide assets and resources to take care of a person with a disability, while the living trust is a will substitute that I might use in place of having a will for my estate plan.

A special needs trust is a legal arrangement that lets a physically or mentally ill person, or someone chronically disabled, have access to funding without potentially losing the benefits provided by public assistance programs.

Some of the benefits of utilizing an SNT include asset management and maximizing and maintaining government benefits (including Medicaid and Supplemental Security Income). Some possible negatives of utilizing an SNT include lack of control and difficulty or inability to identify an appropriate Trustee.

The money simply replaces state-funding benefits and services until their fund drops below the excluded capital level, when they go back on to means-tested benefits. A Vulnerable Beneficiary Trust or Disabled Person's Trust can be a way of ringfencing the windfall so that means-tested benefits are not affected.

The major disadvantages that are associated with trusts are their perceived irrevocability, the loss of control over assets that are put into trust and their costs. In fact trusts can be made revocable, but this generally has negative consequences in respect of tax, estate duty, asset protection and stamp duty.