The Oregon Irrevocable Trust for Lifetime Benefit of Trust or with Power of Invasion in Trust or is a legal instrument commonly utilized in estate planning, offering various benefits and provisions to the trust or. Designed to protect assets and ensure their efficient management, this type of trust provides flexibility and control over one's assets while also preparing for the future. Here, we delve into the details of this trust and highlight its key features and benefits. An Oregon Irrevocable Trust for Lifetime Benefit of Trust or with Power of Invasion in Trust or allows the trust or, the individual setting up the trust, to transfer their assets, such as real estate, investments, or personal property, into the trust. By creating this irrevocable trust, the trust or establishes a separate legal entity that will hold and manage the assets according to their wishes. The primary advantage of this trust is that it provides lifetime benefits to the trust or while protecting the assets from potential creditors, lawsuits, and estate taxes. The trust or can determine the terms of distribution, specifying who will receive income or principal from the trust and under what circumstances. Moreover, by granting themselves the power of invasion, the trust or retains the ability to access the trust's assets during their lifetime, offering a measure of control and flexibility. There are different types of Oregon Irrevocable Trust for Lifetime Benefit of Trust or with Power of Invasion in Trust or, each designed to suit specific objectives and needs: 1. Oregon Irrevocable Life Insurance Trust: This type of trust allows the trust or to fund it with life insurance policies. Upon the trust or's passing, the insurance proceeds are paid to the trust, and the trust's beneficiaries receive these proceeds outside the trust or's taxable estate. 2. Oregon Qualified Personnel Residence Trust: This trust is particularly useful when the trust or wants to transfer their primary residence or vacation home to the trust while remaining living in the property for a specified period. This arrangement can result in a reduction of estate taxes. 3. Oregon Medicaid Asset Protection Trust: This trust is an effective way to safeguard assets from potential long-term care costs. By transferring assets into the trust five years before applying for Medicaid, the trust or can protect these assets from being depleted to cover their healthcare expenses. 4. Oregon Charitable Remainder Trust: This trust allows the trust or to support charitable causes while receiving income from the assets transferred into the trust. After the trust or's lifetime, the remaining assets are distributed to the designated charitable organizations. In conclusion, the Oregon Irrevocable Trust for Lifetime Benefit of Trust or with Power of Invasion in Trust or is a versatile estate planning tool suitable for individuals seeking asset protection, tax mitigation, and flexible distribution options. Different types of trusts cater to diverse objectives, ensuring the specific needs of each trust or are met. Consulting with an experienced estate planning attorney is crucial to determine the most appropriate type of trust based on individual circumstances and goals.

Oregon Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor

Description

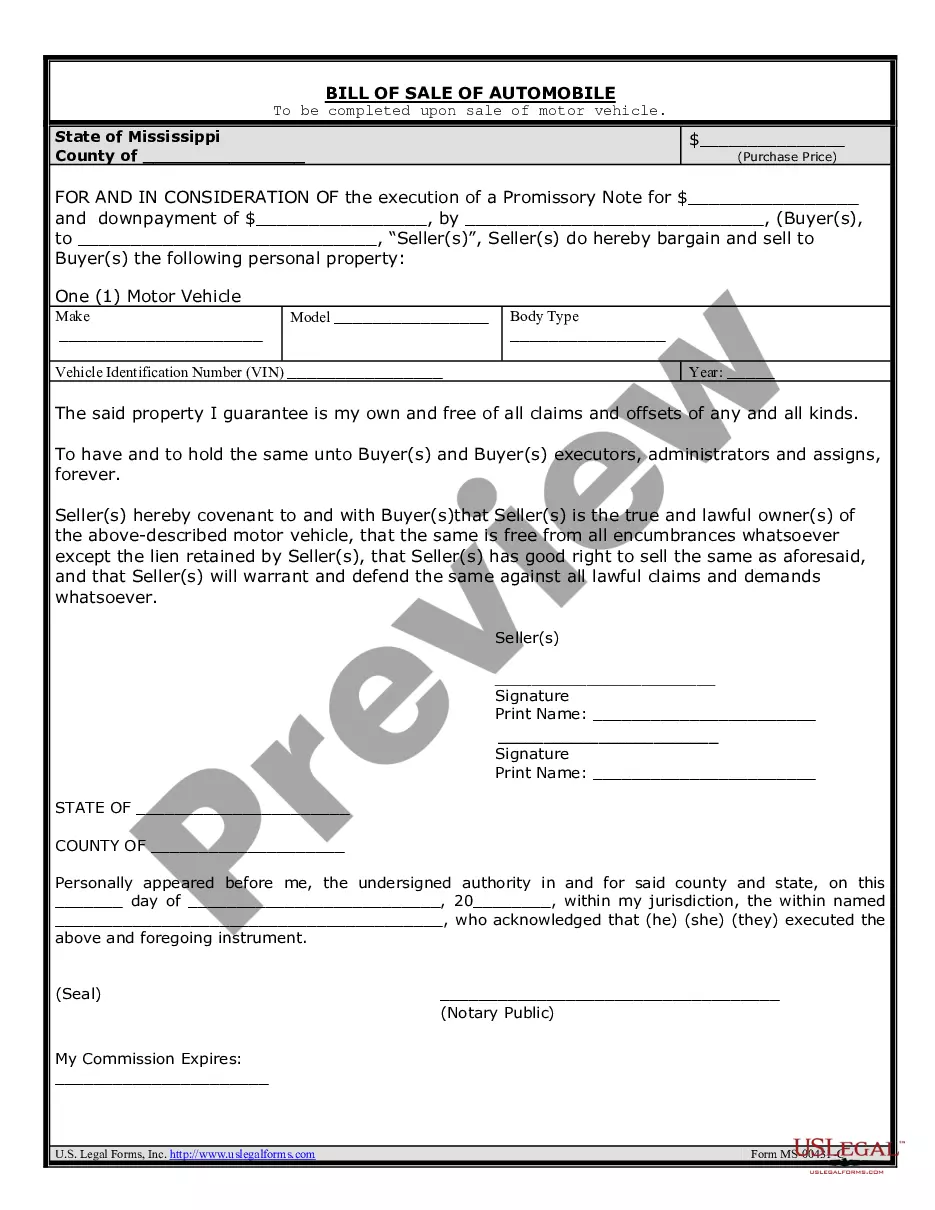

How to fill out Oregon Irrevocable Trust For Lifetime Benefit Of Trustor With Power Of Invasion In Trustor?

US Legal Forms - one of the greatest libraries of lawful varieties in the United States - offers an array of lawful document themes you may download or print. Making use of the site, you can find 1000s of varieties for organization and personal functions, sorted by types, suggests, or keywords.You can find the most up-to-date models of varieties such as the Oregon Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor in seconds.

If you already possess a subscription, log in and download Oregon Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor from the US Legal Forms local library. The Acquire key can look on every single form you see. You gain access to all previously delivered electronically varieties in the My Forms tab of your respective bank account.

In order to use US Legal Forms the very first time, listed here are easy directions to help you began:

- Be sure you have picked the correct form for your metropolis/state. Go through the Preview key to review the form`s content. See the form description to actually have chosen the right form.

- If the form does not satisfy your needs, take advantage of the Lookup industry towards the top of the monitor to obtain the one which does.

- When you are happy with the shape, confirm your selection by clicking on the Acquire now key. Then, opt for the rates prepare you prefer and offer your accreditations to sign up for the bank account.

- Procedure the transaction. Use your Visa or Mastercard or PayPal bank account to accomplish the transaction.

- Select the file format and download the shape in your device.

- Make changes. Complete, modify and print and indicator the delivered electronically Oregon Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor.

Each format you included in your money lacks an expiry time and it is your own for a long time. So, if you want to download or print an additional backup, just check out the My Forms section and click on about the form you require.

Gain access to the Oregon Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor with US Legal Forms, probably the most comprehensive local library of lawful document themes. Use 1000s of professional and state-certain themes that meet up with your business or personal needs and needs.